Reading Time: 8 minutes

Following up on my previous post on Lemonade (where I outlined the bull case for the company), in this post I will do the opposite. I’ll discuss the bear case and play devil’s advocate to some of the bull arguments. Readers can then make up their minds on whether this company is a worthy addition to their portfolios.

To briefly summarise my previous post, the main bull arguments for the company is that it’s (1) a digital disrupter, (2) establishing a significant data moat, (3) scores very high in customer satisfaction, (4) has a low cost advantage, (5) has the potential to add new product lines and (6) expand to new geographies, (7) will benefit from tailwinds in customer churn through an ageing of its cohorts, (8) benefits from aligned incentives and the (9) stability that reinsurance provides, (10) is an attractive ESG play.

Now to the bear case.

Bear Case

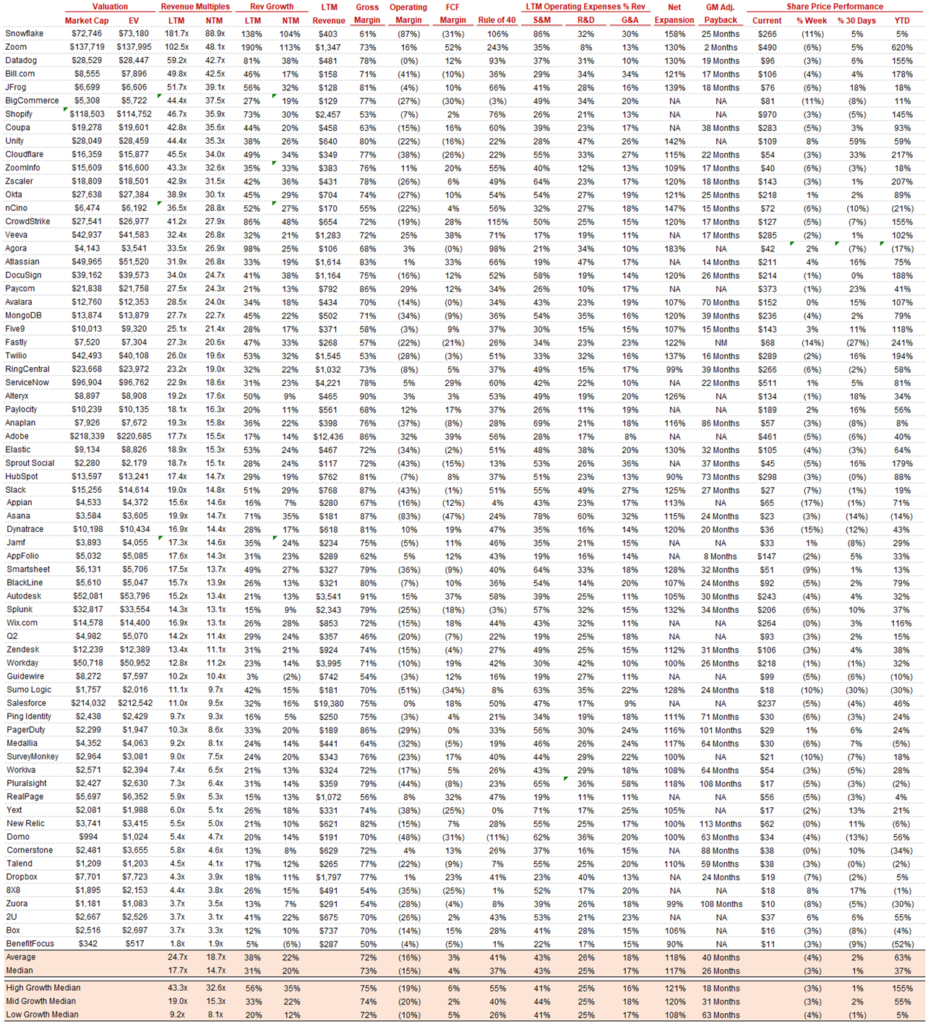

- Valuation. At time of writing, the company traded for $50 per share, implying a market capitalization of $2.85 billion. With net revenue of $86-88 million expected for full year 2020, it is valued at approximately 32x FY 2020 sales. This is comparable to the top echelon of SaaS companies (graph and table below from the fantastic CloudedJudgement) :

The key question is does it deserve to get a similar multiple as a SaaS business such as nCino (36.5x LTM), Twilio (26x LTM) or DocuSign (34x LTM)?

To answer this, I will start with the premise that two businesses with the same growth rate, the same margins, the same re-investment needs and the same risk in cash flows should get exactly the same multiple. Relaxing some of these assumptions, one at a time, gives some useful insights:

A. Gross Margins are much lower at Lemonade. Adjusted Gross Profit was approximately 18% of Revenue in Q2 2020. This is significantly lower than the gross margin of, say Docusign (~ 75%) which has a very similar revenue multiple. In other words, every dollar of revenue is not worth the same to Lemonade as it is for DocuSign, which means Lemonade would need a much larger revenue basis to support the same level of gross profitability compared to a company like DocuSign. All else equal, this should result in a lower revenue multiple.

B. Stronger capital need for growth at Lemonade. Since Lemonade is in the insurance business, it will need to maintain minimum levels of capital to satisfy solvency requirements as the business expands. To some extent, the capital need has been mitigated by the use of re-insurance, but Lemonade still retains 25% of gross premiums written, which needs to be covered by sufficient capital to ensure it can make good on its promises. This is in sharp contrast to SaaS businesses where the reinvestment needs of providing a new customer an existing product is pretty close to zero (not including marketing costs). Again, all else equal, this should result in a lower multiple for Lemonade.

C. Net Expansion Rate is lower at Lemonade. As highlighted in my previous post, Lemonade does suffer from relatively high churn despite very strong customer satisfaction. Its 1-Year and 2-Year customer retention rate were 75% and 76% respectively. These figures exclude company initiated cancellations, rescissions and non-renewals based on underwriting risk assessments which account for a further 13% and 5% decreases in the 1-Year and 2-Year retention rate. Including these factors, gives a 1-Year and 2-Year retention rate of 62% and 71% respectively. This means:

(i) Lemonade loses roughly 1 out of 3 customers in Year 1

(ii) Less than half (44%) of customers stay for 2 years or more.

These are very high churn rates and significantly lower the LTV of its customers.

Offsetting this churn is the fact that premium per customer is increasing. In Q2 2020, premium per customer increased 17% YoY. Extending this to the churn rate, we have a Net Expansion Rate in the range of 72.5% – 83%. This is significantly lower compared to Docusign (~ 120%), nCino (~ 147%) and Twilio (~137%).

D. Gross Margin Adjusted Payback period longer at Lemonade. Lemonade’s average premium per customer was $190 as of Q2 2020. Using a gross margin of 18%, this equates to ~ $34 of gross profit per customer. Its customer acquisition cost was approximately $190 per customer (84,835 new customers in Q2 2020 from $16.1 million of sales & marketing spend). That’s a payback period of 5.5 years or 66 months. Interestingly, this calculated marketing efficiency is significantly lower than the ‘$1 of marketing spend for $2 in premiums’ touted by the company. Even if we were to take this ratio at face value, the payback period would still be 2.8 years or about 33 months (($190*0.5)/$34)). Very few of the companies shown in the table above that have multiples above 30x, also have payback periods above 30 months.

So if Lemonade has lower gross margins, a higher need for capital as it grows, a much lower net expansion rate and longer gross margin adjusted payback periods, what could possibly justify its current multiple?

The answer, I believe is likely its growth rate. Its number of customers are up 84% YoY and its in force premium is up 155% YoY. Its revenue for Q2 2020 was up 116% year on year (although from a very low base of $13.8m in Q2 2019). Only Snowflake and Zoom have revenue growth above 100% and these trade for much higher multiples of 181x LTM and 102x LTM respectively.

The question then becomes since the unit economics depends so much on growth, to what extent can the company continue, unimpeded, along its current growth trajectory? I believe there are several risks to its growth story which I will further outline below.

2. Success in the renters insurance market may not be easily repeatable. A common argument against Lemonade is that it has built a great product for a niche market (renters insurance) that may not extend well to other insurance verticals. For example, part of the reason why it attracted a strong customer following, was its ability to pay claims fast, one third of which are paid out in less than 3 seconds. However, that may be a function of a simpler claims process in the renters insurance market, where the most common claims are theft and vandalism claims. It’s relatively quick to appraise the value of personal items, cut a check and just send the customer on their way. This is not necessarily true for homeowners insurance, where replacing a roof or repairing structural damage to a building is much more complicated. The same could be said of life insurance and auto insurance that also have longer claims cycles on average compared to renters insurance. This may result in the number of policies per employee declining to levels more similar to incumbent insurers. At the moment, it able to process 2,500 policies per employee, which is about 5 times more than its nearest competitor. If this declines, as the complexity of insurance products it provides increases, it may not be able to scale at a speed needed to support its current valuation.

3. The GiveBack program may not be significant enough to change behaviour. For the full year 2019, the company donated $600,000 on an average customer base of 504,923 customers. This works out at roughly $1.19 per customer. If you compare this to the average premium per customer during 2019 of $166, it is less than 1%. This then begs the question, is the prospect of $1.19 either going or not going to charity by their actions really going to change behaviour for the average customer? My suspicion is “no” and the GiveBack might come under greater scrutiny as the company grows and gains more of the media spotlight.

4. Dependence on re-insurers. I’d argue that Lemonade would find it extremely difficult to meet its growth aspirations without re-insurance. The capital requirements needed for growth would be too costly and the risk of running an un-diversified insurance book too great. Reinsurance plays a key role in mitigating risk and reducing capital requirements. In this sense, re-insurers are the ‘suppliers’ of capital and at the moment, with parts of the industry in oversupply, the ‘bargaining power’ of these suppliers is weak. If this changes in the future, the terms on which Lemonade is able to secure re-insurance might become less favourable. For example, there may be pressure to reduce the 25% ceding premium the company receives from its reinsurers. In addition, as the company scales, it is unclear to me whether it would still be able to retain its reinsurance rates or whether the larger re-insurance needs would strengthen the bargaining power of the re-insurers. Time will tell.

5. Financial Tail Risk. As with all insurance businesses, the company is exposed to tail risk or the risk of very low probability, high impact events. This could come in the form of catastrophic events that trigger a flood of property and casualty insurance claims. Less likely but more damaging, tail risk could come in the form of a major re-insurer facing financial difficulty and unable to make good on its reinsurance. In that event, Lemonade would still be liable for its policies towards its customers, with the re-insurers being liable to Lemonade. In other words, Lemonade comes with a very remote but possible ‘disaster’ risk, that some of the SaaS companies discussed earlier simply don’t have. With those companies, the ‘disaster’ risk is more on a competitor inventing a ‘better mousetrap’ and outcompeting its products. But Lemonade faces both: financial risk and the ‘better mouse trap risk’ from insurtechs – as we shall see next.

6. Competition from new Insurtechs. Since insurance has such a large TAM, is growing as the world’s middle class expands, and is dominated by (antiquated?) incumbents, it has attracted a lot of ‘insurtechs’ seeking to disrupt the industry. For example, Root Insurance is seeking to disrupt auto insurance through the use of smartphone technology. It purports to be able to measure driver behaviour and distinguish between good and bad drivers, thereby providing better drivers with better prices. Other Insurtechs include Hippo (Homeowners Insurance), Next (small business insurance), Bright Health (health insurance) and many others. This competition may limit Lemonade’s ability to enter new markets and increase its TAM in the future. At the very least, it may increase Lemonade’s customer acquisition costs, as insurtechs race to acquire customers.

7. Scrutiny on AI. One of the company’s biggest strengths – its ability to gather approximately 1,700 data points on customers (compared to 20-50 that incumbents collect) – could also be a hidden vulnerability. Customers may begin to question what is included in the 1,700 data points or may want more control on how this data is used. Regulators may also be interested in controlling the use of certain information in the decisioning process (e.g. discrimination laws etc). Regulation in this area would benefit incumbents who are still far behind in AI. Regulation in the form of stiffer capital requirements would also benefit incumbents that have more capital and higher levels of profitability.

8. Wading into political issues. A concern I have for the company is its propensity to get involved in political issues. One example is its strong stance on gun control that can be somewhat polarising to potential customers. A quote from the company:

“We will exclude assault rifles altogether [from our policies]. We simply don’t understand why civilians need military-grade weapons, and we prefer not to insure them.”

Although many would agree with this statement in principle, it is a polarising issue and some would view the wording as being unnecessarily antagonistic. Proponents may argue that it’s part of the company’s mission of turning insurance into a social good. My concern is not so much that the company takes a public stand on political issues per se, but the potential for these public stances to distract management from where their focus really should be. I want management to spend all of their available time thinking about how to improve the customer experience, expand into new insurance markets etc. I don’t want them spending any time wading into hot button political issues, with little tangible upside and very real downside risks.

In sum, as I outlined in Part I, there are persuasive arguments on both sides. I hope Part I and Part II have helped you in forming a decision on the company.

For my part, I find the bear arguments to be weightier than the bull arguments (for now at least). I would rather watch from the sidelines over the next few quarters and follow how the company is executing on its new insurance lines. I’d also like to see churn rates improve significantly. I realise that I may be giving up significant upside by waiting for these metrics to improve. I’m ok with that, since if it does execute well, there is a long run way of growth ahead and plenty of time to become a shareholder.

Thanks for reading.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Buy and Sell Shares in PRE-IPO Companies with PREIPO®. Access Here.

- Source: https://ipohawk.com/lemonade-a-closer-look-part-ii/?utm_source=rss&utm_medium=rss&utm_campaign=lemonade-a-closer-look-part-ii