Executive Summary

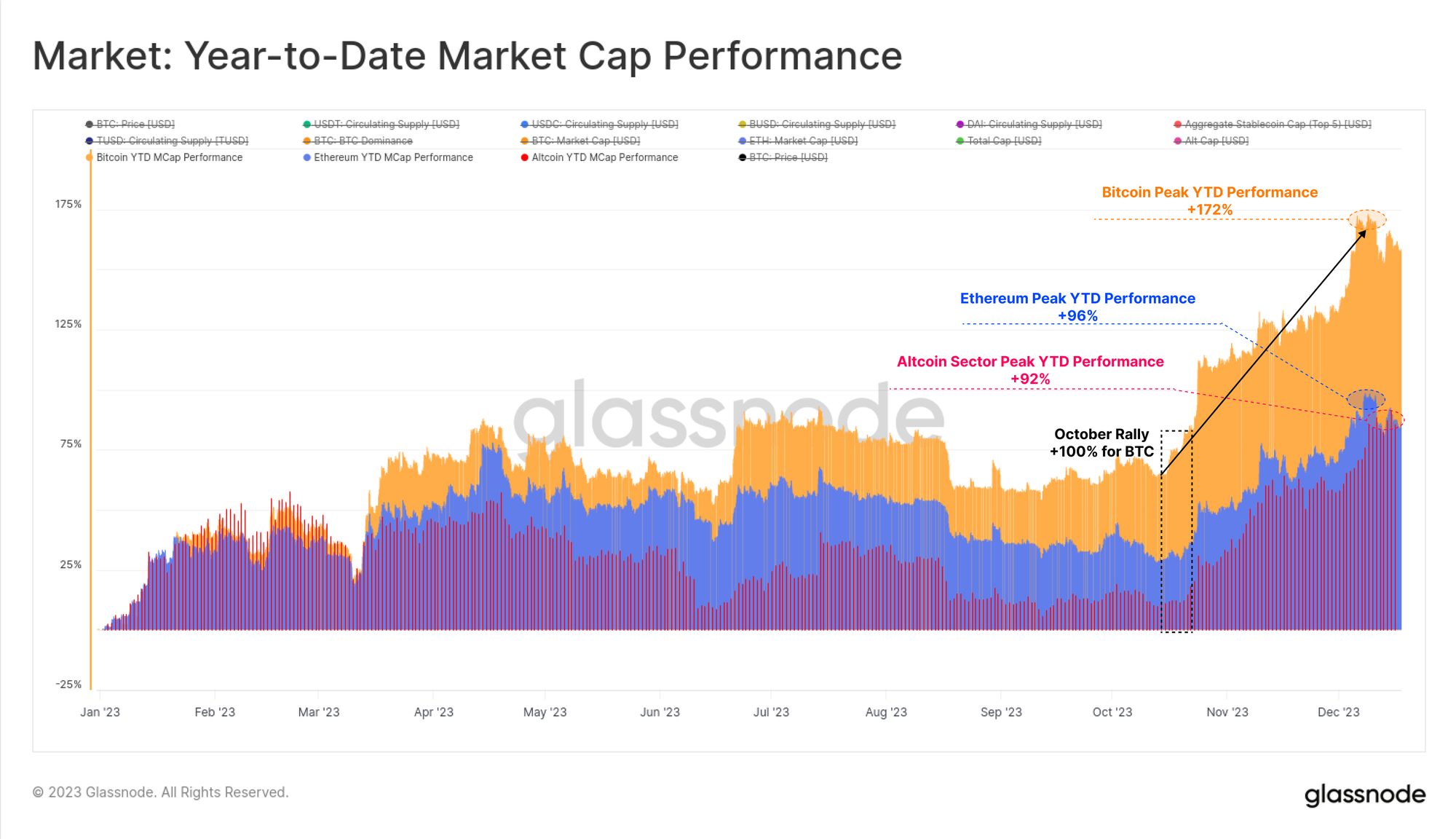

- 2023 has been an incredible year for digital assets, with Bitcoin up over 172%, correcting less than 20%, and net capital inflows into BTC, ETH and Stablecoins.

- The market has broken above several important technical and on-chain pricing models this year, with October being a major pivot point for institutional capital flows.

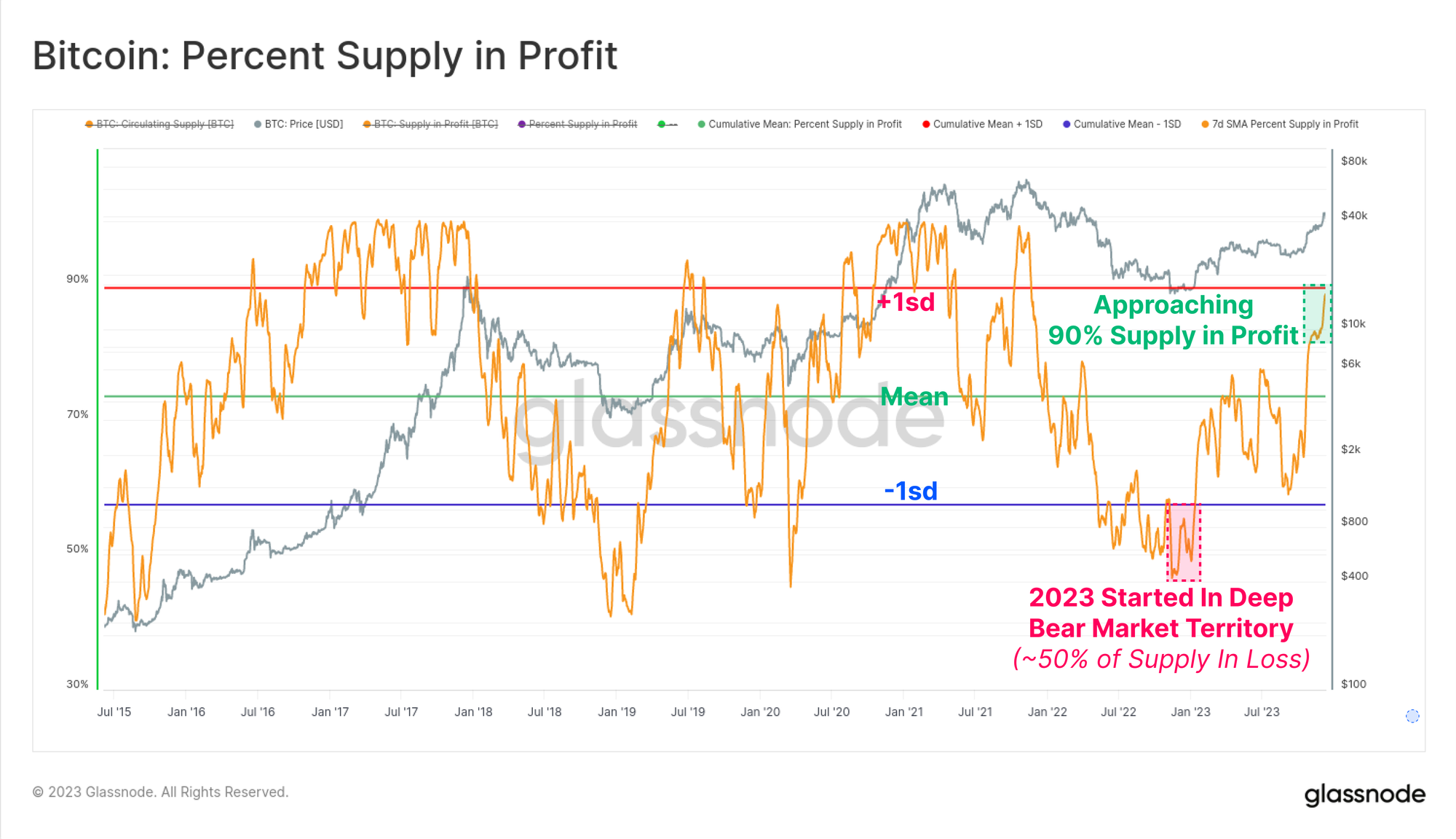

- Long-Term Holders currently hold a near all-time-high of the Bitcoin supply, and a super-majority of coins are now held in profit.

- Major market structure shifts are taking place, such as Tether re-asserting dominance amongst stablecoins, CME futures flipping Binance, and significant frowth of Options markets.

In this last edition for the year, we will do a whirlwind tour of what changed this year, on-chain. We will explore how the Bitcoin, Ethereum, Derivative, and Stablecoin landscapes have evolved in 2023, and how this sets up the space for an exciting road ahead.

2023 has been an exceptional year for digital assets, with Bitcoin’s market cap increasing by a peak of +172%. The rest of the digital asset ecosystem has also had a strong year, with Ethereum and the wider altcoin segments seeing +90% growth in their market caps.

This highlights a rising Bitcoin dominance, which is often seen as the market recovers from protracted bear markets, such as 2021-22. Ethereum in particular has had a somewhat slow start on a relative basis, with the ETH/BTC Ratio declining to multi-year lows at around 0.052, despite a successful shipping of the Shanghai update, and growth of its L2 ecosystem.

Whilst digital assets have significantly out-performed traditional assets like Equities, Bonds, and Precious Metals all year, the rally since late in October has been responsible for the lions share of the gains. This started with a break above the psychologically important price level of $30k, as well as numerous important pricing levels.

No Pullbacks Given

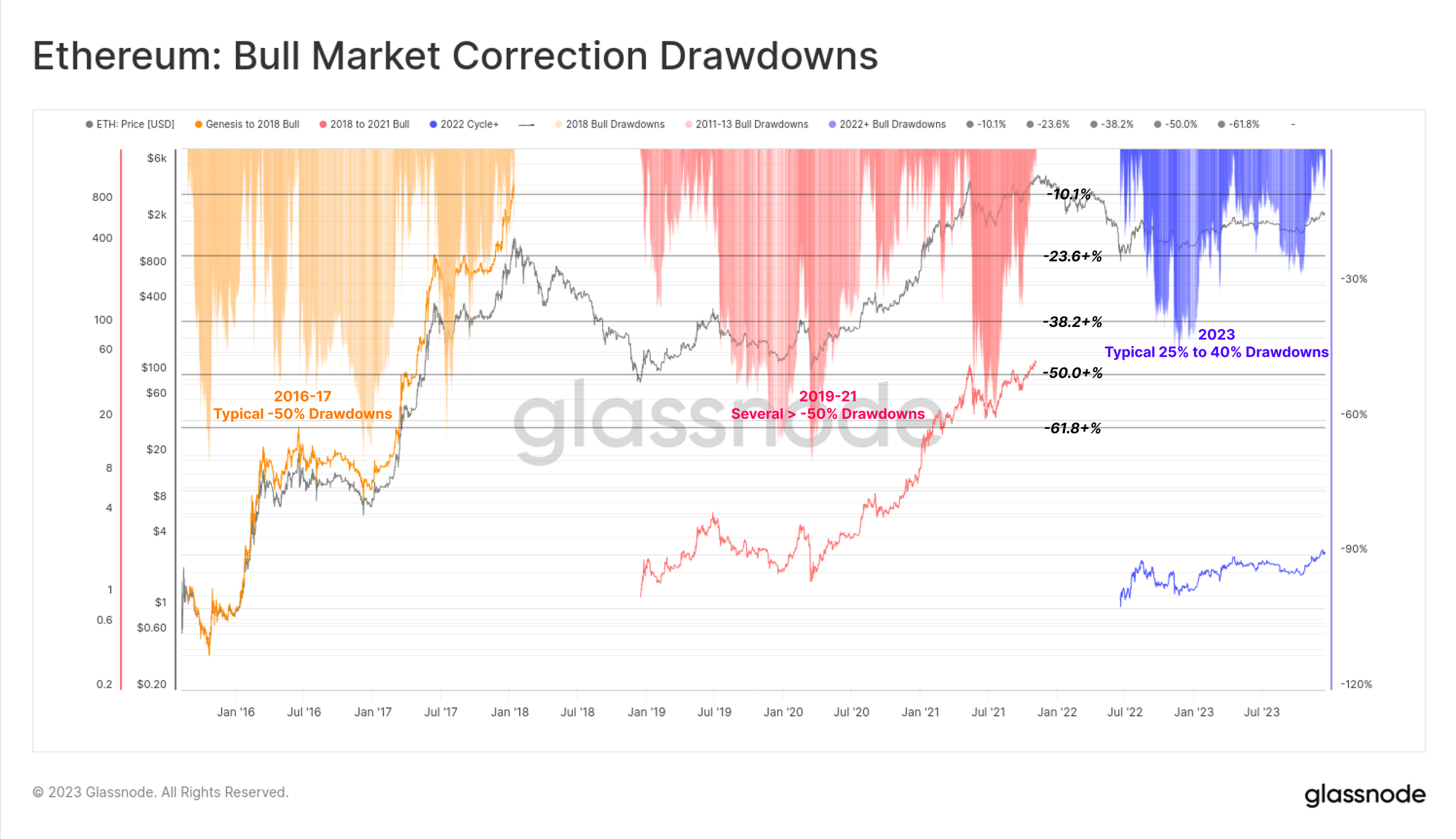

One of the standout features of the 2023 market has been the remarkably shallow depth of all price pullbacks and corrections. Historically, periods of bear market recovery, and bull market uptrends for BTC regularly see at least -25% pullbacks from the local high, with many examples exceeding -50%.

However, the deepest correction in 2023 closed just -20% below the local high, suggesting that buy-side support, and the overall supply and demand balance has been favourable all year.

Ethereum has also seen relatively shallow corrections, with the deepest reaching -40% in early January. Despite the more sluggish performance relative to BTC, this also paints a constructive backdrop where reduced supply issuance from the Merge, is meeting relatively resilient demand flows.

The 2022 bear market was marginally less brutal than the 2018-20 bear cycle, with most major digital assets starting off 2023 at a -75% drawdown from the ATH. The strong performance since the lows recovering a large percentage of their losses. The major assets are currently trailing their ATHs by -40% (BTC), -55% (ETH), -51% (Altcoin excl ETH and Stablecoins), and Stablecoin supplies (-24%).

From an on-chain perspective, the Realized Cap for BTC and ETH provides an excellent tool for tracking the recovery of capital flows into the respective asset. The total Realized Cap drawdown during the 2022 bear reached similar levels to prior cycles, reflecting a net capital outflow of -18% for BTC and -30% for ETH.

Capital inflows have been recovering at a much slower rate however, with the Bitcoin Realized Cap ATerH hit ov 715-days ago. This compares to a full recovery of the Realized Cap taking around ~550-days in prior cycles.

Breaking Through $30k Resistance

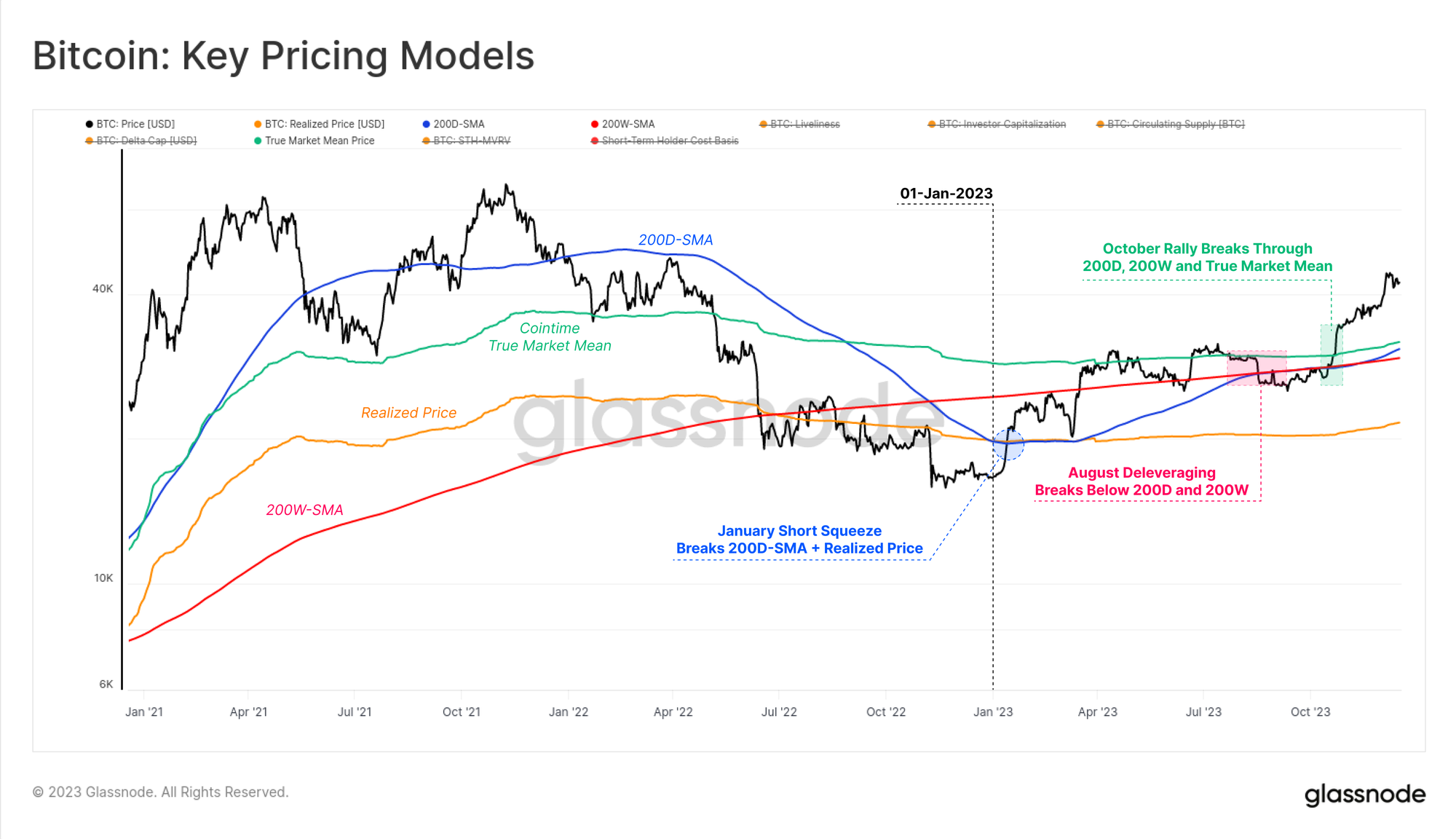

The Bitcoin market overcame numerous technical and on-chain pricing models this year, all of which help us appreciate just how strong the performance has been.

The year started out with a short squeeze in January which pushed the market above the Realized Price 🟠, which had effectively capped prices since June 2022. This upswing also broke through the 200D-SMA 🔵, until it meet resistance at the 200W-SMA 🔴 in March.

Bitcoin prices proceeded to consolidate between the 200D-SMA 🔵 and the True Market Mean Price 🟢 until the August, leading into one of the least volatile periods in Bitcoin history (see WoC-32 and WoC-33). Shortly after, a swift deleveraging event brought prices from $29k to $26k in a single day, and below both of the aformentioned long-term technical price averages.

It was the rally in October which really changed the game, recovering through all remaining price models, and breaking through the key psychological $30k level. Bitcoin ha since reached its yearly high of $44.5k, and is consolidating around $42k at the time of writing.

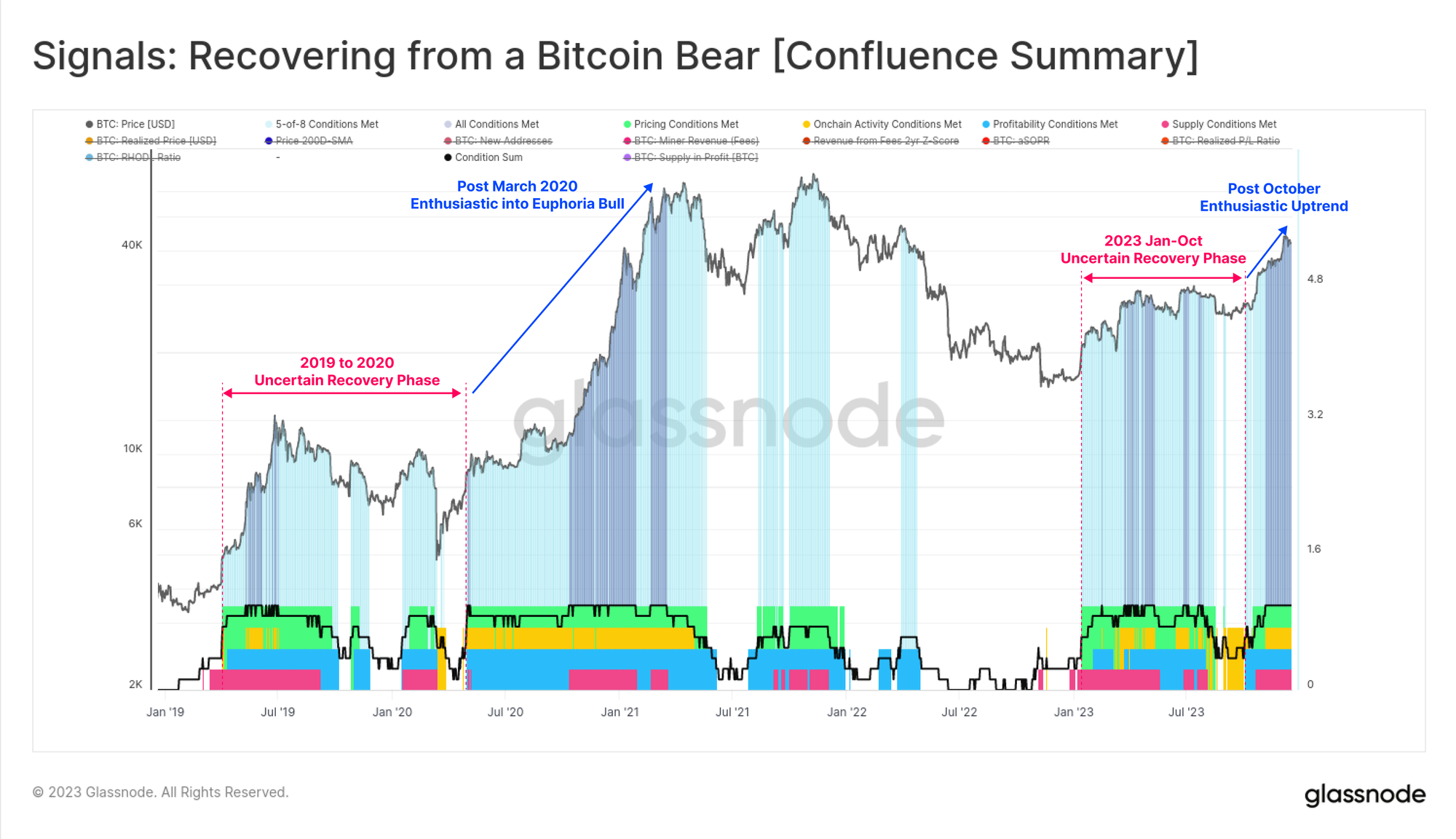

A common thread readers may notice in this article is how capital flows, market momentum, and performance have accelerated since late October. In WoC-49, we explored how this was associated with BTC prices breaking above the $30k level, which we characterise as a transition from the ‘uncertain recovery’ phase into an ‘enthusiastic uptrend’.

Notably, the October rally broke through two important levels which have delineated this transition in prior cycles:

- The technical market mid-point: being a price level broady acting as support during the early bear, and resistance in the late bear. This cycle, $30k was the last major area of support before a series of capitulation sell-offs, culminating with the collapse of FTX.

- The Cointime True Market Mean Price: which reflects the cost basis of active investors. This model was developed within our Cointime Economics research in collaboration with ARK Invest.

We can also see a marked change in character across our Recovering From a Bitcoin Bear Signal, as all eight indicators have entered positive territory since October. Readings were spotty through most of 2023, displaying a very similar character to the 2019-20 period.

With all eight indicators now firing, this suggests that across several metrics, and areas of Bitcoin market structure, the market has entered positive territory often associated with resilient uptrends.

Upticks in Volume, Fees, and Inscriptions

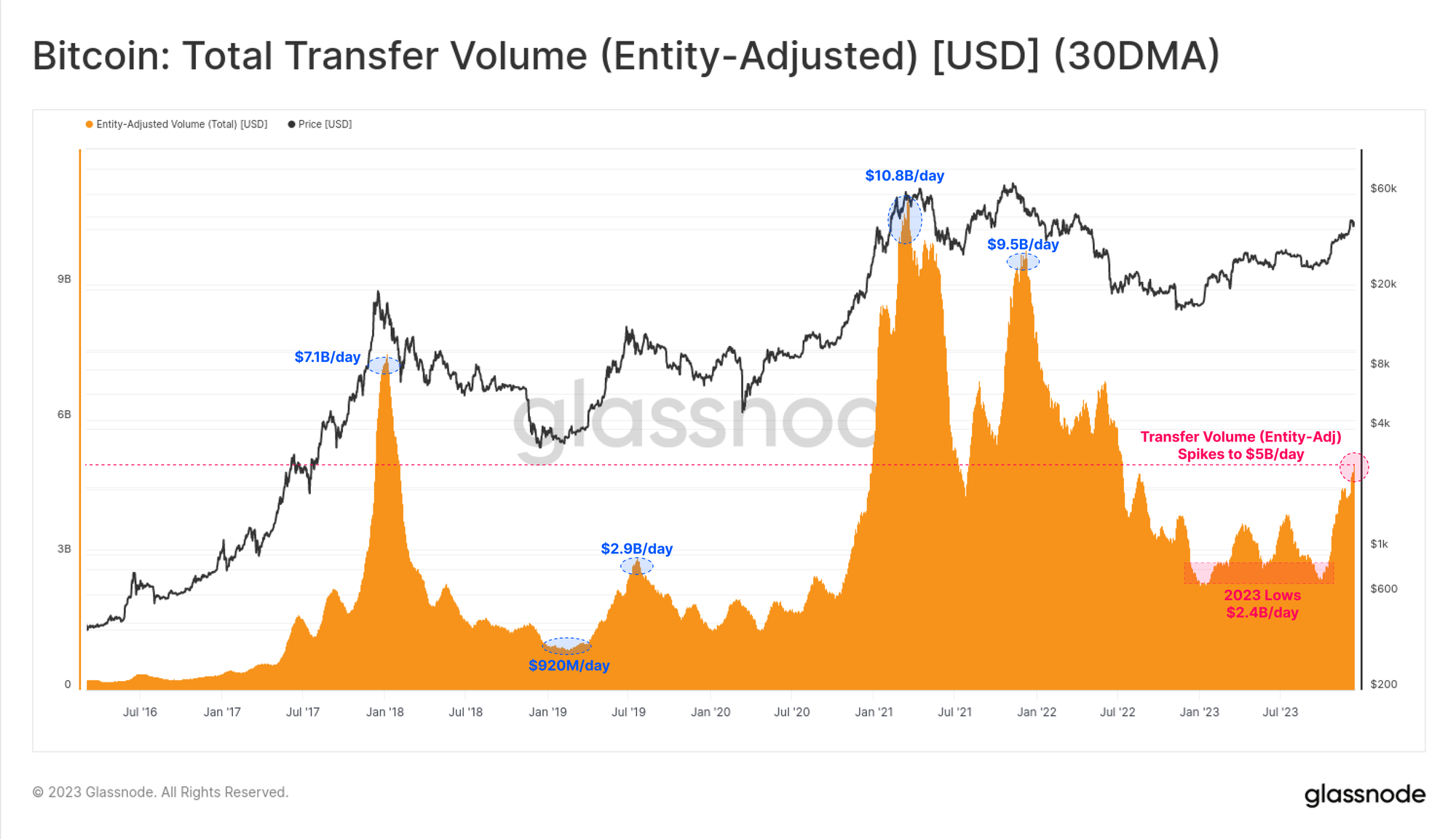

Supporting the notion that October was somewhat of a market phase shift, we can see that transaction volumes for Bitcoin were relatively stagnant up until that point. The October rally motivated transfer volumes for Bitcoin to double from $2.4B/day to a over $5.0B/day, the highest levels since June 2022.

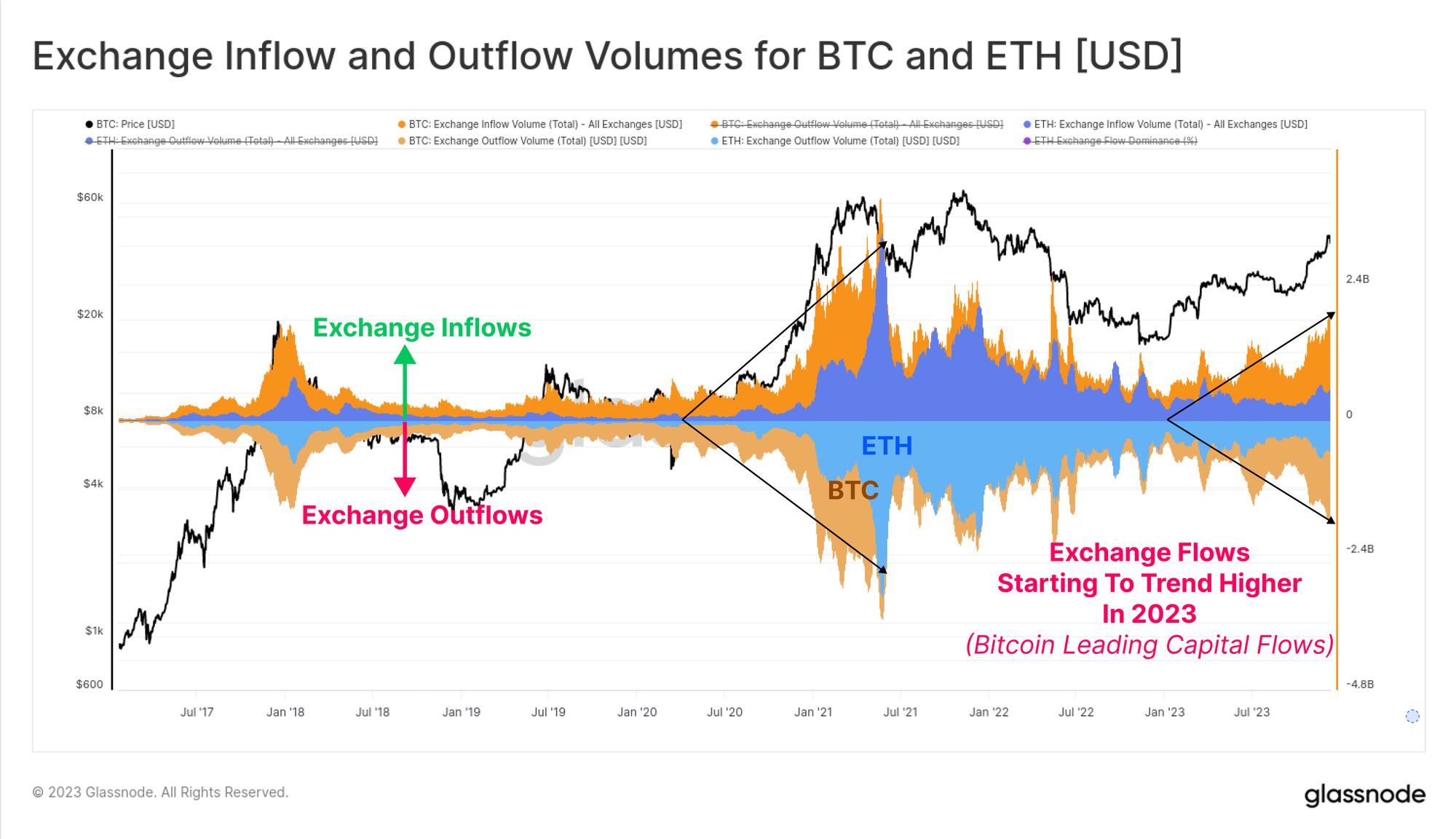

We can also see Exchange inflow and outflow volumes for BTC and ETH picking up throughout the year, suggesting a general expansion in spot trading interest. Of note is how BTC volumes are increasing significantly faster than ETH volumes, aligned with the observation of rising Bitcoin dominance. It is common for BTC to lead investor confidence out of the doldrums following long bear markets, and this chart helps visualise this phenomena.

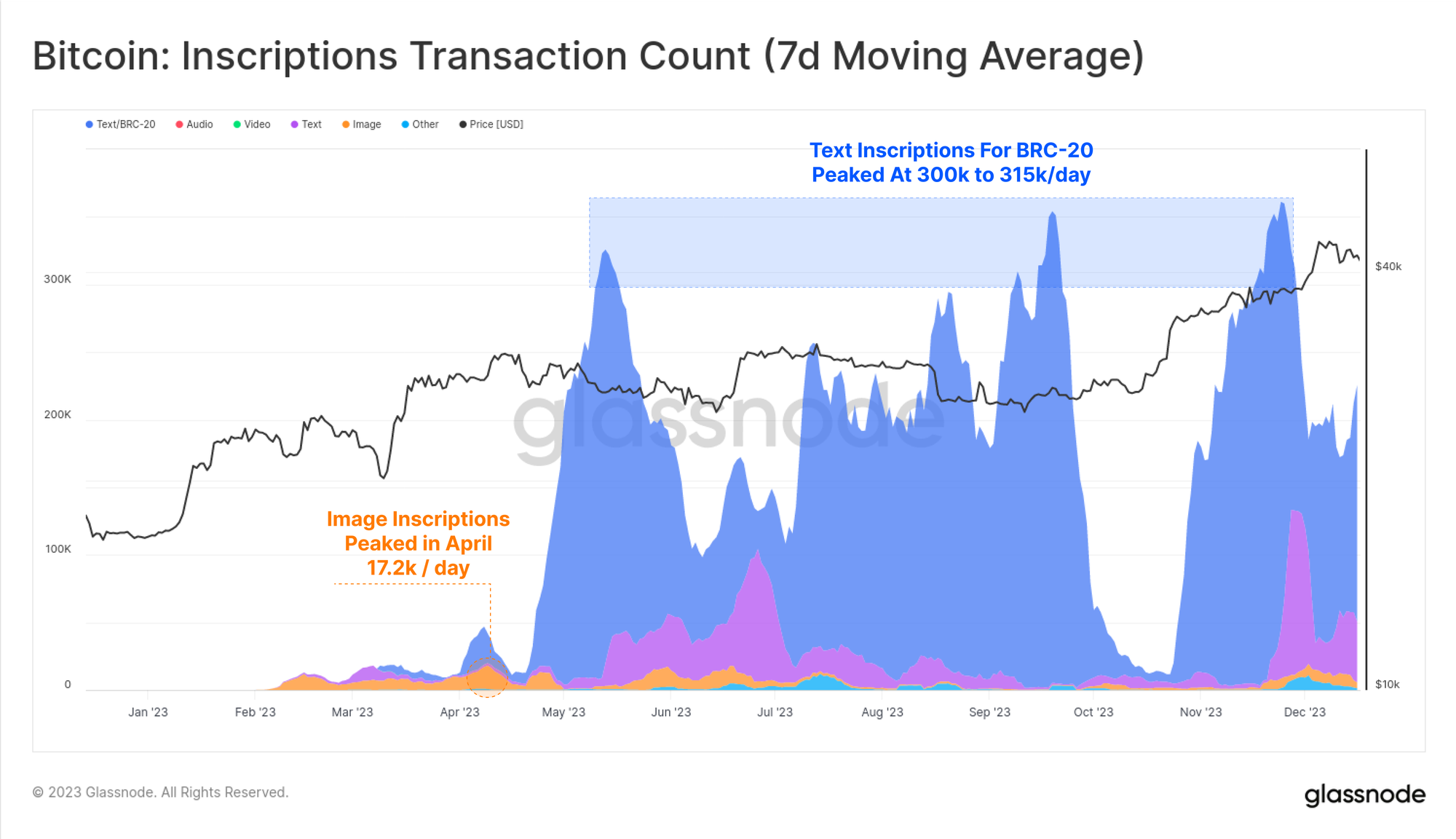

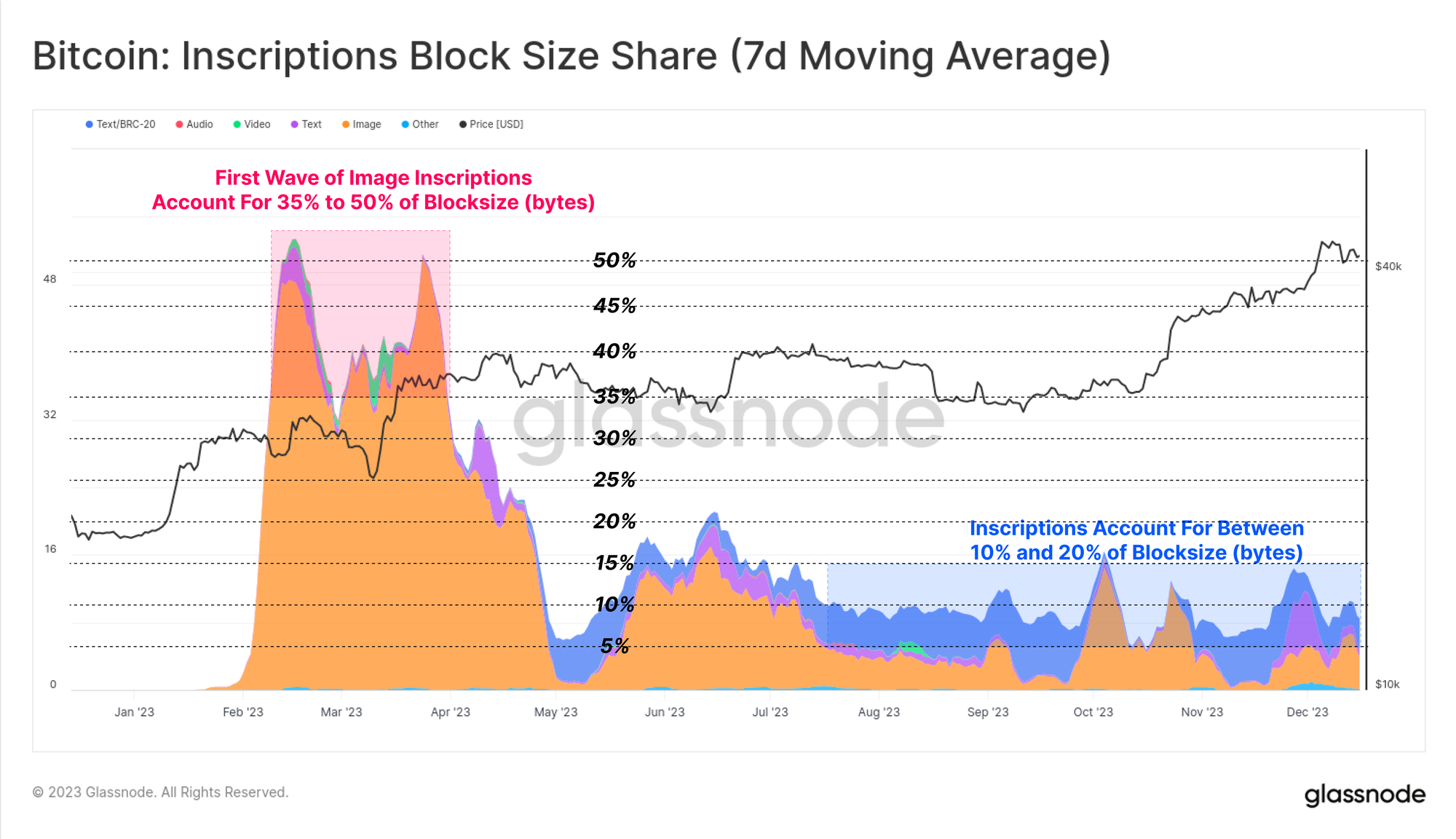

Bitcoin transaction counts reached new all-time-highs this year, largely due to the unexpected rise of Ordinals and Inscriptions. These transactions embed data such as text files and images within the signature portion of a transaction.

As a result, we can now assess two types of Bitcoin transactions:

- 🟠 Total Transaction Counts (unfiltered)

- 🔵 Monetary Transactions which have reached a new multi-year, and almost all-time highs of 372.5k/day.

- 🔴 Inscription Transactions which have added an additional 175k to 356k transactions per day ontop of the classic monetary transactions.

The vast majority of inscriptions tend to be text based, and are associated with a novel token standard referred to as BRC-20 🔵. At the peak, the Bitcoin network has seen over 300k inscriptions per day, well and truly eclipsing the peak of 17.2k/day for Image based inscriptions 🟠 in April (images are larger and thus more expensive to inscribe as fees increase).

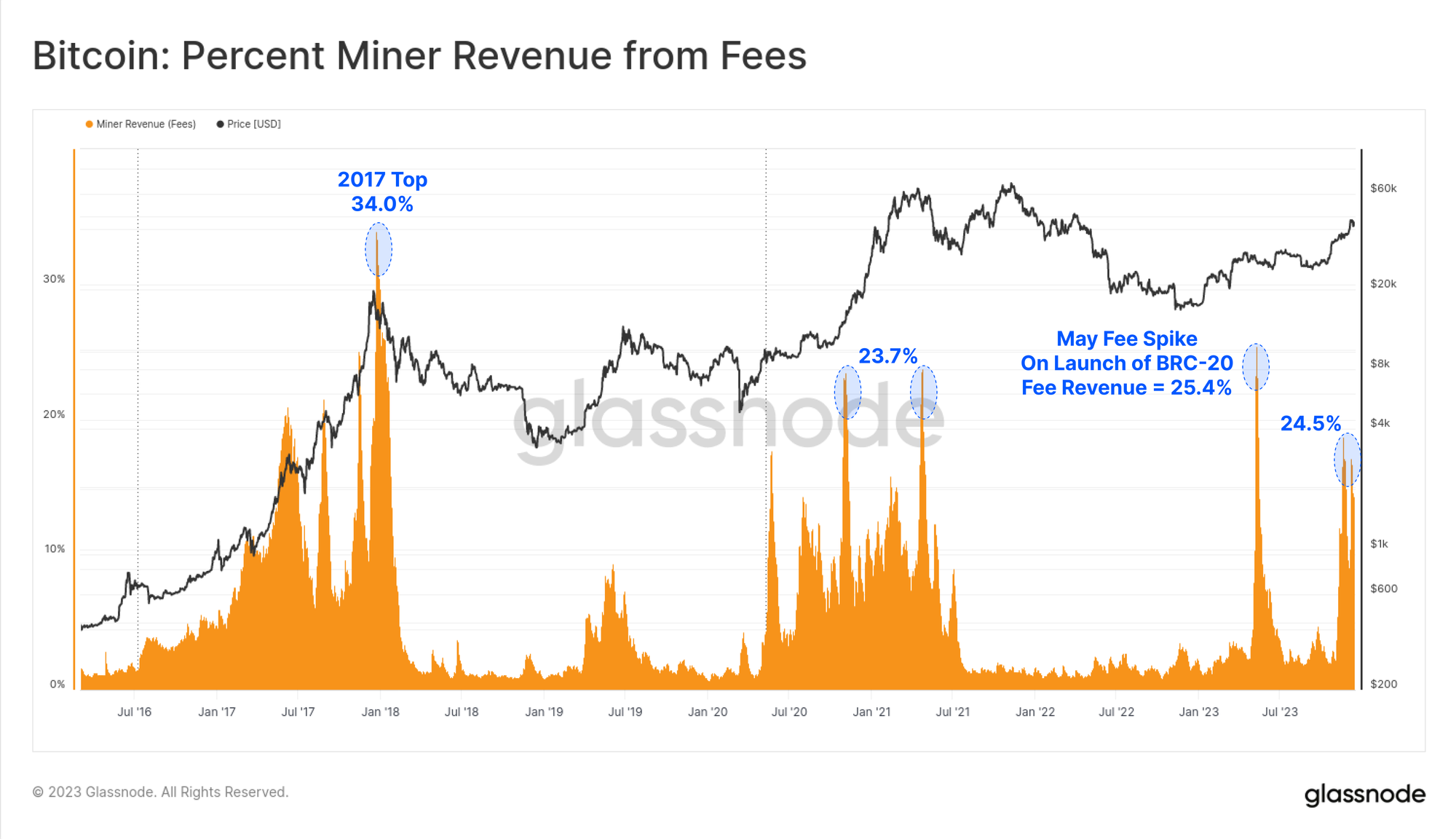

As a result of this new buyer of Bitcoin blockspace, miner revenue from fees has increased significantly, with several blocks in 2023 paying fees which even exceeded the 6.25 BTC subsidy. There have been two major fee spikes this year, with fees now accounting for around a quarter of miner revenues. This is on par with the euphoria phases of the 2017 and 2021 bull markets.

Interestingly, whilst Inscriptions account for around 50% of confirmed transactions, they surprisingly only take up around 10% to 15% of blockspace. This is a result of both the small size of text files, and nuances associated with the SegWit data discount (a topic we cover in WoC-39).

Inscriptions have contributed between 15% and up to 30% of the total transaction fee revenue for miners this year. This highlights the unintuitive nature of the SegWit discount, where Inscription transactions consume a minority share of blockspace (in bytes), pay a meaningful proportion of fees, but also account for around half of all confirmed transactions.

In effect, Inscriptions and the SegWit data discount allow miners to fit more transactions, which pay more fees, into the same maximum size block. The impact on miner revenues should demand for Inscriptions persist is likely to improve miner economics meaningfully, especially with the fourth halving fast approaching.

Bridges, Staking, and Shanghai

For Ethereum, on-chain activity has been a little on the sluggish side this year, with October again being a notable inflection point.

- Active Addresses has been relatively flat at around 390k/day

- Transaction counts have recently increased from 970k/day to 1.11M/day

- ETH Volume Transferred has increased from $1.8B/day to $2.9B/day

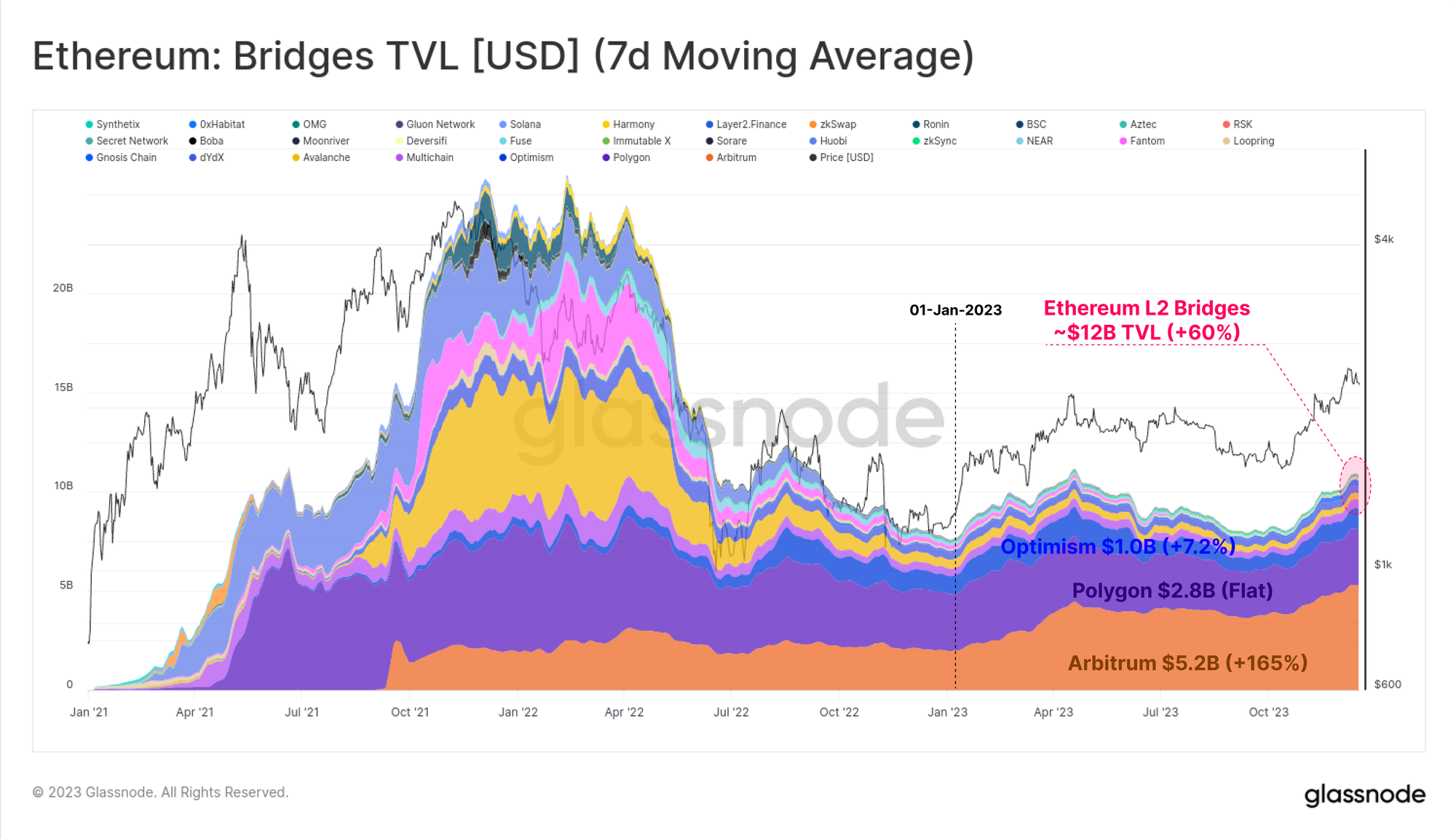

Whilst the market price of ETH has generally under-performed the wider digital asset space, its ecosystem continues to expand, mature, and grow. In particular, the Total Value Locked into the ever expanding fleet of Layer-2 blockchains has increased by 60%, with over $12B now locked into bridges.

These L2 chains are seeking to scale and expand Ethereum blockspace, whilst anchoring their data and finality into the Ethereum main-chain to maintain their security.

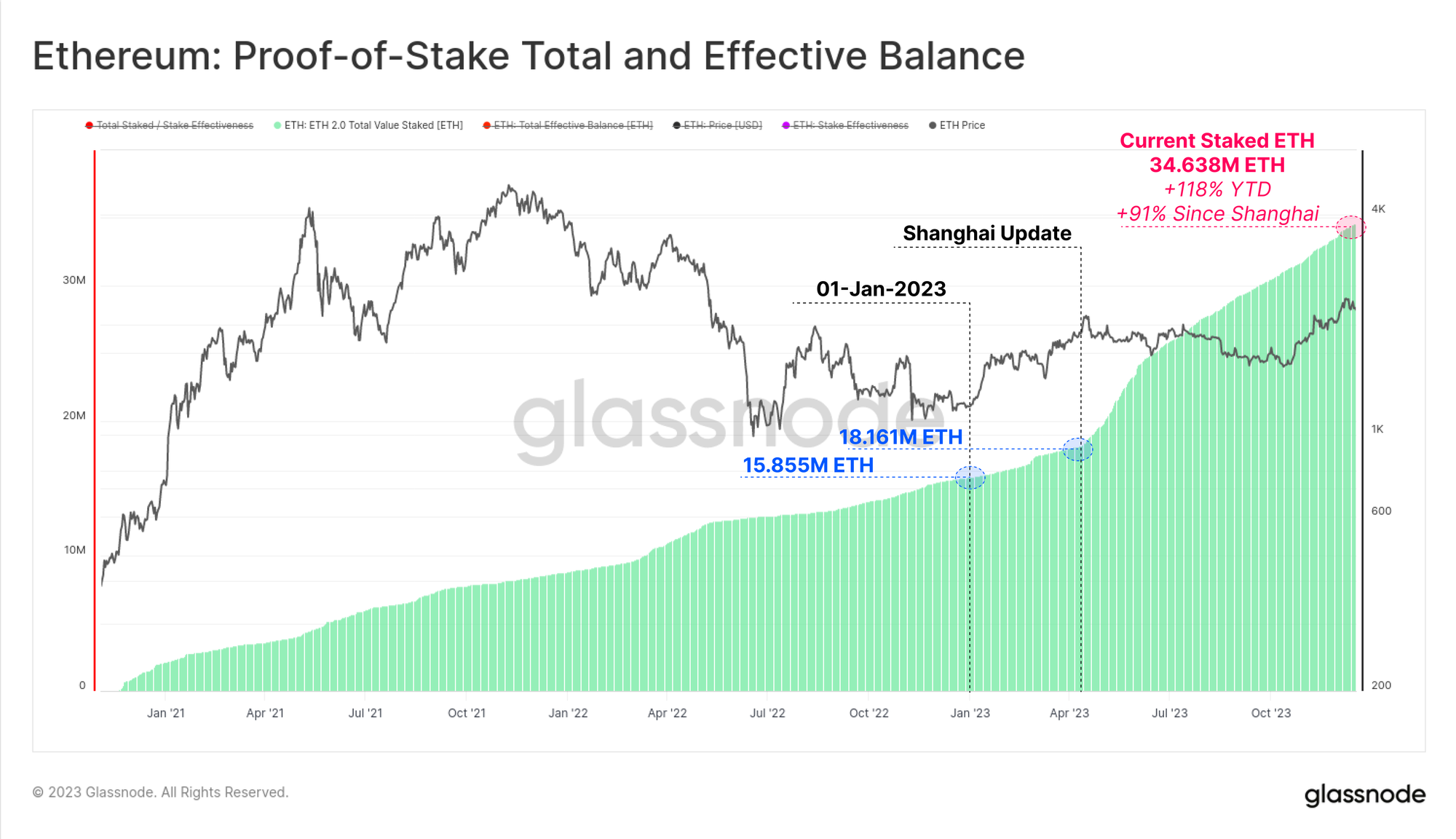

The other key area of growth for Ethereum has been the total volume of ETH staked via the new Proof-of-Stake consensus mechanism. Staked ETH has seen a 119% increase in volume YTD, reaching over 34.638M ETH now locked into the staking protocol. The Shanghai update was also successfully rolled out in April, allowing stakers to complete withdrawals, and reshuffle their staking providers and setups for the first time since the Beacon chain launched in Dec 2020.

📰

Taking a Long-Term View

Despite the incredible price performance of Bitcoin, a large portion of BTC remains dormant, and reaching Long-Term Holder status in investor wallets. Out of a total circulating supply of 19.574M BTC, over 14.900M (76.1%) are held off exchanges and have not moved in over 155-days, increasing by 825k BTC YTD. This also puts Short-Term Holder Supply at what is effectively an all-time-low of 2.317M BTC.

💡

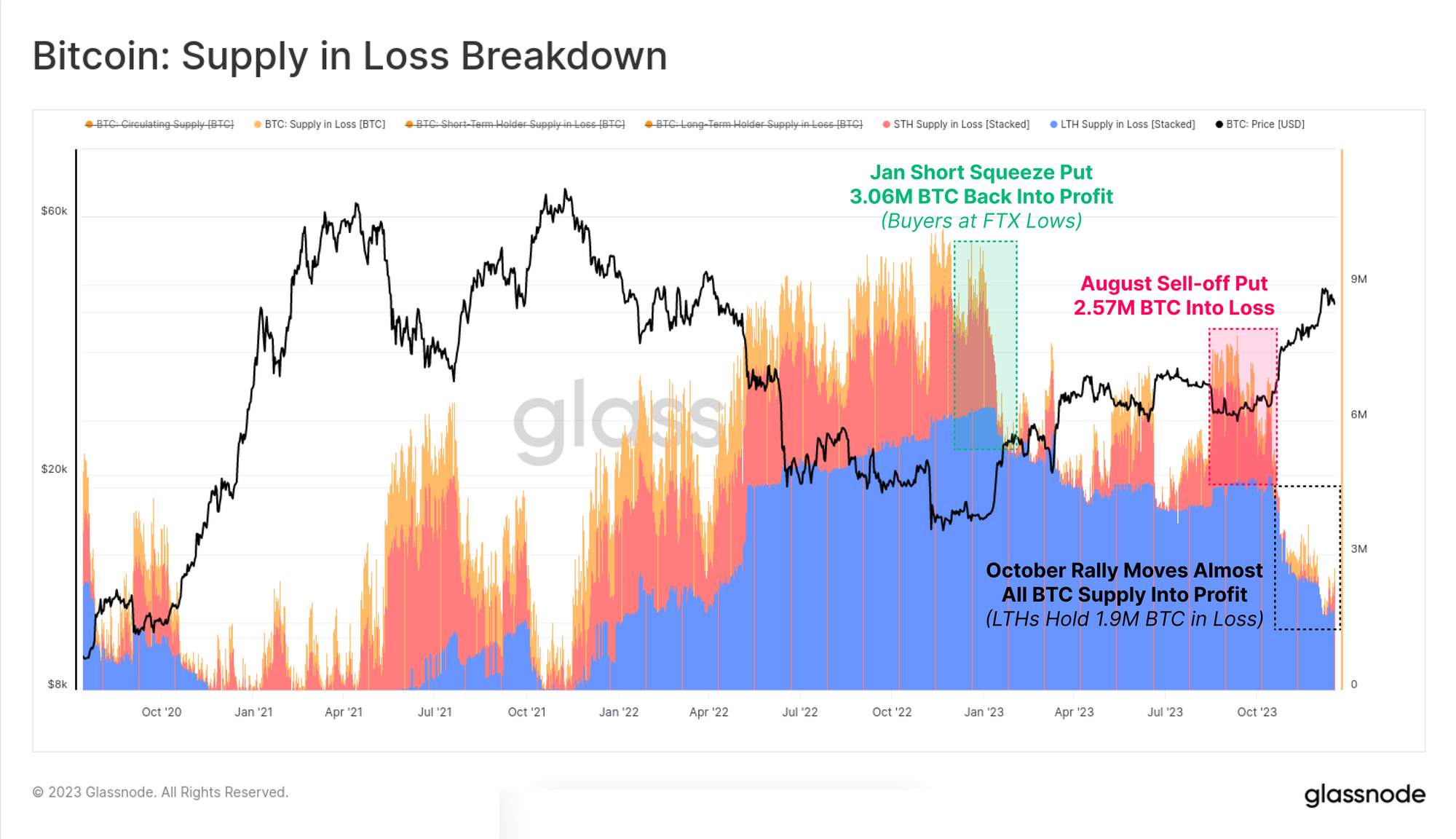

As the market rallies, a super-majority of investor coins have returned to being ‘in-profit’, whether due to changing hands, or by prices rallying above the cost basis. The chart below shows how the total volume of coins held ‘in-loss’ has declined to around 1.9M BTC, with most held by Long-Term Holders who bought near the 2021 highs.

The flip side is that Supply held ‘in-profit’ is now over 90% of the circulating supply, with the October rally being the event making it above the all-time-mean. Given 2023 started out with over 50% of supply being underwater, this is one of the fastest recoveries in history (second to the rally in 2019).

The chart below visualises the change in percent supply in profit over each calendar year since 2015. Whilst the delineation by year isn’t perfect, the classic four year Bitcoin cycle allows us to spot some interesting patterns:

- 🟠 Bear Floor/Recovery sees the largest increase in supply in profit as coins capitulated near the lows return to profitable territory.

- 🔵 Early Bull Market where the general uptrend puts the majority of coins in profit, and rallies to new ATHs.

- 🟢 Euphoric Late Bull where the market is at ATHs, resulting in small positive, to negative readings since all coins are already in profit and the market nears exhaustion.

- 🔴 Primary Bear following the market peak, as significant volumes of coins fall into loss.

Whilst simple in construction, this framework really highlights the similarities between 2015-16, 2019-20, and the progress of 2023 thus far.

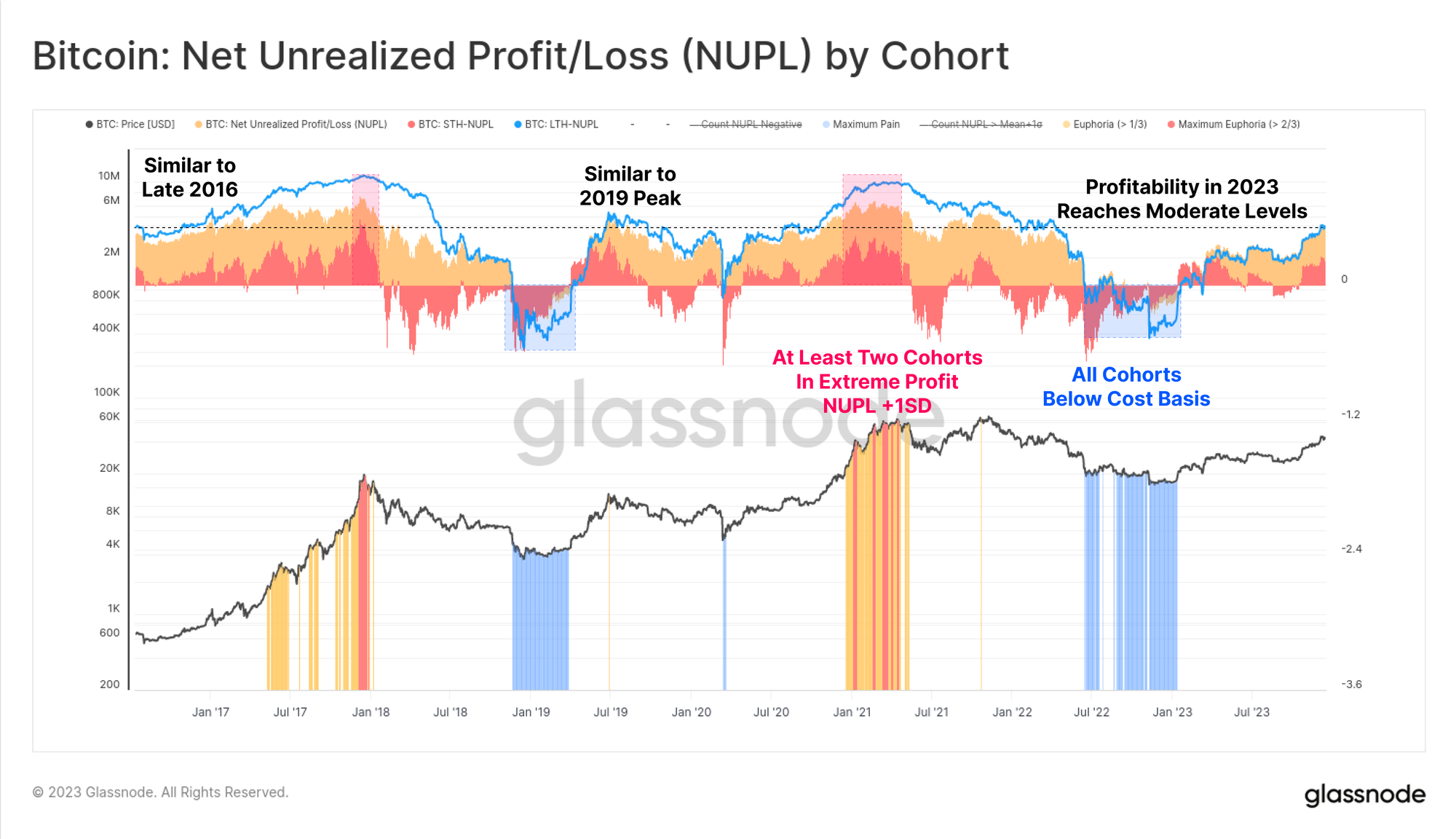

Lastly on the topic of investor profitability, 2023 has taken Long-Term Holders, Short-Term Holders, and the average holder from an unprofitable, to a moderately profitable state. The NUPL metric for each cohort is not yet at euphoric highs, but is also comfortably above the respective cohort break-even level.

Maturing Derivatives Markets

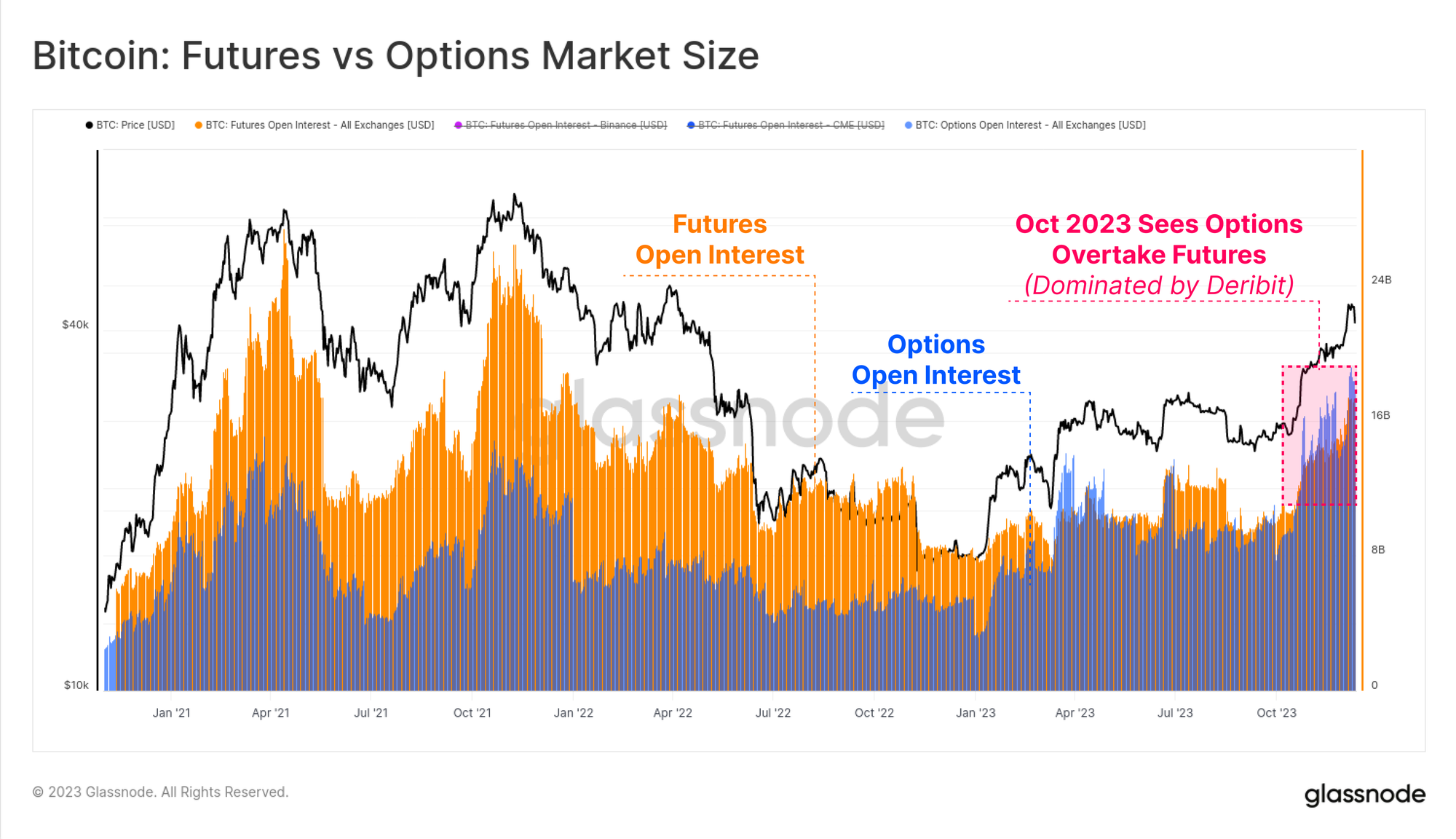

A defining feature of the 2020-23 cycle was the emergence of futures and options markets as the preferred venues for price exposure and liquidity. 2023 has proven to be an important year in this maturation, as Options markets have grown to match and even overtake Futures markets in open interest size.

Both now boast between $16B and $20B in open contracts, with Deribit continuing to dominate (90%+) the options space. This alludes to a growing institutional interest in Bitcoin, as traders and positions utilize options market to deploy more sophisticated trade, risk management, and hedging strategies.

Within the futures market there has also been a noteworthy dominance shift, with open interest held at the regulated CME exchange overtaking offshore exchange Binance for the first time in history. Once again, October appears to have been an important moment for this phase shift, alluding to an influx of institutional capital.

Futures trade volume for both BTC and ETH saw an uptick in October, with a combined daily volume of $52B/day. Bitcoin contracts dominate around 67% of the trade volume, compared to 33% associated with Ether contracts.

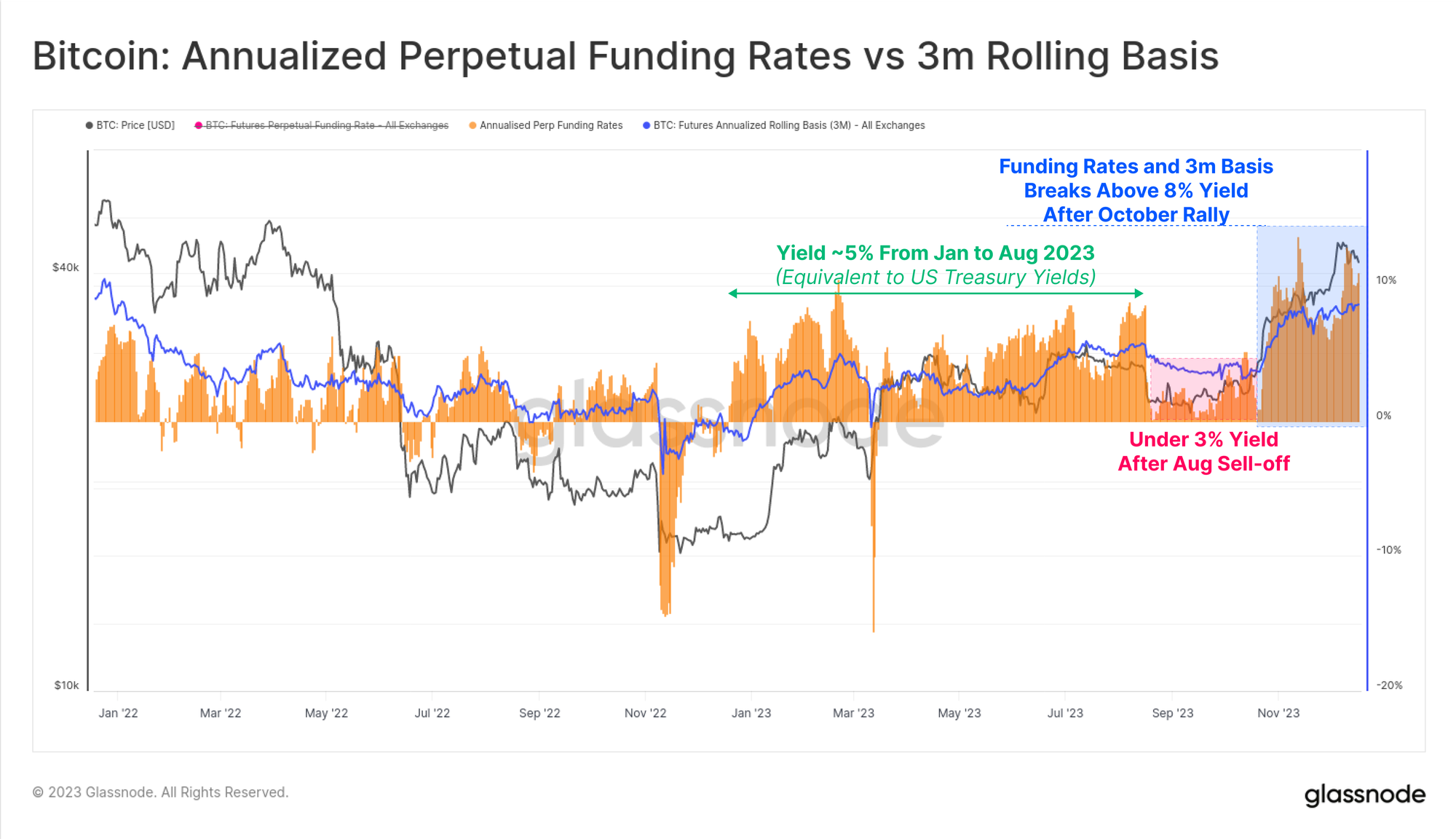

The cash and carry yield available within futures markets have seen three distinct phases throughout the year which also tells a story about capital flows into the space:

- January to August with yields fluctuating around ~5%. This is largely in line with short-term US Treasury yields, and thus is relatively unattractive given the additional risk and complexity of the trade.

- August to October with yields under 3% following the sell-off to $26k, and a surprisingly low volatility environment.

- October onwards as yields break above 8%. With futures basis now maintaining levels 300bps above US Treasuries, market maker capital now has a meaningful incentive to return to the digital asset space.

Stablecoins Supplies

A relatively new phenomena the last cycle was the outsized role that stablecoins have played in market structure, becoming the preferred quote currency for traders, and a primary source of market liquidity.

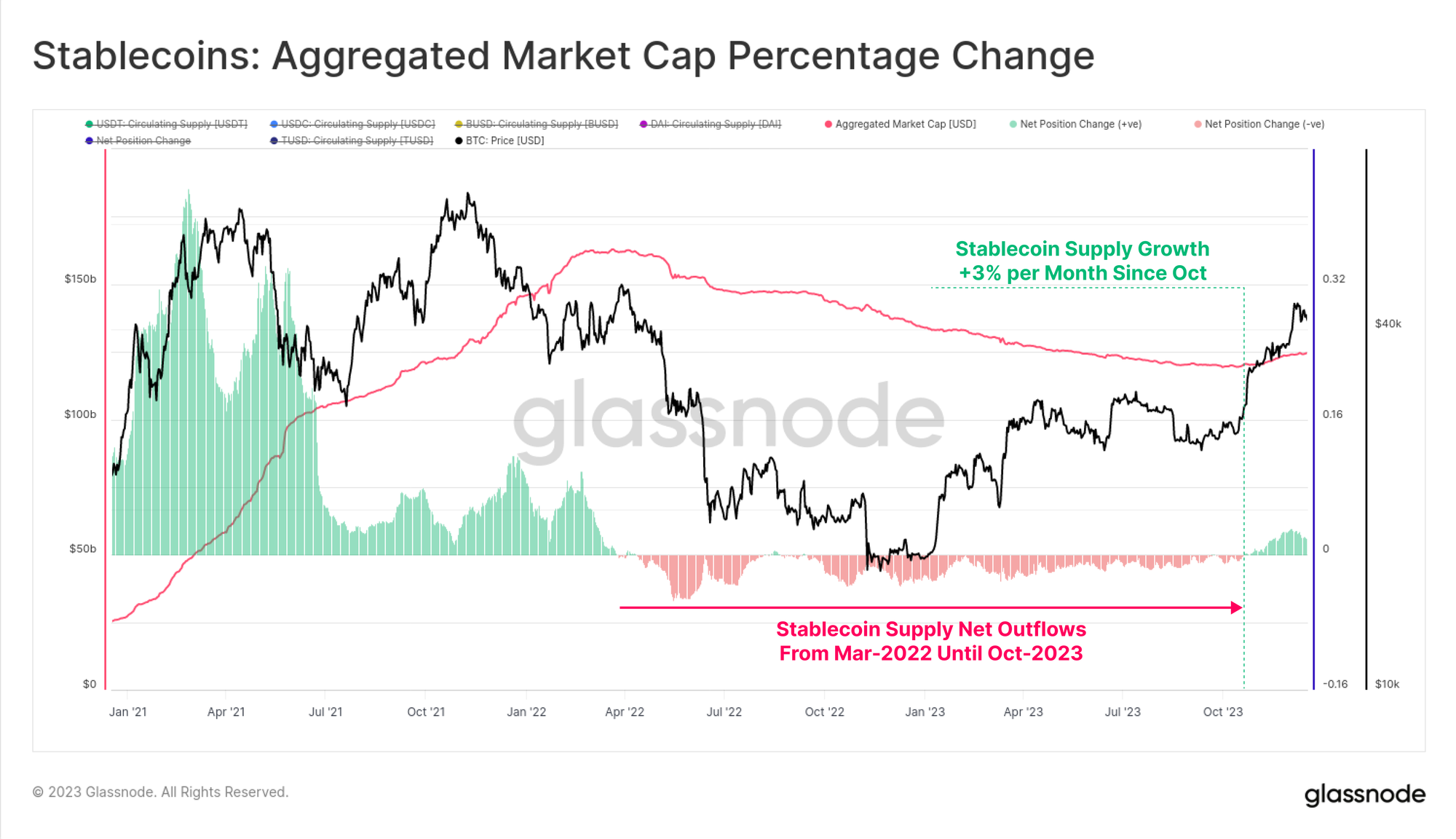

Aggregate stablecoin supplies had been in decline since March 2022, falling by -26% from the peak, being a major headwind for market liquidity. This is due to a combination of regulatory pressures (SEC charged BUSD for being a security), capital rotation (preferring US treasuries vs non-interest bearing stablecoins), and waning investor interest in the bear market.

However October has been a pivot point, with total stablecoin supplies bottoming at $120B, and supply starting to grow at a rate of up to 3% per month. This is the first expansion in stablecoin supply since March 2022, and a likely sign of returning investor interest.

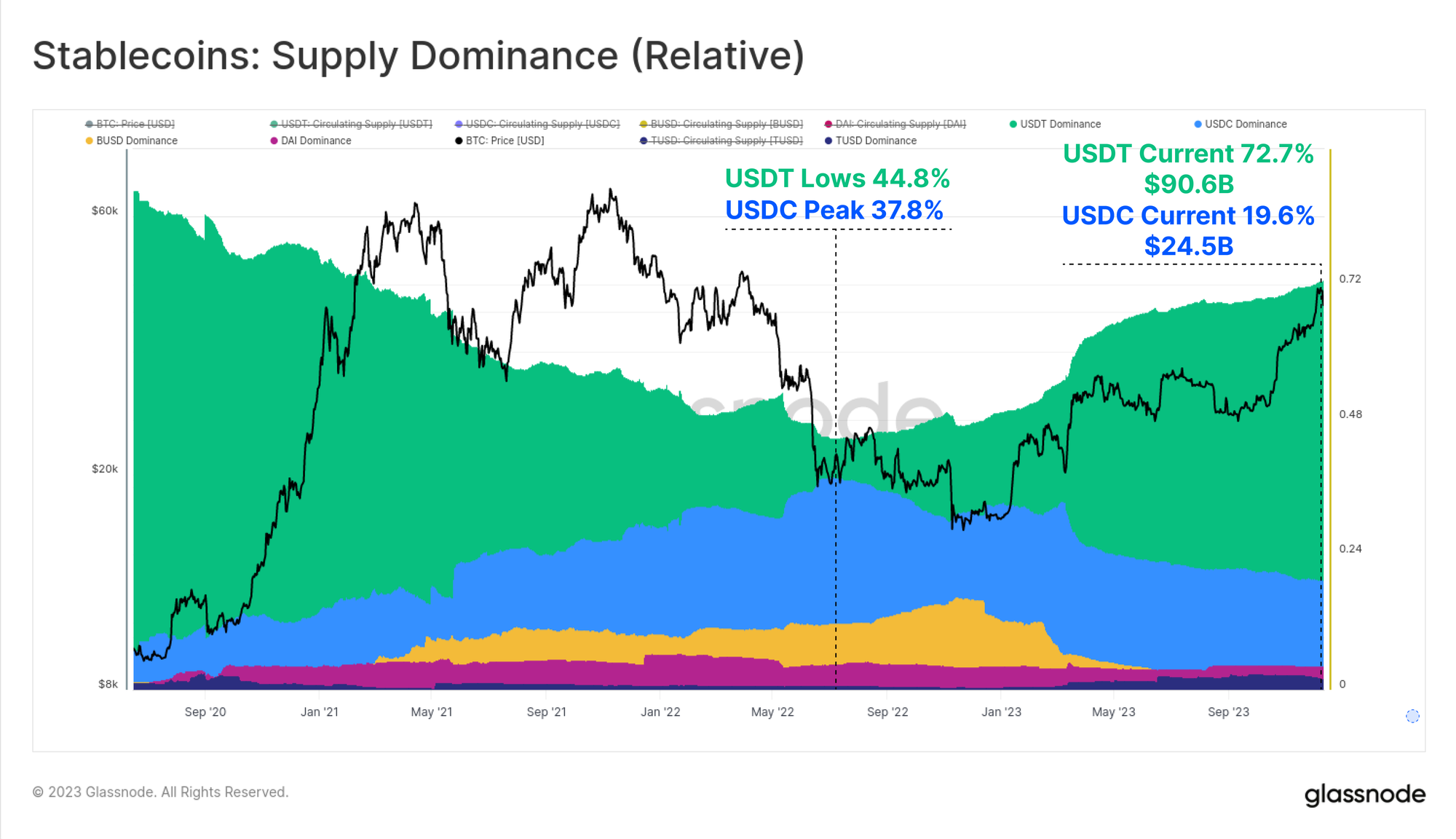

The relative dominance between various stablecoins has also undergone significant shifts between 2022 and 2023. Previously rising stablecoins like USDC and BUSD have seen their dominance shrink significantly, with BUSD entering redemption only mode, and USDC dominance falling from 37.8% to 19.6% since June 2022.

Tether (USDT) has once again asserted itself as the largest stablecoin, with total supply climbing to over $90.6B, and commanding 72.7% of the market share.

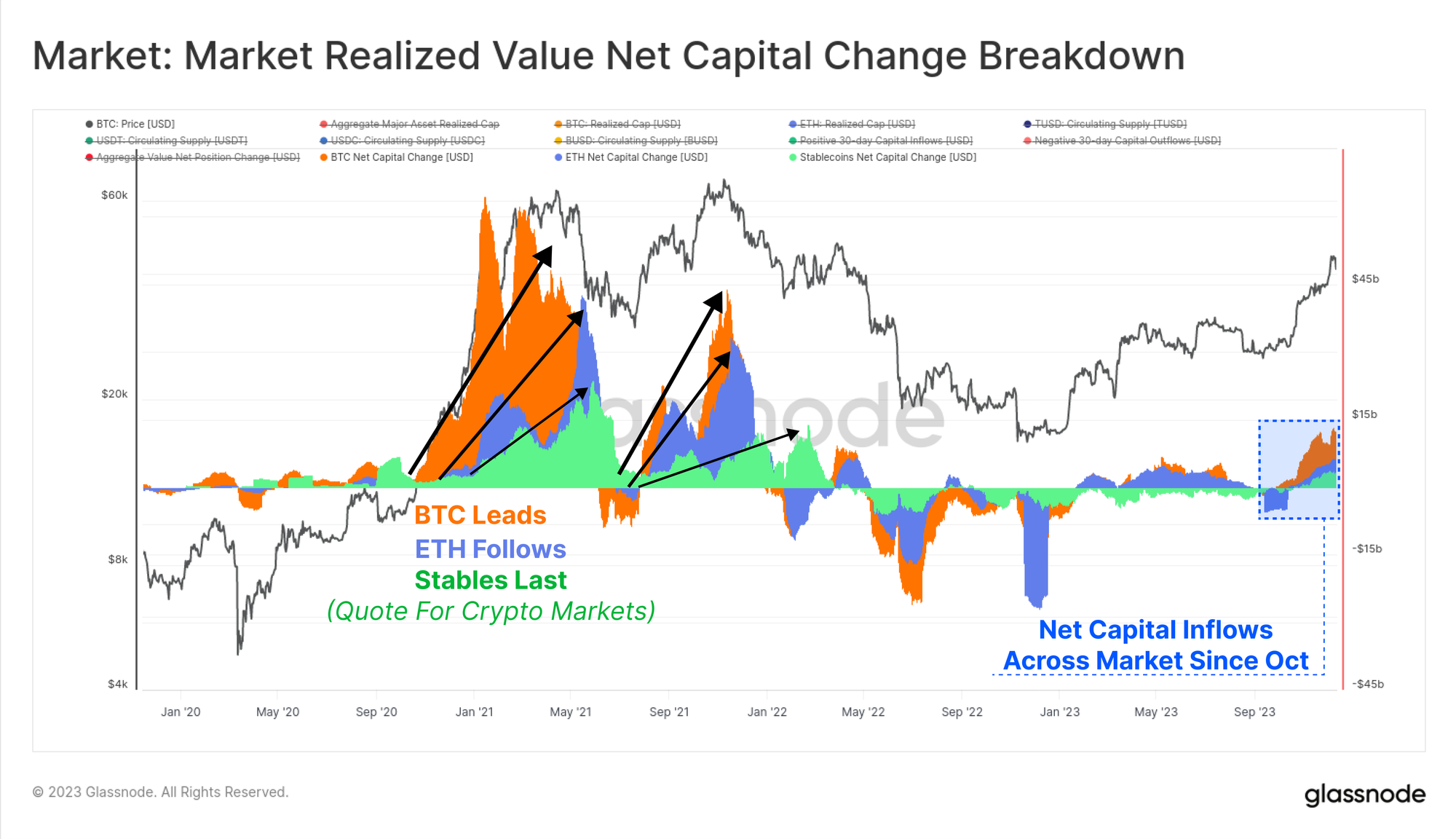

Finally, we can compare the 30-day change in the Realized Cap for BTC and ETH to that of the aggregate stablecoin supply. These three metrics help visualise and measure the relative capital flows, and rotation between sectors.

Once again, October stands out as a key moment where capital inflows into all three assets turning positive, aligning with the market breaking above the key $30k level, institutional interest expanding in derivatives markets, and net capital inflows to the three major digital assets.

Summary and Conclusions

2023 almost couldn’t have been more different to the devastating deleveraging and market downtrend of 2022. Instead, this year brought renewed interest in digital assets, significant out-performance, and new on-chain artefacts in the form of Inscriptions on Bitcoin.

The Bitcoin supply is currently tightly held by Long-Term Holders, and the majority of investors are now holding profitable coins. With a US based ETF looking increasingly likely in early 2024, and the Bitcoin halving due in April, the stage is set for an exciting year ahead.

From the Glassnode team: To all readers of The Week On-chain, and to Glassnode members, we want to thank you all for your support and readership this year. We hope you enjoyed reading The Week On-chain, and using Glassnode tools, as much as we enjoy writing and building them. We wish you all the very best over the holiday season, and look forward to another exciting year in 2024.

Disclaimer: This report does not provide any investment advice. All data is provided for information and educational purposes only. No investment decision shall be based on the information provided here and you are solely responsible for your own investment decisions.

Exchange balances presented are derived from Glassnode’s comprehensive database of address labels, which are amassed through both officially published exchange information and proprietary clustering algorithms. While we strive to ensure the utmost accuracy in representing exchange balances, it is important to note that these figures might not always encapsulate the entirety of an exchange’s reserves, particularly when exchanges refrain from disclosing their official addresses. We urge users to exercise caution and discretion when utilizing these metrics. Glassnode shall not be held responsible for any discrepancies or potential inaccuracies. Please read our Transparency Notice when using exchange data.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://insights.glassnode.com/the-week-onchain-week-51-2023/