As national charging infrastructure is created, coastal

America still dominates EV registrations

With USD5 billion in electric vehicle charging network funds

(and more to come) available under the Bipartisan Infrastructure

Law, states are lining up for their share of federal largesse.

However, outside of the large coastal cities, retail

registrations of EVs have yet to take hold, according to new

analysis from S&P Global Mobility. The top-eight EV markets in

the US are all in coastal states, and represent 50.5% of total EV

registrations in 2022. The greater Los Angeles and San Francisco

metropolitan areas* alone account for nearly one-third of total

share of the US EV market.

While the 22 heartland states** represent 27.1% of total US

vehicle retail sales through August, their representation in EV

adoption has remained stagnant from 2021 into this year—at a

tepid 15.5% share. Only Colorado and Nevada (and to a minuscule

extent, Utah) outpunch their overall retail share in EV

representation, according to S&P Global Mobility data.

Coastal dominance

It is no surprise that California, a leader in green initiatives

and EV adoption, dominates the top of share rankings. Greater Los

Angeles (18.9% share of total EV sales), the San Francisco Bay Area

(10.8%), and San Diego (3.3%) saw no change in their top-five

position year-over-year when comparing rankings for calendar year

to date (CYTD: January-August) 2022 versus 2021, while Sacramento

improved its position from the previous year.

Additionally, of the 13 markets that increased share for CYTD

2022 versus 2021, most were in the “smile” states***, including

Atlanta, Austin, Dallas, and Houston. Only Chicago, Las Vegas,

Missoula, and Salt Lake City represented share gains in big cities

of “Heartland” states. Not all coastal markets are guaranteed share

gains; New York and Boston registered slight EV share declines this

year.

“BEV market share control on the two coasts is attributed to

their higher mix of early adopters compared to buyers in middle

America,” said Tom Libby, associate director of Loyalty Solutions

and Industry Analysis at S&P Global Mobility. “Their

demographic profile is more in sync with the traditional BEV buyer

than the middle-American profile.”

But Libby sees potential in EV growth in top heartland markets: “More acceptance and much broader consumer awareness is resulting

in a natural progression of adoption from the coasts to the

Heartland.”

A chicken-and-egg scenario might also be in play. The coastal

cities have worked harder at creating charging infrastructures, as

well as incentives for homeowners to install charging equipment in

their garages.

“There is no doubt that the lack of charger availability is an

influence in midwestern states, but it is not the factor,” said

James Martin, associate director of consulting for S&P Global

Mobility. “An equally strong factor is the availability of product

in form factors that customers are willing to purchase.

“There was no real option in terms of family friendly,

moderately priced CUVs,” Martin added. “And some models, such as

the Hyundai Kona EV, were initially not available in midwestern

states – based on OEMs deciding to focus on Section 177 (CARB)

states where automakers could accumulate credits. Now automakers

are beginning to produce more mainstream electric vehicles.

Availability of these vehicles will most likely be a factor in

spurring installation of more charging infrastructure.”

With the BIL and Inflation Reduction Act (IRA) laws passed, more

nationwide tax incentives will be available. The state receiving

the most funds of the initial USD900-million tranche will be

Texas—even though its major city with the most market share is

Dallas, with a mere 2.4% chunk of the EV market (8,591 EVs retailed

through August). Texas may be gambling that more charging

infrastructure will spur EV demand in the state.

Heartland buyer profiles

Is there any difference in the buyer profile between coastal and

heartland America?

Yes and no.

According to S&P Global Mobility loyalty analytics data,

which tracks buyers’ return-to-market behavior, there is little

difference in the demographic and psychographic profile of those

moving into battery-electric vehicles.

Comparing inflow movement into BEVs from coastal market share

leaders (Los Angeles, New York, Sacramento, San Diego, San

Francisco, and Seattle) versus inland market share gainers

(Atlanta, Austin, Chicago, Dallas, Houston, Missoula, Salt Lake

City) shows few differences in the buyer cohorts. There are just

more of those types of people in Coastal and Smile states.

Caucasian buyers with high household incomes dominate both

regions’ adopter bases. The only difference is that the central

markets skew more toward a slightly younger demographic.

Year-over-year comparisons between the two regions show similar

results; both reflect the largest declines in share from Caucasian

buyers and the highest gain from Asian-American buyers. The jump in

inflow from Asian-American buyers signals the early adoption of

this technology was not a passing phase.

“The typical Asian-American new-vehicle buyer is younger than

that of any other ethnicity, including African-American and

Hispanic,” Libby said. “Through the first eight months of 2022, 48%

of Asian-American buyers were age 18-44. Younger buyers typically

are more open to new ideas and products; their brand loyalty

typically is lower than that of most other age groups.”

Is there a difference in brand preference between coastal and

heartland buyers? Tesla’s dominance remains unchanged because it

controls over 65% of all BEV conquest share in both areas. The

brand’s public perception as the preminent BEV manufacturer

solidified its position as the first choice of buyers willing to

move from an internal combustion engine (ICE) vehicle to a BEV.

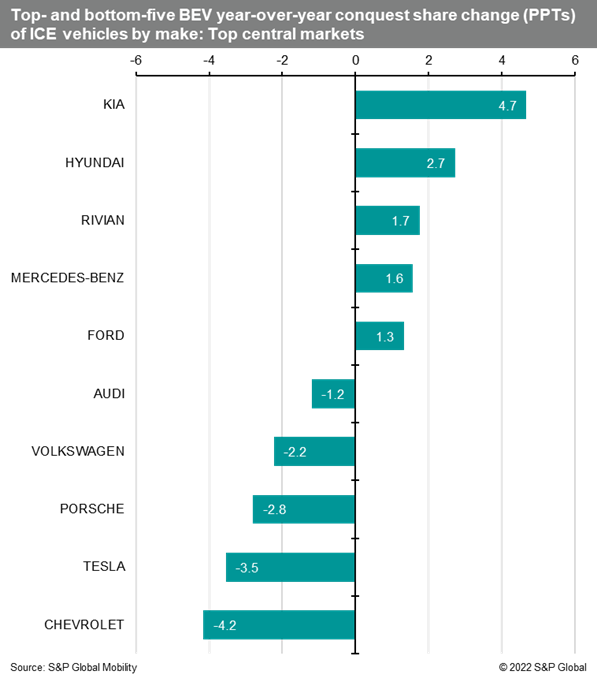

However, the year-over-year change in conquest share shows that

demand for Tesla appears to be slowing down in the heartland

markets. Both Kia and Hyundai were the leaders in market share

gain, improving their position by more than 2 percentage points –

even though the budget-conscious Hyundai Ioniq5 is sold in only 39

states. Mercedes-Benz, Rivian, and Ford were the other brands to

appear among the top-five largest heartland gainers for CYTD 2022

versus 2021.

The increased interest in the Korean brands coincides with a

decrease among more established BEV manufacturers. However, that

may not necessarily represent a drop in demand. For instance,

Volkswagen has seen sizeable registration declines in 2022 for its

ID.4—mostly owing to supply chain snarls and market allocations

to more EV-friendly regions. However, VW’s new ID.4 assembly line

in Tennessee went live in October, and the automaker says it has

20,000 unfilled reservations and a plant capacity of 7,000 units

per month.

Acceptance of BEVs is moving inward in America, albeit at a

slower pace than expected. Libby believes it will take time before

electrification is fully embraced in the heartland.

“The adoption of BEVs is a long-term process that needs to reach

an inflection point similar to the adoption, or acceptance, of

Asian-sourced vehicles in the US,” Libby says. “That inflection

point is when the product becomes generally accepted and it usually

occurs when volume and exposure reach a level that influences all

the reluctant outliers.”

—-

* Given their fluid geography and county boundaries, “Greater

Los Angeles” includes the contiguous Los Angeles, Orange,

Riverside, and San Bernardino counties. “San Francisco Bay Area”

includes the Bay Area of San Mateo, Santa Clara, Alameda, Contra

Costa, Solano, Napa, Sonoma, and Marin counties.

** For this calculation, S&P Global Mobility analysts

categorized heartland states as Arkansas, Colorado, Idaho,

Illinois, Iowa, Kansas, Kentucky, Michigan, Minnesota, Missouri,

Montana, Nebraska, Nevada, North Dakota, Ohio, Oklahoma, South

Dakota, Tennessee, Utah, West Virginia, Wisconsin, and Wyoming.

*** Smile States are categorized as starting in California in

the west, swinging through the Sun Belt and Southern coastal

states, then swinging up the Atlantic coast to Virginia.Please

contact automotive@spglobal.com to find out more information around

our insights to help you make data-driven decisions with

conviction.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

- Coinsmart. Europe’s Best Bitcoin and Crypto Exchange.Click Here

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: http://www.spglobal.com/mobility/en/research-analysis/when-will-the-heartland-embrace-electric-vehicles.html