When scientists split the atom, some predicted it would usher in a utopia, others the apocalypse. Now, we know how they felt. Artificial intelligence is suddenly the most talked about advance in decades. Some say it will solve the world’s problems, others that it will end civilization as we know it.

Reality usually lands between those two extremes. But AI certainly has the potential to change the world in meaningful ways. As investors, we need to think about how to incorporate it into our portfolios. This is a big subject, so I’m dedicating three posts to it: How to Invest in AI (this post), How Businesses Will Use AI (second post), and How AI Will Improve Investing (third post). Let’s dive in.

What is Generative AI?

The colloquial term “AI” refers to something more formally called “generative artificial intelligence,” which consists of computer algorithms that have been trained on data to create new content on demand. The content could be text, music, programming code or many other things. An AI tool named DALL-E will even create original artwork for you!

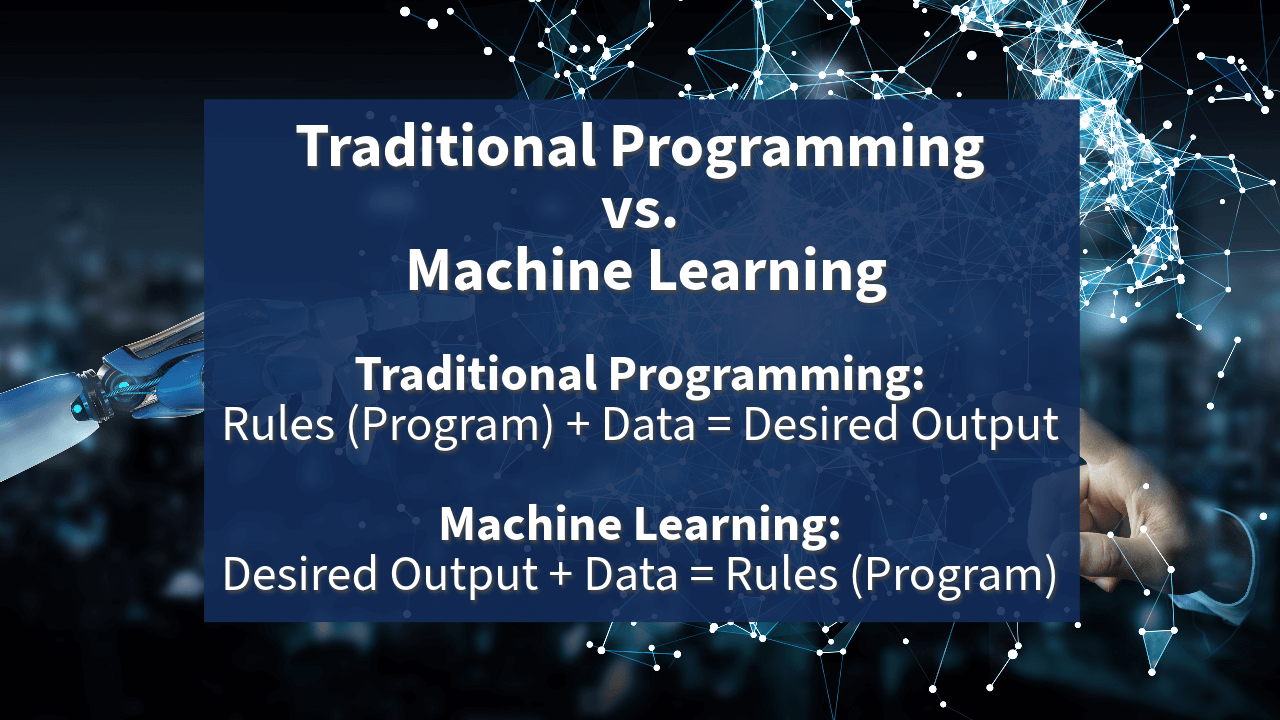

Some descriptions I’ve read of AI relate it to computer programming. Traditional programming involves giving a computer rules (the program) and data so it can produce a desired output. Conceptually, AI is more like giving the computer a desired output and data and letting the computer figure out the program. This is also called machine learning, and it turns the traditional model on its head.

The AI algorithm pores through its dataset—whether publicly available or private—and “learns” from the patterns it finds. Once the algorithm is in place, the learning process does not require explicit human direction. And after it has learned, the algorithm can begin responding to human queries through a graphical interface or voice assistant . Learning can continue through more queries, feedback and new data, so that the algorithm evolves as it ages, sometimes in unpredictable ways.

If traditional programming is like teaching a dog to perform tricks, AI is like sending a child to school and waiting to see what it will do.

Are you frightened yet? After all, kids sometimes go bad. But while AI obviously brings up the specter of HAL, the computer that decides to overthrow its human handlers in the 1968 film 2001: A Space Odyssey, we haven’t seen anything like that with the current crop of AI . The more likely (and hopeful) outcome is that AI will make much of human work more productive and interesting.

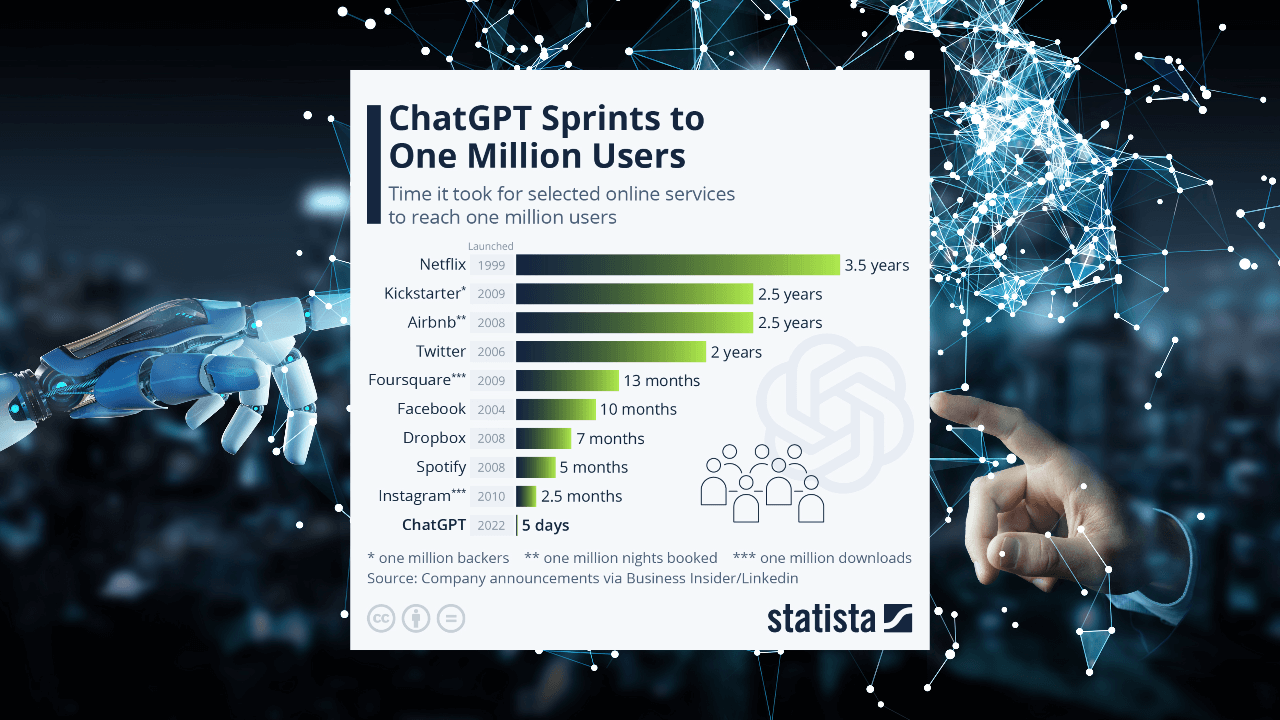

ChatGPT—the tool that kicked off the current mania for AI—was developed by OpenAI, a firm backed by Microsoft, at a development cost estimated to be in the millions. It launched in November of 2022 and hit 100 million downloads in a matter of days. It’s a “chatbot” that can converse with you on virtually any topic imaginable. I asked it for a stock tip, but all it gave me was something that read like the fine print of a disclosure page, so it still has limitations.

There are other chatbots out there, such as BERT and BARD (acronyms are a big part of this space), both from Google, as well as hundreds of more specialized AI tools that can produce everything from medical imaging analyses to weather forecasts. And voice assistants like Siri and Alexa have been using AI technology for years. But ChatGPT is the tripwire that caused the current explosion, as the figure below shows.

Image Source: Statista (https://www.statista.com/chart/29174/time-to-one-million-users/) (background added)

We all know what kind of fortunes were amassed by many of the names in that list. As a finance guy, I have to wonder what kind of returns are going to accrue to the AI explosion, and how investors can extract a share. Let’s explore that.

The Business Side of AI

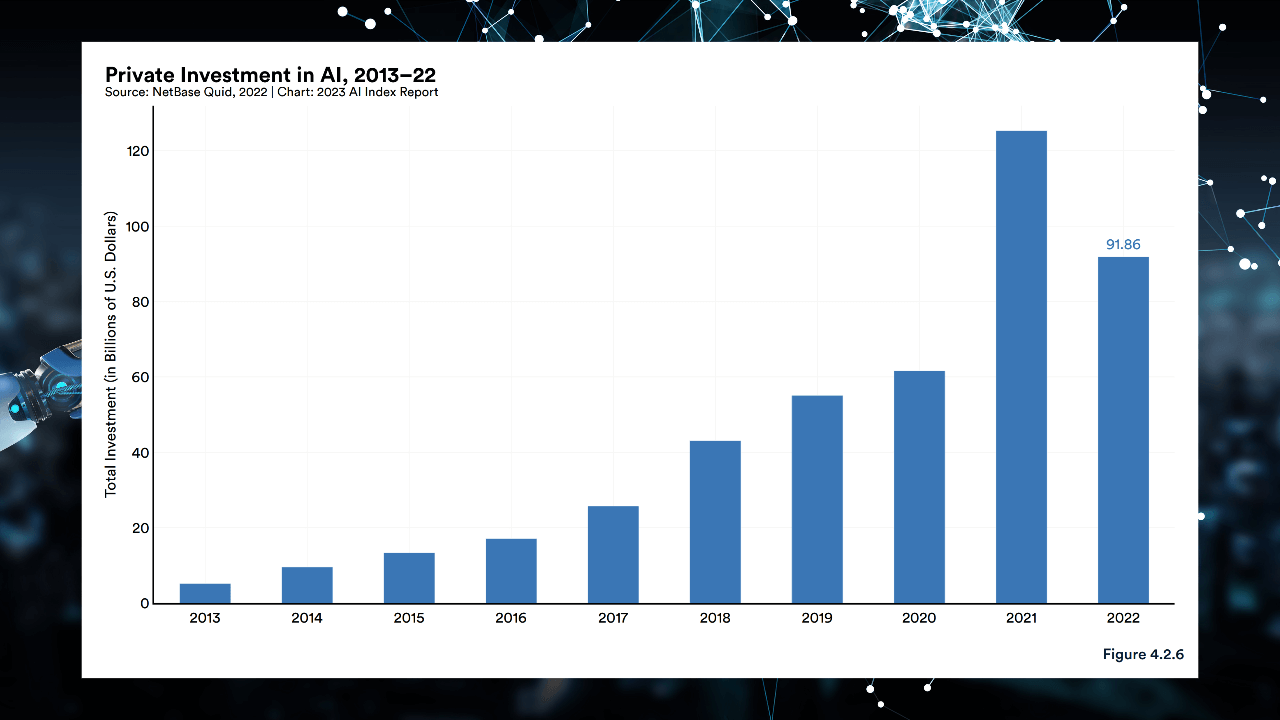

The AI universe is massive and fast-growing, with a huge amount of private capital already pouring in. According to a report from the Stanford Institute for Human-Centered Artificial Intelligence, private investment in artificial intelligence in 2022 was $91.86 billion. That was 18 times greater than in 2013.

Image Source: Stanford Institute for Human-Centered Artificial Intelligence report on AI (https://aiindex.stanford.edu/report/) (background added)

At the same time, that figure of $91.86 billion was actually a 26.7% decline from 2021. It’s a somewhat mystifying drop, but it mirrored a 10% decline in the raising of private capital globally, something I’ve written about (Private Equity in a Recession | A Simple Model). It’s possible 2021 was simply an outlier because of a post-covid rebound of pent-up investment. At any rate, few expect another decline in 2023 for AI, especially since ChatGPT launched after the data from Figure 3 was aggregated.

So far, the United States is dominating the AI space, accounting for $47.36 billion of the 2022 private investment total. China is second with $13.41 billion. Healthcare is the number one sector with $6.1 billion. This reflects a great hope for the potential for AI to improve the diagnosis and treatment of disease. Data Management, Processing, and Cloud is in second place with $5.9 billion, followed closely by FinTech with $5.5 billion. The list goes on, and it’s hard to imagine an industry that AI will not impact heavily as it continues to progress.

Investing in AI

An obvious way to invest in AI is backing the companies that produce the algorithms themselves. But questions abound. Will large existing players like Google, Meta and Microsoft dominate the value extraction long term? Or will small, upstart ventures retain a sizable share of the market?

Either way, investment in software companies producing AI algorithms is only one, albeit central, piece of the full value chain available to investors looking to profit from AI. Upstream is a sprawling ecosystem of computer chips, storage drives and data centers, as well as the information itself on which AI trains (these algorithms consume data like Joey Chestnut does hot dogs). Downstream is a whole web of consultants, such as “prompt engineers,” who want to help businesses figure out how to implement and better use AI. Additionally, some AI algorithms have manufactured components integral to their use, such as wearables, self-driving vehicles and smart robots used in manufacturing.

The more you think about AI, the more the investing possibilities multiply. An investment director at GAM advocates seeking out manufacturers of the “picks and shovels” critical to AI. (https://www.reuters.com/technology/investing-ai-how-avoid-hype-2023-05-26/). This is an upstream strategy which could include current (and already profitable) makers of data-storage hardware and computer chips. Similarly, Kyle Bass of Hayman Capital Management has been publicly advocating investment in data centers (Kyle Bass Says Invest in Data Centers to Capitalize on AI – Bloomberg), which appear scarce in view of the massive demand for server farms and related infrastructure to support AI development and use. “People that are developing data centers,” he said, “don’t even get them developed before one of the FAANGs leases it for 30 years.”

This is a good place to emphasize that investing in AI can be tailored to the expertise, size and appetite of any investor. Bass’ recommendation is ideal if you understand real estate. If you understand manufacturing, investigate the world of smart robots. If you understand business services, AI consultants will be critical in the coming years.

Another way to approach AI is by sector. Investors who already possess expertise in an industry—healthcare, fintech or just about anything else—should leverage their existing industry knowledge and relationships to explore the ways AI is affecting their sector and any opportunities or dislocations that creates. In healthcare, for example, the Mayo Clinic is already testing a Google Cloud tool that will let them create their own bespoke chatbots and train them on private data. In fintech, old-fashioned algorithmic trading (how crazy does that phrase sound?) could take a quantum leap with AI’s ability to find subtle patterns hiding in massive sets of data.

All of which is to say that in the next ten years, the impact of AI on the economy will be pervasive. But it’s important to remember that the best investments are often the closest to home (i.e., in areas and applications you know well and feel comfortable with, even if the technology itself is new). There are also almost certainly AI productivity implications for companies already in your portfolio , and we will discuss this topic in more detail in the next post.

Conclusion: Get in on the Party, But Don’t Drink the Spiked Kool Aid

Here’s the catch: We are now in the exact environment in which hype, overvaluation and speculative bubbles grow. As we continue to wrap our heads around AI and open our portfolios to it, don’t lose your capacity for skepticism. AI may turn into a replay of the 2000 dot.com bubble, in which companies high on promise and low on profits were bid into the stratosphere before crashing to earth. If someone tells you it won’t happen this time because AI is for real, remember two things. One, that is exactly what people say when speculative bubbles form. Two, AI is for real, but so was the Internet in 2000. Bubbles don’t form because there is no value in something, but because there is value. It just gets bid out of its rational range.

With that said, don’t be afraid of AI. Just move cautiously, avoid hype like the plague and try to stick to areas where you have prior knowledge and relationships to leverage. Our ASM community is built on informed decision-making, careful modeling and rational valuation, and as always, there’s no shortcut around those things, even in the age of AI.

Have you come across an interesting potential investment related to artificial intelligence or a novel use of the technology in private equity investing or portfolio company management? Reach out to us at info@asimplemodel.com or through one of the channels below and tell us more – we’re always looking for new opportunities and examples to incorporate as we continue the discussion around AI.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.asimplemodel.com/insights/how-to-invest-in-artificial-intelligence