Before the mid-twentieth century, a “computer” was a person whose job was doing mathematical calculations by hand. Good luck finding that gig today. Likewise, elevator operators, “pin boys” who reset bowling pins between frames, and telephone switchboard personnel have all gone the way of the dinosaur. In a dynamic economy, “creative destruction” is an old story. Now, artificial intelligence is literally writing a new chapter in that story.

The good news about technological change is that we have a large historical dataset to draw conclusions from, and while certain occupations may disappear, jobs—in the general sense—will remain. Creating goods and services from scarce resources has always required human involvement, innovation and creativity in one form or another. Despite what some may be saying, I don’t think that will change in the age of AI.

In fact, technology often creates more work than it destroys. A report from McKinsey (Jobs Lost, Jobs Gained: Workforce Transitions in a Time of Automation) estimates that 3.5 million U.S. jobs were lost to the personal computer and the Internet. But some 19.3 million other jobs were gained, for a net job gain of 15.8 million.

We don’t know how many jobs AI will disrupt in the coming years, but there is probably not a single business of scale that won’t be impacted. A study by Vanson Bourne of large companies in the U.S. and U.K. estimated that some 19 days per employee were spent annually on boring, repetitive tasks. In theory, AI has the potential to alleviate that, making work both more interesting and more productive.

And unlike previous technological revolutions, this one may drop its heaviest disruptions on highly skilled labor. Content writers, coders, investment advisors, and many other knowledge workers are among those who will need to adapt. That means businesses and the investors who support them will also need to grow and change as well. This post will try to shed some light on how. It’s the second of a series that began with How to Invest in AI, and will conclude with How AI Can Improve the Investing Process.

AI Promises to Make Businesses Across the Board More Productive

Cars move people faster than horses and buggies ever could. Computer spreadsheets can help complete tasks in a fraction of the time needed with manual ledgers. As disruptive technology spreads through an economy, history proves that the ability to do more with less raises the average standard of living and opens new opportunities for profit and progress. But as old ways of doing things are shaken up, winners and losers always emerge.

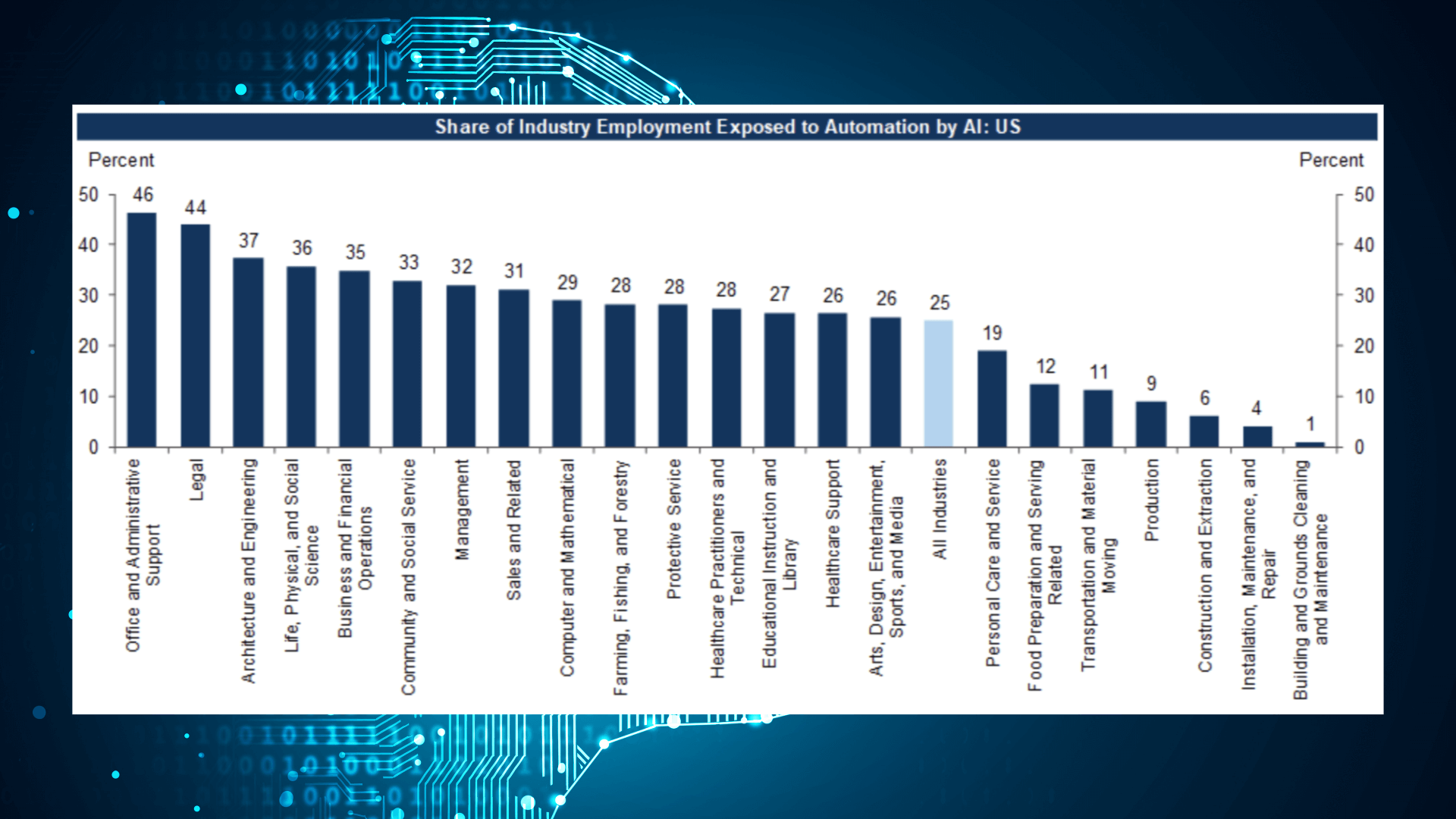

In the case of AI, the areas of disruption will undoubtedly be numerous. A recent WSJ article says that AI “promises to affect every activity that involves touching a keyboard.” That may sound hyperbolic, but consider the figure below from a recent Goldman Sachs report.

Image Source: Goldman Sachs report titled “The Potentially Large Effects of Artificial Intelligence on Economic Growth” (LINK) Background Added

If charts like this one are right, workers in virtually every sector will need to learn how to work alongside and leverage AI, which in many cases will require at least some degree of retraining. Workers who make this transition quickly and successfully, though, will likely earn higher wages than before and have more opportunities for advancement. A recent Brookings Institution post summed up the dynamics of this transition well:

“Workers who can complement the new automation, and perform tasks beyond the abilities of machines, often enjoy rising compensation. However, workers performing similar tasks, for whom the machines can substitute, are left worse off…Very importantly, workers who can gain more education and training, either on the job or elsewhere, can learn new tasks and become more complementary with machines. For instance, while robots have displaced unskilled workers on assembly lines, they have also created new jobs for machinists, advanced welders, and other technicians who maintain the machines or use them to perform new tasks.”

Overall, some 65% of U.S. executives surveyed by audit and consulting firm KPMG (LINK) expect generative AI to have a “high or extremely high” impact on their organizations over the next 3-5 years. But 60% claimed to be a year or two away from implementing it, due to barriers such as talent, governance and the sheer size of the task of retraining workers along the lines described above.

That said, there are already examples of AI changing the type of work that occurs at private equity portfolio companies every day. At this stage, the impact is most apparent in white-collar fields involving repetitive administrative tasks with textual output. For instance, the WSJ reports that law firm Allen & Overy is making productivity gains by having an AI tool named Harvey research and write first drafts of documents, before passing them off to a human to carry over the finish line.

Generative AI is also infiltrating customer service. Call the support line for your bank or home insurance company and you might find yourself talking to a chatbot with a name like Charlie or Amelia who can handle basic queries without the need for a human agent. Similarly, advancements in AI are transforming the lending industry, speeding up and improving the loan application process by taking over more basic data entry and customer support functions, as well as parsing new patterns to help determine borrower eligibility outside of traditional credit score metrics.

With this in mind, it is easy to see how generative AI could soon analyze consumer spending trends like a market researcher or parse a family’s financial situation, income prospects and retirement goals like an investment advisor. Radiologists and optometrists could also see basic diagnostic aspects of their jobs transferred to AI, freeing up more time to spend working with patients. The possibilities, even just over the next few years, are quite literally endless.

What This Means for Private Equity Portfolios

Imagine time-traveling back to 1992, before Mosaic—the first widely used Internet browser—appeared. I don’t know about you, but I would probably be on my “cordless” phone calling my broker (they were mostly still humans back then) with buy orders for a few select equities, unaware that within a decade or two, the whole process could be done in a few clicks on a screen in your hand. We are in a similar time now. Tremendous value will accrue to firms that effectively introduce AI into their business models, just as it did to those who effectively harnessed the Internet.

Imagine a private equity fund acquiring a business with a (non-AI-based) plan for making the sales force 10% more efficient while eliminating a few redundant back-office positions. Adding an AI strategy to that plan might pass significant additional tasks off to AI. If this freed up another 20% of the sales force’s time, a star performer in the portfolio would become a comet, with returns potentially 2-3x those expected in a pre-AI past. Multiply this by the vast number of firms where AI can be incorporated in the coming years, and you begin to sense the possibilities.

Here’s another way to think about it. A study by McKinsey estimated (LINK) that 6 out of 10 present jobs are at least 30% automatable. And that study was done before ChatGPT! Now, instead of picturing those workers sitting on their hands, imagine them using that time on less routine, less automatable tasks that will drive profitability.

There is also the possibility of new revenue streams for businesses already in a private equity firm’s portfolio. AI solutions developed in-house could be sold to other companies or to AI developers. Similarly, proprietary data sets could be sold or licensed to AI developers hungry for new data on which to train their algorithms. As we discussed in the prior post, though, investors should be careful about pouring time and capital into developing bespoke solutions when off-the-shelf offerings from tech giants like Google and Microsoft might more than suffice for a company’s needs.

Above all, it is important to remember that the most substantial returns will accrue to the first and best adopters of the technology. Once the new generation of AI is ubiquitous and the paradigm has shifted, the outsized gains associated with a more productive salesforce, better customer service offerings and the like will quickly be competed away.

Conclusion: Learning From AI

The further implementation and evolution of artificial intelligence could represent the most momentous social change of our lifetimes. So as AI learns about us, we should also learn about it. We can’t process data or discern patterns at the speed it can, but our flesh-and-blood brains still do things AI cannot, such as think conceptually about a future with AI in it, and where it can (and can’t) be put to its highest and best use. It would be naïve to think jobs will not be lost to AI. But it also has the potential to create new, more productive roles that will pay many people higher wages and hopefully leave them feeling more engaged with their work than they are today.

From a business perspective, a more productive and engaged workforce is a tantalizing prospect for profits and returns. But it is important to remember that for almost any company, though the work of AI itself may seem somewhat like magic, it cannot be implemented with just a flick of a wand. Choosing where and how to leverage AI will require careful study, planning and retraining of a company’s workforce, as well as hiring for new roles and skillsets over time. Allen and Overy’s rollout of AI, for example, included what they termed “a lot of change management around that, a lot of governance. We always have an expert in the loop.”

If this sounds scary, it shouldn’t be. As with any big change, it’s best to start small and with proven tools that are already available. Look for the “low hanging fruit” opportunities across your portfolio where AI algorithms can free up employee time for higher-value activities, such as big-picture thinking and dealing with more complex client issues. Examples of these types of opportunities abound, from drafting basic content and emails, to summarizing meetings, translating documents, managing customer service inquiries, and speeding up keyword research.

Just keep in mind that you will want to have clear policies in place for when and how employees can leverage publicly available tools like ChatGPT, particularly where confidential or proprietary information is involved. Above all, don’t bury your head in the sand. If generative AI is the watershed moment it appears to be, when you pull it out, you could find yourself in a world you don’t understand.

Have you come across an interesting potential investment related to artificial intelligence or a novel use of the technology in private equity investing or portfolio company management? Reach out to us at info@asimplemodel.com or through one of the channels below and tell us more – we’re always looking for new opportunities and examples to incorporate as we continue the discussion around AI.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.asimplemodel.com/insights/how-ai-is-changing-businesses