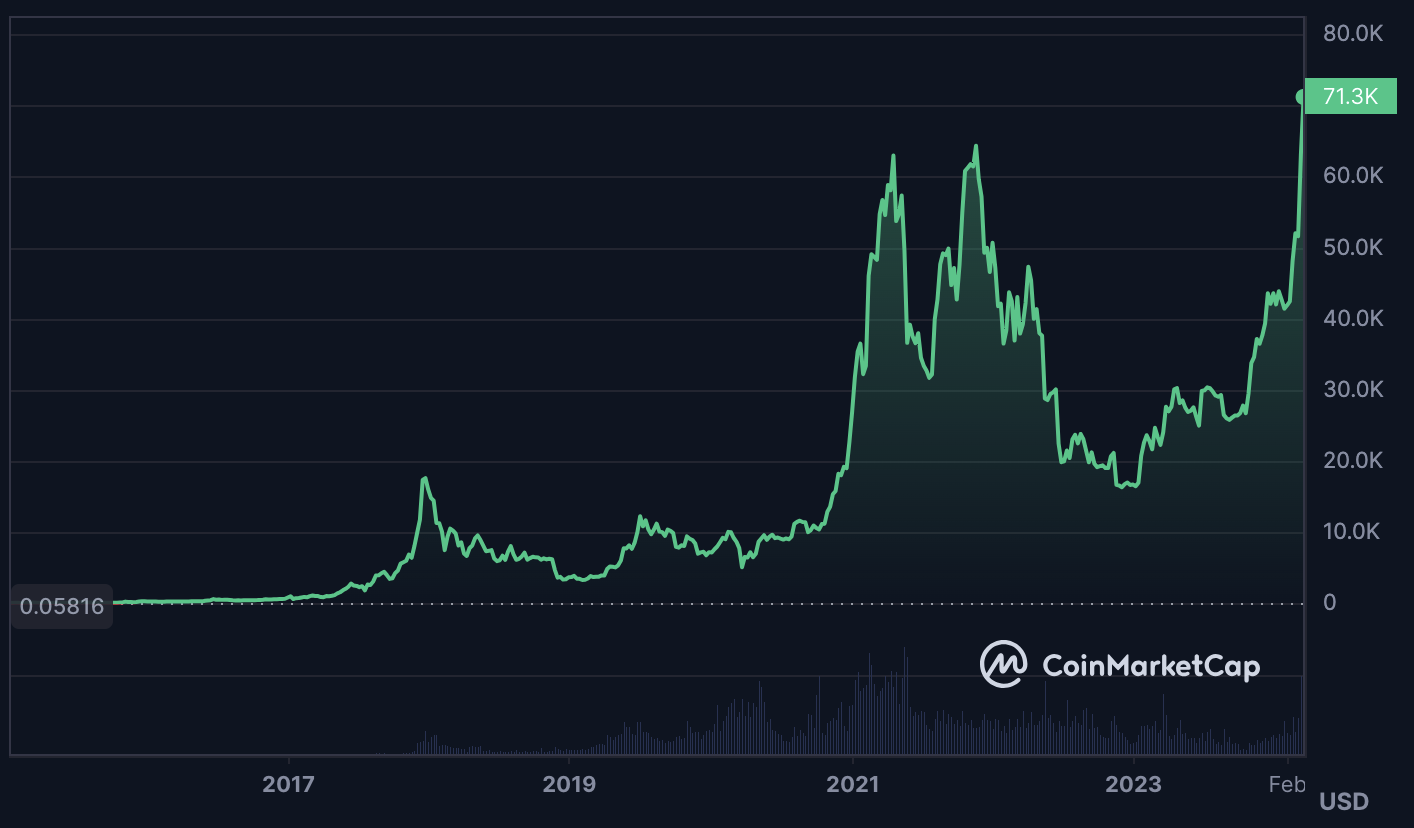

While the whole community is celebrating Bitcoin hitting an all-time high and entering the exciting stage of price discovery, a selected group of crypto natives have been pointing out an interesting paradox – venture capital investment lags behind!

Let’s look at the current landscape from the lens of a crypto VC investment analyst at InnMind; identifying differences from previous cycles and factors catalyzing the current market.

My goal of this observation is to shed light on the current paradox in crypto market trends without having a critical approach; more of an honest review of the current setup and the history that preceded it.

📩 And don’t forget to subscribe to our weekly newsletter: no spam, just updates about early-stage Alpha, crypto VC fundraising events, hot deals and insights for and about web3 startups.

Decoding the Correlation: A Historical Journey of Web3 Funding and Bitcoin’s Milestones

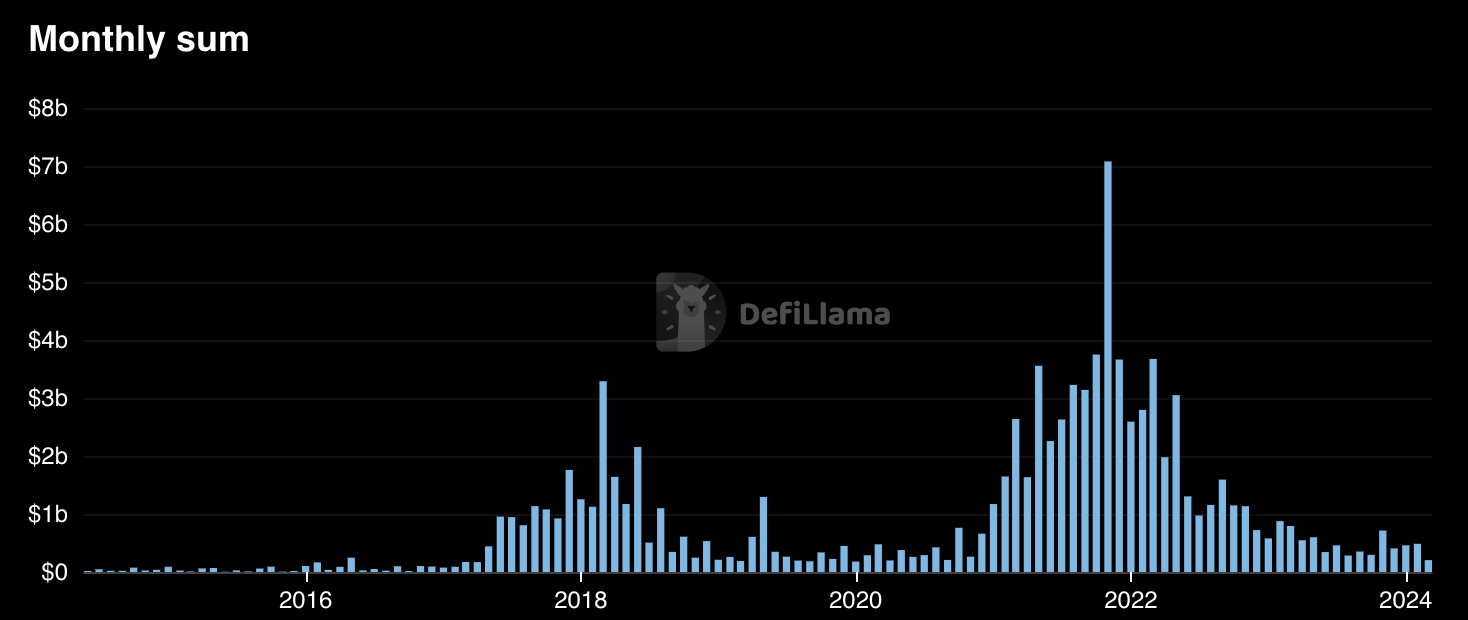

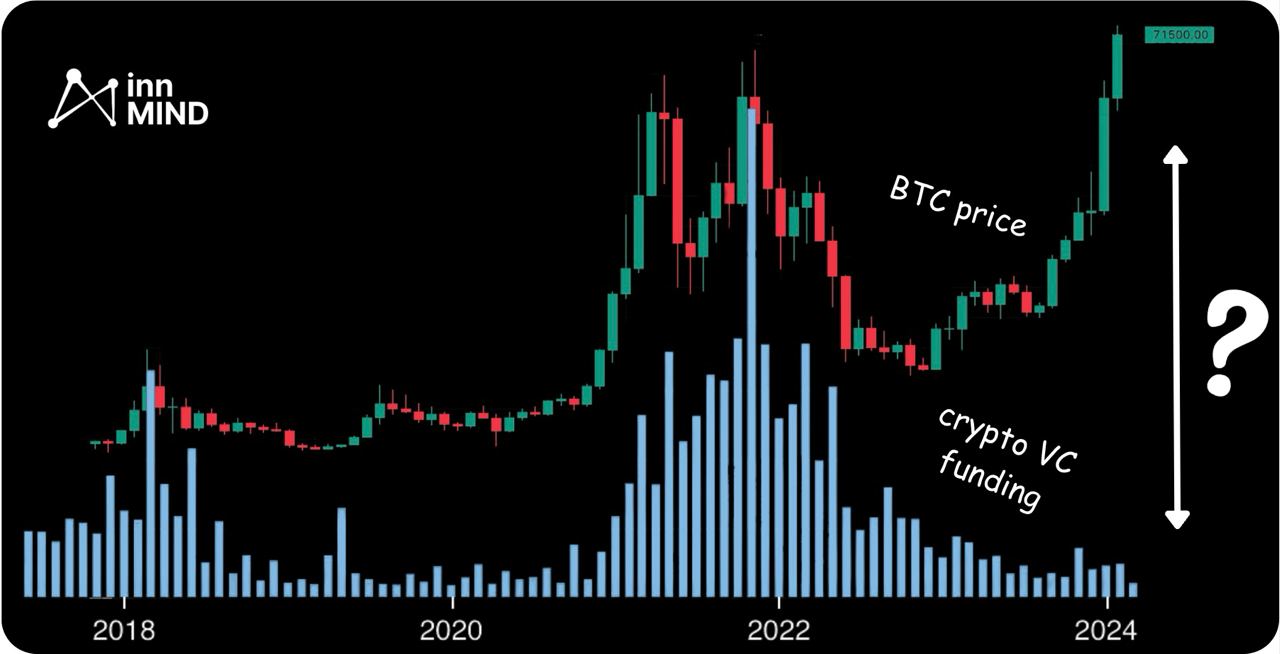

Venture capital funds have been financing the web3 ecosystem for more than 10 years already. However, the real crypto VC activity at a scale started in the 2018 cycle. Still, the correlation between market cycles and investor funding volume is evident, following closely the peaks and troughs.

In 2018, VC funding peaked three months after Bitcoin reached an all-time high, as depicted in the figure below.

It is important to mention that bitcoin prices will always lead the race between the two, peaking first while funding follows shortly behind. This can be accounted for by the ease of buying a cryptocurrency token compared to closing an investment deal which requires due diligence, negotiating the investment terms, transferring funds and finally publicly announcing the investment.

Also, investors consider market sentiment as a driver for investing, and the bitcoin price increase is an indicator of bullish market sentiment.

The same pattern is identified in the last bull market and precisely in November 2021, where bitcoin peak price and investment volume coincide. Bitcoin reached $69,000 and total funding was valued at $7.09B, an x3.6 increase from 2018, where peak funding investment was valued at $3.29B.

It is interesting to point out the simultaneous matching of the two metrics.

A possible explanation for the peculiar occurrence in November 2021 can be found in the double-top pattern of the last bull market and the common practice of start-ups to delay investment announcements when market conditions are not ideal.

In the previous cycle, the market experienced a sharp decrease after the first spike, thus deals closed during this first top were announced later when the market started to rebound.

Hold on to that thought, we might use it later.

2024 Market Outlook: Evolving Dynamics in the Web3 and Crypto Investment Arena

One of the exciting factors of Web3 is the constant innovation and ever-evolving landscape, be it from a technical, investment, or even regulatory perspective.

2024 already counts one of the major milestones of Bitcoin’s journey, establishing itself as an alternative asset class and a viable investment option for traditional financial institutions via spot Bitcoin exchange-traded funds (ETFs).

More than ten years after the first application, BTC ETFs debuted in the US in January 2024, placing Bitcoin in the spotlight once again paired with enormous buying pressure.

Simply put, based on the law of supply and demand as well as simple human psychology, price is bound to increase. ETFs constantly absorb BTC from the open market while people start to fear missing out on an upcoming bull market.

It is essential to understand that the introduction of bitcoin ETFs has altered the Web3 landscape in many ways and the rapid change of market sentiment is one.

Behind the Curve: Unraveling the Lag in Venture Capital Investments in Crypto

At the beginning of this blog post, I’ve already mentioned how venture capital funding adheres to the movement of the bitcoin price. If we look at the crypto fundraising volume in 2024, a huge gap between the two metrics is identified.

A plethora of reasons can be attributed to the lag in VC fundraising, so let’s get to it.

- Projects are keeping their cards close to their chest – not announcing investment deals as they expect the market to move higher.

- Higher interest rates and thus higher cost of capital may suggest a smaller number of deals relative to past years. This is also accompanied by a price rally fuelled by ETFs that has caused the two metrics to diverge.

- Market maturity can be attributed as one of the main factors for the VC fundraising lag. The well-documented crashes of the last cycle, striking examples being FTX, Celsius, and Terraform Labs, have instilled fear in many investors who saw their investments turn into dust. With investors being more reserved and strict in their investment decisions, closed deals occur less often.

- AI is becoming a prevalent ecosystem, attracting capital from both venture capital funds and big tech. Capital that would otherwise be deployed towards web3 start-ups is being directed to AI, thus widening the gap.

Crypto VC Investors’ View on Funding Lag

Let’s be honest: it’s always important to analyse market trends & fundamentals. But the inputs of market insiders can bring even better understanding & clarity together with practical takeaways.

Thus, we asked professionals – experienced crypto VC investors from InnMind – to share their opinion about this lag. And that’s what they think about it:

According to Sascha Epp from Paper Ventures, the funding slowdown we’re observing stems from a couple of key factors.

“Firstly, the market is evolving much faster than anticipated, catching many by surprise. The consensus was on a gradual market recovery but the ETF decision has dramatically accelerated the pace, compressing investment timelines in the process. Meanwhile, there’s a noticeable rush in the crypto space, with an unprecedented number of projects seeking funding. This surge has made it more challenging for VCs, who now find themselves having to be even more selective amidst a sea of pitches. The volume of proposals is up, but that doesn’t necessarily mean their quality has improved. As a result, VCs are spending more time meticulously reviewing each pitch, striving to identify the truly viable opportunities”.

Jason Tolliver from Autonomy Capital is quite critical. He said:

“Not only did values lag coming down post the previous bull market but we only had about 6-8 months of reasonable valuations before projects saw BTC oscillating upwards and subsequently raising their valuations. It makes more sense for self funded VCs such as ourselves to stay liquid during these boom times and not buy hype & long lock ups.”

There is no denying that 2024 has started on a great note for everyone involved in the blockchain space. As we are heading into a new market cycle and euphoria starts to become more prevalent for all stakeholders, the gap between the bitcoin price and fundraising volume will start to converge.

As the ecosystem has matured, new startups are being founded on the basis of novel ideas with real world applications. VCs are more mature in their investment decisions, selecting startups with strong founding teams, clear go-to-market strategies, and good traction.

Read also:

Navigating Blockchain Grants in 2024 for Web3 Startups

A comprehensive guide on blockchain grants in 2024 and InnMind’s ultimate list of 140+ active blockchain grant programs for web3 & crypto startups

Top 10 Active Web3 Venture Capital Firms in October 2023

Discover the leading Web3 venture capital firms making waves in crypto winter 2023. Explore our analysis of top investors & their recent deals

2024 Crypto Trends: Weekly Altcoins & Bitcoin Insights

Gear up for 2024 with our weekly crypto show! Get the latest on altcoins, Bitcoin halving, and top investment tips to navigate the crypto market

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://blog.innmind.com/2024-crypto-venture-capital-landscape-bitcoins-record-peaks/