Bitcoin has undergone a significant evolution since its inception as a peer-to-peer electronic cash system. Originally created by an individual or group using the pseudonym Satoshi Nakamoto in 2008, Bitcoin was intended to serve as a decentralized digital currency, allowing for fast and low-cost transactions without the need for intermediaries like banks.

According to the Bitcoin whitepaper, Bitcoin was designed and created to be peer-to-peer electronic cash. The whitepaper states Bitcoin:

“Would allow online payments to be sent directly from one party to another without going through a financial institution”. Source: Bitcoin white paper

But how much of Satoshi’s original vision has Bitcoin managed to achieve?

The answer to this question is quite subjective. For many people, Bitcoin is absolutely meeting the demands that were set out in the whitepaper, yet, for others, Bitcoin has strayed from Satoshi’s original vision.

People approach a topic with a level of bias, which is attributed to their political beliefs, feelings, experiences and understanding of the subject matter.

For the average person, with no understanding of:

- Self-ownership and self-sovereignty

- Importance of decentralisation

- How fiat currency works

- Central banks

- Inflation

- Keynesian economics

- Austrian economics

- Game theory

- Hard assets

- And Monetary properties

It may appear that Bitcoin has failed in its original vision of being a peer-to-peer currency. I think this is because most people think that peer-to-peer digital money for online transactions should be very cheap and quick, much like what they are used to in the traditional finance world. As such, detractors will cite a number of different reasons as to why Bitcoin has failed as a peer-to-peer currency such as:

- Expensive transaction fees

- Slow block and confirmation times

- Slow transaction speed

- Lack of scalability

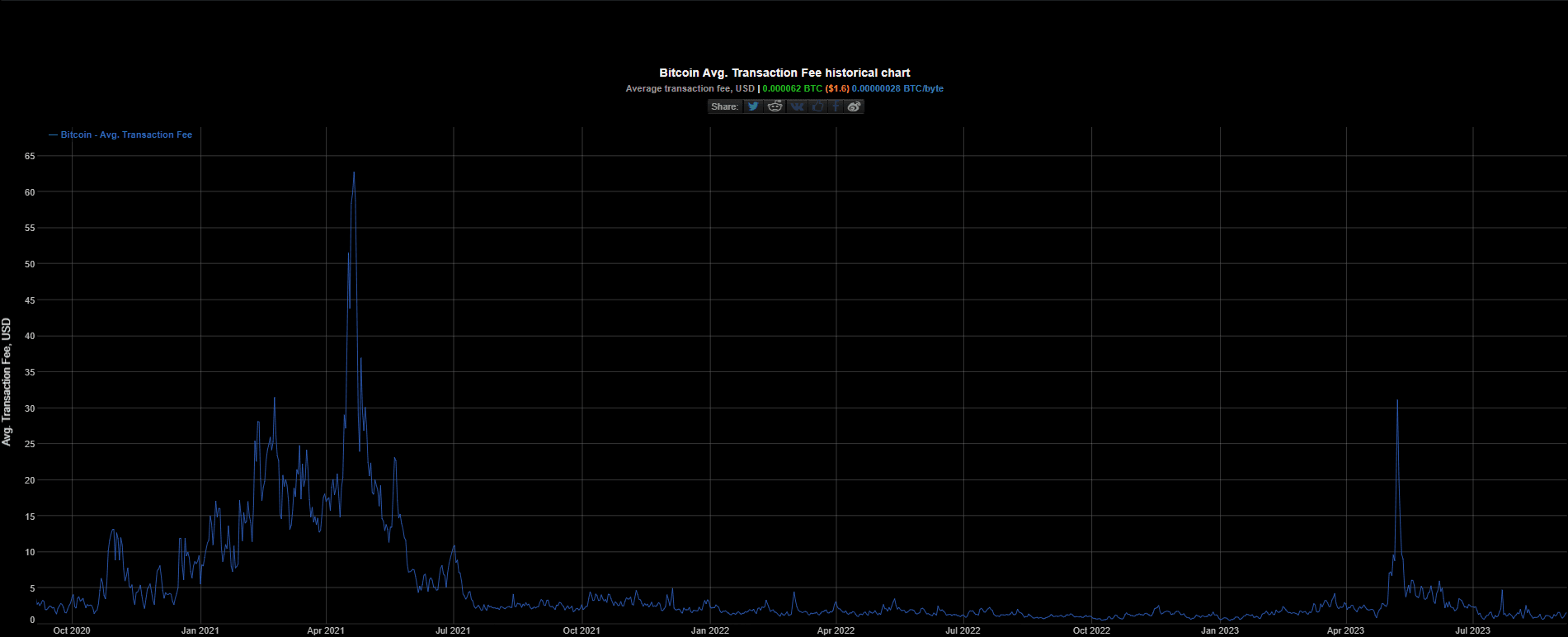

Most people conflate peer-to-peer digital cash with the ‘convenience of fiat currency’ and expect the same levels of ease of use. As such, because the average transaction fee on Bitcoin exceeds $2, many claim that Satoshi’s original vision is doomed, because nobody wants to pay $2 to make a payment, when credit cards, PayPal and many other options charge far less transaction costs.

Bitcoin’s value proposition is not in making the small consumer purchases, but in making large and important payments, particularly across borders. Payments in person, for small amounts, can be conducted in a wide variety of options: Using Bitcoin’s L2 lightning layer, physical cash, barter, favours, credit cards, bank checks, and so on. Payments across the world, however, are a very different story.

There are only a few currencies that are accepted for payment worldwide, namely: the US Dollar, the Euro, gold, and the IMF’s SDR’s. The vast majority of international payments are denominated in one of these currencies, with only a tiny percentage shared by a few other major currencies.

To send these currencies in values around thousands of dollars internationally costs dozens of dollars usually and is subject to invasive forensic examination by financial institutions. Compared to these transactions, Bitcoin’s permissionless transaction fees of $2.5 are still a bargain.

Ultimately, as with so many things in crypto, it’s a matter of opinion as to how you want to view Satoshi’s original vision for Bitcoin. This exploratory article delves into how different Bitcoin is today from the whitepaper’s vision, with a focus on its transition from a peer-to-peer payment system to a digital store of value. We’ll also discuss issues related to scalability, block times, confirmation times and transaction costs that have emerged as Bitcoin has grown in popularity.

Scalability Issues: Block Times, Confirmation Times, and Transaction Costs

One of the main reasons why some feel that Bitcoin failed to live up to Satoshi’s original vision for Bitcoin as peer-to-peer digital cash is because of Bitcoin’s scalability issues. As Bitcoin evolved and gained popularity, scalability became a significant challenge, leading to issues related to block times, confirmation times and transaction costs.

In the whitepaper, Satoshi suggested a target block time of 10 minutes. However, due to the increasing difficulty of mining, block times have not always adhered to this target. Longer block times can lead to slower transaction confirmations and hinder Bitcoin’s ability to function as a fast, peer-to-peer payment system.

Additionally, the long confirmation times required for a Bitcoin transaction to receive sufficient confirmations for security has varied. Smaller transactions may require fewer confirmations, but larger transactions may need to wait for several confirmations to mitigate the risk of double spending. This can result in longer confirmation times, especially during periods of network congestion.

Lastly, Bitcoin’s transaction fees have seen significant fluctuations. During times of high demand, transaction fees can skyrocket, making it costly to send Bitcoin. This undermines the original vision of Bitcoin as a low-cost, peer-to-peer electronic cash system. After all, who wants to pay $10 in Bitcoin for a $4 coffee?

Evolution of Bitcoin

There’s a phrase that’s used in the cryptocurrency markets which can be used to convey how or why the markets do what they do and that’s narrative. Narratives drive price in crypto and an effective positive narrative can get the market on your side and push the price in a bullish trajectory. As Bitcoin has evolved, narratives have changed over time as Bitcoin’s unique properties have filled different needs for different situations. Bitcoin has notably switched from being:

- Cheap peer-to-peer digital cash

To:

- Store of value

- Inflation hedge

- Digital gold commodity

The evolution of the above narratives is fuelled by the constant changes in a dynamic economic landscape. For example, it would be difficult to call Bitcoin a store of value or digital gold when its market cap was only $100 billion; it also wouldn’t have embraced the inflation hedge narrative if it wasn’t for COVID-19 and the aggressive money printing that accompanied it.

Over the years, Bitcoin has evolved in ways that both align with and diverge from Satoshi’s original vision. For me, the biggest divergence from the original whitepaper is how mining has evolved.

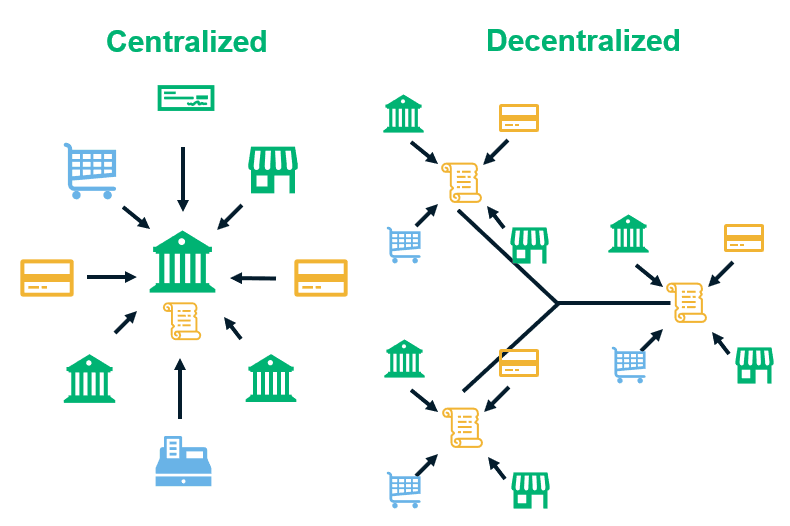

In Satoshi’s whitepaper, the use of CPUs (Central Processing Units) for mining was mentioned, allowing individuals to participate in the network’s security and earn rewards through the process of mining blocks using the SHA-256 Proof of Work mining algorithm. At the time, this approach was aligned with the idea of a decentralized, accessible system where anyone with a computer could participate. It has now transitioned into a more centralized system with large mining farms and specialized equipment.

The Transition to ASICs and Centralized Mining

One of the most significant departures from Satoshi’s original vision is the shift from CPU mining to the use of ASICs (Application-Specific Integrated Circuits) for Bitcoin mining. This change has resulted in a more centralized mining landscape, which diverges from the decentralized ethos laid out in the whitepaper.

- ASICs and Mining Centralization: Initially, Bitcoin mining could be done effectively using consumer-grade hardware like CPUs and later GPUs (Graphics Processing Units). However, as the network’s popularity grew, specialized hardware in the form of ASICs were developed. These ASICs were exponentially more efficient at mining Bitcoin as they are custom-built to specifically only mine the SHA-256 Proof of Work algorithm, making it nearly impossible for average individuals to compete with large mining farms. This shift in mining power has led to concerns about centralization, as a handful of mining pools and entities control a significant portion of the network’s hashing power.

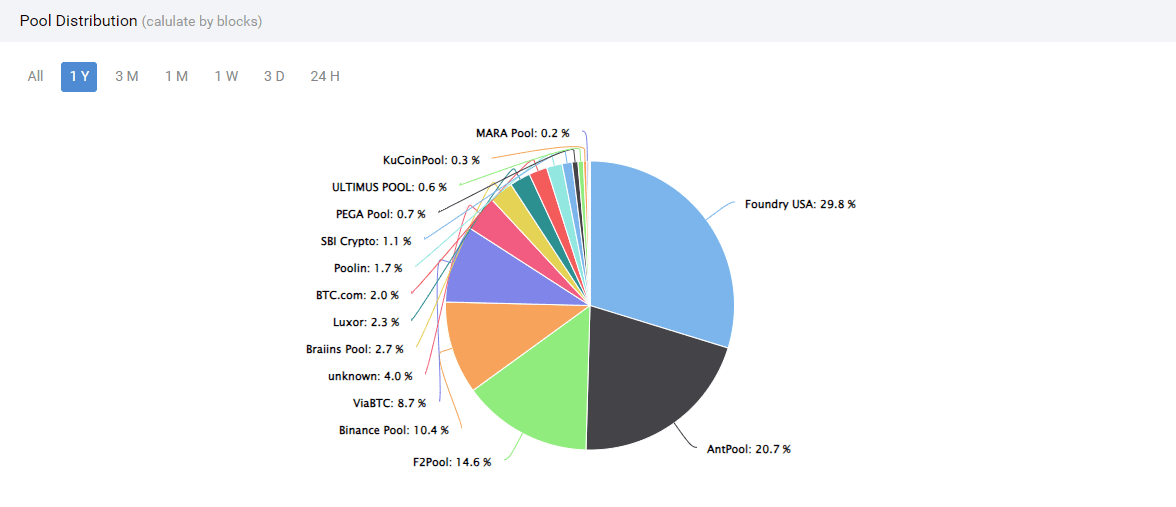

- Concentration of Mining Pools: Mining pools, which allow miners to combine their computational resources (hashrate) and share rewards, have become increasingly centralized. A few large mining pools now dominate the Bitcoin network, giving them significant influence over block validation and consequently, the direction of the network.

Although it is true to say that the mining pools are made up of a larger group of individuals, it would still be preferable for the mining pools to be more evenly distributed and decentralised. For example, 100% of the hashrate being divided between 500+ pools is infinitely better than 100% being made up of 4 different pools.

Currently, the levels of centralisation within mining pools aren’t working in Bitcoin’s favour. As you can see from the pie chart below, with Foundry USA controlling 29.8% of all hashrate, followed closely by Antpool with 20.7% across a one-year period.

In my opinion, this is the most obvious aspect of Satoshi’s original vision which was not intended to happen. I don’t believe Satoshi would have wanted the mining pools to be run by large-scale mining farms that use ASICs and run off renewable energy sources. These renewable energy sources offer cheap electricity to large industrial mining farms that otherwise are not available for the average casual miner. In turn, this creates a monopoly effect and increases centralization in favour of those with the biggest wallets.

Unfortunately, although Satoshi was a master of game theory, I don’t think this level of hashrate expansion was expected. For me, I think Satoshi’s utopian idea was for everyone to mine Bitcoin at home just using their CPU power and earning a small amount of Bitcoin. I don’t think Satoshi could predict the level of growth that Bitcoin achieved and the scale at which mining has progressed to.

Lastly, there are increasing environmental concerns as the use of ASICs and the concentration of mining power means Bitcoin mining consumes a substantial amount of energy, leading to debates about its sustainability. With ESG movements gaining popularity, it makes Bitcoin an easy target for scrutiny and potentially over-regulation.

We have a dedicated video on the facts and fud of Bitcoin mining and the environment that you can find below:

The Emergence of the “Store of Value” Narrative

In contrast to the whitepaper’s vision of Bitcoin as a peer-to-peer electronic cash system, Bitcoin has increasingly adopted a “store of value” narrative in recent years. This shift in perception has several key drivers:

- Volatility: Bitcoin’s price volatility, characterized by rapid fluctuations, has made it less practical as an everyday medium of exchange. People are more inclined to hold it as an investment rather than spend it for everyday transactions.

- Institutional Adoption: Large institutions and financial players have shown growing interest in Bitcoin as an asset class. This institutional adoption has further reinforced the store of value narrative, as these entities view Bitcoin as a digital gold-like asset for wealth preservation. CC: Michael Saylor.

- Limited Supply: The Bitcoin whitepaper specified a maximum supply of 21 million coins. This scarcity has been a critical factor in positioning Bitcoin as a store of value. Many investors view its fixed supply as a hedge against inflation and economic uncertainty. Provable digital scarcity is a new phenomenon that many investors are still getting their heads around. The boomer generation finds it particularly difficult to understand the idea of owning something that doesn’t physically exist. That being said, demand for Bitcoin is growing and a spot Bitcoin ETF is likely just around the corner, especially with BlackRock leading the charge.

- Digital gold commodity:

Bitcoin is often compared to gold as a similar investment due to several reasons. While they have significant differences, they also share some common characteristics that make them attractive to investors seeking alternative assets or hedges against economic uncertainties. Bitcoin is considered a similar investment to gold for the following reasons:

- Store of Value: Both Bitcoin and gold are viewed as stores of value that can help protect wealth from inflation and currency devaluation. They have historically shown resilience in times of economic uncertainty.

- Limited Supply: Both assets have a finite supply. Gold is limited by the physical quantity available on Earth, while Bitcoin has a predetermined maximum supply of 21 million coins. This scarcity can drive up their value over time.

- Decentralization: Bitcoin operates on a decentralized blockchain network, meaning it is not controlled by any central authority or government. Similarly, gold is not controlled by any single entity. This decentralization can appeal to those seeking assets independent of government influence.

- Portability: Both Bitcoin and gold are relatively portable. Bitcoin can be easily transferred electronically across borders, while gold, although physical, is compact and has historically been used for international trade.

- Diversification: Investors often use both Bitcoin and gold to diversify their portfolios and reduce risk. The assets can behave differently from traditional investments like stocks and bonds, offering a potential hedge against market volatility.

- Hedge Against Inflation: Gold has a long history of serving as a hedge against inflation, as its value tends to rise when fiat currencies lose purchasing power. Bitcoin is also seen as a digital alternative for this purpose, given its fixed supply.

- Global Acceptance: Both assets have gained global acceptance. Gold has been used as a store of value for centuries, and Bitcoin has garnered a significant following and acceptance in the financial industry.

Here is a great visual from CoinMonks showing how Bitcoin stacks up against gold and fiat as alternatives:

Solutions and Adaptations

Recognizing these challenges, the Bitcoin community is always evolving and has explored various solutions and adaptations to address scalability and transaction costs.

- Segregated Witness (SegWit): SegWit was a significant upgrade to the Bitcoin protocol that aimed to increase the block size limit by separating transaction signatures from transaction data. This helped reduce transaction fees and improve scalability.

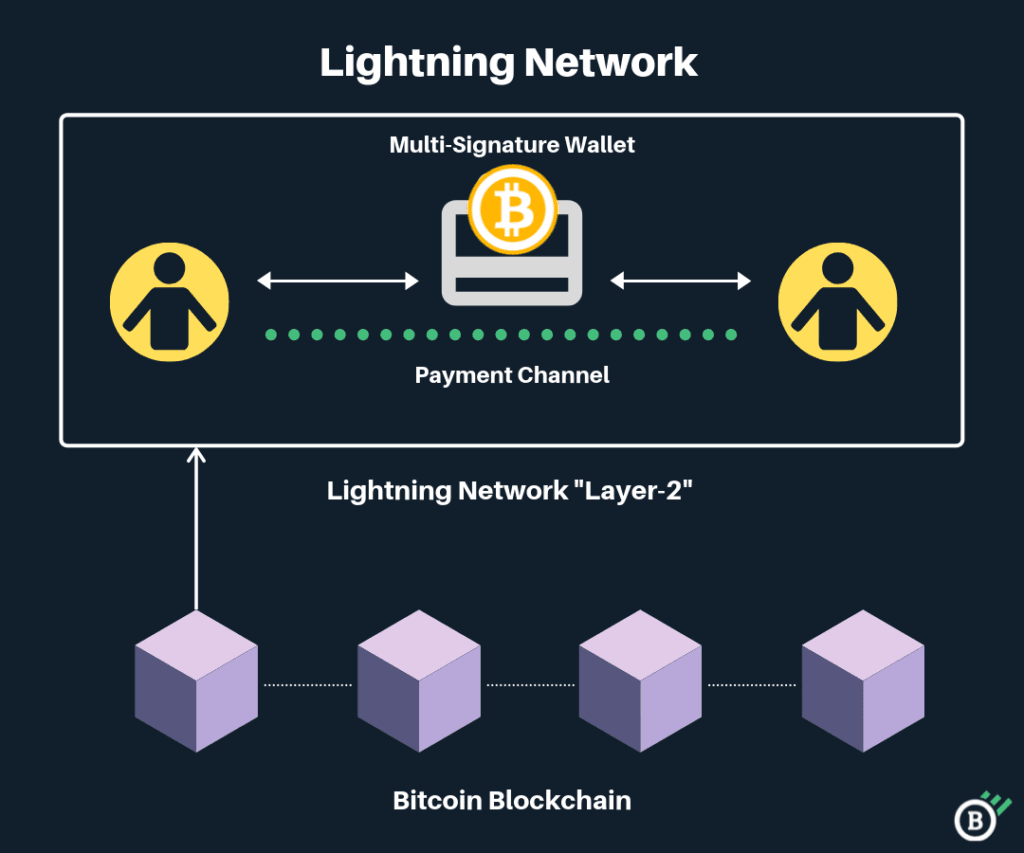

- Lightning Network: The Lightning Network is a layer-2 scaling solution built on top of the Bitcoin blockchain. It allows for faster and cheaper transactions by creating off-chain payment channels. While it offers scalability benefits, it also introduces complexities and requires additional infrastructure.

- Bitcoin Upgrades: Periodic upgrades, such as the Taproot upgrade, have been implemented to enhance privacy, security, and functionality. These upgrades aim to make Bitcoin more versatile and user-friendly while maintaining its core principles.

- Debates on Block Size: The Bitcoin community has engaged in ongoing debates regarding the block size limit. While larger blocks could accommodate more transactions and reduce congestion, there are concerns about centralization and the increased demands on network participants in relation to node sizes and storage capacity worries.

Despite these efforts, there’s still a general consensus within the community that Bitcoin is working exactly as intended and therefore any efforts to modify or change the protocol to improve scaling issues are often met with hostility. Consequently, Bitcoin without the Lightning network is still a far cry from Satoshi’s original vision of fast and cheap digital payments. However, with the use of the Lightning network, Satoshi’s original vision can be achieved. People argue as to whether these ‘solutions’ are valid, as they don’t take place on the Layer 1 base chain. Instead, payments are processed on the Lightning Layer 2 which does sacrifice decentralisation and security – but nevertheless, the end product is impressive.

A particularly good example of what can be achieved with the Lightning network is Strike, invented by Jack Mallers. Jack Mallers innovative software ‘Strike’ has harnessed the potential of Bitcoin and the Lightning Network to redefine the way fiat remittances are sent across the world. Strike is a game-changer in the world of cross-border transactions and in my opinion, helps keep Bitcoin as a monetary network true to Satoshi’s original vision.

Strike operates using 3 steps:

1. The USD to Bitcoin Conversion:

Strike initiates the remittance process by debiting U.S. dollars from your Strike account. This marks the starting point of a remarkable journey. The magic begins with a Bitcoin-to-USD conversion, where Bitcoin is used to purchase U.S. dollars. This step is where Strike’s genius truly shines. Instead of relying on traditional currency exchange rates, Strike leverages the inherent liquidity and global acceptance of Bitcoin. In other words, it’s not about a dollar-to-Buro rate; it’s all about the “Bitcoin/Dollar” and “Bitcoin/Euro” dynamic.

2. Lightning Speed and Security:

The second leg of Strike’s remittance journey involves a Bitcoin-to-Bitcoin payment using the Lightning Network. This is where the innovation of the Lightning Network comes into play. The Lightning Network is a Layer 2 solution for Bitcoin, designed to facilitate rapid and secure transactions while alleviating the scalability concerns of the Bitcoin blockchain.

With Strike, your Bitcoin funds are transferred swiftly across the Lightning Network to escrow, ensuring the cash’s finality, much like a traditional bearer instrument. This means that once the payment is initiated, there’s no need to wait for lengthy confirmation times as seen on the Bitcoin blockchain. Strike’s Lightning-powered transactions offer instantaneous settlements with unparalleled security.

3. The Euro Conversion:

As your Bitcoin reaches its destination, the final step of the remittance process takes place: the Bitcoin-to-Euro conversion. Here, Strike performs a seamless conversion of Bitcoin to Euros, marking the completion of your cross-border transfer. What’s fascinating is that Strike avoids the complexities of traditional currency exchange rates.

Jack Mallers proudly emphasizes that Strike doesn’t rely on a separate Dollar-to-Euro rate. Instead, it uses the “Bitcoin/Dollar” and “Bitcoin/Euro” pairings to achieve the desired U.S. Dollar-to-Euro conversion. This approach not only streamlines the process but also eliminates the need for intermediaries and the associated fees.

The Strike Advantage:

What sets Strike apart in the realm of global remittances is its ability to deliver a frictionless, cost-effective, and lightning-fast solution. By harnessing the power of Bitcoin and the Lightning Network, Strike has unlocked a new paradigm for cross-border transactions. It bypasses the traditional banking system, reduces fees, and accelerates the transfer process.

Moreover, Strike’s approach empowers users with financial sovereignty, allowing them to send and receive money without the constraints of traditional banking hours or geographic borders. It’s a game-changer for individuals who rely on remittances to support their families and loved ones across the globe.

Jack Mallers’ Strike represents a ground-breaking innovation in the world of fiat remittances. By seamlessly integrating Bitcoin and the Lightning Network, Strike has redefined how we send and receive money globally. With Strike, financial inclusion and accessibility are no longer distant dreams but a tangible reality. This is exactly what Satoshi wanted in the vision laid out in the Bitcoin whitepaper.

I predict more services like this will continue to grow and more will be created. It will be interesting to see the space evolve and I hope it becomes adopted as a mainstream way of making payments/remittances across the world.

Then vs. Now – A Comparison Overview

While the fundamental principles of Bitcoin outlined in the whitepaper remain largely intact, there have been notable developments and deviations from Satoshi’s original vision in several key areas, including centralized mining and the shift from a peer-to-peer payment system to a digital store of value.

Centralized Mining:

- Satoshi’s Vision: The whitepaper described Bitcoin as a decentralized system where anyone with a computer could participate in the network as a miner. Mining was intended to be accessible to individuals and small groups, making the network highly decentralized.

- Reality Today: Over time, Bitcoin mining has become highly centralized. Large mining pools and industrial-scale mining operations, particularly in regions with cheap electricity, have gained significant control over the network’s hashrate. This concentration of mining power has raised concerns about the centralization of Bitcoin’s consensus mechanism.

Peer-to-Peer Payment System vs. Digital Store of Value:

- Satoshi’s Vision: The whitepaper emphasized Bitcoin’s potential as a peer-to-peer electronic cash system. Satoshi envisioned Bitcoin being used for everyday transactions, allowing users to send and receive digital currency directly without the need for intermediaries like banks.

- Reality Today: Bitcoin’s primary use case has shifted away from being a medium of exchange for everyday transactions. Instead, it has evolved into a digital store of value or “digital gold.” Many people now view Bitcoin as a long-term investment or hedge against inflation and it is primarily held as a store of wealth rather than being used for day-to-day payments. Several factors have contributed to this shift, including scalability challenges, price volatility, and regulatory uncertainty.

Scalability and Layer 2 Solutions:

- Satoshi’s Vision: The whitepaper did not address the issue of scalability in detail. It assumed that as the network grew, improvements would be made to accommodate a larger number of transactions on the main blockchain.

- Reality Today: Bitcoin has faced scalability challenges, with limited transaction throughput and high fees during periods of network congestion. To address these issues, various off-chain and layer 2 solutions like the Lightning Network have been developed to enable faster and cheaper transactions while maintaining the security of the Bitcoin blockchain.

Regulatory and Institutional Involvement:

- Satoshi’s Vision: The whitepaper did not discuss the potential regulatory challenges or the involvement of institutional investors and financial institutions in the Bitcoin ecosystem.

- Reality Today: Bitcoin has attracted significant attention from governments, regulators, and institutional investors. Regulatory frameworks have been developed in many countries, and institutional players have invested heavily in Bitcoin. This mainstream adoption has both positive and negative implications for the cryptocurrency’s original ethos of financial independence and decentralization.

In summary, Bitcoin has undergone substantial changes and adaptations since the release of the whitepaper, including the centralization of mining, a shift from a peer-to-peer payment system to a store of value and the development of scalability solutions and regulatory frameworks. These changes reflect the complex and evolving nature of the cryptocurrency space as it seeks to balance its original vision with real-world challenges and opportunities.

Conclusion

In conclusion, the evolution of Bitcoin from Satoshi Nakamoto’s original vision has been a fascinating journey marked by significant shifts in its core principles and operational dynamics. One of the most noticeable transformations has been the evolution of Bitcoin mining.

Initially designed to be a decentralized process achievable with consumer-grade CPUs, it has since morphed into a centralized operation dominated by Application-Specific Integrated Circuits (ASICs). This change has raised concerns about the concentration of mining power in the hands of a few, potentially compromising the network’s decentralization.

Moreover, Bitcoin has shifted its primary use case. Originally envisioned as a peer-to-peer digital cash system, it has progressively transitioned towards being seen as a store of value, often referred to as “digital gold.” This transformation has been fuelled by various factors, including its limited supply, increasing adoption as a hedge against inflation and growing recognition among institutional investors.

While these changes have sparked debates about whether Bitcoin is staying true to Satoshi’s original vision, they also reflect Bitcoin’s adaptability and resilience in the face of evolving market dynamics and technological advancements. Bitcoin’s journey continues to be a subject of scrutiny and discussion, as it grapples with finding a balance between its roots as a decentralized currency and its emerging role as a digital asset store of value.

Ultimately, the evolution of Bitcoin underscores the complex interplay between technology, economics, and ideology in the world of cryptocurrency. Whether Bitcoin’s trajectory aligns with Satoshi’s vision or not, it remains a transformative force in the world of finance and a symbol of innovation in the digital age. Its evolution is a testament to the ongoing evolution of the broader blockchain and cryptocurrency ecosystem, which continues to shape the future of global finance.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- ChartPrime. Elevate your Trading Game with ChartPrime. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.coinbureau.com/analysis/evolution-of-bitcoin/