Get ready to discover what it truly takes to become a successful day trader. The stories and processes I will share with you in this guide will redefine your path to trading success and help unlock your true potential as a day trader.

Hi, my name is Adam.

Over the past 20 years, I’ve traded for some of the largest trading firms in the county, coached day traders at elite institutions, and helped countless retail traders grow their trading businesses.

In this guide, I lay out step by step how to build a winning day trading strategy as well as how to master the objective mindset necessary to consistently produce profits. What you will learn can be applied to any market including Stocks, Futures, Options, Crypto, or Forex.

I’m guessing for many of you, this is not the first “guide” you’ve read on how to become a successful trader. I promise this one’s different.

I’m going to share with you the stories of my own personal struggles, how I overcame them, and unlocked my potential to achieve all of my day trading goals.

The first thing I want to mention is that if you’ve failed up to this point in your day trading, it’s probably not your fault. The educational system for retail day traders is broken.

The industry is littered with misinformation from people who are nothing more than failed traders themselves.

I say it’s not your fault because it’s impossible to become a successful trader when you’re learning failed processes and strategies from the start.

That all changes today. Once you’re exposed to the truth and have seen the journey of someone who has actually done it, the path forward to achieving your trading goals will become much clearer.

Most online educators want you to think that you need their trading strategy! It’s the secret to your success. Every corner you turn online, you see a new advertisement for the best trading strategy ever!

I’m sure you’ve seen it. Make money from the beach, fly private, drive a Ferrari. This is all BS!

The vast majority of people teaching day trading online have never been successful traders. Their training is useless and will cause more harm than good. Quite frankly, what they are doing is very dangerous.

I’ve seen first hand from some of my students the aftermath of an education system that creates false expectations and hope. Furthermore, it’s a system that prevents people from ever experiencing success because the majority of what’s being taught is just flat out wrong.

Most of these gurus don’t care if you succeed; it’s more profitable for them if you fail. If you’re successful, they can’t continue to sell you training.

Even the ones who want you to succeed either don’t know what to teach because they’re failed traders themselves. If they are successful traders, which a few are, they are misguided on what’s truly causing their success, and as a result, they don’t teach it.

I promise you don’t need to be a genius to become a successful trader. I’m not. You also don’t need to be super creative. There’s an old quote that says…

This is true in any industry. Here’s the good news: I know the path, I’ve done it.

Today I will share with you proven processes you can use to become a profitable day trader.

If you’ve been trading for a while, and like most, have been struggling, I’m going to show you how to turn your current strategies into winning strategies.

Next, I’m going to teach you the processes to build an objective mindset, which will lead to flawless execution.

Most educators call this “Discipline”, but what I teach isn’t the white-knuckle approach; it’s a process.

Soon you will understand what really sets profitable traders apart from the rest: an Objective Edge.

By the time you finish this guide, you’re going to walk away knowing two things with absolute certainty…

#1. An Objective Edge, which you will learn about shortly, is the key to becoming a consistently profitable trader.

#2. You will know EXACTLY what you need to do to build your own Objective Edge, step by step.

One thing I want to stress: this is NOT going to teach you some way to get rich quick. There are zero shortcuts to becoming a successful trader. If that’s what you’re looking for, you’re in the wrong industry.

I’ve received way too many emails from people with stories of losing a lot of money. Some of them have put themselves in terrible positions financially. A lot of the conversations have honestly been heartbreaking.

I’m on a mission to put an end to it. Let’s start with a simple fact. Most retail traders fail. Some studies state this number is as high as 97%.

So, if you are struggling, you’re not the only one. If you don’t want to become another statistic, please follow these 3 simple rules. Those of you who do, will exponentially increase your odds of success.

Protect Yourself

1- Never trade money you can’t afford to lose. All traders lose money when they first start live trading. I did.

2 – Never trade a live account until you’ve proven your abilities over an extended period on a simulated account.

3 – Do not take another live trade until you’ve completed this guide.

I’m about to hand you the blueprint that not only has made me successful, but other traders just like yourself. Don’t end up like the pioneer with arrows in your back.

I want to mention that I will be discussing some of my successes as well as some of the traders I have trained and worked with when I share some of my personal stories. Please don’t lose sight of the fact that day trading is not easy.

What I can tell you with absolute certainty is that every single successful trader I have personally trained or befriended, including some of the most accomplished individuals in this industry, all share a common approach to achieving their goals. That approach is none other than going ALL IN.

I know I have to prove it to you, but I’m going to prove it to you beyond a shadow of a doubt that an Objective Edge is the key to building a successful day trading career. The only way you will ever truly achieve an Objective Edge is if you go all in. What does going all in mean?

These guys right here, they were dabbling; they didn’t go all-in, right?

These guys right here, they went all-in.

Think about this for a second. Fortunes are made (and lost) in the financial markets every single day. It is one of the most competitive industries in the world.

Do you really think a half ass commitment is going to get you to your goals?

If you do, please end your day trading aspirations right here. I don’t say this to hurt your feelings, I say it to protect you from burning through your hard earned money.

Without 100% commitment, going ALL IN, you will pay to go to work as a day trader.

I don’t say this to discourage you, I say it because it’s the truth. If you’re looking to accomplish any large goal in your life, it’s imperative you approach it with realistic expectations or you will only be left with disappointment.

Tony Robbins says it best, “If you want to take the island, then burn your boats. With absolute commitment come the insights that create real victory.”

If you truly have aspirations to become a day trader, one who actually makes money, I want you prepared to burn the boats.

My Trading Journey Begins

The first question people always ask me is, what in the world is an Objective Edge, and do I actually need it to become a successful trader?

To help you understand what an objective trading edge is, let me share the story of how I actually discovered it.

I grew up in a small farm town in the Midwest. It was my junior year of high school, and I had zero idea of what I wanted to be when I graduated.

The path taken by most people from my area was either farming or working at one of the nearby mills. If there’s one thing people knew how to do in my hometown, it was work.

On top of being a full-time mother, my mom also worked a few hours every single morning and typically had three night shifts every week.

My dad would leave the house before 8:00 a.m., 7 days a week, and typically wouldn’t get home until 9:00 at night or later. Rarely would he get a weekend off, and he never had a holiday off.

I absolutely loved where I grew up, but even as a kid, I knew my destiny wasn’t tied to that town. I wanted to meet new people, learn new things, find something I was passionate about to pursue, and experience life outside of the small bubble I had grown up in. I wanted an adventure.

I also was determined to make money. I grew up watching my parents work nonstop. Not only did I want to be in a position to help them with anything they wanted, but I also wanted to live a different life.

That year, I watched a movie, and it amazes me to this day how profound of an impact it would have on my life.

That movie was the instant classic, Wall Street. Not only was it a great movie, but I saw it at the perfect time. Bud Fox instantly became my hero.

I started spending hours after school and on weekends reading trading books and chatting with people on the old-school Yahoo bulletin boards, trying to learn anything I could about the markets.

By the end of that year, I had paid for multiple teleseminars (yes, as in telephones, webinars didn’t exist yet), as it was still the wild west of the internet. I also subscribed to a bi-monthly newsletter that included the “Hottest Penny Stock Tips.”

I had saved $1,500 working the summer before my senior year of high school. I was extremely fortunate to have parents who did everything they could to support my interests. They tracked down a broker and helped me open my first trading account with $500 from the money I had saved that summer.

Online brokerages didn’t exist yet. If you wanted to place a trade, you would call your broker. Your broker would get you the current bid and ask for the stock, you would tell them what you wanted to buy or sell, and they would call their representative at the exchange to place the order.

I’ll be forever thankful for Ray; I can remember him taking way too much of his time to help feed the endless curiosity of a 17-year-old kid.

Just a few months after opening the account, I put the entire $500 into a penny stock that my newsletter said was ready to “surge”—I distinctly remember them using that word… and shockingly, it did.

A few weeks after buying the stock, it jumped from below 50 cents to three dollars. I immediately called Ray and told him to sell everything I had ended up making a $2,000 profit.

Just a few days after I had sold the stock, it crashed lower than my initial purchases. I just experienced my first pump and dump, and I was hooked. I made more money from a newsletter and a couple of phone calls than I had made working the entire summer before.

I now had a pretty good idea of what I wanted to do when I graduated, become a day trader. I figured if Bud Fox could do it, why couldn’t I, right?

I cashed out the entire account. I didn’t have a trust fund waiting for me when I graduated high school, and back then, it was a ton of money.

Over the next few months I racked up a huge long-distance bill trying to track down trading firms in New York and Chicago. Eventually, I had some success but quickly discovered that all of them required a resume and a transcript from a four year University, something I obviously didn’t have.

I had a very difficult decision to make. No one in my family had ever graduated from college. Quite frankly, I didn’t want to go to college at the time. Although I had decent enough grades, I was never a big fan of school when I was young. I was ready for an adventure.

Yet, I knew I wouldn’t find what I was looking for if I stayed in my town. I was extremely interested in trading, and I saw it as a way out, as my adventure.

So, I packed up and shipped off to do what I had to do, spending the next four years getting my degree.

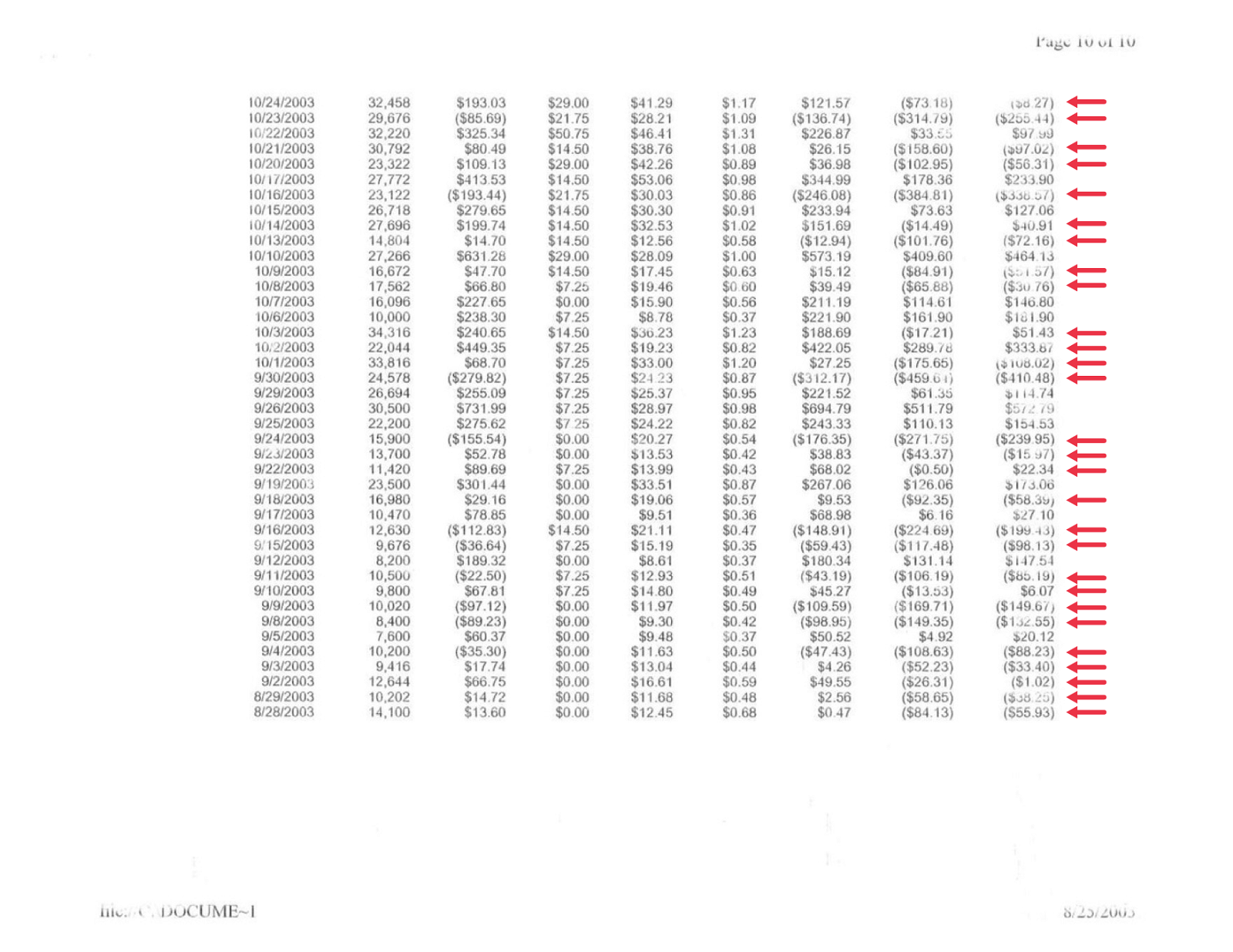

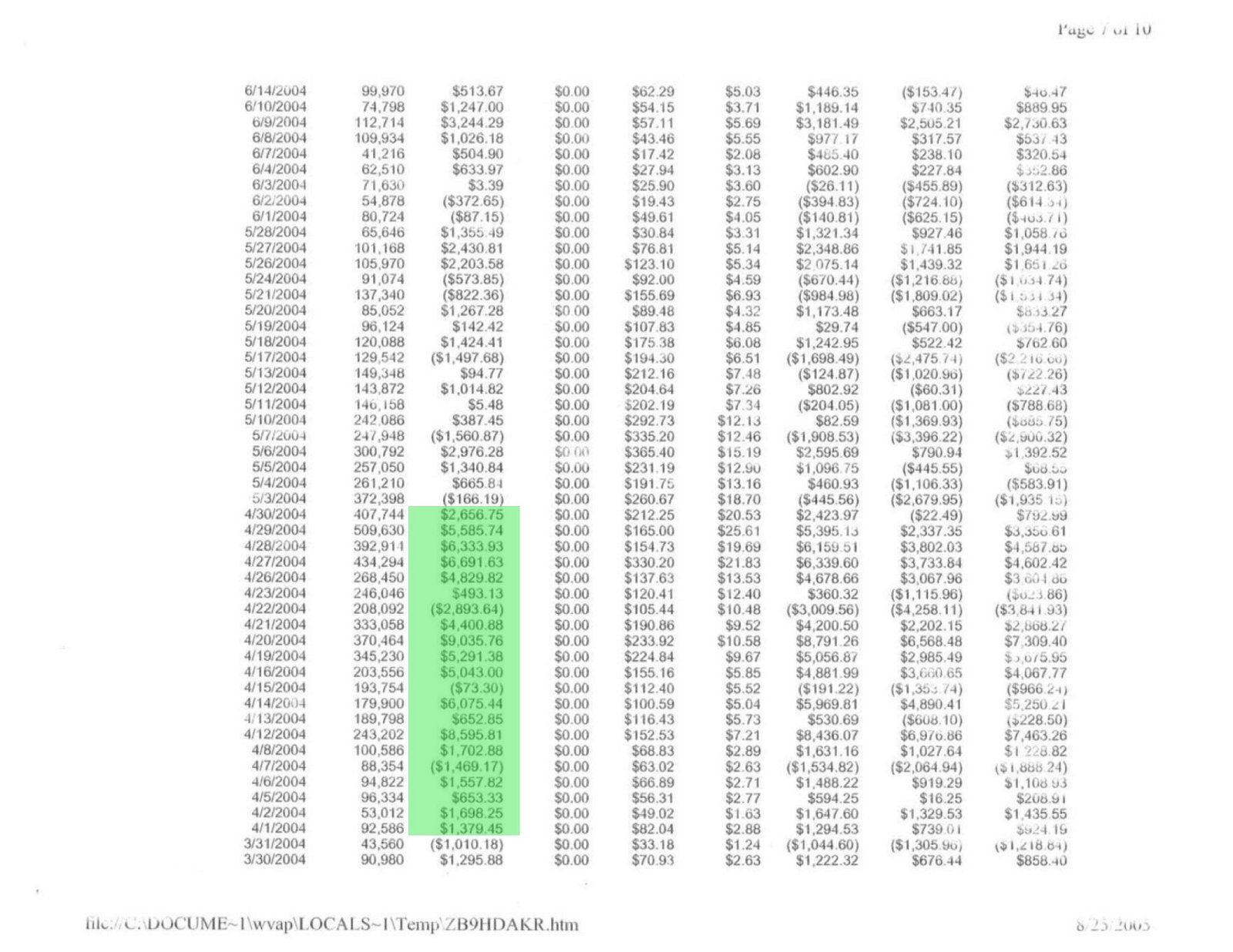

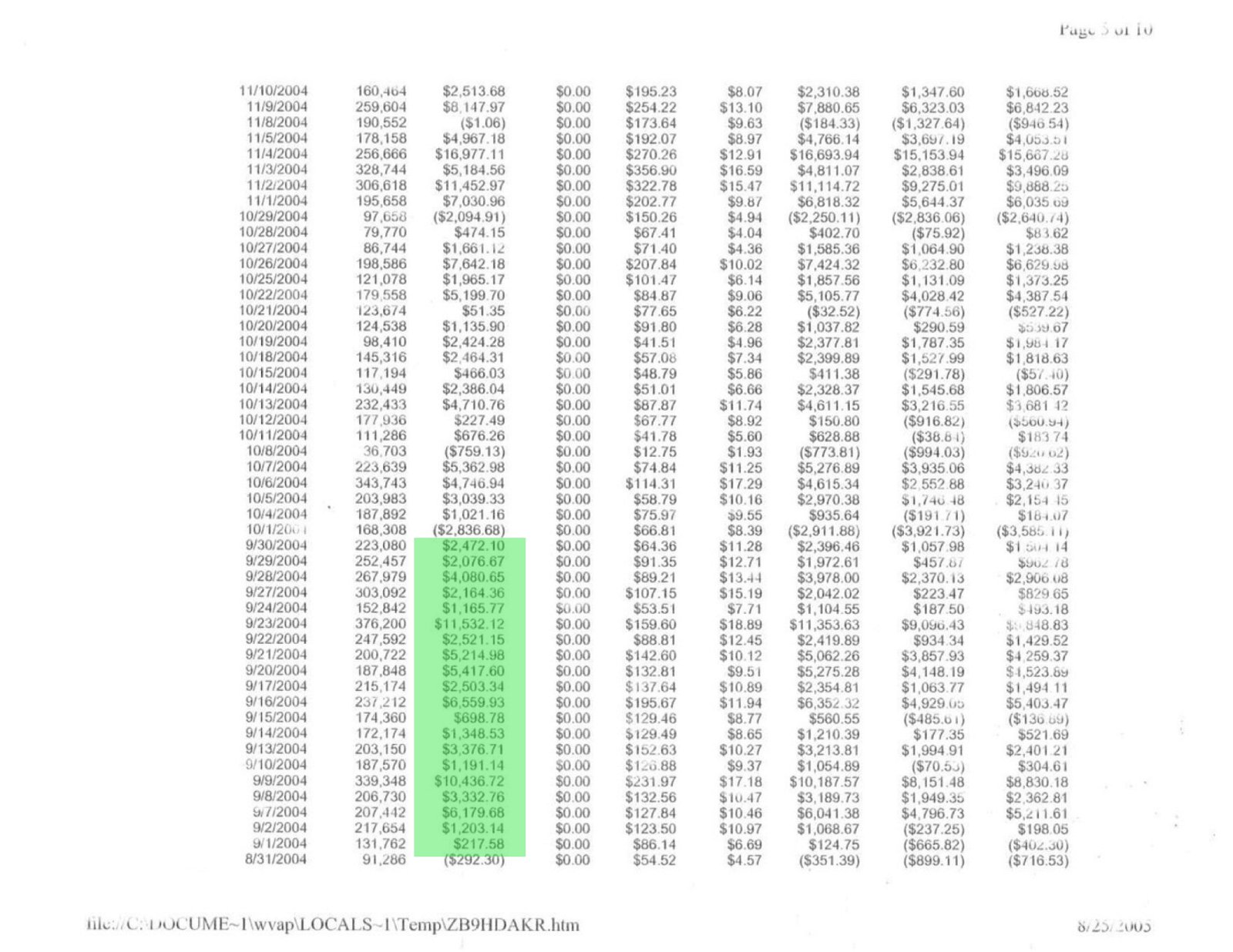

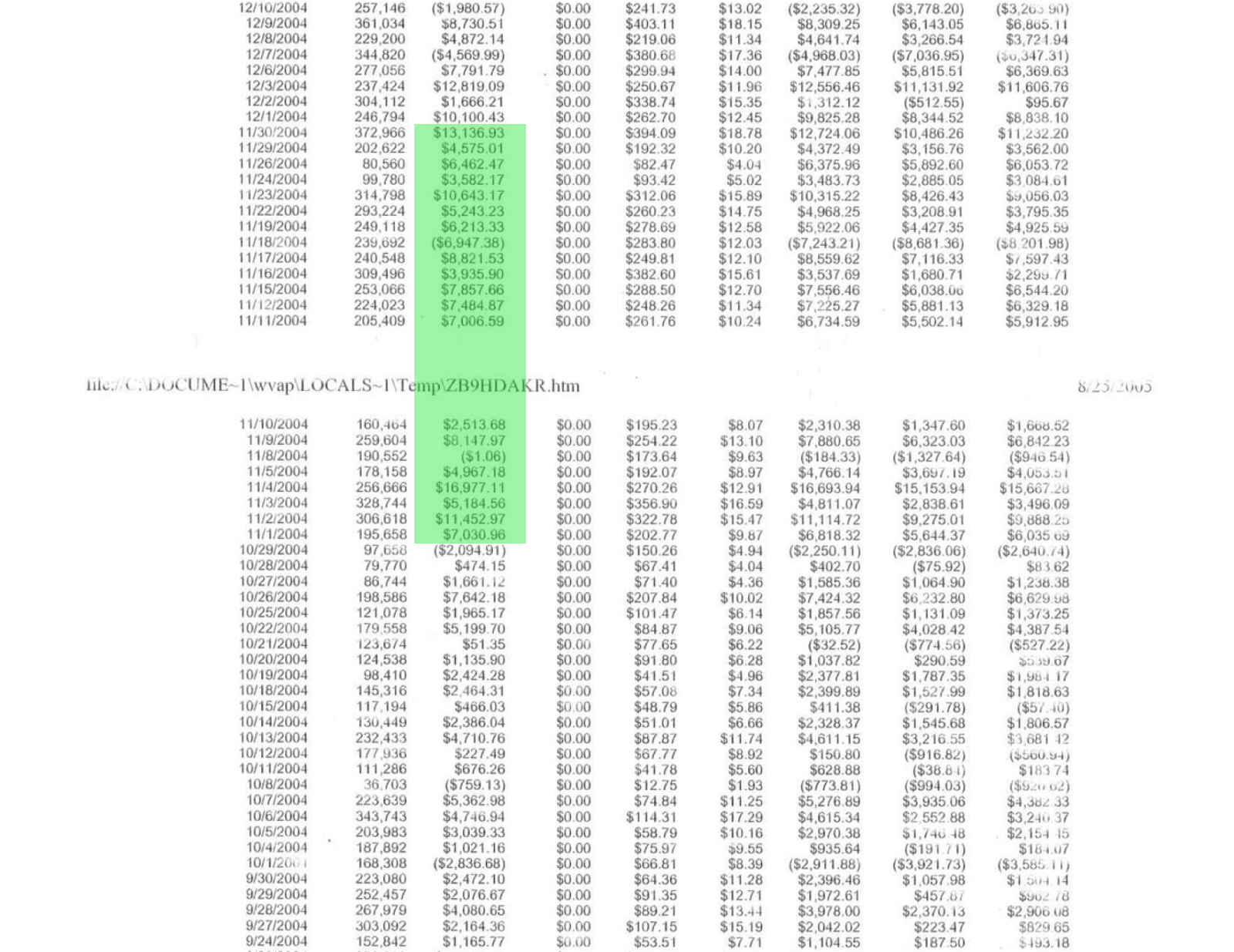

Fast forward to October 2003. I had graduated college and was four months into my new career as a day trader for GPC in Chicago.

At the time, it was one of the largest proprietary equity firms in the country, with about 200 traders. Schonefeld Securities out of New York is the only firm I’m aware of that was larger at the time.

I was four years into my journey, received my degree and landed the job I wanted, at the firm I wanted, in the city I wanted. Pretty amazing, right?

Wrong. Things were going terrible!

I was failing miserably, on the brink of being fired, and if I wasn’t fired, I would have to quit because I was dead broke. Out of the twenty traders I was hired on with, I was dead last, literally.

I was negative over 70% of the days in my first four months of live trading.

I was moving backwards and digging a deeper hole—I wasn’t expecting this outcome. It was a very difficult point early on in my life.

I had racked up a lot of debt to go to college, all because I wanted to be a trader. This was supposed to be the good part. I had just worked four years to get to this moment!

Throughout my four years in college I worked for an insurance company. They had offered me a a job just a few months prior to graduating.

Jim, my boss and mentor while I worked there, was an amazing man. However, the thought of going back to a corporate desk job made me sick to my stomach, and truthfully, it made me angry.

I was about to get stuck in a job I never wanted, just to pay off debt for something I didn’t want to do in the first place.

The stress had been building, and I hadn’t spoken to anyone about it. I didn’t tell my family or my friends, I was just too embarrassed and frustrated.

Here I was, on the brink of getting fired or having to quit a job that I just spent four years of my life and a lot of money to get.

I was surviving on a $1,500 monthly draw the firm paid us as new traders. I’m still not sure how I made it through it considering my rent, utilities, student loans, and monthly train fare. There was no way I could afford to live in the city, so I commuted every day on the train to Grand Station, which took about an hour and fifteen minutes each way.

Truthfully I was at a point where I wanted to give up. I couldn’t believe the position I was in after all the work I had put in over the past four and a half years. It was my dream to get to this point, but it was quickly becoming a nightmare.

On Halloween Day 2003, right after the markets closed, I received a call from Ron asking if I wanted to come over for dinner.

I had met Ron a couple of years earlier while I was in college. During a summer break, I had the chance to shadow Ron at the Chicago Board of Trade.

It was a day I will never forget—an electrifying experience, especially considering my goals at the time. It only reconfirmed what I wanted to do for a career.

Ron and I stayed in touch as I finished college, and by the time I graduated, we had already built a strong friendship. Ron was in his mid-40s back then and would retire just a few years later.

Not only is he one of the most accomplished traders I know, but he’s also the first person I met who truly understood the game. At the time, I reluctantly said yes to dinner, but I’m forever grateful that I did.

Our trade floor was right across the street from the CBOT where Ron worked. I walked over to meet him, and the moment we hopped in the cab, he asked me, “So Adam, why do you suck at trading?” Ron is very blunt, something I’ve always loved about him.

I told him everything—how terribly work was going, my financial position, and how I was likely going to be fired or have to quit very soon. While most of the reasons I gave him for my failures were incorrect, he sat and listened.

Our conversation extended late into the evening, lingering well after dinner was over. The stories he shared and the lessons I learned would prove to be instrumental in shaping the trader I would eventually become, setting me on a trajectory towards developing an Objective Edge.

That evening I learned that in order to become a successful day trader —one who endures over time, flourishes amidst significant market fluctuations, and consistently generates profits month after month, year after year—you must accomplish two main objectives.

First, you need to learn how to think and react in terms of probabilities, what I call an Objective Mindset. Only then will you be able to flawlessly execute a trading strategy.

Second, in order for a trading strategy to be profitable, it must be repeatable, specifically for you!

When you combine an objective mindset with a repeatable trading strategy, you have what I call an Objective Edge.

It’s literally the key to achieving all your trading and financial goals. If you’ve been searching for the holy grail, this is it. It’s what over 90% of traders fail to ever achieve in their careers.

Near the end of the evening, Ron said I needed to set a financial goal. He challenged me and asked what I had seen some of the other guys at the firm make.

I had already seen a senior trader make a hundred grand in a single day—that was in my first or second week on the job. Just a few weeks before I had dinner with Ron, I saw another senior trader, Ben, make over three hundred thousand dollars on one single trade.

Ron asked, “What’s so different about them compared to you?”

Truthfully, the answer was nothing.

Ten grand a month was the number that I really wanted to make. That would be enough to quickly pay off my student loans, move downtown, and allow me to start building a bit of a cushion—something I was desperate for.

He laughed, called me some choice words, and he pretty much forced me to settle on making a hundred thousand dollars in a single month, sometime in the next calendar year.

Let me remind you, this was an absurd amount of money back then. As a 21-year-old kid, sitting there looking at this, with goals and aspirations just to become a profitable trader, just to save my job.

Yet I thought, if these two guys, who are just like me, just like any of us, can make six figures in a single day of trading, I wonder if I can make six figures in a month?

It was the first time that kind of money ever crossed my mind in my life—or at least me personally making that kind of money. I was a long way from home…

Building My Objective Edge – The 100k Challenge

I can vividly remember the cab ride back to the suburbs after leaving Ron’s that night.

I still had no clue what I was doing yet, but that night, I felt empowered. For the first time in a long time, I had some confidence again. More importantly, I had an entirely new perspective of the markets.

I was determined to make it. I dove right in that weekend and honestly never looked back.

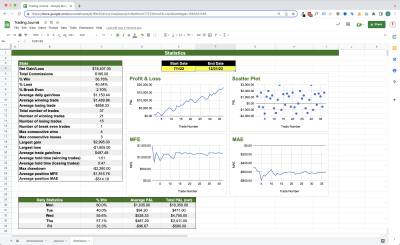

I became obsessed with my analytics. I began reviewing all my trades, including my SIM trades, because my live trading was terrible.

I started seeing patterns in the setups and securities that I traded best. Despite the fact it was the exact opposite of what most coaches at the firm said I should be doing, I was finding the most success trading thin securities that were highly volatile.

(Need a trade journal to track your trades? Become an JT Insider… it’s FREE – Join NOW>>)

I immediately changed three things the following week after meeting with Ron.

First, I stopped looking at my P&L and removed it from my platform. I didn’t know what my P&L was until the end of every week.

Next, I graded myself on every single trade that I took. I scored the setup, my sizing, and how well I followed my trade management rules. At the end of every day, I would examine the trades that I graded myself poorly on, trying to discover what I could have done better. Seeking what processes what processes I could put in place to improve my execution and performance.

Third, I was all in, literally. No, I didn’t have best Christmas lights in town. I busted my ass, knew my goals, and I wasn’t willing to let anything stop me from reaching them. PERIOD.

I started planning out every day of the week, hour by hour. I’d get up at 5:00 every day and be at the office by 7:00. I’d review my trades and journal notes from the prior day and check what was moving premarket.

I’d walk around and chat with the senior guys, building friendships, asking how their trading was going, trying to pick up any advice that I could.

After the close, I’d attend the meetings held every day by a few of the senior traders who were coaches for the firm. They would discuss their recent trades, what they had been seeing, what they were working on or trying to improve. These meetings were pure gold.

As everyone left for the day, I’d sit back down and continue to review my trades and work on my strategies. I’d catch the 5:00 o’clock express train and head home. On the train ride to and from work everyday, I was reading books, primarily psychology books.

Trading became my life. I was dreaming about it most nights, no joke.

On November 20th, I hit my first milestone and chopped my first comma, making a thousand dollars in a day, which was a big celebration on the floor the first time a trader achieved it.

November would be my first positive month, 6 months into the job. I grossed $5,000 for the month, which wasn’t even enough to cover my past draws, but it was a win, one that I continued to build upon.

Day after day, week after week, I was grinding. As a result, the definitions of my strategies started to become more precise, more logical, and easier to execute.

When reviewing the trades that I had graded myself poorly on, I noticed that it was usually due to a situation I hadn’t seen before, a setup that had occurred in a little bit of a gray area where I was unsure.

I worked on defining those situations and getting more precise. I also began to cut out the setups that I couldn’t see the logic in or that I found difficult to execute.

I became extremely competitive with the only person that mattered, myself. Constantly looking for ways to improve not just in my day trading, but in life. They go hand in hand (remember that).

A few months later, I hit another milestone. I made over $10,000 for the month of February and received my first actual paycheck from my trading profits. It wasn’t a large check, but I can tell you that check meant everything to me.

My consistency was improving drastically. I saw the market from a completely new perspective.

That April, I hit another major milestone: I closed the month out up $68,000. I can remember getting that paycheck.

I honestly couldn’t believe it at the time. Most people where I grew up would work a couple of years to make what I just made in one single month.

I continued to grind, and my confidence grew as my edge became more and more objective.

In September, I hit a new high-water mark, closing out the month up $73,000.

With only two months left to hit my goal of a hundred grand in a month, Ron made sure to give me a hard time and keep the pressure on. Ron has always known how and when to push me.

In November, one year from the date that I set out to make hundred grand in single month, I accomplished my goal, closing the month out up $135,000. I finished the fourth quarter strong, making over $250,000.

I continued to break my goals and set new milestones. The following June, only two years into my job, I became the youngest head coach at the firm.

I went on to break milestone after milestone throughout my career. While it’s not the only reason, no doubt I can attribute a lot of my success to that single dinner I almost skipped.

Take every opportunity you have in life to learn from those with experience and a track record of success doing the things you want to accomplish yourself. No matter what your eventual goals are in life, I hope you take that piece of advice with you. Don’t be the pioneer.

The last 20 years have been the best adventure I could have asked for. What’s truly been the most rewarding is that I’ve been able to give back to my parents and my family, to whom I owe everything.

I’ll be forever grateful for the experiences I’ve had, the relationships I’ve built, but most importantly, I’m thankful for the challenges trading has provided that have pushed me to become the man I am today. I’m not sure my adventure would have been the same without them.

Now you might be thinking, “Well, that’s awesome, Adam… but I don’t work for a professional trading firm.”

Well here’s the good news. I have, and I’m here to help those who are ready to make the commitment it’s going to take.

As you can probably tell, I became obsessed with developing my objective edge. Day trading has never felt like work to me. I love it; it has become my entire life’s work.

After grinding for over 20 years, I decided to retire from working full-time at the end of 2022. I’ve made major sacrifices in my life to reach my professional life goals, and as a result some of my personal life goals have been severely neglected.

I will be connected and involved in trading one way or another for the rest of my life because it’s a passion. One of the passions that has been reignited as a result of this website is coaching traders and helping them to achieve their goals.

I realize the problems retail traders face, and I’m here to help fix them. But first, I need to show you the hard way of learning to day trade. Actually, it’s more like the impossible way.

It’s the same process I constantly see retail traders performing, resulting in failure after failure. But don’t stress out; after this, I’m going to show you the exact process to start developing your own objective edge.

Meet Joe. Joe is tired of his job, his industry, his pay, and is looking for a new opportunity.

Joe sees an ad online for a day trading course. It sounds interesting. The educator seems to be smart and successful, so Joe purchases the course.

Joe begins studying and learning the trading strategies and after a few weeks, he’s ready to go!

He’s opened a brokerage account, knows how to place a trade, and best of all, he has his strategy (from some random person on the internet with no rack record…).

Joe’s super excited and begins trading. It’s exhilarating; he absolutely loves his new job!

A few more weeks go by, and Joe’s having some problems. It seems his strategy isn’t working, he’s losing money.

A few more weeks go by, and Joe has a big problem: he lost all the money in his trading account. He’s angry. The strategy sucks. Everything his educator told and taught him was crap (probably true).

But wait, Joe’s back, and he’s excited.

Joe just learned about a new trader, and the best part is that he has a secret strategy that is the #1 trading strategy in the world. According to Joe, you can’t lose with it. He’s really excited about this strategy; he’s convinced it’s going to get him back on track.

He puts more money in his trading account, and he’s back at it, ready to conquer the world with the new strategy. Can you guess what happens next?

This cycle leads to what I call the Education Loop, where most retail traders jump to more education and new strategies and fail yet again, and repeat this cycle over and over. The education loop stop your progress in it’s tracks. This is usually the point where retail traders get stuck until they give up.

I’ve repeatedly heard this same story from retail traders since I started Jumpstart. Trust me, it’s usually not because of a lack of effort. Some of these people are better educated on some topics than I am.

The problem is their focus is on all the wrong things. They never learn what a profitable trading strategy truly is, and they’re going down a path that makes it impossible to build the objective mindset necessary to execute a strategy.

If your story is like Joe’s, we’re going to get you on the right track today.

If you’re brand new to trading, I’m going to save you from a lot of headaches and wasted time.

The following three secrets, which we will cover for the rest of this guide, are imperative if you want to become a successful day trader.

Secret #1: An Objective Edge is critical in order to overcome a trait we’re all born with, which wreaks havoc on the novice day trader.

Secret #2: How to build a winning day trading strategy, one that never leaves you unsure of your next move, allowing you to avoid the common mistakes of unprofitable traders.

Secret #3: How to develop an objective mindset (discipline) that will result in flawless execution.

Are you excited? Are you ready? Awesome! Let’s jump into it.

Secret #1 – An Objective Edge is critical in order to overcome a trait we’re all born with, which wreaks havoc on the novice day trader.

It took me about a year to develop something that resembled what I would consider an objective edge today.

That doesn’t necessarily mean I wasn’t making money along the way. What changed drastically as I developed my edge further was my consistency.

New traders I often get asked why I’m willing to share my trading strategies. My strategies aren’t what made me a successful trader over the years. It’s my ability to execute a strategy that separates me from 99% of others.

One of the first things Ron taught me when I started at GPC was to make friends with the quiet ones, not the traders who were breaking keyboards and throwing monitors, even if they were making a ton of money.

I discovered that the quiet guys with cool emotions were willing to help and share their insights and ideas. They had no egos. They knew that what separated them from the rest was their ability to execute, not their strategies.

The traders who were emotionally erratic tended to be the one-hit wonders. Their egos never let them see and understand the true reasons for their success. They were extremely secretive in what they were trading or anything about their strategies. Their swings would lead to burnout and an exit from the industry.

Give me a hundred hours, and I’ll design a profitable trading strategy. To be 100% candid, some of the most profitable strategies I’ve traded over the last twenty years aren’t very complex.

What typically leads traders to failing is their inability to think objectively.

The definition for objective is “not influenced by personal feelings or opinions in considering and representing facts.”

The tool we use to extract money from the markets is our trading strategy. A trading strategy is nothing more than an edge that signals when there is a higher probability of one thing happening over another over a series of trades.

The outcome of a trade can only be one of three things: a win, a loss, or breakeven. There’s a probability tied to each of those outcomes depending on your strategy. After a large enough series of trades, every outcome will come to fruition… assuming your execution is flawless.

Yet, most traders fail to ever internalize this concept. Why?

As humans, we are absolutely terrible when it comes to thinking in probabilities. Although we believe that our perceptions provide an objective view of the world, the truth is that our evolutionary history did not equip us to perceive the world as it really is—a chaotic place where every single outcome is purely based on luck.

Our brains have evolved to prioritize survival, to create order and certainty out of chaos, and one way our brain does this is by minimizing uncertainty.

Imagine thousands of years ago, one of our ancient ancestors heard a rustling in a bush or in the grass.

Sure, it could be due to wind, but after seeing a family member eaten by a lion a week ago, they wouldn’t sit around to observe or contemplate the odds of it really being a lion.

It was much safer to just assume the rustling was a lion and run.

Finding simple patterns and shortcuts like this is how we’ve evolved and survived. They help us navigate the world, but they also stop us from seeing the truth… Ever outcome in our life is 100% based on chance.

We are able to influence the probabilities of outcomes based on our actions and the decisions we make, yet we can never guarantee an outcome of a single trade.

I think we all recognize the existence of chance and luck, but we fight the idea that despite our best efforts, things just don’t always work out the way we want, such as an individual trade.

As a result, we tend to label our decision-making as good or bad based on a small set of outcomes.

When a trade ends in a good outcome, the novice will attribute it to their skills. When something bad happens, they attribute it to a bad trading strategy or blame the market. When In reality the outcome of a single trade is nothing more than chance.

I used to illustrate this to my trainees when they were in a position that I knew had gone further against them than they initially planned. I would ask them where their out was, and if the price got near whatever level they told me, I would take out the entire level and they would miss their stop.

I was illustrating the fact that it only takes one trader to change a winning positions into a loss or vice versa, turn a losing position into a winner. Considering we don’t know the opinions of every trader in the world, the outcome of any single trade is nothing more than chance.

Yet, simply being aware of our irrational behavior and wanting to change isn’t enough. In the same way that when looking at an optical illusion, simply knowing it’s an illusion isn’t enough to make the illusion go away.

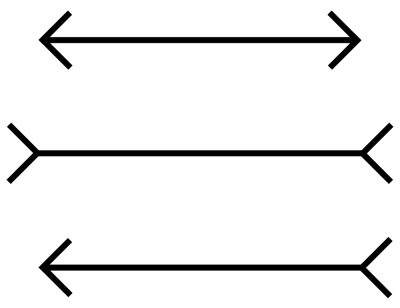

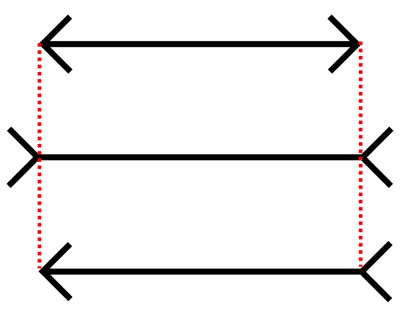

We can use the Müller-Lyer Illusion to illustrate this.

Which of the lines below is the longest?

Our brain tells us the second line, but you can measure the lines and see that they’re all the same length.

Yet, you can’t force yourself not to see the illusion. So, what’s the solution?

This is where most online education is failing traders. They say you need discipline! Again, willpower isn’t enough.

You have to create workarounds, such as carrying around a ruler to check against how your brain processes what you see.

As a day trader, you must build well defined strategy that doesn’t leave you second guessing and implement a process that reinforces an objective mindset.

It starts with becoming comfortable with not knowing. Since childhood, we’ve been discouraged from saying “I don’t know” or “I’m not sure.” Yet, “I’m not sure” is a more accurate representation of the world.

The world is a random place. The influence of luck makes it impossible to predict exactly how things will ever turn out.

When analyzing our trades on an individual basis or in a small group, the outcomes are entirely based on luck. When you accept this, you will be able to execute your plan because you won’t be putting any statistical relevance on the very next trade.

Remember, the patterns that we trade simply measure the collective mind of the market, indicating when there is a higher probability of one thing happening over another, represented as an edge—not on a trade-by-trade basis, but rather over a series of trades.

Let’s take a look the first step in building a Objective Edge, which lead us into secret #2.

Secret #2 – How to build a winning day trading strategy, one that never leaves you unsure of your next move, allowing you to avoid the common mistakes of unprofitable traders.

In 2009, I faced my first major market disruption as algorithms began accounting for most of the daily market volume. It was evident that the landscape was going to change.

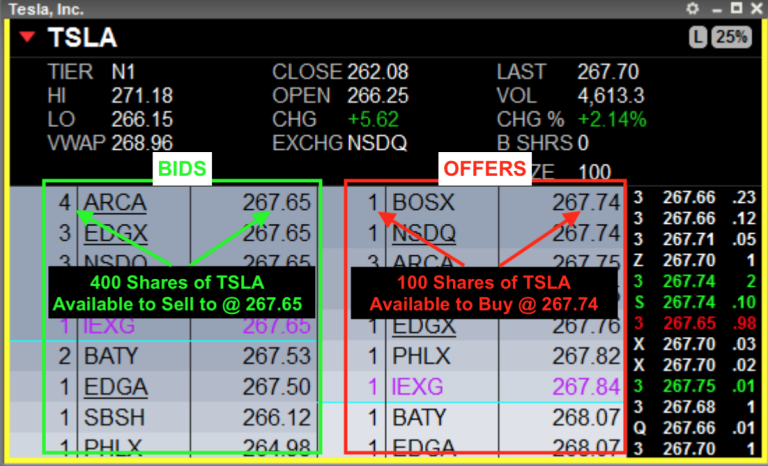

For every firm and day trader whose strategies were built around scalping off a Level II (seen above), the game had changed. The algorithms flooding the market, along with the ability to now hide trade size on ECNs like Island, greatly reduced the transparency and effectiveness of Level II.

Making money with the strategies we were trading became increasingly difficult. It was a major transition period for many day traders, similar to when floor traders had to adapt to the markets transition from the pits to electronic.

About a year prior, I had started working on an algorithm with a friend and trader named Matt whom I met at the firm. The algorithm arbitraged an opportunity that existed at some of the new retail forex brokerages that were emerging online.

We discovered that some of these brokerages were acting illegally as bucket shops. Bucket shops use a quote feed to obtain market prices and take your order, but they would never actually fill it.

Since the majority of retail traders lose money, these bucket shops would profit when a trader lost. They also provided traders with excessive leverage, ensuring their eventual losses. If you were profitable, the bucket shop would still pay out, knowing they would always win in the long run.

We found that the quote feed used by these bucket shops had a few millisecond delay, and we capitalized on it during economic news events around the world. We eventually left the firm and partnered up to trade our own capital, focusing on the algorithm for the next few years at several different bucket shops.

The returns were extraordinary, but we knew it would only work for a limited time at the scale we were trading. Either the bucket shops would be exposed and go out of business, or they would simply refuse our business due to “unusual trade activity” and close our accounts.

The algorithm required minimal time and effort, aside from waking up in the middle of the night to set up for foreign releases. During the two years we were traded the algorithm, I spent most of my time working on developing and testing new trading strategies.

Initially, I had mixed results. I developed several strategies, but executing them proved challenging for me. Coming from a background of focusing on Level II all day, where constant feedback was available, I often felt like I was in the dark when in a position with the strategies I had built.

I also tried a few strategies that some of my friends found success with, but I couldn’t see the logic behind them. They weren’t repeatable for me personally, given my core market theory and trading style.

Over the past 20 years, I’ve observed the same pattern with every successful trader I’ve taught or befriended. We all find strategies and security characteristics that align with our strengths and how we view the market.

Trading strategies don’t come one-size-fits-all. The exact way I trade my strategies most likely wouldn’t be suitable for you. That’s why you need to learn basic strategy development skills to adjust a strategy to fit your goals and style.

I went back to the drawing board and focused on tools and indicators that supported my personal market theory. I focused on tools I understood the logic behind, such as volume profiles, delta, tick indicators, among others. Eventually, I developed strategies that provided the feedback I was seeking.

If a strategy is difficult to execute, if it’s not repeatable, specifically for you, it’s useless. To make a strategy repeatable, you need to clearly define every step of the process.

Consider a very basic example. Suppose you’re trading a strategy where one context requirement is that price is forming a double top or double bottom, meaning it retests a prior high or low and is rejected.

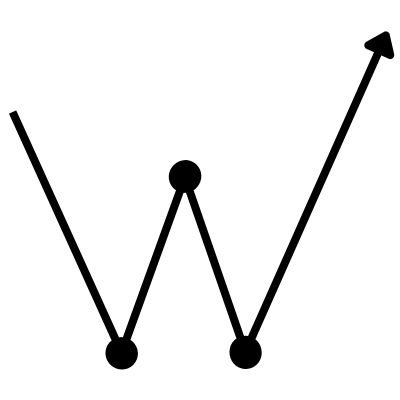

Above we have a textbook definition of a double bottom.

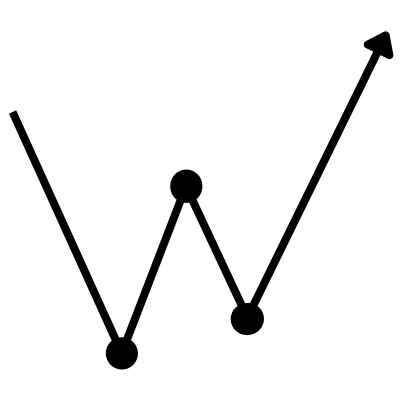

However, what about this example? Is it a double bottom?

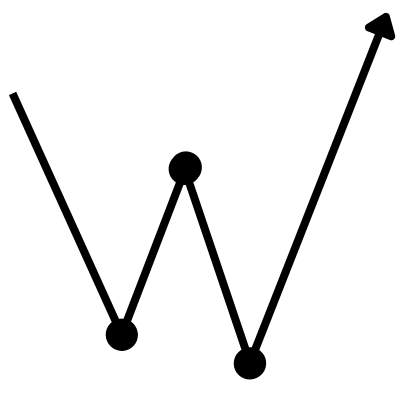

How about this one?

These are the types of elements that require PRECISE definitions in your strategy.

Poor definitions lead to uncertainty, which in turn leads to red trading accounts. If your strategy is not repeatable specifically for you, you simply don’t have an edge in day trading.

To better help you learn how to build a repeatable trading strategy, lets walk through how I build a playbook.

Developing Your Playbook

Your playbook serves as a comprehensive guide, outlining every component of your trading strategy in a step-by-step manner. It acts as a living document that enhances your execution skills and allows you to progress as a trader.

I recommend creating separate playbooks for the different strategies you trade.

Step 1: Strategy Goals

This is where you map out your targets in terms of win percentage, risk-to-reward ratio (R multiple), and the style of strategy (e.g., scalping or swing trading).

To do this effectively, you need some basic strategy development skills and an understanding of how the parameters you define, such as your minimum R or different trade management techniques, will impact factors like win percentage and drawdowns.

Personally, I know my execution is best over the long run when trading a strategy with a minimum win rate of 45% or higher on setups of 2R or greater.

It’s important to note that every trader is different, and what works best for one may not work for another. The only way to discover what suits you is through experimentation.

Trading strategies are not one-size-fits-all; they should reflect your core market beliefs and strengths while protecting you from your weaknesses. Clear definitions throughout your playbook is the key to achieving this.

Step 2: Logic

I cannot stress enough how crucial it is that you understand the logic behind why your strategy works, as well as the logic behind each tool and indicator you use to analyze the market.

Failing to do this will lead to doubt in your strategy during drawdowns resulting in poor execution.

Devote significant time to this step while developing your playbook. If you cannot explain the logic behind an indicator or any other component of your strategy, you shouldn’t be using it. Remember, the goal is to create a repeatable strategy, and understanding the logic is a necessary step towards achieving that.

Here’s an example of how I would define the logic for an indicator I use, Cumulative Volume Delta:

“Cumulative volume delta displays the aggression of local buyers and sellers. When examining CVD relative to price, especially at swing highs and lows, we gain insight into other time frame participant activity.”

The more precise you can be in all your definitions, the easier it will be to execute your strategy.

Finally, you need to describe your overall macro theory—your core beliefs. In your own words, explain what actually moves the markets. Personally, I’m an Auction Market Theorist, and all my trading strategies align with this.

Step 3: Security Types

In this step, define the characteristics of the securities you will trade. Every security has it’s own characteristics features regarding volatility, behavior around key levels, spread, liquidity, and more.

Through simulated trading, you will discover which characteristics best suit you and your strategies. Some basic examples of definitions include low float, high short interest, tight spread, and average daily volume greater than a certain threshold.

Step 4: Context

Here you outline the context you will use to identify trade opportunities. You can think of Context as the CEO of your trading business, it looks out above the trees and see we’re going that way!

Many novice traders consider a simple pattern, or what I refer to as a trigger, along with basic trade and risk management rules, a complete trading strategy. However, it is only when the proper context is applied to these patterns that they become profitable.

Some generic examples of context are double tops/bottoms or a swing high/low.

Step 5: Triggers

Define the triggers (patterns) you will use to assess to enter a position.

After determining the market direction using context, you look for triggers which allow you to evaluate the reward-to-risk of a potential setup.

If the setup meets the R parameters defined in your playbook, take the trade; otherwise, pass.

Step 6: Trade Management

In this step, define the techniques you will use to manage your positions. YOU MUST BE EXTREMELY PRECISE!

When novice traders enter a position, they often freeze up like a deer in the headlights of a car. All logic gets thrown out the window. It’s crucial to establish a repeatable process for managing trades.

Additionally, ensure that your trade management techniques align with the goals of your trading strategy.

For example, if your strategy aims for trades with a 3R or better (3:1 reward-to-risk ratio), your management strategy will be less aggressive than someone targeting a minimum of 1.5R.

I frequently see traders using excessive discretion when managing their positions, resulting in an unrepeatable trading strategy.

Here’s an example of something I would use while scalping.

Trail swings until target 1 is hit, exit half of the position, stay in the remaining position as long as delta is tracking until taken out at a swing or exit on a high tick reading.

You may not fully understand this right now, but it’s a management strategy I personally could execute flawlessly, with absolutely zero hesitation.

Step 7: Position Sizing

Unless you’re already a profitable trader, trade the minimum contract or share size possible on every trade.

You must earn the right to increase your trading size by proving your ability to execute a strategy.

Your focus should always be on grading your execution of a trade, not its outcome. Increasing your trade size too early makes it difficult to maintain an objective mindset, as it can quickly becomes solely about the money.

Step 8: Acronyms/Tracking

Define the acronyms you will use to track context, triggers, trade management techniques, and risk management techniques deployed for every trade you take.

Tracking and reviewing your trades every single day is essential to your progress as a day trader. If you’re not keeping precise analytics on all your trades and reviewing them daily, you’re operating your business blind.

You can’t improve what you don’t measure.

Step 9: Questions

Even with strong definitions, when you first start trading a new strategy, you will encounter scenarios you hadn’t considered, leaving you uncertain about the appropriate course of action.

In such cases, prioritize logical and pass on the trade. Take a screenshot and track it in your playbook.

After the trading session, go back, test, and redefine certain definitions, ensuring that the next time you encounter a similar example, you know exactly what to do, even if it simply means passing on the trade temporarily.

Step 10: Future Ideas

As mentioned earlier, your playbook is a living document. As you backtest, sim trades, and go live, you’ll come up with new ideas and potential ways to improve your strategy.

Some of these ideas may find their way into your playbook, while others may not.

I have countless playbooks spanning the past 20 years, which have served as a source of inspiration and ideas when needed.

These categories are what I have my students include in their playbooks, but feel free to add any additional items you find beneficial.

The only wrong way to create a playbook is to not create one at all.

I promise if you take this systematic approach to developing your trading strategy you will find success.

Once you’ve developed a rough draft of your playbook, it’s time to focus on building an objective mindset.

Secret #3 – How to develop an Objective Mindset (discipline) that will result in flawless execution.

I believe discipline is a word often misused in trading. Most gurus teach a trading strategy and then emphasize the importance of discipline for success.

While it is sound advice, as you learned earlier, willpower alone isn’t enough. We need safeguards and repeatable processes to remain focused and in the zone.

In 2016, Jumpstart Trading officially began with a couple simple blog posts. It sat idle for several years until the pandemic hit and I found myself with extra time on my hands. Over the years the website garnered a lot of comments on the blog posts and people inquiring if I did any sort of training.

This led to a live training series I conducted online for a small group of traders over several weeks. It was a fun and engaging way to shift our focus away from the chaos of the world. From that experience, I walked away realizing the following:

First, I realized how much I missed coaching traders. Second, I recognized the flaws in the current retail education system. Third, I discovered a huge disconnect between myself and retail traders.

The world of retail trading was entirely new to me, and I had to overcome some significant challenges in order to help people. Most of our members came from a broken system with bad habits, incorrect beliefs, and flawed processes.

I had to rewrite their beliefs about what makes a successful day trader like I am right now for you. I also had to reflect on my own journey and share my “aha” moments to help them embrace the concept of developing an Objective Edge.

Some of the processes we are about to discuss most likely are not new to some of you. However, I promise if you think you can skip any of these steps and become a successful trader, you’re absolutely wrong.

Let’s dive into the processes and outline the logic behind why ever step is critical in your development.

Step 1 – Build a Foundation

Building a foundation does not mean you go out and learn a trading strategy and start trading it on a live account.

Start by developing a broad market theory and forming a hypothesis on the mechanics that move the markets.

Spend time learning multiple context patterns and practice predicting price moves on a macro scale.

Next, familiarize yourself with different patterns or triggers that will you will use to calculate the risk of a setup.

Finally, spend time developing some basic strategy development skills and learn how to adjust metrics like R value and win percentage to align with your trading style and goals.

Step 2 – Start Your Playbook

Precisely define the components of your strategy to make execution easier.

Remember to pay special attention to the logic portion of your playbook as it is crucial to your success.

Again, your playbook will grow and progress as your skills progress.

If you would like a Playbook Template become a JT Insider (It’s Free).

Step 3 – Backtest

I didn’t get serious into backtesting until I began developing my own strategies. However, I think backtesting can play a critical role in your development. It’s where you first learn to build better definitions.

When you first learn a new strategy, you’re going to run into a lot of situations where you’re unsure if it’s a setup you should take or not.

Backtesting is where you can work through these questions, and improve the definitions of your strategy so when you go live, you know what your answer will be.

Backtesting is also where you begin to build an objective mindset. You begin to see that being a profitable trader, isn’t predicting every move. It’s simply executing your edge through the processes you’ve built in your playbook.

You will begin to realize that no matter how flawless your execution is, your strategy will have losers.

I suggest you keep your backtesting simple by doing it manually and tracking everything in google sheets or excel or by using a replay tool if you’re charting platform has one.

Once you’ve completed your backtesting and have your rough draft of your playbook, it’s time for step 4, sim trading.

Step 4 – Sim Trading

Skip this step, and I can almost guarantee that you will fail as a trader.

I’m SHOCKED at the number of retail day traders that have never traded on a simulated account.

I began my career at an elite trading firm, you know what I did the first few months? I traded on SIM. The firm was never going to give me capital until I proved I could at least make money on SIM. Why would they?

I was learning from some of the best traders in the world. If I did it in a professional environment with tons of support, you better make sure that you sim trade when trying to do this on your own.

Every single successful day trader I know, began their careers sim trading, all of them. You’re new, you need to learn. It’s ok to lose money on a SIM account. It’s where your real training truly begins.

Everything up to this point was just preparing you to SIM trade. SIM trading is where you learn to develop your context skills, how to spot the patterns you will trade in a live market, the characteristics of different securities, what your strengths and weaknesses are as a trader, and just like in backtesting, you use your SIM experiences to develop better definitions in your playbook.

It’s also where you begin to find your niche. Are you better with scalping strategies or longer interval setups. What trade management strategies do you find easiest to execute? What triggers do you like to trade? What context works best for you?

There’s no right or wrong answer on any of these, everyone is different. Far too often I see new traders trying to force themselves into a style of trading, rather than taking the time to experiment to find what works for them.

SIM trading also allows you to experience trading free of any emotions that are a result of money being on the line. This is critical. Trading has to be about execution, not the money. If you grade yourself on execution, your trading will improve. If you focus on the money, you’re setting yourself up for failure. It’s much easier to focus on execution when money isn’t on the line.

How long should you SIM trade? Until you’ve proven that you can execute your strategy with very few mistakes. Your performance will tell you when it’s time.

I promise you, if you can’t make money on a simulated account, you will never do it on a live account.

Sim trading helps set a baseline for you mentally of what it’s like to trade with objectivity, free of any emotions. It’s how you gain the confidence and the discipline to follow your rules.

It will help you better understand drawdowns of the strategy. EVERY trading system will have drawdowns. You’ll begin to realize that a drawdown is just a part of the random distribution of trades. You will start looking at your performance over a series of trades rather than on an individual basis.

Unfortunately, most traders go right to a live account, and mess up the psychological side of their game before they even know what they’re doing. Day trading is unique, you can test your ideas and build your skills in a live environment while taking zero risk.

There are not many businesses you can do this with, take advantage of it. Learn at your own pace. I tell my students all of the time, screen time makes the dream time.

I want you to promise me right now, that you’re going to SIM trade until you are consistently making money on SIM. Even if you’re already trading live, if you’re losing money, stop, get on a sim account.

I receive countless emails from people who are losing money and complain that they have no idea what they’re doing.

It fascinates me that people will tell me about the money they are losing, and then state they don’t know what they’re doing. The first question I always ask is why are you trading on a live account?

Finally, while SIM trading, it’s imperative you keep impeccable records of your trades. This is going to build a baseline of metrics for you to grade your performance when you first go live.

Step 5 – Going Live

When you transition from sim to live trading, follow these important steps.

-Start with the minimum share or contract size possible to maintain focus on execution rather than the money.

-Keep a detailed journal of every trade and review them daily.

-Update your playbook based on your live trading experiences.

-If your live performance doesn’t match your sim performance, go back to sim trading for a few weeks to reset and re-focus.

-Only increase your size once you find consistency in execution at your current levels.

FOCUS ON EXECUTION, NOT THE MONEY.

This exact process helped me go from a losing trader to making six figures per month within a year. Once you understand the game and develop an objective edge, it’s never about the money anymore. The game is all about execution.

If you diligently follow these steps and develop your own objective edge, you can be successful.

I have taught hundreds of traders who have used this process to grow their trading businesses.

It doesn’t matter if you have a college degree or not, if you’re young or old, or if you’re a professional or retail trader. This process can work for anyone.

Embrace this framework, and you will join the ranks of successful traders.

Final Thoughts

Day trading can be one of the most rewarding jobs in the world, both financially and mentally. The journey to success will challenge you, but with pure commitment you can reach your goals.

I hope my stories have helped you set some better expectations in order to make an informed decision if day trading is something you want to pursue.

If you’re intrigued, make the commitment and go after your goals and dreams.

Remember to ask yourself, “What makes me any different?”

Happy Trading,

Adam

P.S. Make sure to leave a comment below if you have something cool to say!

- SEO Powered Content & PR Distribution. Get Amplified Today.

- EVM Finance. Unified Interface for Decentralized Finance. Access Here.

- Quantum Media Group. IR/PR Amplified. Access Here.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.jumpstarttrading.com/how-to-become-a-day-trader/