Executive Summary

- The majority of Bitcoin investors are holding unrealized profits, and the first signs of speculation appetite is returning to the market after two months of sideways trading.

- The Short-Term Holder cohort are shouldering the vast majority of market losses, a condition typically observed during bull market corrections from new ATHs.

- Both Long and Short-Term Holders have experienced a reset in their Sell-Side Risk ratio, suggesting a new equilibrium has been found. This indicates that the market is ready to move, and volatility expectations for the near future should be heightened.

Mt Gox on the Move

On 28-May-2024, the market reacted to an internal wallet consolidation by the Mt.Gox Trustee, the legal entity who custodies the 141k BTC from the failed exchange. After more than a decade, this is the first indication that the long awaited Mt.Gox distribution event is on the horizon.

Mark Karpeles, the former CEO of Mt.Gox, confirmed that the nature of the coin movement was due to internal wallet management in preparation for distribution back to creditors. Distributions are expected to be completed by October this year.

As far as I know everything is fine with MtGox. The trustee is moving coins to a different wallet in preparation of the distribution that will likely happen this year, there is no imminent sale of bitcoins happening.

— Mark Karpelès (@MagicalTux) May 28, 2024

Evaluating the Mt.Gox balance, we can visualize this event leveraging Glassnodes Point-in-Time (PiT) metrics. PiT metrics are immutable, and reflect the state of each metric using all known wallet clusters at the time of observation. The standard MtGox Balance metric is mutable, and reflects the best estimate across all points in time. This demonstrates the learning behaviour and clustering of Glassnode metrics as it tracks entity wallets.

Here we can see the internal wallet management, where over 141k BTC were moved over several tranches throughout the day of 28-May.

Capital Flows and Composition

A major impact of such a large pool of long-dormant coins being spent is that unfiltered metrics like Realized Cap, SOPR, and Coindays destroyed will show a large spike associated with these Mt Gox coins. Theoretically, these coins have been revalued to a higher cost-basis during the wallet management transactions.

We can utilize our entity-adjusted variant of the Realized Cap to filter out these non-economical transfers, to maintain a clear picture of capital flows into Bitcoin. The Realized Cap currently resides at an ATH valuation of $580B. However, we can see that the rate of new liquidity inflows has slowed down since late April as the market consolidated.

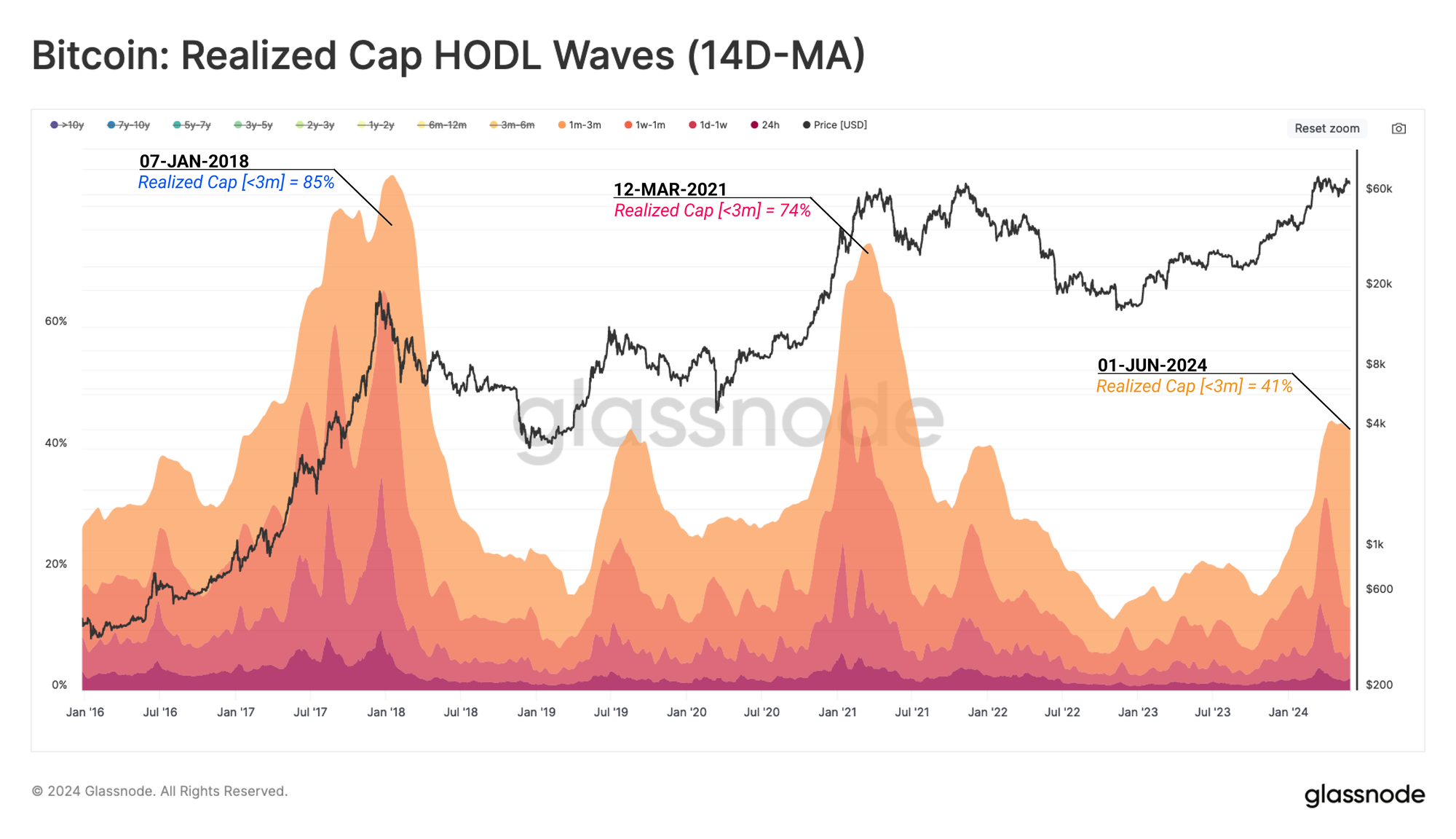

The Realized Cap HODL Waves metric can then be used to inspect the composition of this aggregate wealth by age. By isolating coins younger than 3-months old, we are able to evaluate the proportion of liquidity held by ‘new demand’.

This cohort currently accounts for a non-trivial 41% of network wealth, providing evidence that a wealth distribution towards new demand is occurring. With respect to historical terminal values across cycles, this wealth transfer often reaches 70%+ saturation by new demand, suggesting that a comparatively smaller volume of supply has been spent and sold by longer-term investors.

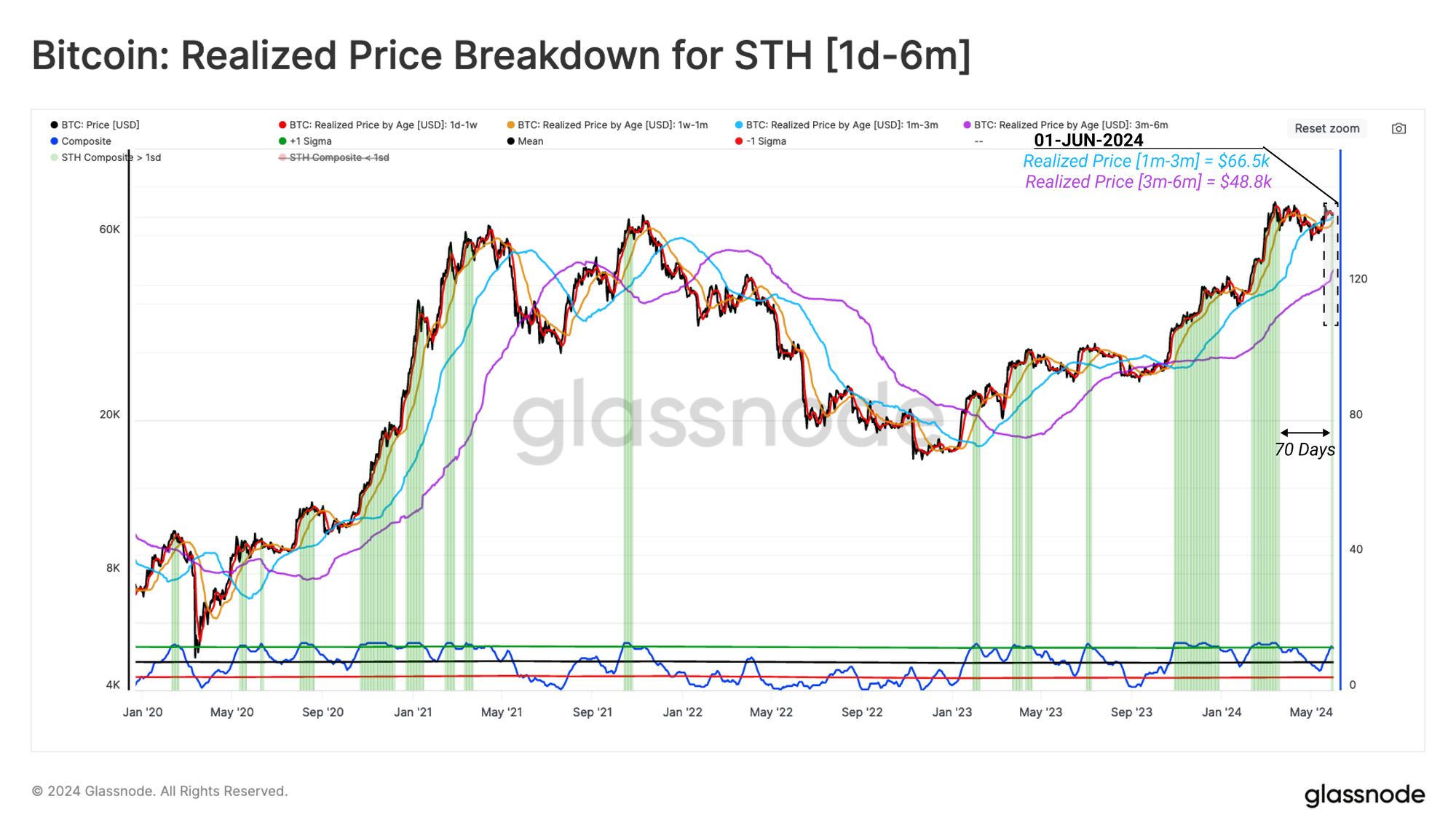

Whilst both inflowing liquidity and appetite for speculation have slowed down over the last 2 months, the reclamation of the $68k level has driven a majority of the Short-Term Holder cohort back into holding an unrealized profit.

This indicates that despite recent sideways choppy price action, the majority of recent buyers now have a cost basis which is more favourable and below the current spot price.

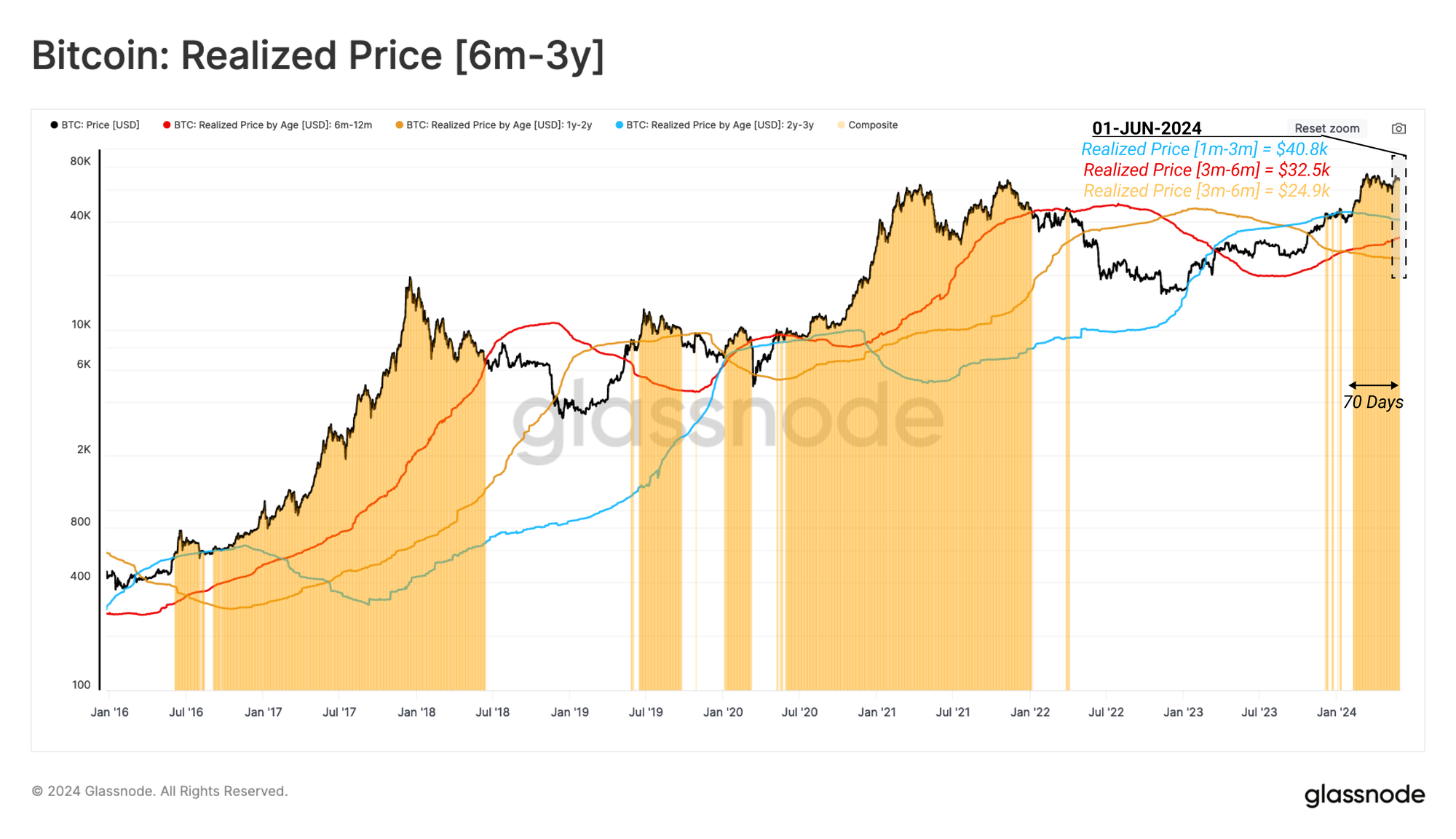

We can study the average acquisition prices across various age band constituents, and another group of interest are the Single-Cycle holders (coins aged 6m-3y). We note that all components of this group have been holding a significant magnitude of unrealized profit since prices broke above the $40k region.

The market absorbed a large magnitude of distribution from this cohort as price rallied into the $73k ATH. We can expect that this cohorts incentive to sell more supply will grow should prices climb high, and elevate their unrealised profit further.

A Long-Term Holders Market

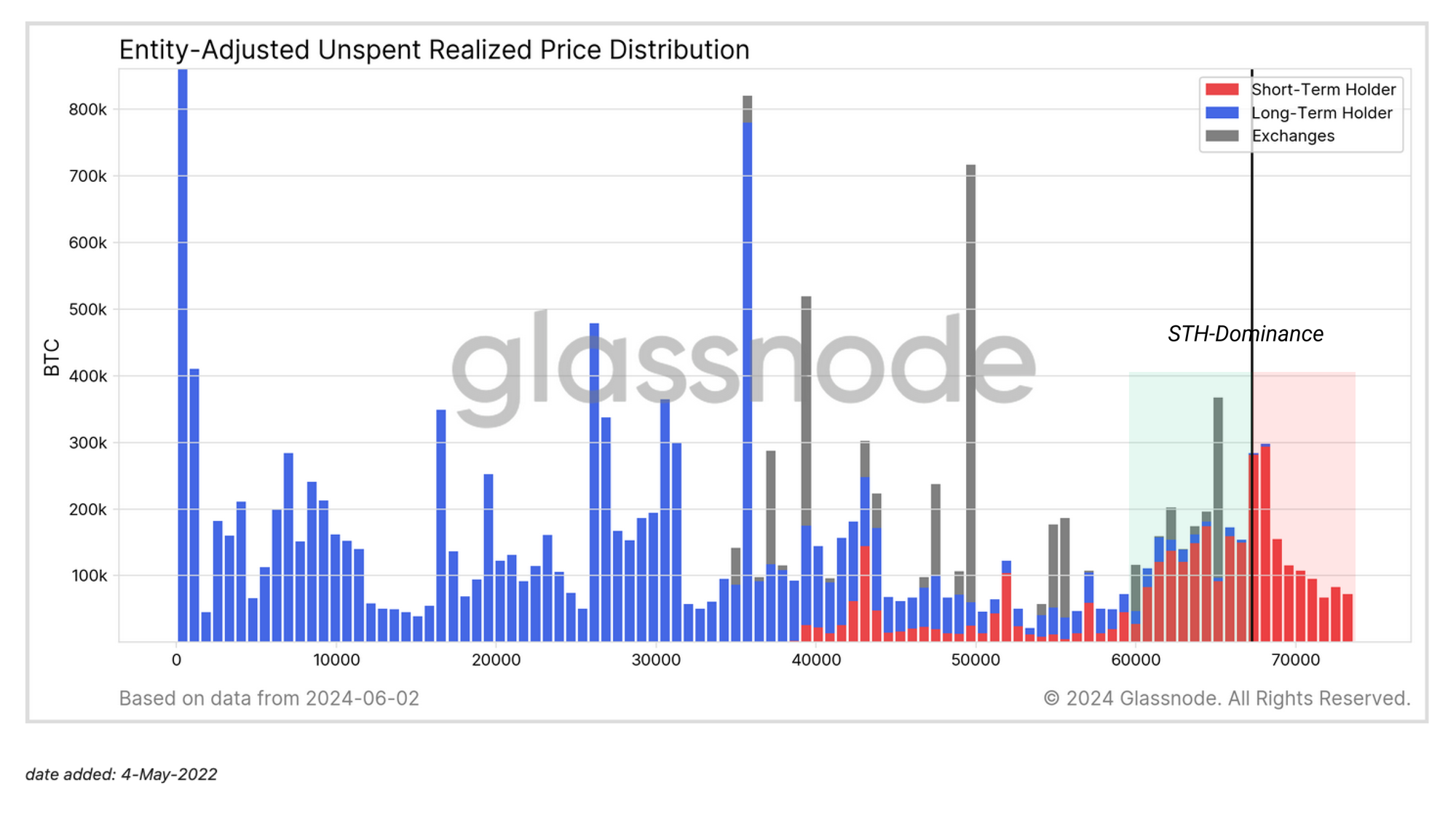

With the market consolidating just shy of its ATH, we can employing the URPD metric to visualize the BTC supply by the cost basis at which it was acquired.

There is a significant cluster of Short-Term Holder coins which have been accumulated in close proximity to the current spot price. This suggests significant investment has taken place within this price region. This however introduces a risk of increased investor sensitivity to any volatile price fluctuations in either direction.

Almost all coins held in an unrealized loss are in the Short-Term Holder cohort, which makes sense given the proximity to the prior cycles ATH.

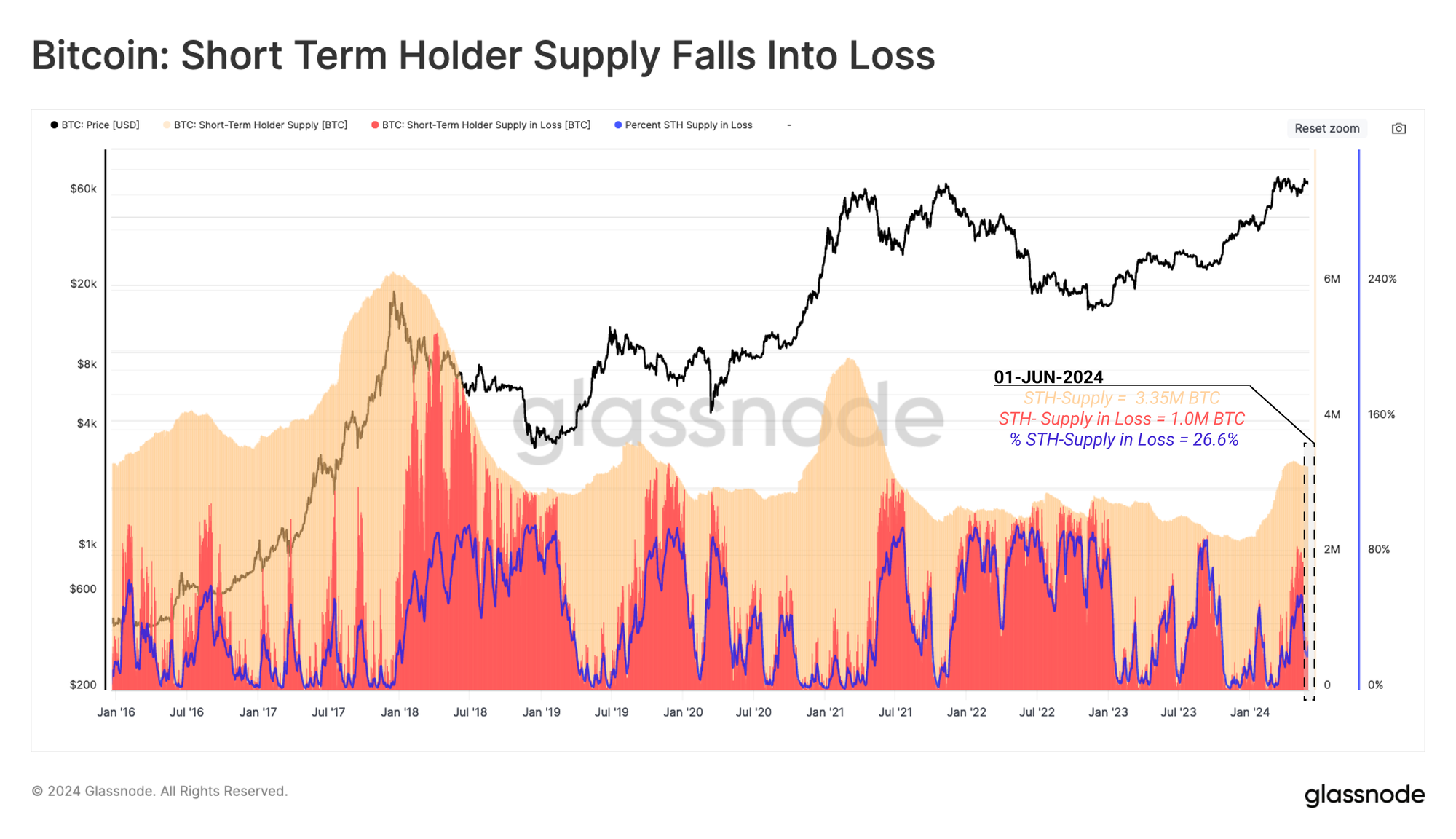

The chart below is a tool describing the proportion of the Short-Term Holder supply which is held in loss. This tool can be used to observe when this cohort experiences heightened sensitivity to changes in price action, particularly when a large volume of supply falls into loss over a short time period.

The market recently pulled back to $58k, reflecting a -21% correction, and the largest contraction since the collapse of FTX. At the lows of this move, a staggering 56% (1.9M BTC) of the STH supply moved into a position of loss.

However, whilst a large volume of supply was technically underwater, the magnitude of unrealised loss remained in line with typical bull market corrections, and is beginning to abate as the market stabilizes.

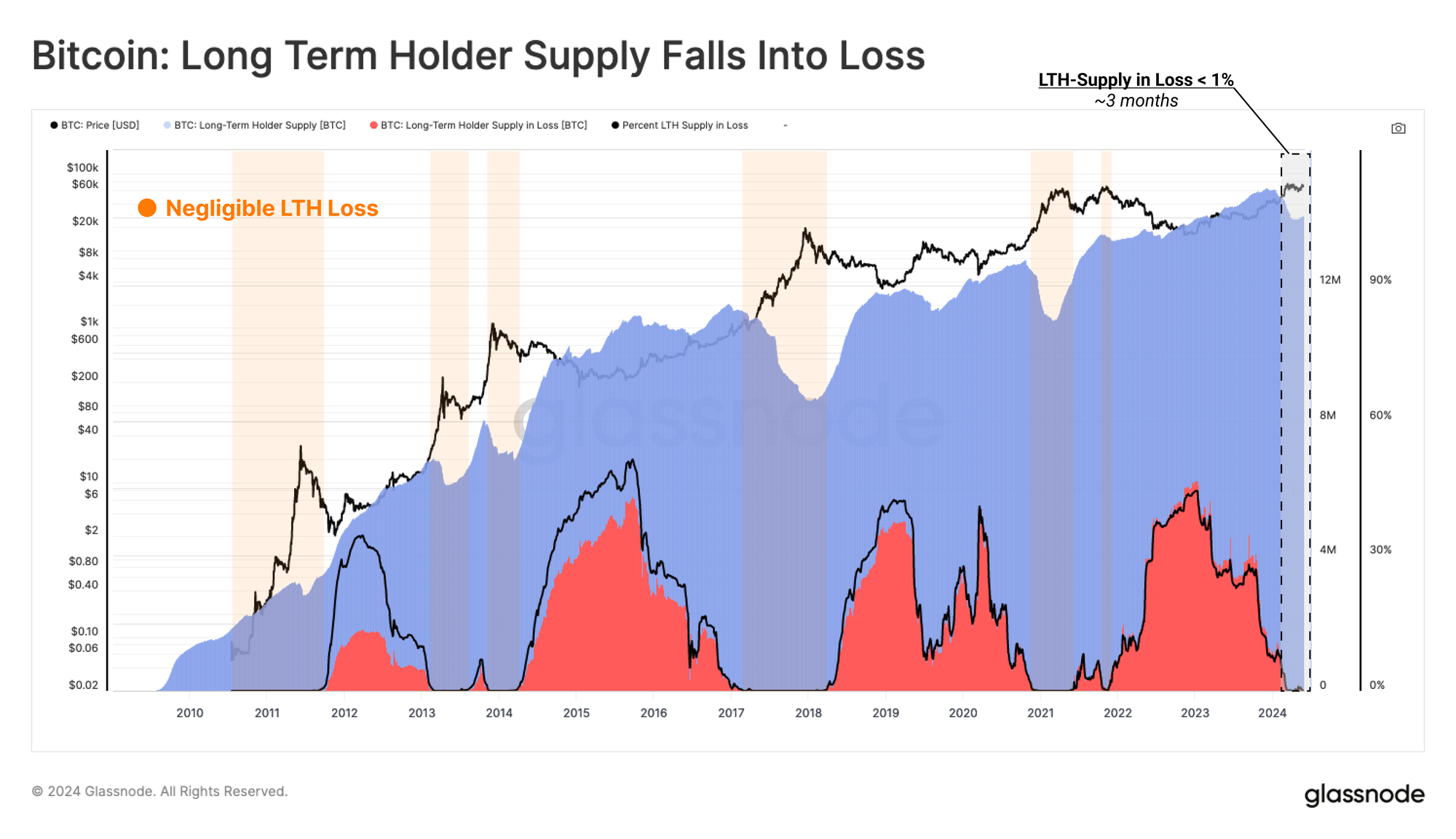

Turning to Long-Term Holders, we can see that the total volume of LTH Supply held in loss is negligible, with only 4.9k BTC (0.03% of LTH Supply) acquired above the spot price. Given new ATHs were only set in March (less than 155-days ago), these LTH coins in loss are the small few holders who bought the 2021 cycle top, and have held ever since.

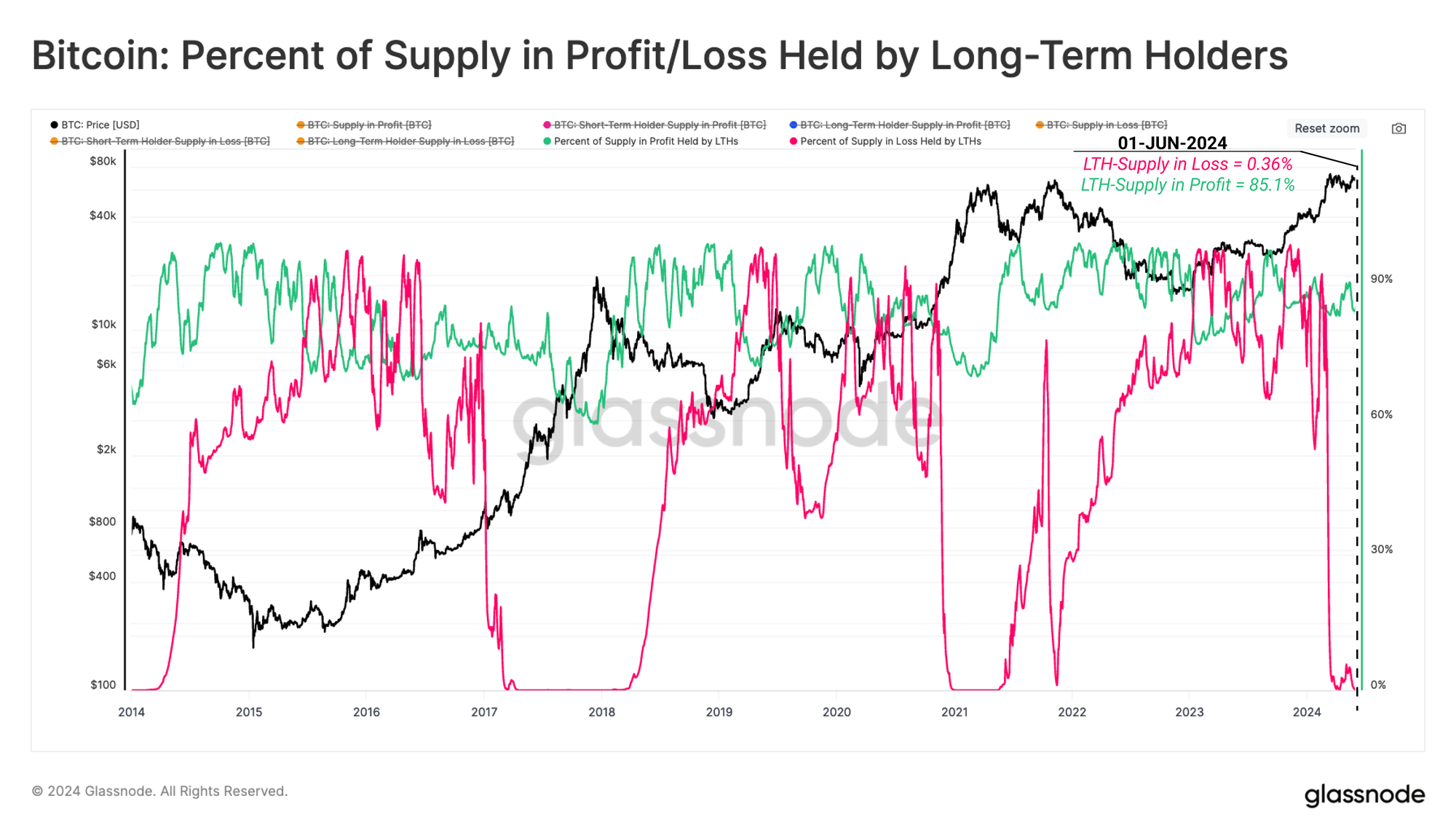

Another way to visualise this is via the proportion of all supply held in loss, which falls into the LTH cohort. At the bottom of bear markets, LTHs tend to carry the majority of unrealized losses, as speculators are flushed from the market, and the final capitulation results in a major transfer of coin ownership towards high conviction holders.

Conversely, during the euphoric phase of the Bull Market, the LTH contribution to the supply held in loss tends towards zero. In parallel, the STHs shoulder the vast majority of market losses, as new demand buys coins near the local and global price peaks.

At the moment, the LTHs hold a marginal 0.3% of the supply in loss, whilst subsequently accounting for over 85% of the supply in profit.

Room for Growth

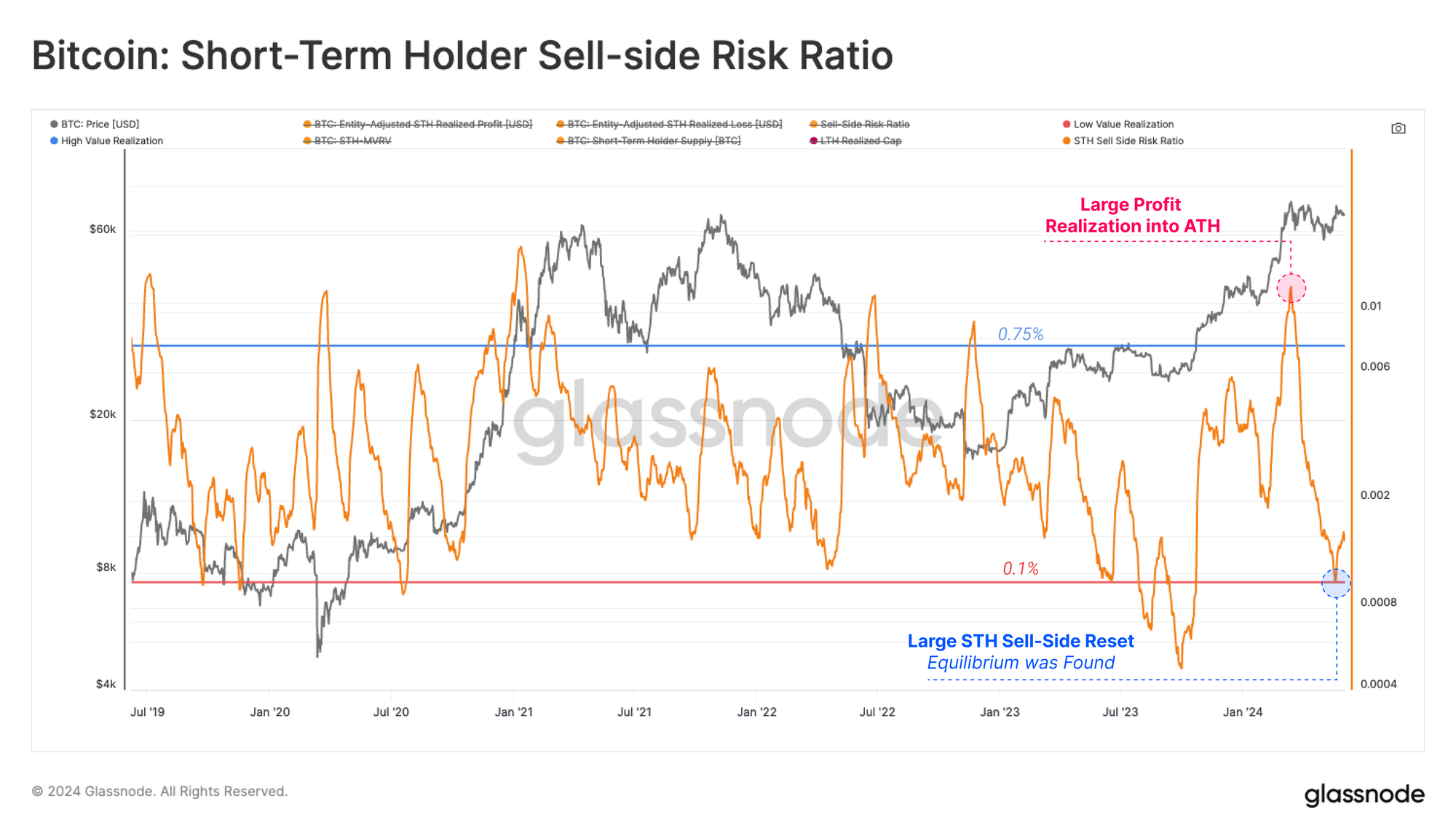

We can investigate the activity of our Long and Short-Term holder cohorts via analysis of their spending behaviors. For this, we can utilize the Sell-Side Risk Ratio which assesses the absolute value of profit plus loss locked in by investors, in relation to the size of the asset (measured as the Realized Cap). We can consider this metric under the following framework:

- High values indicate that investors are spending coins at a large profit or loss relative to their cost basis. This condition indicates that the market likely needs to re-find equilibrium, and usually follows a high volatility price move.

- Low values indicate that the majority of coins are being spent relatively close to their break even cost basis, suggesting a degree of equilibrium has been reached. This condition often signifies an exhaustion of ‘profit and loss’ within the current price range, and usually describes a low volatility environment.

Notably, a reset in both profit and loss taking has occurred across the STH cohort, suggesting a degree of equilibrium has been established during the recent sideways price consolidation.

For the Long-Term Holder cohort, their Sell-Side Risk ratio increased significantly as profits were taken leading up to and through the $73k ATH.

However, in a historical context, their Sell-Side Risk ratio remains at a lower level compared to prior ATH breaks. This implies that the relative magnitude of profit taken by the LTH cohort is small relative to previous market cycles. This may suggest that this cohort is waiting for higher prices before ramping up their distribution pressure.

Summary and Conclusion

The first glimmers of market speculation appear to be returning after a a multi-month price consolidation. Both new buyers, and single-cycle investors are primarily holding unrealized profits. This observation is bolstered by the fact that only 0.03% of the Long-Term Holders are in a position of loss, which is typical of the early euphoric phase of a bull market.

Over the last 2-months, the Sell-Side Risk Ratio for both Long and Short-Term Holders has reset and returned to an equilibrium. This suggests that a majority of profit and loss which was likely to be taken in this price range, has been, and hints to an increased risk of substantial volatility in the near future.

Disclaimer: This report does not provide any investment advice. All data is provided for information and educational purposes only. No investment decision shall be based on the information provided here and you are solely responsible for your own investment decisions.

Exchange balances presented are derived from Glassnode’s comprehensive database of address labels, which are amassed through both officially published exchange information and proprietary clustering algorithms. While we strive to ensure the utmost accuracy in representing exchange balances, it is important to note that these figures might not always encapsulate the entirety of an exchange’s reserves, particularly when exchanges refrain from disclosing their official addresses. We urge users to exercise caution and discretion when utilizing these metrics. Glassnode shall not be held responsible for any discrepancies or potential inaccuracies. Please read our Transparency Notice when using exchange data.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://insights.glassnode.com/the-week-onchain-week-23-2024/