The near-ubiquitous availability of robust, secure, wireless connectivity still involves navigating substantial complexities for service providers. In the transportation and logistics sector, service providers are faced with the need to connect not only the vehicles in their fleets but also the loads being transported. Increasingly, these include the ability to connect the load and its contents including pallets, large objects, assets in transit and even parcels. Although connectivity options are available in both the low power wide area (LPWA) network arena and with global navigation satellite system (GNSS) connections, cellular connectivity provides an optimal solution for the transport and logistics sector, for most applications, most of the time.

This whitepaper therefore focuses on the applications of cellular connectivity in fleet vehicles and the items they transport. Cellular sits in the sweet spot between cost, coverage, security and reliability that transport service providers require from their connectivity. The challenge today is to achieve cellular connections with the minimum of friction, allowing automated provisioning, greater flexibility and maximised choice. Simultaneously, the switch to 4G and 5G, caused by the sunsetting of 2G and 3G networks, must be handled smoothly to avoid disruption and avoid unnecessary costs.

The transport and logistics sector has been an early adopter of Internet of Things (IoT) technology to help increase efficiency and to serve customers better. The sector has seen the value of rolling-out management systems and augmented these with connectivity. Since the 1980s, large transport and logistics providers have used transport management systems (TMS) which help them to plan, execute and optimise how physical goods are moved. Adoption of these systems continues but the richness of data they now rely on has increased enormously as vehicles, packages and containers can communicate not only their locations but also information such as shock, temperature and moisture.

Analyst firm Berg Insight estimates that the value of the European TMS market reached around US$1.16 billion in 2022. Growing at a compound annual growth rate (CAGR) of 11.4%, the market value of transport management systems in Europe is forecast to reach US$1.89 billion in 2027. The North American TMS market is at the same time predicted to grow from US$1.47 billion in 2022 to reach almost US$2.42 billion in 2027, representing a CAGR of 10.6%.

Specific sub-sections of the transport and logistics sector have been quick to adopt IoT technologies to support high value and sensitive cargo. ABI Research reports that the global pharmaceutical industry, for example, will surpass US$1.9 trillion in revenues by 2027 and online pharma revenues will surpass US$185 billion by 2027. With online healthcare, tailored medicines and regulatory stringency all increasing alongside an elevated focus on drug supply security following the Covid-19 pandemic, pharma supply chains have drawn considerable attention.

Digital transformations are being used to ensure not only resilient supply but also to enable competitive differentiation. As a consequence of this, the analyst firm predicts that cold chain track and trace revenue for refrigerated containers in the pharma industry is expected to reach US$2.9 billion globally by 2027 as companies look to tackle the US$35 billion worth of products lost to failures in temperature-controlled logistics within the industry each year.

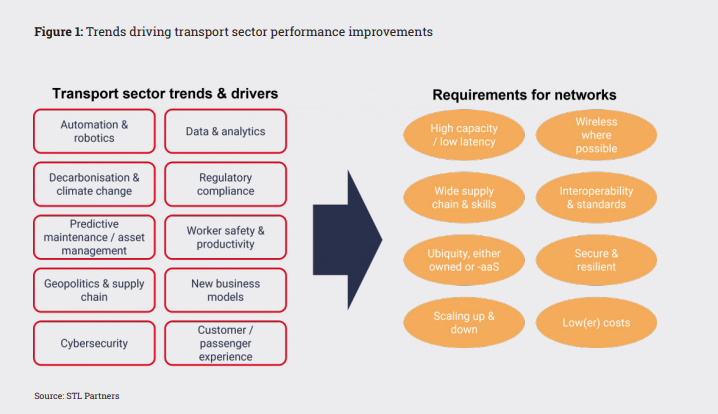

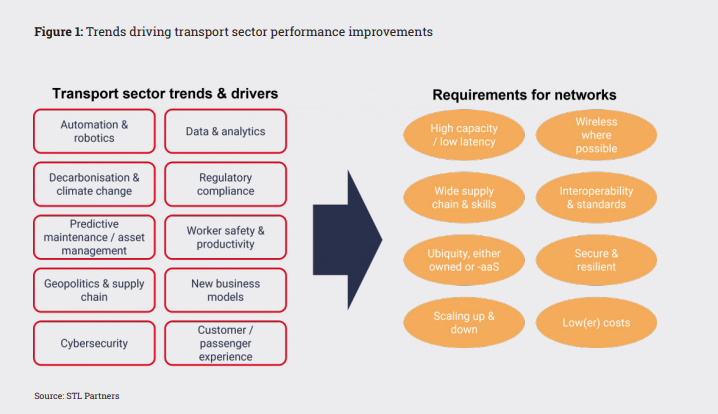

It’s not only the pharmaceutical industry that is pioneering adoption of new technologies to streamline logistics performance. STL Partners has detailed some of the key trends enabling the next generation of transport and logistics in a recent report. The firm highlights automation and robotics which are being deployed in transport hubs and warehouses to enable greater efficiency. This extends further to port cranes, supply chain handling systems and the utilisation of automated guided vehicles.

Robots and automated systems are increasingly using video cameras for detecting packages and to enable remote control by operators. The firm says that transport and logistics companies are at the forefront of data-rich applications which range from digital twins of jet engines, wind turbines and rail locomotives, to optimised scheduling and packaging of goods in warehouses. Better-connectivity underpins progress and connected equipment, IoT sensors and video input can improve turnaround times, reduce shipment errors and lower energy consumption.

A key driver behind investment in connected systems is that transport service providers are in a capital-intensive sector. The cost of downtime for a vehicle or critical system in a warehouse or airport terminal can be huge. STL Partners therefore identifies a large opportunity for using networked information and sensors to enable predictive maintenance.

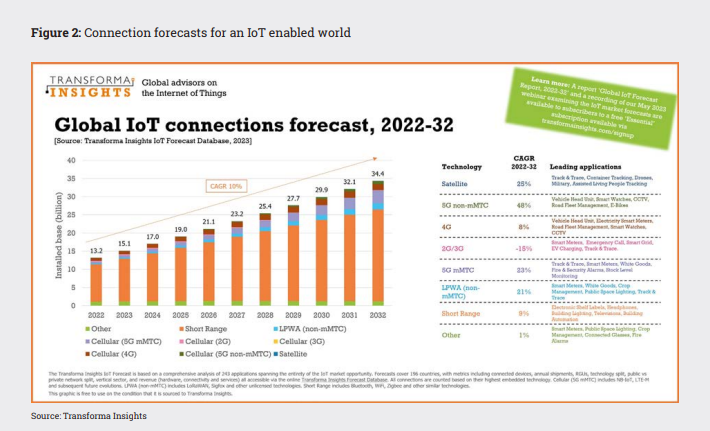

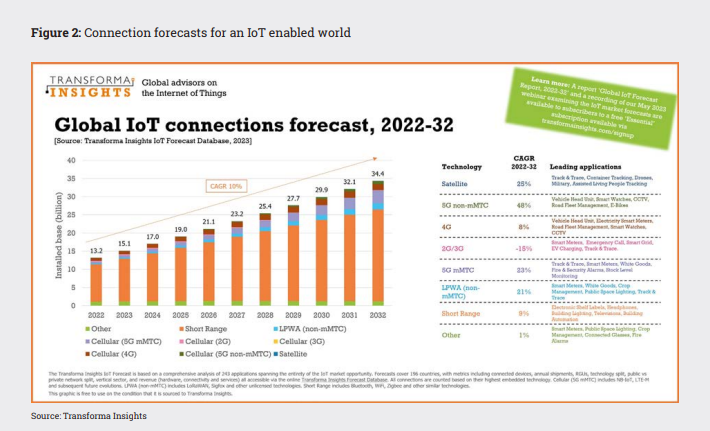

The advanced uptake of technologies enabled by connectivity in the transport and logistics sector will see transport service providers overshadowed as innovators as IoT applications are adopted at mass scale by consumers. Analyst firm Transforma Insights predicts that in 2032 the consumer sector will account for 61% of all connections. Of the enterprise segment in 2032, 30% of devices will be accounted for by cross-vertical use cases such as generic track-and-trace, office equipment and fleet vehicles, 26% by utilities, most prominently smart meters, 22% by retail and wholesale, 8% by government, 4% by transport and storage, and 2% each for agriculture, forestry and fishing, finance and insurance, and manufacturing.

While the market matures in this way, it’s clear that cellular connections will be adopted for non-short range scenarios. Inevitably, as 2G and 3G networks continue to be sunset, 4G and 5G will step in to fill the gap, continuing to deliver ubiquitous, secure, wireless connectivity with more than adequate capacity and latency for transport and logistics use cases.

Later in this decade, the performance of newer-generation cellular connectivity is likely to have stronger relevance to transport and logistics applications as richer data is required and video is increasingly used to enable robots and support in-depth condition monitoring. The vehicles themselves will become ever-more connected according to Kaleido Intelligence which predicts that telematics connections will reach 573 million subscriptions by 2028.

The firm acknowledges that telematics applications won’t use the same volume of data as infotainment systems but expects data rates to grow. It says the average data rate per connection is set to grow by 47% between 2023 and 2028, as the use of video telematics becomes more common in road haulage fleets. This will double telematics connectivity revenue over the same period.

The firm also notes that although direct tracking of cargo by cellular means is becoming more common, connections will grow at less than 9% CAGR throughout the forecast period. 2G and 3G shutdowns in several countries are a significant contributing factor to this relatively low growth rate. Logistics firms and suppliers will need to adopt LTE-based tracking, and the cost of replacement of older equipment will be prohibitive in many cases. As a result, Kaleido Intelligence expects less than 40 million cargo tracking cellular connections to be in place by 2028.

A key consideration for transport and logistics organisations today is how to future-proof their technology selects and ensure they have maximised flexibility to power through the sunsets and into the 5G era. 4G in the form of LTE and LTE-Advanced will be popular enabling technologies with operators intending to continue to offer 4G for the foreseeable future.

What has changed?

Transport and logistics has surfed a wave of radically increased volumes of shipments and logistics and now encompasses several quite different activities. Last mile deliveries for example are very different from shipping twenty-foot equivalent (TFE) containers around the globe or ensuring foodstuffs don’t spoil in refrigerated transport. To maintain customer satisfaction and be ready for greater demand, organisations are transforming their operations to take advantage of new opportunities and address customers’ needs. There are three significant drivers transforming the sector:

- User expectation

End users now expect to be able to track their shipments in transit and gain accurate information on demand. Service providers similarly need timely, accurate location data to support their services. Cold chain or pharmaceutical deliveries, for example, rely on the transport service provider being able to prove the products have been delivered within an acceptable temperature range and timescale. Users are familiar with tracking dongles in the consumer market and expect to have at least the same functionality available for their goods in transit. Users also have the expectation that their service providers will minimise their environmental impact, so being able to demonstrate minimised emissions through route optimisation and vehicle efficiency is now part of the business of transport and logistics.

- eSIM and eUICC

Embedded SIM (eSIM) and embedded universal integrated circuit cards (eUICC) enable SIM functionality to be installed into devices at the point of manufacture so a global SIM can then initiate its own connection – known as bootstrapping – at the point of deployment. This means vehicle manufacturers, and the retrofit market, can ship global products with a single stock-keeping unit (SKU) designation. For transport providers this means their devices can turn on and automatically connect to the best available operator regardless of their location. This decouples the connection from the local mobile operator so organisations aren’t locked-in to contracts and have the ability to switch operators if coverage is poor or, with the 2G and 3G sunset, terminated. There’s no need to replace a physical SIM so money is saved and flexibility and scalability enhanced.

- Network performance

With the arrival of 5G and various categories of 4G, cellular connections now offer high-speed throughput alongside resilience and security. For many basic tracking apps, this capability isn’t needed or affordable but, for higher value shipments, the ability to continuously track and monitor is a monetizable business opportunity. At the lower end offerings such as narrowband-IoT and LTE Cat 1 bis, offer ample capacity to enable simpler transport and logistics functions.

These three dynamics have come together to enable a new degree of data transmission for the transport and logistics industry. This extends from connectivity in vehicles and also retrofitted equipment down to advances in sensor technology which can monitor temperature, shock and velocity while also tracking location down to the centimetre level, if required.

Future-proofing transport and logistics

The sheer volume of shipments demands greater management and connectivity simplification. Logistics providers can’t manage hundreds of relationships with different network providers, they need to simplify and automate to handle the scale and deal with the potentially very short lifespans of connections, which may exist only for the life of a single shipment or an adhesive label on a parcel.

In support, solutions need to accommodate greater intelligence to process useful data and send only relevant information for consumption. This might involve the richer insights detailed earlier or confirmation that an EV has been used for a delivery.

How KORE Wireless helps

KORE has been at the heart of delivering connectivity to IoT organisations of all types since the dawn of IoT. It currently covers more than 200 companies via relationships within excess of 500 carriers and sells its offerings to telematics equipment OEMs as well as transport and logistics service providers and their technology providers. The company offers a comprehensive range of connectivity and connectivity-as-a-service offerings which are augmented by its sector-specific offerings and its management platforms which include the KORE One Platform.

In the transport and logistics sector specifically, KORE has offerings that enable critical asset and cold chain monitoring, container tracking and reusable transport asset tracking. This portfolio encompasses managed services for visibility and traceability with actionable data that can help bring together the disparate elements of the fragmented global logistics sector.

The company’s innovative capabilities have enabled it to harness the potential of new developments such as eSIM and eUICC. For example, when AT&T and Verizon in the US announced their plans to retire 3G, eSIM would have enabled organisations to switch to the remaining 3G networks in that area, potentially enabling 10 months or more of additional usage by a device. This flexibility is important and, while Verizon has committed to LTE until 2030, changes in coverage and capacity availability continuously impact IoT applications. The ability to be able to switch to the best available network to support a business case is fundamental to the business success of IoT.

As fleets shift and electrify, further complexity is added and systems will be needed to manage the charging demands of vehicles. It is, however, unlikely that large trucks will turn to electrical power exclusively in the short to medium term but customers will want to be assured that environmental impact associated with their shipments is being minimised and this will need to backed up with data collected by advanced systems.

For transport and logistics organisations, KORE’s ability to provide multi-carrier connectivity ensures optimised coverage without the headache of having a customer organisation manage multiple carrier relationships in all the markets it operates in. KORE’s platforms automate and simplify management and operations vastly cutting the need for manual network tasks to be completed and freeing up resources for other activities. The diversity of KORE’s network footprint means customers can manage their global deployments and scale up or down easily with KORE as their one network.

A further benefit is that KORE is technology agnostic and is able to provide narrowband-IoT, LTE-M and LoRaWAN, in addition to 4G and 5G networks, to support low-power IoT devices and to ensure maximised redundancy and failover options in the event of network outages. This is a significant contrast to services provided by a global carrier which, regardless of the size of the carrier, will be delivered using a patchwork of preferred partners who are often in a position to shift blame amongst themselves and create obstructions to efficient service management. Global carriers simply can’t offer the optimum coverage and capacity for every application in every market in the world through their relationships.

KORE’s aim is to abstract the complexity and fragmentation of global connectivity away from customers so they can focus on their core business of service delivery and customer satisfaction. KORE has designed its coverage, management and service offerings to achieve this and free up IoT companies in all industries to focus on their innovations, not the network connectivity.

Comment on this article via X: @IoTNow_

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.iot-now.com/2024/04/03/143682-increased-transport-and-logistics-complexity-demands-simpler-faster-and-easier-cellular-connectivity/