Crowdfunding generates billions annually by empowering individual backers to collectively finance ideas and causes online. But with money flows at scale between thousands of senders and recipients globally, establishing controls ensuring accountability is crucial.

Escrow services are purpose-built to mitigate common risks around fraud or non-delivery by only releasing contributed funds to campaign owners upon hitting pre-agreed usage milestones or delivery thresholds. This prevents diversion without due oversight.

This guide will cover escrow account fundamentals, leading integration solutions, importance for different crowdfunding models, dispute management, and optimization strategies. Follow along to learn how escrow brings greater credibility and trust across donation, rewards, lending and real estate crowdfunding platforms.

Escrow Account Basics : Definition and Key Functions

An escrow account refers to a neutral third-party special account where money or assets get transferred upon a trigger event or condition being met per contractual rules. The escrow agent ONLY disburses funds to the intended recipient upon verification of compliance, protecting the sender against misappropriation risk otherwise.

For crowdfunding, contributors send funds not directly to campaigns but rather into custodial escrow accounts instead. Only once project owners hit prescribed milestones reflecting appropriate use towards promised outcomes will escrow release incremental fund batches ensuring continued progress. This prevents contributors being left stranded by non-performing campaigns.

Other key escrow account functions include:

- Securely holding monetary contributions across multiple campaigns with accounting separation

- Validating campaign development progress claimed before authorized release of funds in stages

- Processing periodic payments to suppliers as campaign budgetsDictate

- Managing contributor communication around material changes

- Mediating disputes if conflicts around delivery or allocations arise

Specialized escrow agents assume custody, compliance and oversight obligations – creating accountability anchors benefitting all stakeholders when executed transparently.

Top Crowdfunding Escrow Service Integrations

Dedicated technology integrations powerfully streamline escrowing capabilities for crowdfunding platforms by interfacing contribution handling, identity verification, milestone tracking and disbursement payouts seamlessly.

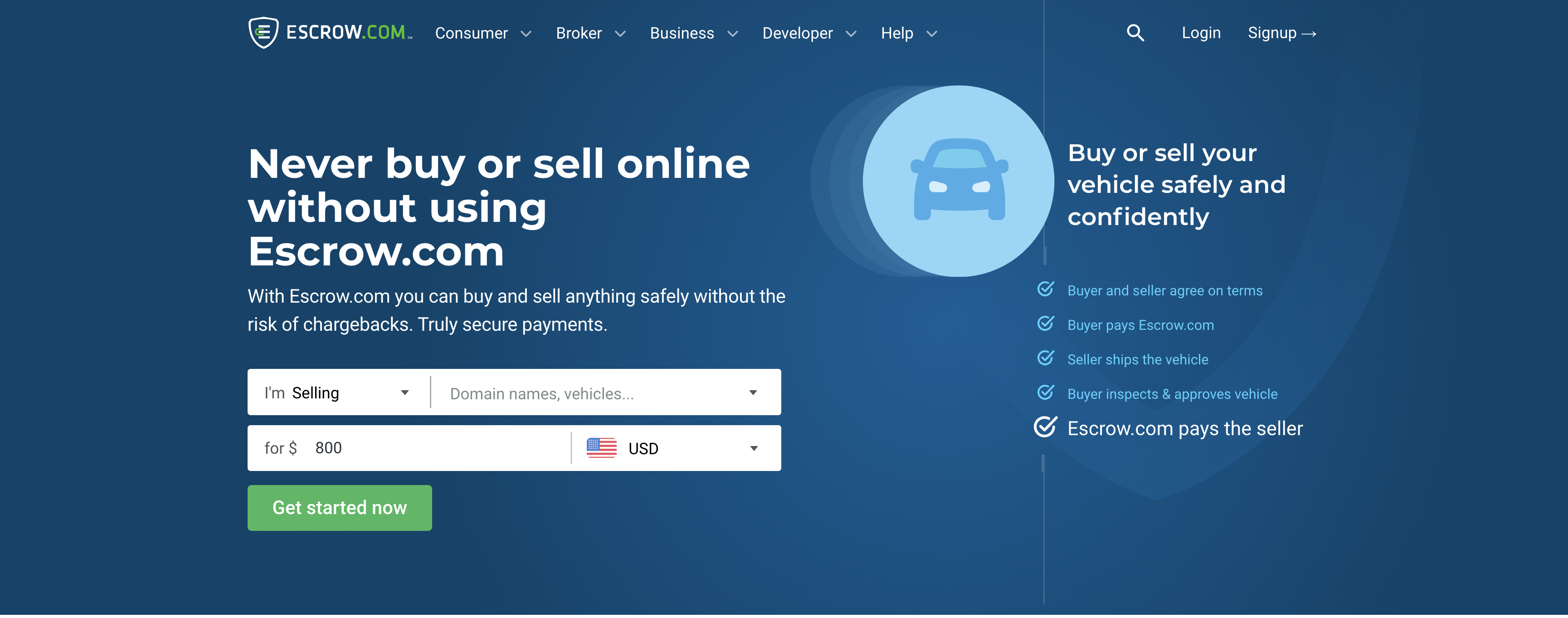

Leading dedicated providers like:

- Escrow LLC

- Vertalo Offer turnkey API and payment processing integrations so campaign contributions get securely routed into proper escrow accounts automatically. This prevents funds ever touching campaign accounts directly.

Additionally they provide:

- Scalable ledger management across thousands of campaigns

- Automatic ID checks and duplicate detection

- Customizable milestone management frameworks per project vertical

- Multi-signatory authorization releasing funds needing campaign plus admin consent

- Digitized agreement signing and records access

Such specialized escrow technology layers remove reconciling asset transfers outside the platform while still giving visibility into account balances. This future proofs scale, compliance and accountability simultaneously.

Importance of Escrow Integration by Crowdfunding Model

The significance and type of escrow account management required differs based on the crowdfunding model specific risks needing mitigation:

Donation Crowdfunding – Helps ensure contributions by supporters actually go towards intended charitable causes or medical needs rather than get diverted by fraudulent fundraisers or operators.

Rewards Crowdfunding – Supports campaign creators proving incremental spend translating to promised product development updates for backers funding ideas upfront on good faith.

Lending Crowdfunding – Validates underlying asset values against money lent and borrower repayment capacities preventing excess leverage without collateral justification.

Real Estate Crowdfunding – Allows release of construction funds held against inspector verified project milestones before wiring cash preventing misdirection.

So while donation models focus on outright misuse, lending models track financial health. But universally escrow provides confidence around outcome delivery and traceability when structured properly.

Navigating Disputes Over Release Terms

Despite extensive planning, disputes around release timing or amount appropriateness can still arise between contributors and campaign creators.

Common scenarios include:

Delays – Uncontrollable external factors like shipping container shortages or pandemics postponing delivery timelines

Value Misalignment – Backers disagree with creators on asset worth changes warranting payout amount deltas

Decision Paralysis – Multi-signatory approvals stall with sign-offs missing preventing routine escrow movement

In these scenarios, escrow agents mediate by reviewing evidence and guarantees made in original agreements around timing flexibility or valuation anchors. Some recalibration compromises get structured allowing founders additional windows while protecting backers from excessive indefinite delays.

Having pre-defined contingency protocols for resolving conflicts ensures continuity of operations and prevents stagnation while problems get sorted internally.

Optimizing Escrow Account Strategies

Beyond setting up initial integrations, firms should optimize escrow account management for efficiency, transparency and clarity:

- Standardize release schedules whether utilizing tranches tied to usage or fixed intervals like loan payments. This allows contributors better ability to model payout expectations.

- Maintain indexed records of signed commitments preventing ex-post facto changes to promises made. Timestamp key documents for maintaining single source truth.

- Structure inspection requirements ahead of creator withdrawal requests to validate asset worth stability rather than relying just on their word.

- Maintain standalone portal dashboard visibility into escrow account balances, transaction histories and release statuses without needing to engage support personnel.

Ultimately more predictable automation, accountability proofs and user transparency helps efficiency in preventing unnecessary frictions down the road.

In Summary

Mature crowdfunding marketplaces recognize escrow integration today not just as a box checking exercise but rather a value adding capability improving reliability, transparency and agreement enforceability.

Choose trusted specialty providers guaranteeing robust escrow management allowing your platform teams to focus on high order business model innovation and customer experience excellence knowing funds remain protected.

Now that you understand the fundamentals around capabilities, importance and leading tools – make informed decisions unlocking the power of optimized escrow accounts across all your crowdfunding community experiences

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.fundraisingscript.com/blog/managing-crowdfunding-contributions-securely-essential-escrow-account-setups/?utm_source=rss&utm_medium=rss&utm_campaign=managing-crowdfunding-contributions-securely-essential-escrow-account-setups