By the end of next week, the UK Competition & Markets Authority (CMA) will probably have lost its only ally against Microsoft’s purchase of Activision Blizzard: the U.S. Federal Trade Commission (FTC) may still be against the deal, but I believe it will have lost decisively. I consider it highly likely that the United States District Court for the Northern District of California will deny the FTC’s motion for a preliminary injunction (PI) that was filed on Monday. A temporary restraining order (TRO) has issued (unsurprisingly), and a two-day PI hearing will be held in about a week (Thursday, June 22, and Friday, June 23). The court will probably rule at the end of the hearing, or very shortly thereafter.

Against that backdrop, the earliest closing date–if Microsoft is prepared to close over the CMA’s objection–will be Monday, July 3, which means that two weeks would still be left under the existing merger agreement to find middle ground with the CMA, which presumably knows that its April 26 decision is indefensible on appeal.

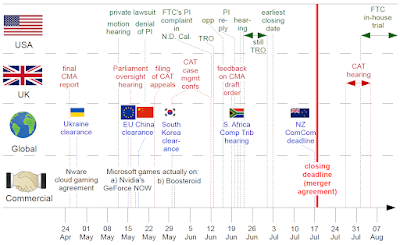

Here’s my updated timeline chart (click on the image to zoom in and make it look crisper):

Now let’s talk about the latest developments since yesterday’s post. You can find my real-time commentary on this rapidly-evolving merger topic on Twitter, so for my Twitter followers some of the below is not new.

First, FTC v. Microsoft & Activision was related (i.e., merged for procedural purposes) with the class-action-style lawsuit in the same district, and the same judge–United States District Judge Jacqueline Scott Corley–is now presiding over the proceedings, particularly also next week’s PI hearing. She recently denied a PI that was requested by the “gamers” who act as plaintiffs for the lawyers who are the driving force (and have received at least some logistical support from Sony).

The basis on which the PI was denied in the private action was that even if the court had agreed with the class-action lawyers on irreparable harm (negative consequences for consumers from the consummation of the merger), such hypothetical harm would not have been immediate. The likelihood of success on the merits (i.e., the question of whether those plaintiffs could prevail after a full trial) was never reached. In fact, the PI hearing was purely about irreparable harm and its non-immediacy.

In the FTC case, the focus will be very much on the likelihood of success on the merits. In the equitable analysis, it could–and in my view should–still weigh against the grant of the PI that any of the alleged effects of the merger are far-fetched and (even if they were–as they are not–realistic) far off. The balance of hardships here comes down to the FTC seeking to kill a merger that has a July 18 closing date while any of the hypothetical effects on competition would not materialize for quite some time to come, especially in light of the fact that Microsoft offered contractual commitments for 10 years. That 10-year period would be more than enough for the case to be litigated (even for the exhaustion of all appeals) and Microsoft theoretically being forced to divest some or all of the acquired assets at that stage.

The FTC chose to bring a complaint before its in-house Administrative Law Judge (ALJ), which is constitutionally controversial. In light of the Supreme Court’s recent Axon decision, it is even harder for the FTC to explain why it didn’t sue in federal court. Now the FTC runs to the court in San Francisco and wants it to kill a $70B deal, while the only reasonable venue choice would have been to start a federal lawsuit in December.

At one of the hearings in the private lawsuit, Judge Corley made reference to her colleague Judge Edward Davila’s denial of a PI that the FTC was seeking against Meta’s acquisition of virtual reality fitness app maker Within. I discussed the Meta-Within decision in early February. That case was, relatively speaking, a stronger one for the FTC than its opposition to the acquisition of Activision Blizzard King (ABK). The substantive issues are different, but there is an abstract parallel here in the sense that the FTC espouses some wild theories without any hard facts to back them up.

Realistically the FTC won’t have any “smoking gun” to present at the PI hearing. They will presumably just serve a lot of weak tea on those two days. The FTC’s console theory of harm has been rejected by the regulators in charge of 40 countries (even the CMA dropped it). It also raised cloud gaming, which was more of an afterthought in the beginning but will probably be put front and center now because of the CMA decision. As you can also tell from my timeline chart, the CMA decision came down a few weeks prior to the mid-May PI hearing in the private lawsuit, but the clearance decisions by the European Commission, China’s SAMR, and South Korea’s KFTC were announced only subsequently (second half of May). The CMA and the FTC are outliers, and it can be inferred from the public redacted version of the FTC’s filings that Microsoft and ABK essentially forced the FTC’s hand by saying they might close the deal as early as this week’s Friday, triggering the proceedings in federal court that I believe will simply take the FTC out of the game, isolating the CMA.

There may be some discussion of the CMA decision now, but the fact of the matter is that the United States District Court for the Northern District of California is not the appeals court for the CMA: the UK Competition Appeal Tribunal has jurisdiction over appeals from CMA decisions, and the CAT will hold its appellate hearing in late July and early August (as my timeline chart also shows). I was in London earlier this week for a conference (where I was invited–on very short notice–to speak) and seized the opportunity to attend a CAT hearing in person. I must admit I’m honored and humbled by the fact that Mr Justice Marcus Smith, the President of the CAT, stayed at that conference even after his AI-centric keynote speech and listened to the panel session to which I made my little contribution. I had a good time there, and the UK in general seems to be very much open for business, but the CMA’s antics are one of the issues that must be addressed there.

I believe it won’t be hard for Judge Corley to see that the CMA decision is unlikely to stand. For just one example of many, even the class-action lawyers alleged a Microsoft cloud gaming market share of “only” 40%, while the CMA arrived at a 70% figure, which is not only an exaggeration but a lunacy. The combination of the CMA decision being obviously flawed and the global picture–approximately 40 countries in favor–is dynamite.

On Tuesday, Judge Edward J. Davila–the Meta-Within judge–helped out Judge Corley by entering a TRO:

A few hours earlier I had tweeted (while waiting for a flight at Heathrow Airport) the following:

The hurdle for a temporary restraining order is low but it also wouldn’t solve the problem the FTC is facing: they need a preliminary injunction.

Judge Corley knows the merger, could deny TRO but again, a merger TRO wouldn’t mean much. At the latest, FTC will fail to get a PI.

— Florian Mueller (@FOSSpatents) June 13, 2023

The FTC almost always gets a TRO, but the current FTC also loses almost every merger case when it really matters.

Given that Judge Corley is already familiar with this merger and that the FTC’s complaint is egregiously weak, this case could have become an exception to the rule that the FTC always gets a TRO. But given the size of the transaction and all the publicity surrounding this merger, it’s easy to see why the court didn’t want to humiliate the FTC by denying a TRO. The FTC’s TRO motion mentioned that most defendants even stipulate to a TRO, and given that Judge Davila entered the order even before Microsoft or Activision Blizzard had made any filing (other than lawyers signing up), we don’t even know how much resistance the merging parties would have mounted.

The TRO order does not address the merits in the slightest. It’s purely procedural. It’s just a scheduling order. Microsoft and ABK will file their opposition briefs on Friday (and they can take until right before midnight Pacific Time). The FTC will reply by noon Pacific Time on Tuesday.

The TRO will be in place after the PI decision. Assuming that the court rules at the end of the PI hearing and throws out the motion (which is my prediction), that means the end of Friday, June 30. Practically that makes Monday, July 3, the earliest practical closing date. The next day is Independence Day.

The additional time after the PI decision would theoretically enable the FTC to appeal a denial to the United States Court of Appeals for the Ninth Circuit, and to seek emergency relief there.

There will be more than two weeks left between the PI hearing and the contractual closing date. I won’t give up hope that a solution can be worked out between Microsoft and the CMA. Otherwise, after the FTC is defeated in federal court, “closing over” is obviously a possibility, though the parties in that scenario should not find it hard to agree on a short extension to await a CAT decision.

The merger is on the right track, and I continue to believe that it will consummate.

Follow @FOSSpatents on Twitter

Follow FOSS Patents on LinkedIn

LinkedIn is the recommended platform if you prefer to focus on patent topics, while @FOSSpatents increasingly tweets about antitrust.

Share with other professionals via LinkedIn:

- SEO Powered Content & PR Distribution. Get Amplified Today.

- EVM Finance. Unified Interface for Decentralized Finance. Access Here.

- Quantum Media Group. IR/PR Amplified. Access Here.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Source: http://www.fosspatents.com/2023/06/updated-timeline-us-court-to-hear-ftc.html