Is this it? Are we back? Everyone in the startup and venture world has been waiting for months for the re-opening of the IPO window. After a record breaking 2021 (1035 IPOs, beating the previous record of 480 in 2020), 2022 saw a dramatic decline (181 IPOs) and 2023 so far has not been much better.

Common wisdom in the market over the last few months has been that Q4 2023 would be the time the IPO window would cautiously re-open for technology companies (recent non-tech IPOs like restaurant chain Cava being considered non-representative). And it would be crucial that some of the very best companies (the usual suspects being Stripe, Databricks and Instacart) would go out first, to pave the way for a bigger wave of quality companies right behind them.

Well, this week has been an exciting one – on Monday, ARM filed its F-1 (here) and just today (Friday August 25), both Instacart (here) and Klaviyo (here) filed their S-1s. It’s going to be exciting to see what happens this Fall in IPO land.

New IPO filings also mean fresh opportunities for the time-honored VC tradition of S-1 breakdowns, even though timing is unfortunate given summer vacation schedule – here and here.

Consistent with my general investing focus on data and ML/AI, I’m going to pick Klaviyo for this first breakdown of 2023, as it’s a heavily data-driven business. As I did in the past (see the S-1 quick teardowns for Snowflake, Palantir, Confluent, C3, nCino), this is meant as a QUICK breakdown – mostly unedited notes and off-the-cuff thoughts, in bullet point format.

Let’s dig in.

HIGH LEVEL THOUGHTS:

- The business: data and ML/AI at the core. Klaviyo is a marketing automation platform, used primarily for email marketing and SMS marketing. It is also, and perhaps foremost, a data infrastructure business with strong predictive analytics/ML/AI capabilities:

- Klaviyo actually didn’t start as an email automation play, but instead as an e-Commerce focused database to store disparate data types — events, documents and object data models.

- As it evolved into marketing automation, the whole premise of Klaviyo has been to empower e-commerce brands to own their customer data, and create data-driven, personalized experience through owned channels (email and SMS). This is in contrast to selling through large retailers or marketplaces that don’t give brands access to the underlying consumer data and constantly change their algorithms.

- Leveraging one’s customer data in an omni-channel, complex world is not getting any easier: “Businesses today struggle to deliver impactful consumer experiences because they cannot effectively harness increasingly complex consumer data. […] As user tracking rules change, third-party data has become unreliable, complicated, and expensive to use. Meanwhile, the proliferation of first-party data has made it difficult for businesses to aggregate, synthesize, and use these disparate data sets.“

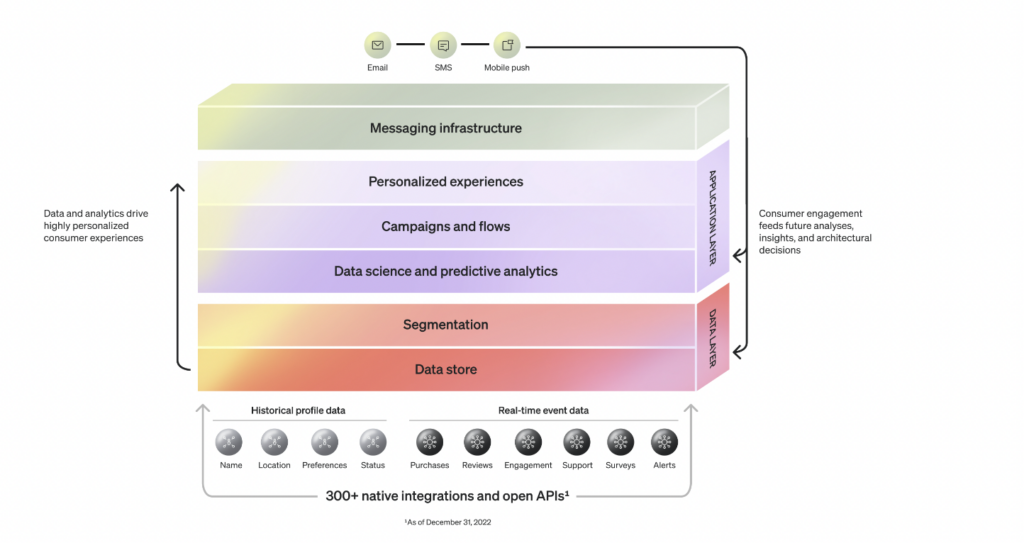

- From the beginning of the S-1, Klaviyo clearly defines itself as being heavily driven by data, ML and AI: “Our modern and intuitive SaaS platform combines our proprietary data and application layers into one vertically-integrated solution with advanced machine learning and artificial intelligence capabilities“.

- The term “artificial intelligence” is only mentioned 17 times in the S-1, a modest number given we are at (or slightly past) the top of the Generative AI hype cycle

- The Klaviyo platform has two core components:

- Data layer: Klaviyo has built from the ground up a highly-scalable platform optimized for large volumes of data, sub-second-level accessibility, and high levels of personalization and attribution. It can process data from over 300 native integrations and open APIs and synchronize unaggregated, historical profile data with real-time event data in a single system-of-record.

- Application layer: Klaviyo built an application layer on top of their data layer, which enables customers to create and manage targeted marketing campaigns and flows, track customer behavior, and analyze campaign performance – without the need to hire in-house engineers, as Klaviyo has a strong no-code component. The application layer also offers built-in advanced data science and predictive analytics capabilities to estimate consumer lifetime value, predict a consumer’s next order date, and calculate potential churn risk.

- Winner does not take all?

- The general consensus is that any category in SaaS obeys a “winner take all”, power law dynamic where the market leader reaps all the rewards, with perhaps a #2 company trailing behind, but everyone else suffering and ultimately disappearing

- However, interestingly, the success of Klaviyo and its IPO seems to go against that consensus view. The ESP (email service provider) market is incredibly crowded, with a whole range of big players from MailChimp to Adobe to Salesforce, as well as a bunch of newer startups (see this Gartner list of email marketing companies). While the big players do not necessarily break down the size of their marketing automation businesses in their public documents, we know that at least MailChimp was bigger in revenues in 2021 (when it was acquired by Intuit) than Klaviyo is today – about $1B for MailChimp then vs $585M for Klaviyo today (not a perfect comparison, but directionally helpful). Yet Klaviyo, while not being the 800 pound gorilla in the space, has still been performing impressively well (see metrics below). Maybe it has to do with the particularly large size of the ESP / marketing automation market; or the fact that Klaviyo has focused deeply on one specific vertical (retail/eCommerce, particularly Shopify merchants); or the fact that barriers to entry and competitive advantage may or may not last and compound in the SaaS world as much as incumbents would hope. In any case, the fact remains that the ESP/marketing automation market has produced multiple very large players, as opposed to a single hyper-dominant leader.

- Shopify & Platform dependency: Klaviyo has been very much focused on the Shopify ecosystem of small to medium-sized brands, and it’s been an interesting dance to watch:

- While it has built a number of partnerships over the years (BigCommerce, Woo Commerce, Wix etc), Klaviyo has *major* overlap with Shopify: 77.5% of its total ARR in 2022 came from customers who use the Shopify platform, so it is majorly dependent on how Shopify treats it.

- “Shopify” is mentioned 198 times in the S-1.

- It clearly highlights Shopify as a risk factor in the S-1: “Our business and success depend, in part, on our ability to successfully integrate with third-party platforms, especially with eCommerce platforms such as Shopify, and our business would be harmed as a result of any disruptions to these third-party platform integrations or our relationships with third-party platform providers“

- At the same time, Shopify has a clear interest in the continued success of Klaviyo:

- Shopify has been positioning itself for well over a decade as a platform on top of which other businesses could thrive, and Klaviyo is one of the crown jewels of that effort

- Shopify is also a major investor in Klaviyo (see below), with a strategic partnership to boot. The S-1 provides some details (p 108) about the partnership agreement they entered in July 2022 – it involves a revenue sharing agreement, common stock warrant agreement, and a stock purchase agreement.

- While it has built a number of partnerships over the years (BigCommerce, Woo Commerce, Wix etc), Klaviyo has *major* overlap with Shopify: 77.5% of its total ARR in 2022 came from customers who use the Shopify platform, so it is majorly dependent on how Shopify treats it.

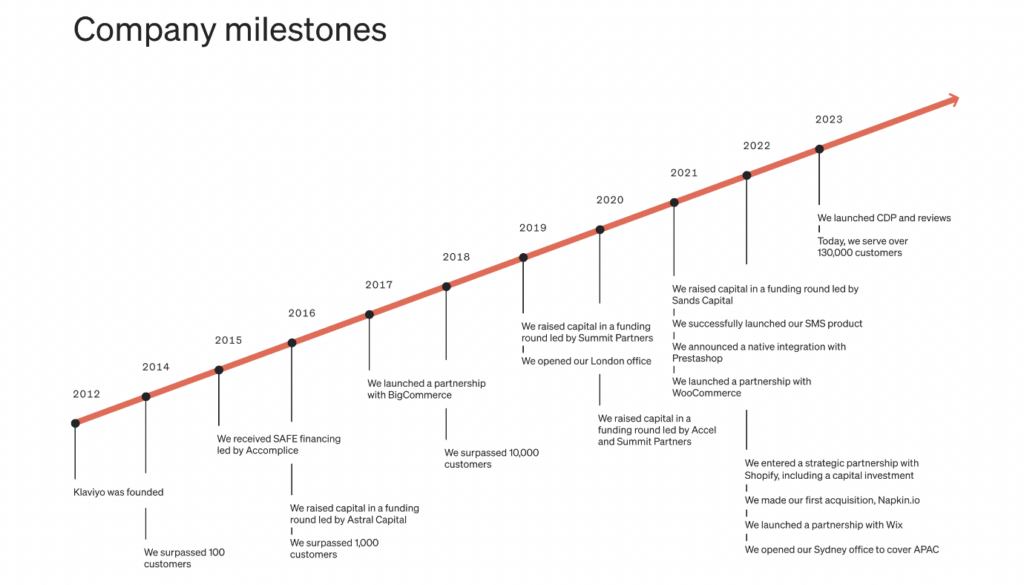

- Bootstrapping origins. While it has raised a lot of money ($454.8M in primary), and was most valued at $9.5B, Klaviyo is not your typical Silicon Valley story.

- Andrew Bialecki (who goes by “AB”) and Ed Hallen founded Klaviyo in Boston in 2012 and bootstrapped the business for three years as a profitable company. Then for the next 3 years, they only raised a total of $8.5M ($1.5 in a seed in 2015 and $7M in a Series A in 2017), according to Crunchbase. Klaviyo did end up raising big rounds of funding (starting with a $150M Series B in 2019), but the business was already thriving by then, commanding higher valuations and leading to lower dilution for the founders.

- As a result, it largely bypassed the traditional Silicon Valley ecosystem. While it did raise from Boston VC firm Accomplice (which owns 5.7% of the company before the IPO) in early rounds, most of its funding came from private equity firm Summit Partners (which owns 22.9% of the Class B shares before the IPO) and strategic investor Shopify (which owns 11.2% before the IPO).

- As a major benefit of its bootstrapping origins, the largest shareholder is still CEO Andrew Bialecki, who controls 38.1% of the Class B shares before the IPO.

FINANCIALS & METRICS

Klaviyo has impressive metrics all around.

Financials

- Big revenue number: Total revenue was $585.1M, for the 12 months ended June 30, 2023

- Impressive growth (at this scale and given the tougher environment): revenue grew at 56.5%, for the 12 months ended June 30, 2023

- Gross margin: 75%

- Unlike most of its SaaS peers, Klaviyo is profitable: it had net income of $15M on revenue of $321M for the first six months of the year, compared with a loss of $25M on revenue of $208M for the same period last year.

- Free Cash Flow margin: 8%

- Profitability seems to be a recent thing (at least since its bootstrapping years), however: on an annual basis, it had a $9.5M GAPP net loss for the 12 months ended June 30, 2023.

- Cash: $439.8M on the balance sheet as of June. This is particularly impressive given $454.8M raised in primary over the company’s history as it means that, on a net basis, the company only burned $15M of capital, pointing to very high business efficiency.

Metrics:

- High net retention, particularly given the number of SMBs in its customer base (see below): 119% NDR, as of June 30, 2023

- Land-and-expand strategy is largely focused on product-led growth

- Expand in three primary ways.

- As customers increase their usage, they move to higher subscription tiers.

- Klaviyo cross-sells additional communication channels, such as SMS to customers who started with email offering, as well as add-ons, such as reviews and their CDP offering.

- For larger customers, Klaviyo sells its platform to their customers’ other brands, business units, and geographies.

- 130,000 customers at an ACV of about 5k

- 1,458 customers at more than $50k ARR as of June 30, 2023, representing growth of 94% year-over-year. This is the result of a sales push upmarket towards larger customers.

- CAC payback period of only 14 months for the quarter ended June 30, 2023.

- 42% of revenue on S&M over the last 12 months

- Excellent rule of 40 at 65%

- Global team of 1,500+ employees (not that high a number given revenue, part of the efficiency built into the business – $390k of revenue per employee?)

- Massive amounts of customer data: “As of June 30, 2023, we assembled over 6.9 billion consumer profiles across our customer base, and in the twelve month period ended June 30, 2023, we processed over 695 billion events, which are data on how consumers engage across channels, such as opening an email, browsing a website, or placing an order.“

CONCLUSION:

- Top quality company with impressive metrics

- Profitability and overall efficiency of the business very much aligned with current market mood and expectations

- While (arguably) less of a generational company compared to a Stripe or Databricks (or Snowflake), it should have a very successful IPO, assuming macro cooperates, and strongly contribute to re-opening the IPO window for others

- Does raise the bar quite a bit for others potentially following, given profitability and efficiency while growing strongly

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- ChartPrime. Elevate your Trading Game with ChartPrime. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: http://mattturck.com/klaviyos1/