Don’t invest unless you’re prepared to lose all the money you invest. This is a high risk investment and you are unlikely to be protected if something goes wrong. Take 2 mins to learn more.

Did you know that Seedrs investors can also register to invest on our parent firm’s platform, Republic?

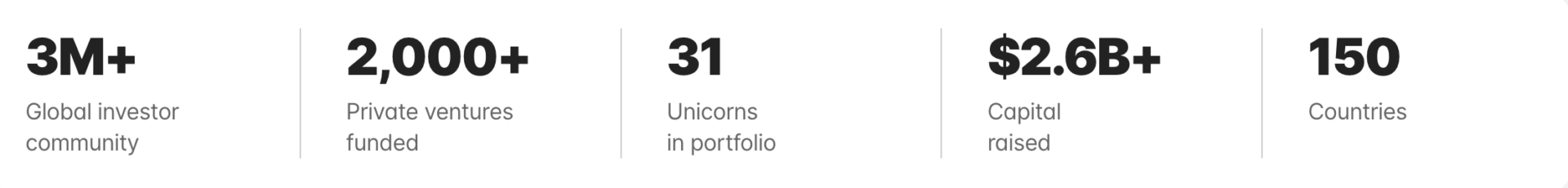

Republic is a leading US fintech company that allows people to invest in a broad range of high-growth private companies. Together with Seedrs, it is the largest private investing platform in the world, with more than 3 million members globally.

Similarly to Seedrs, Republic gives investors the opportunity to invest in early stage startups. Whilst anyone over 18 years old and eligible to invest can open an account and start investing on Republic, there are some important differences to be aware of compared to the Seedrs platform.

This article covers:

- Due Diligence;

- Tax;

- Legal Structure;

- Realising Returns;

- And finally, how to get started on Republic!

Due Diligence on campaigns

What due diligence does Republic do on the businesses that raise with them?

Republic’s diligence process has two aspects: (1) legal and (2) business.

Republic initially screens deals using information provided by the fundraising company. During this phase, Republic is looking for positive and negative signals associated with key areas including (but not limited to) team, traction, eligibility, product, market, and more.

From there, in addition to requiring prospective companies to fill out a comprehensive due diligence questionnaire, Republic seeks the following information and documents:

- Historical Profit and Loss Statements;

- Current Balance Sheet;

- Capitalisation Table;

- Pitch Deck; and

- Entity Organisational Chart (if necessary).

Republic also conducts bad actor checks and conducts comprehensive diligence as required by the United States Securities and Exchange Commission (SEC) and Financial Industry Regulatory Authority (FINRA).

Once the proper documentation is prepared and filed, the company may go live on Republic.

And don’t forget, as a private investor it’s important to also do your own due diligence on each investment opportunity! Republic has put together a Due Diligence checklist for you to refer to here.

How is this different to Seedrs’ due diligence process?

We hope all of our Seedrs investors are familiar with our Due Diligence process, but as a recap we:

- Verify all information and claims included in a company’s pitch

- Perform a number of key checks and searches on every company that raises on the platform

- Enter into a suite of professional contractual protections with each company that raises on Seedrs, including warranties that provide a level of legal protection against a business providing inaccurate information.

- Comply with Financial Conduct Authority (FCA) requirements.

- Work with businesses to help them to create regular and insightful updates post investment.

A key difference to note between Republic and Seedrs’ due diligence is that the information on a standard (‘Regulation Crowdfunding’) campaign page may not have been independently verified by Republic. This means that the claims a company makes on their Republic pitch page may not have been independently evidenced and approved to use in a financial promotion by Republic or Seedrs.

Of particular importance is the fact that Seedrs does not approve the Republic campaign pages as financial promotions, as FCA rules do not apply in the US.

Tax Implications

Do I get any tax benefits from investing on Republic?

Overseas investments are not eligible for S/EIS tax relief. Please speak to your tax advisor for further information about overseas investments.

Legal Structure

When you invest on Seedrs, you invest into our nominee structure whereby we hold the shares in our portfolio companies on behalf of our investors. This structure is used in private investing to simplify the process of managing multiple investors in a single startup.

For Republic, there are multiple legal structures for fundraising campaigns.

You can find a campaign’s terms on the right hand side of their raise page (under ‘Deal terms’), as well as all the necessary documentation below that section.

When looking at investment opportunities on Republic, make sure to familiarise yourself with its type of legal structure and the implications this could have on your investment.

Realising Returns

Is realising returns the same as on Seedrs where I have to wait for an exit event?

Whether on Seedrs or Republic, there are a number of ways for startup investors to potentially realise returns on their investments:

- If the startup is acquired by another business

- If the startup lists on the public markets, through an Initial Public Offering ‘IPO’, or direct listing

- If the investor chooses to sell some shares in a secondary share sale, or on a secondary market, if available

- If the startup turns profitable and chooses to pay dividends to shareholders

Investing in startups – whether on Seedrs or Republic – is a long-term investment, and many of the events outlined above can take many years to occur, even for the most successful startups.

In addition, as is the nature of startups, the majority of businesses will fail before they have the chance to exit, and investors will lose all the money that they invested. You can read more about the risks of startup investing in our guide ‘What Are The Risks Of Investing In Startups?’

Getting started

How do I set up a Republic account?

As long as you are over 18 years old and eligible to invest, you can invest in startups on Republic. Signing up and creating an investor profile only takes a minute.

You will then be asked to provide:

- A valid identity document, e.g., a passport, in the English language.

- A scan of a mail item, bank statement or utility bill, dated in the last 90 days, showing your name and your full address in, as it appears in your investor profile.

Find out more about becoming an international investor on Republic here.

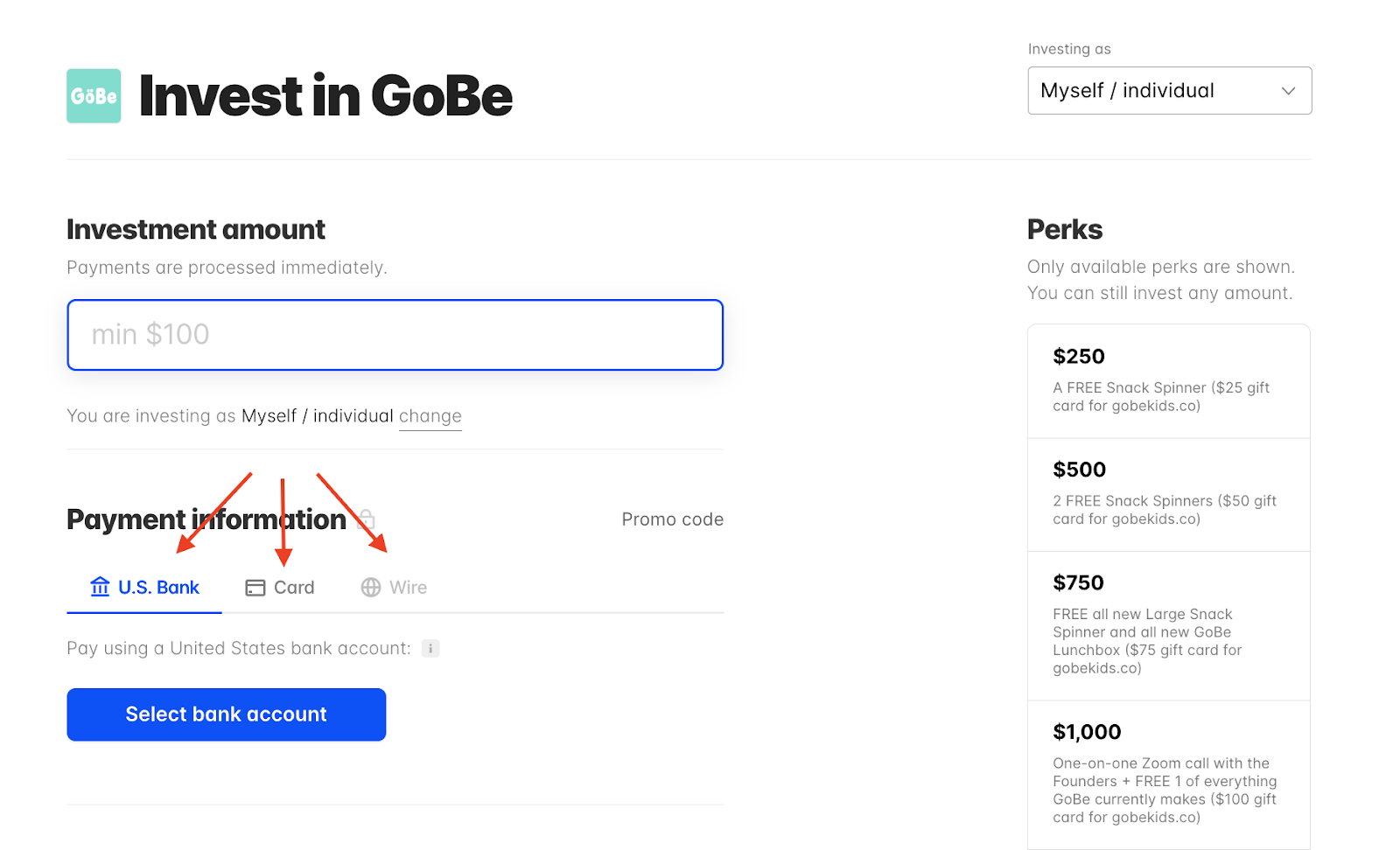

What payment options are available?

Republic accepts all major international debit and credit cards, including VISA, MasterCard, American Express.

The payment options may vary depending on what the fundraising company has chosen to accept, but the majority of campaigns that accept international investors offer credit/debit cards as well as wire transfers as payment methods available for non-U.S. investors.

Do I pay in US Dollars?

Yes, you will pay in US dollars, and your bank will charge you the current exchange rate.

For a full guide on how to invest, visit ‘How to create an investment on Republic‘.

We hope this gives you an overview of the similarities and differences between Republic and Seedrs as investment platforms.

To learn more about Republic and begin setting up your account, visit Republic.com.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.seedrs.com/insights/blog/investing-on-republic-whats-different-to-seedrs?utm_source=rss&utm_medium=rss&utm_campaign=investing-on-republic-whats-different-to-seedrs