In this world of evanescence, the Banyan has become a symbol of stability, constancy, and permanency, and represents immortality.

– Ramakantha

Bitcoin is a meticulously devised technology that combines multiple disciplines.

Currently, it appears that its role is that of a medium of exchange where the supply is strictly predetermined by the code. The consensus around its rules has kept it ironclad since its inception. As with any network, it has properties and rules that shape the interactions between the actors. An interesting element regarding this technology is the mechanism design employed to attempt to reach the goal of a digitally scarce, open, permission-less, global, neutral, non-confiscatable, censorship-resistant, reversion-resistant, salable medium of exchange.

The Architectural Design

The Bitcoin software is freely downloadable and operable on most machines. Once configured properly, it will connect with the other nodes that constitute the network.

A node is literally the Bitcoin core software which contains the rules of Bitcoin, a copy of the blockchain (all the transactions from the beginning of Bitcoin’s time).

For Bitcoin’s network to exist, only a minimum of two nodes need to connect. The more nodes that link together, the harder it would be for an external actor to terminate the game. They would need to play whack-a-mole with all of the existing nodes.

The fact that nodes hold the code as well as the Timechain’s transaction history renders its owner sovereign. They can now configure, request services, and use the services allowed by the network.

This is a peer-to-peer network model, which is different from the broad use of Client-Server network model.

It simplifies and empowers (along with the Proof-of-Work consensus mechanism) the decentralized nature of Bitcoin as an open protocol.

The software is open source, whereby anyone can enter or quit the network at will. Making it all the more neutral to its users. This characteristic is crucial allowing for maximum scalability enabling anyone to join Bitcoin regardless of identification, geographical location, or association. Participation is either by running a node or downloading a wallet application on a phone.

Any participant can run a full node, a lightweight node, a mining node, be a developer, or run a business based on Bitcoin. Most importantly, a participant can be all of the above, simultaneously.

In addition, there are no other means to issue new currency apart from the Coinbase reward that the miners receive for solving the Proof-of-Work puzzle. On average, each block generation occurs every 10 minutes guaranteed by the difficulty adjustment mechanism. This mechanism is set to maintain the coin issuance at roughly 10 minutes. And so, mining 210,000 blocks, which takes about 4 years, across 32 epochs, continues. The 21 million Bitcoins will then be mined in totality. (For more detail, see this: Controlled Supply).

The ultimate source of the determination of prices is the value judgments of the consumers. Prices are the outcome of the valuation preferring a to b. They are social phenomena as they are brought about by the interplay of the valuations of all individuals participating in the operation of the market. Each individual, in buying or not buying and in selling or not selling, contributes his share to the formation of the market prices.

– Ludwig Von Mises in Human Action

There is no central authority that can decide to adjust the supply. Therefore, the issuance is controlled and known with absolute certainty. The peer-to-peer architecture allows for bitcoin to be traded at most natural market prices. These prices thus embody the most accurate, unfettered indication of the value the network provides to users, positioning Bitcoin as the freest money market that has ever existed.

Poker works as a game because the rules don’t change. We can formulate strategies and compete with one another in a productive way, but if you want to drive people insane and really create a lot of conflict just try changing the rules of the game every few hands and this applies to any game especially money. That’s what inflation’s doing. Nobody knows the rules of the US dollar, how many are in circulation, how many will be in circulation, who’s profiting, we don’t even know exactly who the shareholders of the Fed are, what’s their dividend, what are their criteria for deciding how much how many dollars to produce, who’s getting it first, who’s going to be the fed chair next year; like there’s all of this uncertainty injected into managing the asset that’s intended to be an insurance policy against uncertainty that it’s just oxymoronic in a way; and so bitcoin is another way to look at it, is the most certain form of money we’ve ever had and if money is an insurance policy for dealing with uncertainty you would want maximal credibility in the properties of money to deal with that uncertainty and that is bitcoin.

– Robert Breedlove in Impact Theory

The network’s core consensus rules have been crystal clear and unchanged since its inception.

It certainly helps the network’s participants perform the most rewarding actions by making informed decisions about the long-term health of the network.

The Interplay of Actors

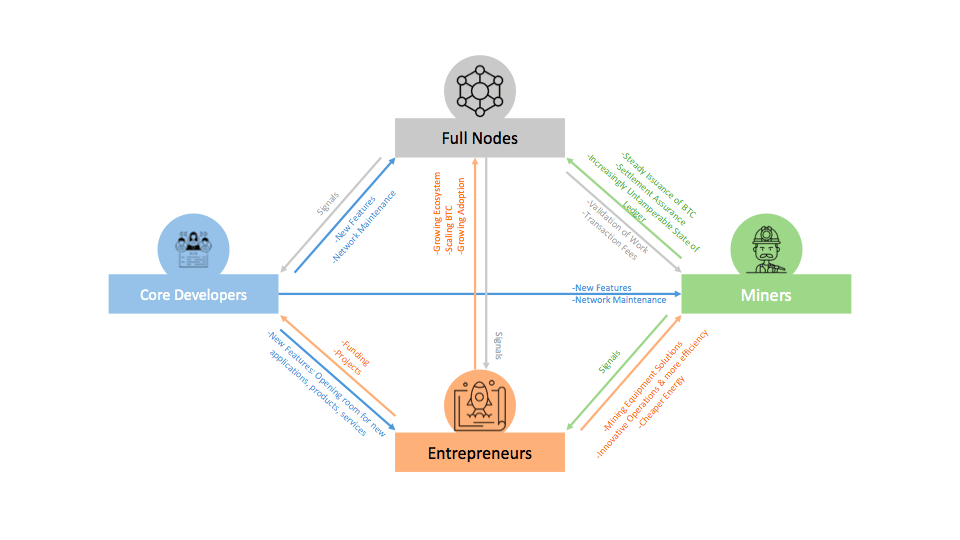

If the actors were to be fully independent and their actions mutually exclusive, the incentives put in place would not allow Bitcoin to achieve its conceptualized goal.

Miners would probably collude, or be more divided, stirring the network in multiple directions, leaving way for hard forks that would make Bitcoin’s future less predictable. Users would have less weight and their needs not met, which could contribute to the downfall of the system. Developers wouldn’t have any reason to perform their best nor would they have the correct signals to act properly. Business owners would also receive fewer and lower quality signals, barely improving the ecosystem, or wouldn’t have ventures to pursue.

Bitcoin’s design is such that all actors are interdependent. With their best actions, they contribute to an increasingly better network. With their worst actions, they collectively impair the network.

Users & Miners dynamic

Since nodes create transactions, miners need their activity to have any role in the game. The size of their rewards also depend on the transaction fees.

Nodes validate and propagate transactions and blocks. They have the authority to invalidate the miners’ efforts in case of dishonest action, essentially leading them to their inferior strategy’s outcome.

Thus, nodes are essentially the ones that oversee the consensus process, as it is their right to do so. They have everything to gain from firm security and a flawless monetary system.

Users & Core Developers

Without nodes, developers do not have a network to maintain and grow. Without developers, users wouldn’t benefit from the network’s functionalities, or wouldn’t even have a product to experiment with. The users give signals to the developers about the working and under-performing features for them to upgrade, grow, and repair the network.

Business Owners & Rest of the Actors:

The vehicle of economic progress is the accumulation of additional capital goods by means of saving and improvement in technological methods of production the execution of which is almost always conditioned by the availability of such new capital. The agents of progress are the promoting entrepreneurs intent upon profiting by means of adjusting the conduct of affairs to the best possible satisfaction of the consumers.

– Ludwig von Mises in Human Action

Users broadcast signals to business owners to find solutions to grow and render the Bitcoin ecosystem more efficient and scalable. Entrepreneurs provide the users with new ways to transfer value to each other, new applications, custody solutions, Bitcoin products and services, and products and services built on top of Bitcoin and the Lightning Network. Miners give signals to the business owners to grow the mining industry by finding ways to provide more energy, while reducing costs, and innovating to produce more efficient mining equipment.

The network’s state depends on all actors to remain honest and do their best. Bitcoin was designed for participants to continuously be incentivized to push each other to excel. This dynamic is embedded in the rules defined by the protocol which have only been evolving since its creation.

It is the embodiment of the real-world economy, with actors incentivized to act for the greater good. Each being crucial to the network with their unique input. Here the users depend on a system that is the fairest ever conceived. Their rights and properties are respected due to the system’s design. They give signals to the builders of the Bitcoin society (Developers and Business owners) to create new systems and solutions to the economy’s problems with their business trials. Like in all societies, disagreement about critical issues breeds divisiveness and is not desired for growth. Miners that are continually audited by the users maintain consensus and sanity of the monetary system in the economy. Moreover, it uses energy instead of violence to maintain this consensus and fair system that empowers the free market.

The creation of this Bitcoin economy is incentivized by the design, where:

- Real signals are communicated within the ecosystem

- There is a hard and sound medium of exchange that allows for high velocity and efficient indirect exchange

- Specialization is desired. There is a continuous need for developing new solutions due to the various skill sets of business owners that join

- Technological advancement is encouraged and leads to the growth and scalability of the network

- Developers and business owners continue to upgrade the network to fill the need of a growing audience. Providing real-time value to users, not promises of value.

One Line of Thinking Could Be

More people use the network → More Monetary Value in the network (in Fiat terms) → More miners enter to secure the network → More users entering a growing and secure monetary network → Developers maintain the network and grow it to adequately support more users → More People build products and services to grow the resilient ecosystem → More people can communicate value between each other → Network becomes even more useful → More users enter the network → Back to Step 1.

The players have incentive to remain honest while growing the network to the best of their abilities in order to collectively and continuously reap the value the network provides. Their respective Nash equilibriums are in alignment. These solutions are designed in a way to empower each other and to continuously make room for innovation and progress.

The network is self-sustaining and self-nurturing. Its network effects are cautiously engineered to empower the users further.

Yet it is not enough. Bitcoin still needs to scale much further to ultimately fulfill its purpose.

Could its design also lead its rise to mass adoption?

Schelling Point

Money’s primary function is that of a medium of exchange. It is a good that one uses to exchange with other products or services that fill a need. It represents one’s labor, or a return on an investment, and needs energy, decision-making, or skill to acquire. To let go of it for another good means that the holder values the acquired good more than the money. Money sends a signal that value is subjectively found in purchased goods. It is a tool that communicates value with the action of letting go of it. Money allows trade to flourish, markets to develop, and sectors to form depending on how it is allocated; amongst many other implications (Check out The “What is money” show).

Bitcoin is a medium of exchange. Yet, it is currently not widely accepted.

Also, it is an open protocol. Therefore, it is an open protocol that communicates value.

Unlike all other products, protocols do not benefit from the perpetual struggle of competing markets as one would assume to be the case in a healthy capitalist environment. Rather the opposite is true; protocols tend to converge to one sole victor over time who subsequently becomes the dominant monopoly player within its respective market […] Money is the language in which we communicate value to one another. Since humans are social beings and we have a proclivity to create value systems as a tool to make sense out of our environment and the world, despite what some utopians might claim, there will always be a need for money, no matter how advanced or altruistic the society. Because money is a form of communication we can therefore assume that it will act as any other communication protocol; it will converge to a single protocol.

– Willem Van Den Bergh in On Schelling points, network effects and Lindy: Inherent properties of communication

As an open protocol, it is considered a welcoming technology.

Perhaps one of the most welcoming technologies ever devised.

- It is, as stated repeatedly, an open protocol that is neutral to its users. This is a crucial point because it allows for a maximum of participants that any technology could benefit from.

- There are only two instances in which the network has been down. It has been running consistently since 2009 while delivering its simple promise to settle money transfers every 10 minutes (on average) in an increasingly secure manner without an intermediate party.

- It operates continuously at every moment in time.

- The ecosystem’s second layer solution enhancements continues. This opens opportunities to substantially increase transaction throughput.

- It has been increasingly easy to use: transfers happen with a few clicks using addresses and simple applications. It is as convenient to use as emails.

- It has been evolving unstoppably for the entirety of its lifetime across the different dimensions (functionalities – performance – ecosystem – financial – adoption) due to the positive interplay of all actors, actively ensuring the betterment of the network.

According to William Spaniel, a focal point (more generally known as Schelling point) is “A particular pure strategy Nash equilibrium that players select due to the salience of that choice.”

Bitcoin firmly presents itself as the apex candidate to become the Schelling point of money.

It has the potential to keep offering value to users through clarity and simplicity, while openly inviting them to join.

Neglecting it is the long-term inferior strategy one can choose in the game of money.

The debasing of all fiat currencies resumes. There is enough certainty to state that printing and devaluing of currencies will continue amongst many other central banks decided actions.

There are so many established and imposed by the state, which makes it difficult to convey value internationally. Exchange rates, expenses, and logistics slow down the velocity of money, foreign trade, and money transfers. Aside from that, the central bank can seize funds halting or reversing payments. They are effectively IOU’s; promises to reimburse someone later in time.

In a world where the value of your time and energy is stolen away and dissolved simply by devaluing your money; in a world where is it increasingly hard to retain your wealth, live unapologetically and thrive; in a world where money has become a tool to influence the masses towards centrally planned goals; in a world where money is vilified so you are disillusioned to detach yourself from it; Bitcoin challenges the status-quo and unfolds a digital realm in which people can choose a new type of unstoppable, non-confiscatable and globally scalable money. It strives to fill the overwhelming need for humans to pivot towards a rights-preserving medium of exchange.

There it is. A game that imposes itself on the world. It is a form of money that emerged from the people to fill a crucial need: a sound monetary medium. Additionally, its construction is a way to incentivize everyone to onboard. The openness of its design makes it such that anyone can enter and quit voluntarily. It is a game that allows you to not join it. It will cost you if you don’t, and benefit you tremendously if you do.

You have the option to refuse if you so choose. There is no punishment if you don’t play by its rules. It is the existing system that punishes you, controls and erodes your wealth. It is failing and undoubtedly dragging you down with it.

Only the existence of a well-functioning and fair monetary system would have obliterated the value proposition of Bitcoin.

Bitcoin will succeed because Fiat is gradually failing. Not only because it is prominent, but because it is revolutionary at the right time.

Open protocol that is Darwinian and competitive in a way that it is not just self-correcting on the protocol level to ensure correct money, but is also self-healing and adaptive to the environment around it.

– Michael Saylor on The “What is Money?” show.

This design brings into effect a positive feedback loop. When adopted and played enough, the value it offers will multiply and intensify further.

Everything will be expressed in satoshis if expansion is sufficient to become the global reserve currency.

As a result of more people using it, the whole world benefits more. The network becomes more functional until a sufficient portion of the global population has access to sound money. Only then will we see a relentless bloom across economies.

Through honesty and impartiality, the way it will link the entire planet will inevitably bring unity to a divided world.

Bitcoin will most importantly offer life-changing opportunities to those most in need. To those that only have access to hyper-inflationary currencies, heavily monitored financial systems, those under monetary colonialism and to those whose regimes are ultra-controlling and restrict their rights.

Bitcoin offers another chance at life for all individuals on earth. It allows individuals to grow and Bitcoin grows thanks to them. Bitcoin empowers anyone. Bitcoin needs no one but needs everyone at the same time.

The bigger it grows, the more abundant and deeper its roots, the stronger it gets, thus the more impactful it becomes.

It is an infinite game.

Bitcoin is a flourishing tree of life; the people are its roots, freedom is its oxygen.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://bitcoinnews.com/why-bitcoin-winning-money-game/