Summary: The market size of the metaverse was recently estimated to be worth around $61.8 billion, a testament to the space’s overall growth in a short period of time. In this piece, we will analyze the current state of the metaverse; identify key trends, investment opportunities, and challenges; and provide insight into the future of this growing and exciting digital space for crypto investors.

Industry Overview

Until recently, the metaverse was a concept explored primarily in science fiction. The term was first coined by Neal Stephenson in his 1992 sci-fi novel “Snow Crash” to describe a computer-generated 3D virtual space.

[embedded content]

A couple of decades and innovative technologies later, there have been significant attempts to bring the metaverse concept to life. It can be loosely defined as a persistent network of 3D virtual worlds powered by the blockchain, accessed by the internet and immersive technologies such as virtual and augmented reality.

In its current state, however, the metaverse does not yet match its definition. However, there are a few industries already making their mark in the metaverse.

- Real Estate: In the metaverse, “real estate” refers to virtual buildings, or undeveloped parcels of land. Just like in the real world where real estate is a highly-priced asset, so too are virtual properties. In late 2021, metaverse investment company Republic Realm purchased $4.3 million worth of land in The Sandbox metaverse. This was a few days after the “Fashion Street Estate,” a sought-after plot of land in the Decentraland gaming platform, sold for $2.4 million.

- Fashion: The fashion industry was also quick to surf the metaverse wave. Luxury fashion brands like Dolce & Gabbana, Louis Vuitton, and Gucci have all launched virtual-only products.

- Music and Entertainment: Another industry that was quick to capitalize on the metaverse trend, with mainstream megastars like BTS, Ariana Grande, and Marshmello all hosting virtual concerts in the metaverse.

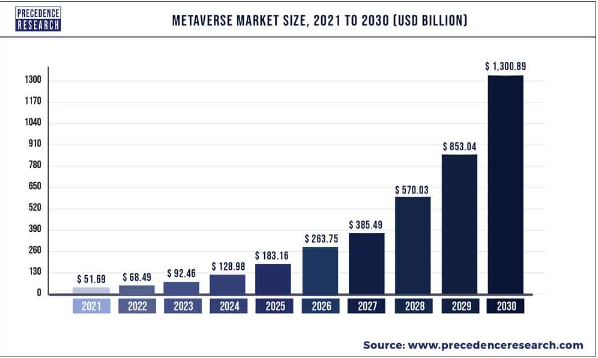

These are just a few of the industries leveraging the metaverse to grow their brands, but there are many more like sports, retail, computing, advertising, and workplaces. Precedence Research estimates the global metaverse market size at $68.49 billion in 2022, and projects the market to reach $1.3 trillion by 2030.

Analysis Group, an economics consulting firm, projects the metaverse’s growth in their 2022 report from a different angle. “If we assume that metaverse adoption were to begin today [2022] then we can also estimate the metaverse’s potential contribution to GDP in dollars and compare it to industry projections of the potential size of the metaverse. Our model implies that if metaverse adoption began today, it would have a contribution to global GDP of $3.01 trillion (measured in 2015 U.S. dollars) in 2031.”

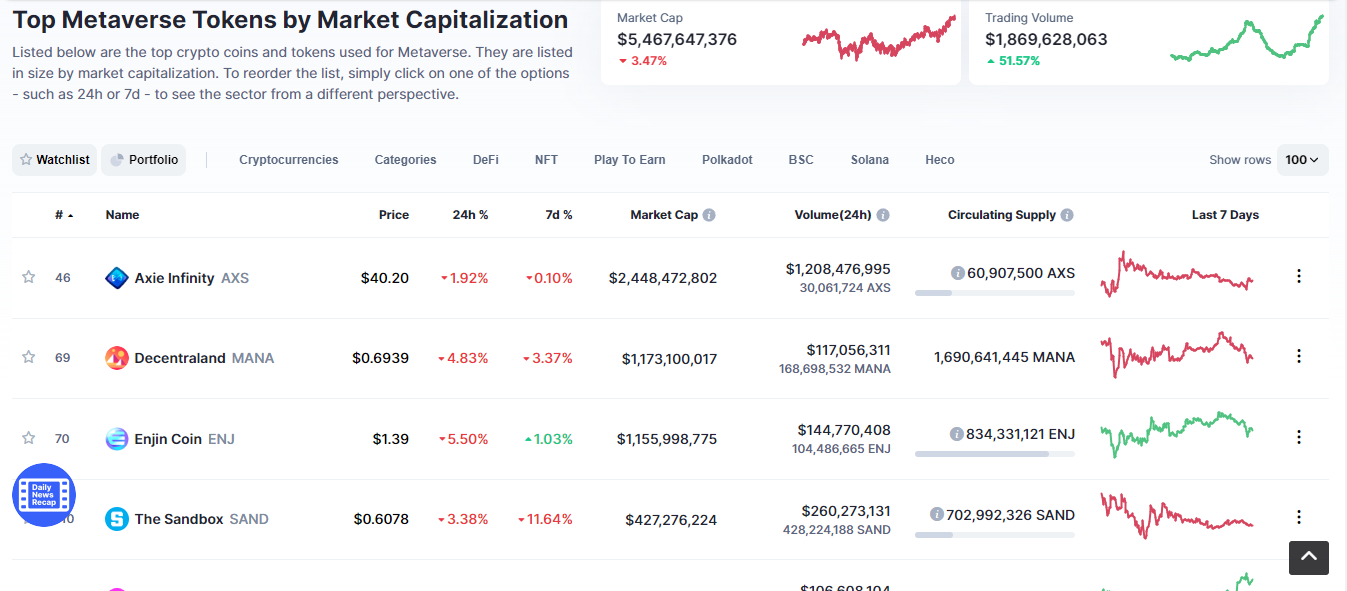

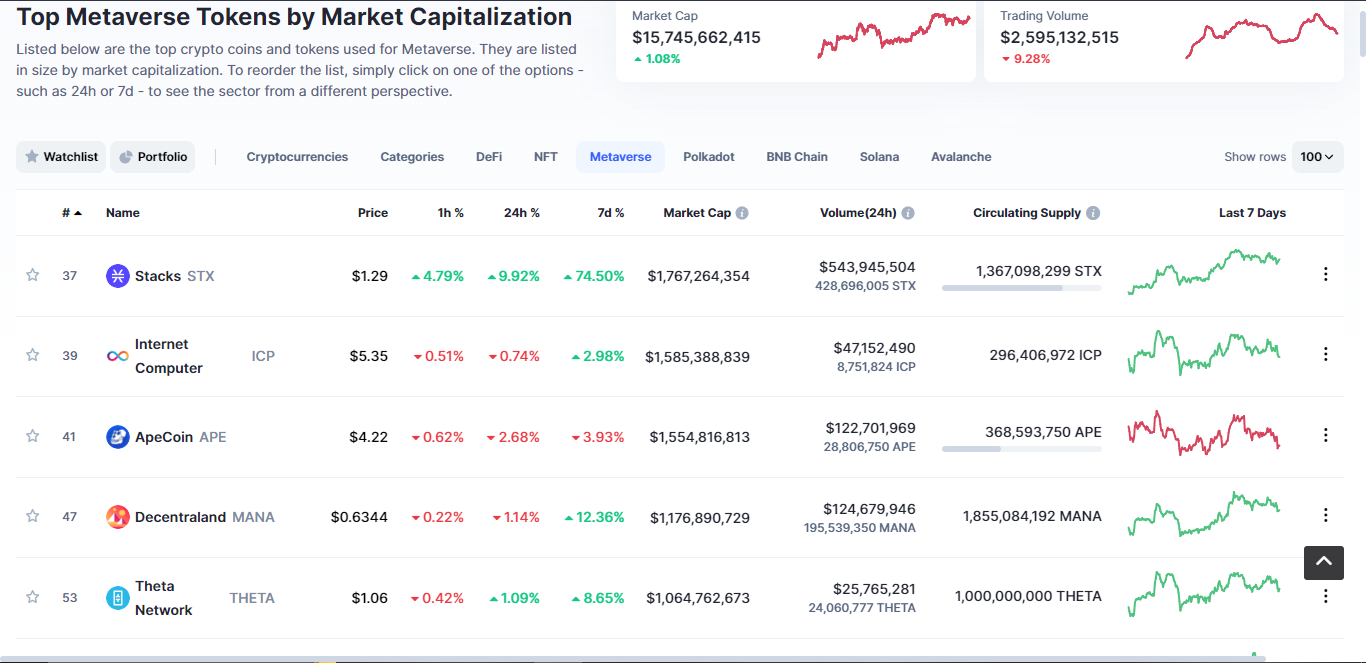

The market capitalization of blockchain-based metaverse projects has also grown tremendously over the past two years. In 2021, the total market cap of such projects stood at around $5 billion. By early 2023, the number tripled to over $15 billion. This growth is a result of an increase in metaverse projects and their adoption. Also, in the same period, there have been changes in the top 10 list in terms of market cap, with newer projects like Internet Computer breaking into the list.

Notably, projects like Decentraland, The Sandbox, Enjin Coin and Axie Infinity have more or less maintained their places on the list.

Various sources estimate over 400 million monthly active metaverse users, with a major chunk coming from virtual platforms like Roblox, and games like Minecraft and Fortnite. The user growth of blockchain-based metaverse platforms, on the other hand, is a different story.

Top Metaverse Projects

| Project | Ticker | Market Cap | Transaction Volume in USD (30-day average) | Daily Active Addresses (30-day average) |

| Internet Computer | ICP | $1,500,000,000 | $50,000,000 | N/A |

| Decentraland | MANA | $1,100,000,000 | $118,000,000 | 870 |

| The Sandbox | SAND | $1,000,000,000 | $29,080,000 | 1,065 |

| Enjin Coin | ENJ | $406,000,000 | $44,000,000 | 1,784 |

| Axie Infinity | AXS | $1,000,000,000 | 94,000,000 | 329 |

Investment Thesis

The metaverse industry is still in its early stages, so crypto investors who are putting their money into this industry are betting on its future potential. They are essentially speculating on early leaders, hoping to capitalize on the unknown value that will be unlocked once the industry evolves and matures. With that said, here are some of the most common ways to invest in the Metaverse now:

- Metaverse tokens and cryptocurrencies: Many blockchain-based metaverse platforms have tokens. Some investors hold these tokens for the long term, which we believe is a proxy for owning company stock since their value is directly tied to that of the underlying “company.” There are other assets – like virtual real estate and non-fungible tokens – which by design are a big part of metaverse-based projects.

- Metaverse stocks: Many metaverse stocks may not necessarily give investors direct exposure to the industry. For example, Meta Platforms (META) is now heavily exploring metaverse concepts, and Nvidia (NVDA) provides the chips that power various metaverse projects. There are also Exchange Traded Funds (ETFs) such as Blackrock’s iShares Future Metaverse Tech and Communications ETF (IVRS) that hold a basket of metaverse-related stocks.

It is risky to invest in any industry that’s still in its infancy. In the worst-case scenario, the industry doesn’t take off, or possibly the companies currently at the forefront fall by the wayside, as the industry rapidly evolves in different directions.

Who’s Investing: Institutional Backing

The Metaverse has attracted a lot of investment from big tech companies and venture capitalists. According to McKinsey, a management consulting firm, the industry attracted over $120 billion in 2022, more than double the $57 billion in investments made in 2021.

Meta Platforms has been one of the biggest investors. In October 2021, Mark Zuckerberg, Meta’s CEO, announced during the company’s Q3 earnings call that it plans to invest $10 billion over the next several years to help build the metaverse.

Another major investor is venture capitalist firm Andreessen Horowitz, which last year launched a $600 million fund focused on metaverse games. Other notable investors include Coinbase, which has also shown interest in the Metaverse, investing in the NFT marketplace OpenSea.

Microsoft last year acquired the popular video game developer Activision Blizzard, a move that they claimed would help the company build the metaverse. “Metaverse is essentially about creating games,” Microsoft’s CEO Satya Nadella said, “It is about being able to put people, places, things in a physics engine and then having all the people, places, [and] things in the physics engine relate to each other.”

Top Metaverse Projects

Internet Computer (ICP)

Internet Computer (ICP)

Internet Computer (ICP) was created by the Dfinity Foundation in 2021 to provide a decentralized, open internet platform that can support smart contracts and other decentralized applications. It basically lets people build websites and apps that are not controlled by any central authority by designing them to run on a decentralized network of computers.

The project raised over $190 million in funding and is backed by venture capital firms like Andreessen Horowitz and Polychain Capital. It has experienced tremendous growth since its launch and currently sits as the top metaverse blockchain project by market cap ($1.5 billion).

DFINITY reported that the number of new users increased by over 647% (Dec 2021-Dec 2022) from 4,079 to 37,224. ICP’s price, however, has been on a downward trajectory since its launch and has currently settled at around $5.

The project has ambitious plans to go toe-to-toe and eventually replace the current centralized web system. They explained in a blog post, “In 10 years’ time, it will be widely recognized by the tech community that the Internet Computer is on a likely trajectory that will one day make it humanity’s primary compute platform for building systems and services, and that the ‘open internet’ will now near-certainly predominate over Big Tech’s closed proprietary ecosystem.”

Decentraland (MANA)

Decentraland (MANA)

Decentraland is a 3D decentralized virtual world game that allows users to experience, create, and monetize content. Players can earn from real estate, creating and selling wearables, or through play-to-earn games. Decentraland is powered by MANA, the main means of exchange in the game, that can be used to buy LAND (parcels of digital land) and other virtual assets.

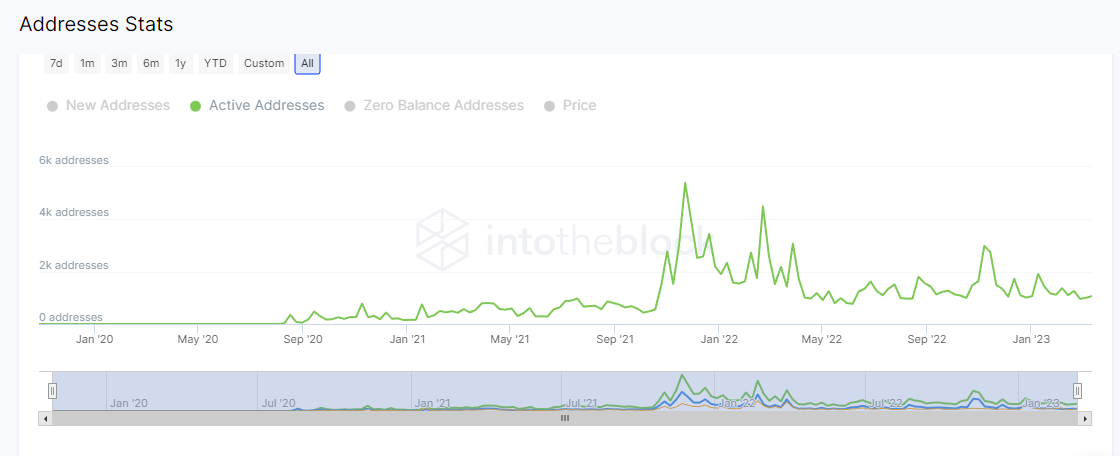

Decentraland properly took off in late 2021 during the NFT craze and its market capitalization quickly shot up to $6.8 billion while the token was trading at an all-time high of $5. However, since then, the price of MANA has dwindled and so has the number of active users. Recently, Decentraland has been recording an average of 1000 daily active addresses. To attract more users, the project is looking into ushering more developers into its platform as part of its growth strategy.

It has raised over $25.5 million in funding from 11 investors, including blockchain investment firms Klover Capital and Krenex Capital. It remains one of the most popular metaverse platforms since its 2021 launch.

The Sandbox (SAND)

The Sandbox (SAND)

The Sandbox initially launched as a mobile game before being acquired by Animoca Brands, a blockchain game software company. Animoca Brands transformed the game into a virtual metaverse world that allows users to create, build, and trade digital assets, such as virtual game items and NFTs. SAND is the utility token of the game, as well as the basis of transactions, allowing players to buy and sell virtual land and digital items.

Similar to Decentraland, Sandbox also had a strong end to 2021. SAND’s price peaked at an all-time high of around $7 with a market cap of over $6.6 billion. During the same period, Sandbox was reporting an average of 2,000 daily active addresses compared to the current average of 1,000.

Sandbox has partnered with some big names like HSBC and Warner Music Group and recently announced a partnership with the government of Saudi Arabia for “future metaverse development.” Just like Decentraland, Sandbox has growth potential and staying power due to its position as one of the go-to blockchain-based platforms.

Enjin Coin (ENJ)

Enjin Coin (ENJ)

Launched in 2017, Enjin is a blockchain-based platform that allows users to create, use, and manage digital assets such as in-game items, virtual goods, and tokens. The platform attempts to make the whole process of creating, listing, and managing NFTs as simple as possible. In 2021, Enjin coin became the first gaming cryptocurrency to be approved in Japan. This followed a massive rise in price to hit an all-time high at $3 which was topped later in the year at $4. However, like many other cryptocurrencies, ENJ experienced a drop in price in 2022.

The number of daily active addresses on the platform has also been low, averaging less than 1,000 since the beginning of last year.

Enjin plans to launch more blockchain-based products in the future. Last year the company landed a partnership with Square Enix, a massive Japanese entertainment company, to launch a digital collection of a popular game’s (Final Fantasy VII) 25th anniversary cards on their network. Such partnerships with well-known companies and titles in the gaming industry may increase Enjin’s growth potential.

Axie Infinity (AXS)

Axie Infinity (AXS)

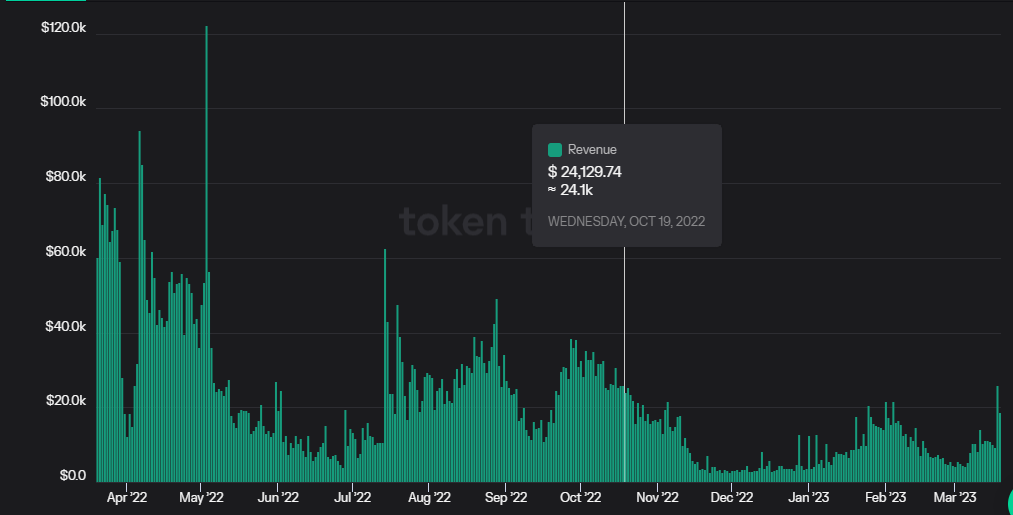

Axie Infinity is an NFT-based online strategy game based on the Ethereum blockchain. The game is inspired by the Pokemon series where players can raise, collect, battle, and sell digital pets called Axies for profit. In 2021 Axie had a meteoric rise in revenue and managed to surpass the $1 billion mark before the end of the year. This success went hand in hand with its market cap of just over $5 billion.

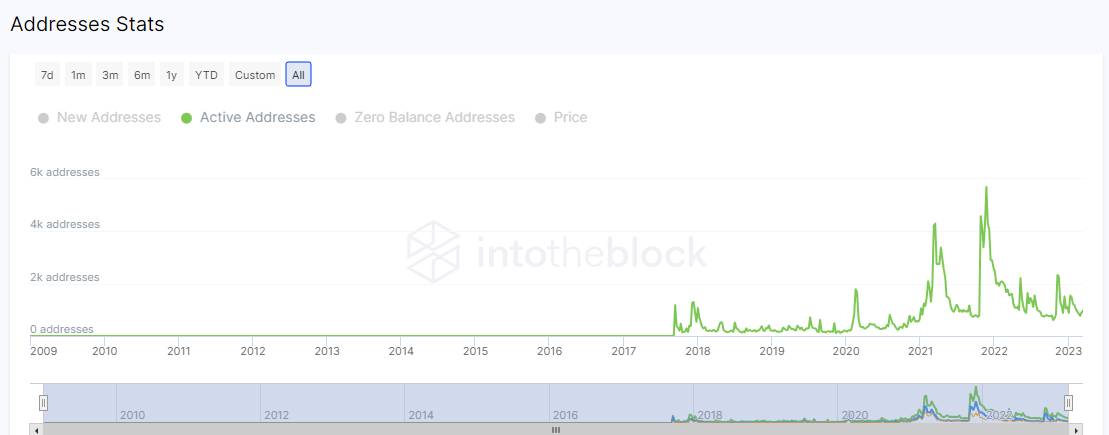

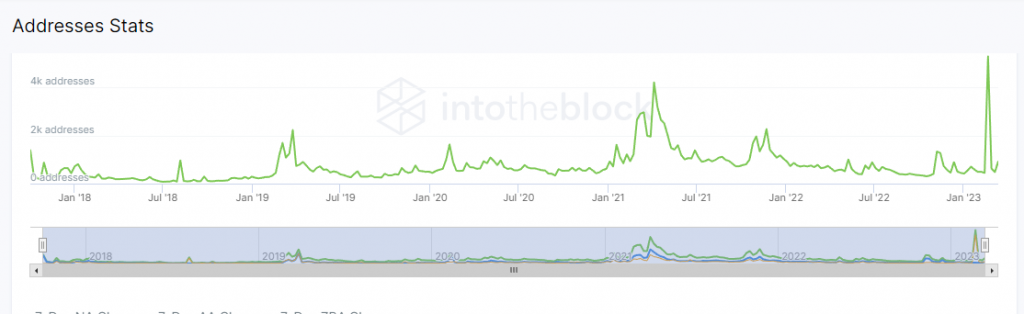

At its peak Axie Infinity was attracting over 9000 daily active addresses, however, this number fell to less than 1,000 since the start of 2022. Revenue has also been dropping over the last year.

The platform is attempting to attract gamers with new game modes and other projects lined up.

Investor Takeaway

The metaverse has the potential to revolutionize the way we live our daily lives, which is why massive tech companies are investing billions of dollars into the industry. It has the potential to create new markets and business opportunities, and to provide a platform for a variety of services. Investors have the opportunity to get in early to maximize their returns.

However, investing in blockchain technology is still risky, and so is the metaverse. From an investor’s standpoint, then, you are doubling your risk by investing in metaverse blockchain tokens. On the other hand, doubling the risk can sometimes double the potential reward.

Metaverse blockchain tokens are probably not the first investments in a crypto portfolio, but if you can stomach the risk, if you love the product, and if you believe it can become a category leader in the next five years, then you might try investing a tiny amount of your overall portfolio (no more than 1-2%) in the metaverse.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.bitcoinmarketjournal.com/sector-report-metaverse/