SaaS businesses grew in 2023, but they did so at a much slower rate than the years of pandemic hypergrowth. At the same time, revenue growth was down and churn rates were at an all-time high, reflecting a period of “normalization” post-pandemic due to rising interest rates and enterprises cutting down on their software expenditures.

After a year characterized by slowdowns and cutbacks, our analysis of real-time subscriptions data from more than 34,000 software companies in Q1 2024 shows that the SaaS market has started the year on a more positive note, with growth coming back, churn slowing down, and businesses adapting to the new realities of a recalibrated software market.

Those findings are from the most recent SaaS metrics report by my company, Paddle, which is a payments infrastructure provider for software companies. Using an anonymized aggregate of data from the SaaS companies that use our ProfitWell Metrics tool, we’re able to see trends for the industry around key metrics such as growth and churn.

Signs of improved health

Drawing on our data from Q1 2024, we’ve noticed signs of improved health in SaaS.

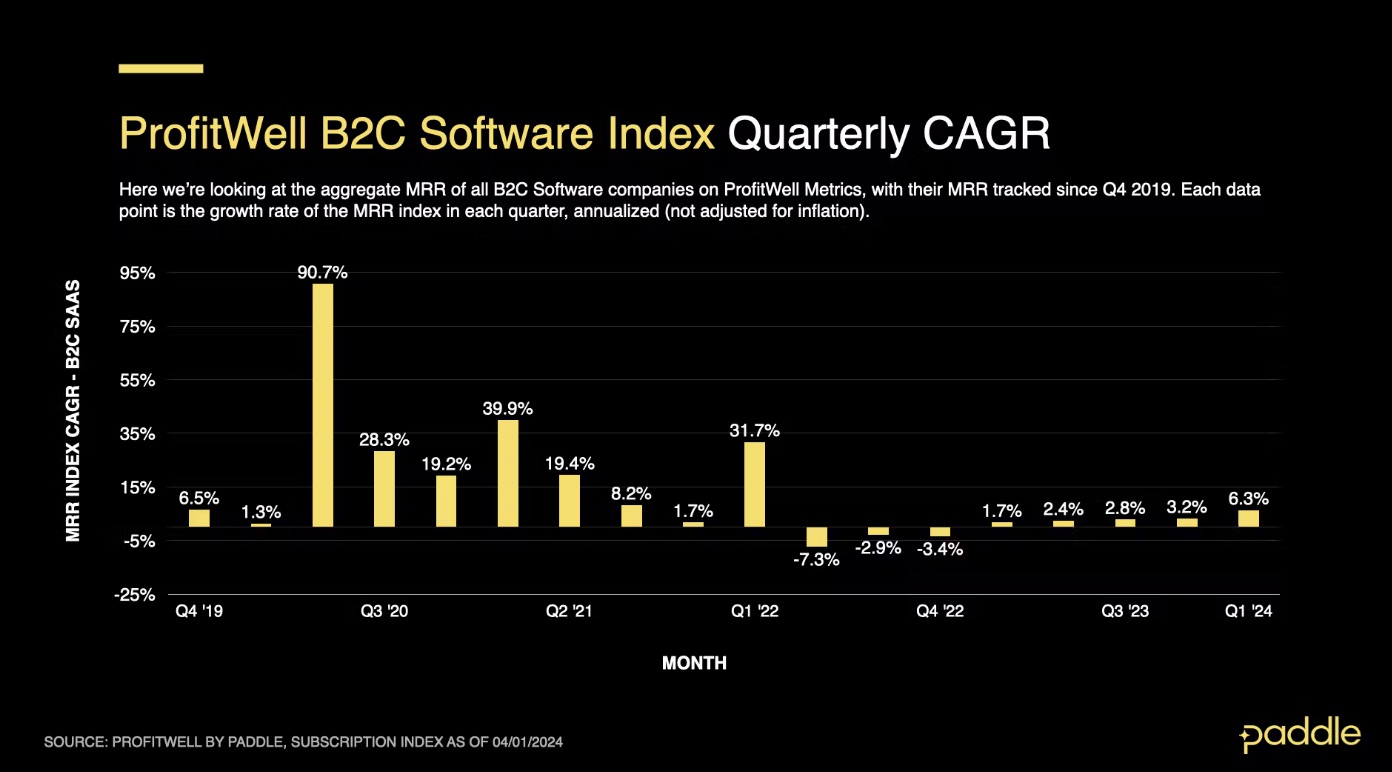

There’s been a resurgence in B2C software growth in particular, with CAGR at 6.3% in Q1 — double that in Q4 2023 and the best quarter since Q1 2022.

A consistent uptick in new sales activity in the B2C market since the end of 2023 has contributed to this, as well as a 17.5% spike in subscription upgrades in February alone.

This bodes well for the B2B sector, as growth in consumer revenue is often a leading indicator of future growth in enterprise revenue.

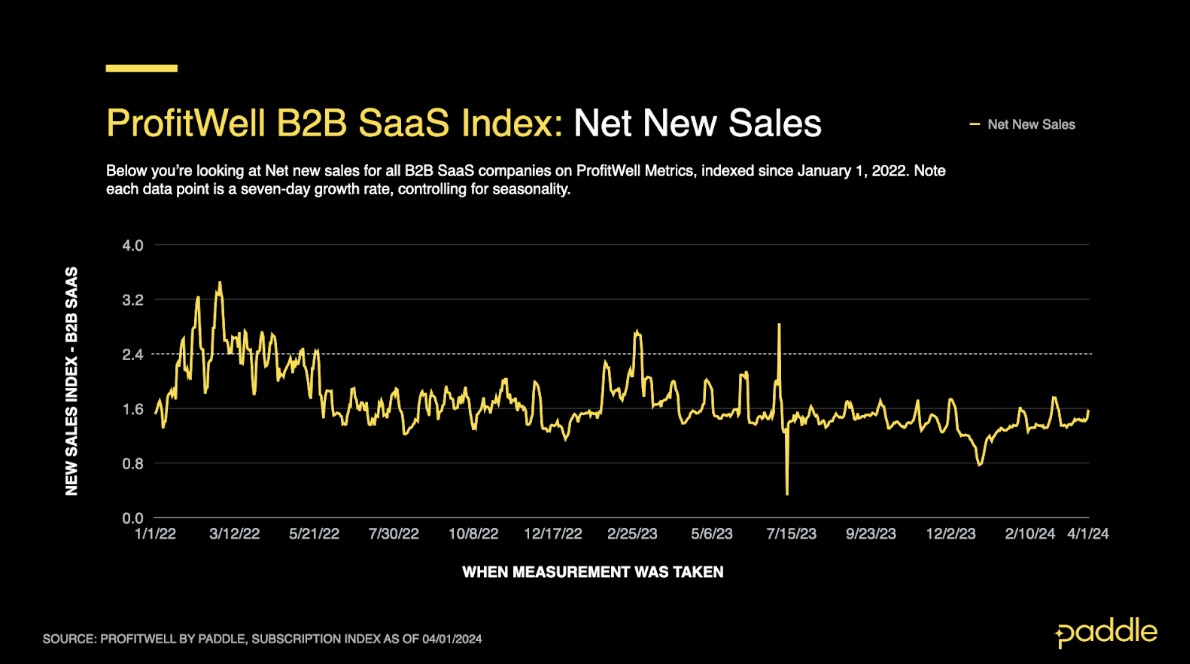

New sales for B2B SaaS companies have also dramatically improved, up 20% from December’s two-year low point.

Taking a quarterly view of new sales, the averages for B2B are still down on the last few high-growth years (2021 and 2022) but are up 40% on pre-pandemic performance (2019) — further evidence of market reconciliation as it settles on a lower level.

(For this graphic, a 1.00 reading represents sales on an “average” day in 2019, while a 1.10 reading would be 10% higher sales.)

B2B software leaders adapt to the ‘new normal’

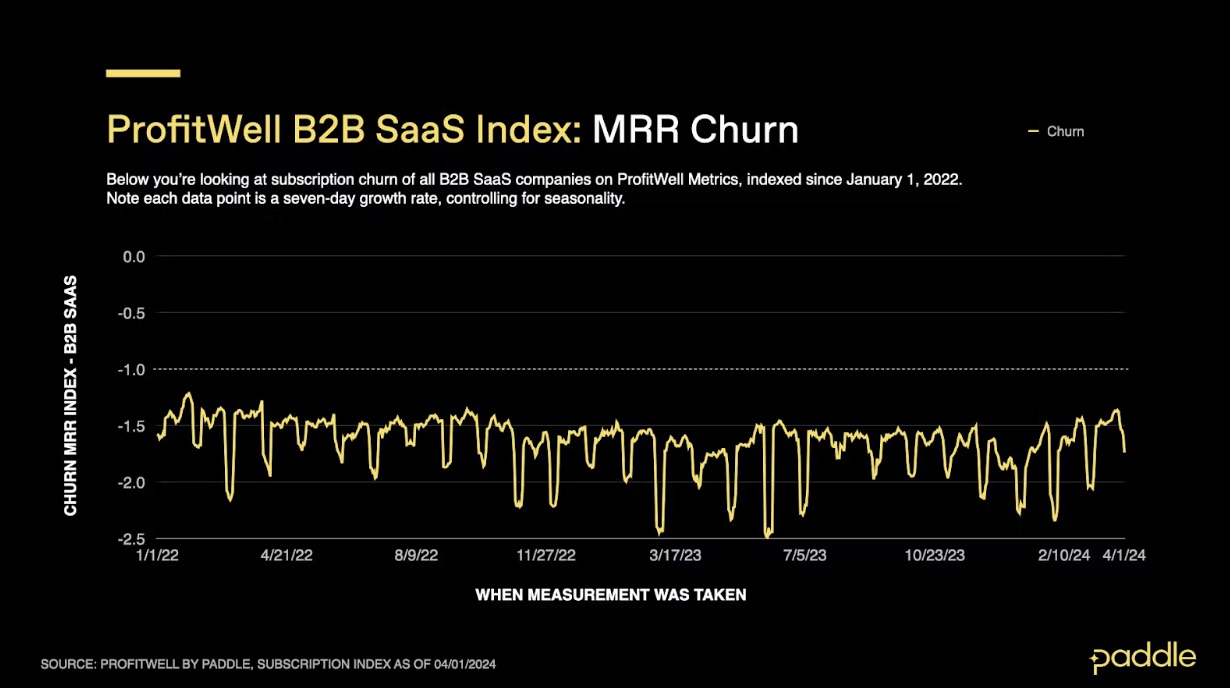

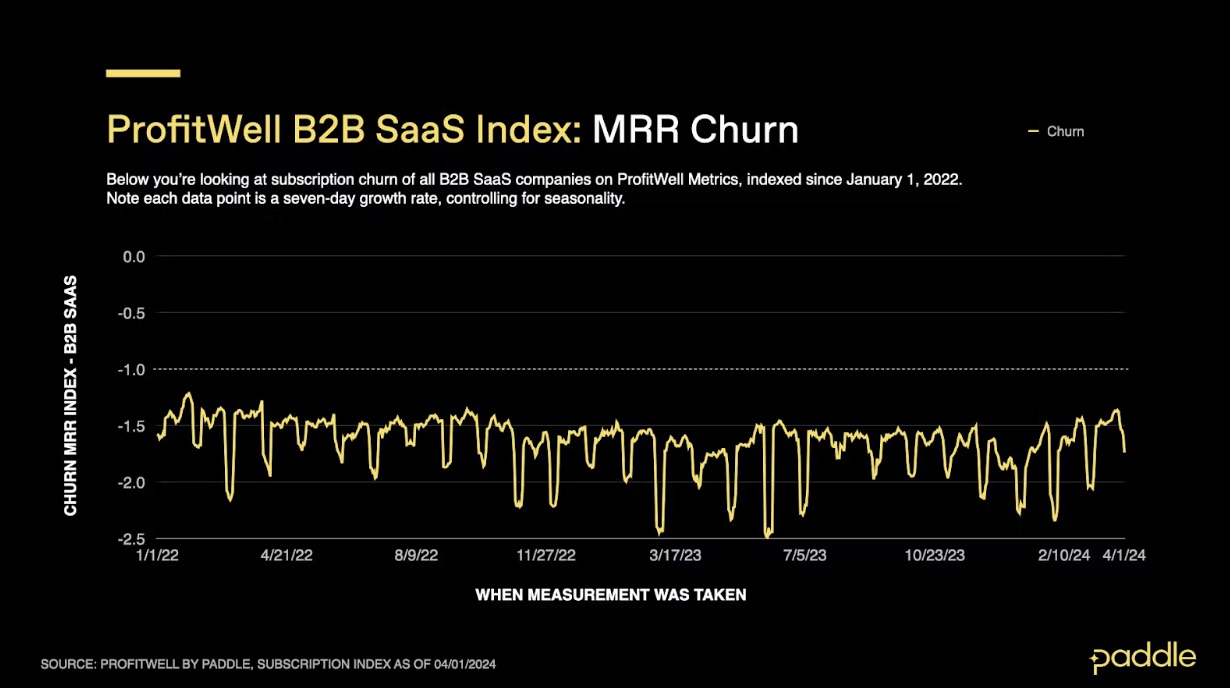

Notably, amid these early signs of improved sales and revenue growth, B2B customer churn has fallen to an 18-month low, improving 14% since December and down 12% from where it was a year ago.

This has come amid an uptick in upgrades and downgrades from companies moving customers to different tiers or subscription plans to keep them from churning.

This suggests B2B SaaS companies are, wisely, actively looking to combat churn and drive more revenue from their existing customers.

Reining in these high levels of churn and focusing on retention and expansion underscores a concerted effort within the sector to fortify relationships with, and continue to deliver value to, their existing customers, something that is much more valuable in a low-growth environment.

Strategies to thrive as the SaaS market resets

As the market goes through this recalibration, there are a number of strategies that SaaS companies should employ to ensure they continue scaling sustainably.

Balance product-led and sales-led growth

In a more difficult selling environment, merging product-led growth and sales-led growth is an obvious option for SaaS founders. Very few companies will be able to scale by relying solely on one or the other.

For those businesses with a strong PLG offering, layering on a sales-led approach means product teams can provide sales with product usage data to bring on target accounts at an enterprise level and win long-term customers.

For those who have a largely SLG motion, opening a product up with PLG widens your total addressable market. Crucially, it also forces you to create a product experience that sells itself. More people using the product drives greater adoption and more opportunities to bring in the sales team at the right time.

Successfully merging these two motions leads to a more efficient overall sales function where expansion and retention are built in.

Experiment with new growth channels

To continue growing, companies need to find ways to increase efficiency while decreasing costs. A growing trend in the mobile app space, for instance, has been to unlock growth by driving customers to complete purchases outside of the traditional app stores.

There are benefits to selling through an app store but it comes at a cost. Most levy a hefty 30% commission on sales and force businesses to follow specific frameworks when engaging with customers that restrain flexibility and revenue generation capacity.

To mitigate this, many companies are now pushing in-app customers to transact via their websites instead to recoup lost revenue and accelerate growth. Done well, the benefits of this can be vast, including access to a bigger customer base, greater flexibility and customer insights, and more control over the sales and marketing experience.

Build strong foundations for international sales

One growth strategy that no SaaS company should overlook is the opportunity to sell globally. Growth has slowed in traditional major markets like the U.S., Canada and the U.K., but markets in Europe, Australia and New Zealand continue to grow significantly.

To successfully scale in international markets, SaaS companies need to ensure they’ve done their due diligence and have the capabilities to clear potential hurdles like international payments acceptance, tax compliance, supporting different currencies and languages, and minimizing FX fees.

Reasons for optimism in 2024

After several challenging years, there are early signs of encouragement for SaaS in 2024.

While both B2B and B2C trends might change in the months ahead, the increased focus among SaaS businesses on combating churn and delivering value to existing customers suggests founders are adapting well to the “new normal” in SaaS.

Combining these good habits of pursuing efficient and more sustainable growth with the strategies outlined above will give SaaS businesses a great chance of having a successful year ahead.

Jimmy Fitzgerald is CEO of Paddle, a payments infrastructure provider for SaaS businesses, powering hyper-scale growth across acquisition, renewals and expansion. A SaaS veteran, Fitzgerald has spent more than two decades growing ambitious technology companies.

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the

Crunchbase Daily.

So far this year, less than $100 million has gone into U.S. companies in Crunchbase’s smart-home and smart-building categories.

Rounds of $100 million or more — or megadeals — have exploded this year, as U.S.-based startups have collected 115 such rounds through mid-May, per…

Safeguarding your business from unpredictable setbacks requires diversification of customers, suppliers and more, warns strategic adviser Itay Sagie…

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://news.crunchbase.com/saas/market-reset-2024-fitzgerald-paddle/