Electric vehicles (EVs) are steadily growing their market share at the expense of internal combustion engine vehicles. The growth is fuelled by several factors. Perhaps most importantly, prices for EVs have started to drop as competition in the industry is intensifying. New players and models are emerging, prompting several established EV makers to lower their prices. At the same time, governments around the world have made it clear that they view the electrification of transportation as a critical means of reducing carbon emissions and continue to implement new regulations to reduce the consumption of fossil fuels. In addition, a wide array of fiscal stimulus packages have been adopted, targeting investments in charging infrastructure and other aspects of electric mobility to increase the share of electric vehicles on the road, writes Berg Insight.

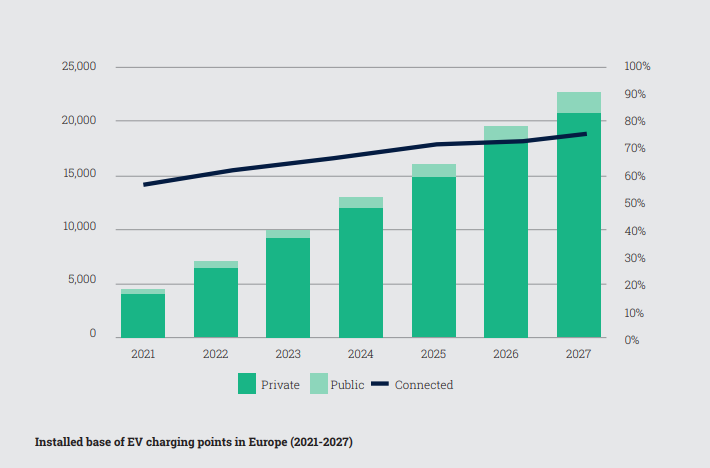

The EV charging market has grown significantly over the last few years, despite recent economic headwinds and supply chain-related challenges. The total installed base of charging points in Europe amounted to about 7.1 million in 2022, including around 0.5 million public charging points and 6.6 million private charging points. Private charging points include all dedicated charging points, excluding the public chargers defined as by the European Alternative Fuels Observatory (EAFO). Private charging points can be home charging points, workplace charging points and other charging points unavailable or partly available to the public according to EAFO’s definition.

EV’s role in future mobility solutions

Today’s market mainly comprises three types of EVs – battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs) and hybrid electric vehicles (HEVs). The batteries in BEVs and PHEVs can be charged using external power sources like household outlets or designated EV charging stations, while HEV batteries are charged through operating the vehicle. Charging stations are crucial to support the rapidly expanding fleet of electric vehicles, making the respective markets highly interdependent. The adoption of both needs to keep pace to reduce range anxiety and ensure a smooth driver experience.

The sales of new EVs have grown rapidly in the European markets for several years. In 2022, new BEV registrations in the EU+EFTA+UK region grew by 30% to 1.6 million vehicles. On top of this, 920,000 new PHEVs were registered in 2022. The trend has continued throughout the first half of 2023 too, with the combined sales of BEVs and PHEVs growing 28% compared to H1 of 2022.

The EV charging ecosystem

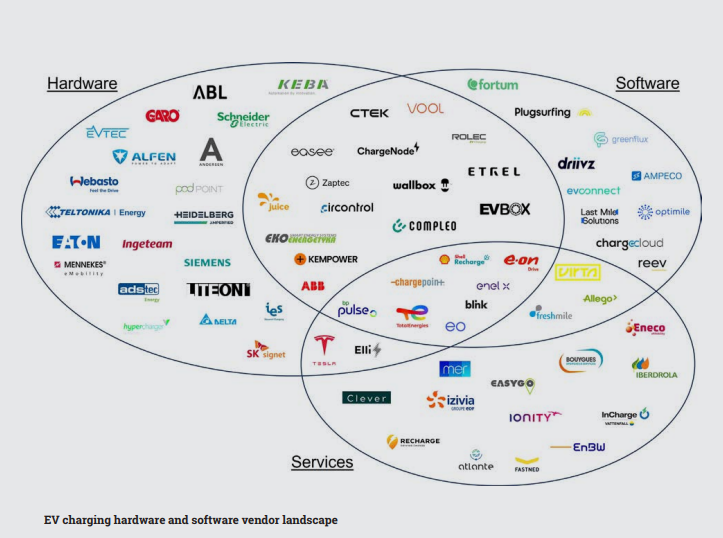

The EV charging market hosts a variety of different types of players. Several hardware providers are specialised EV charging station manufacturers focusing more or less exclusively on these products, with some even focusing solely on either AC or DC charging stations. In addition to manufacturers of EVs and EV chargers, the market includes players offering charging station management solutions, charging station operation and electric mobility services. The business scope varies, with some companies offering end-to-end solutions including hardware, software and services, while others specialise in a specific part of the value chain.

The two main service categories within the EV charging industry are charge point operators (CPOs) and e-mobility service providers (eMSPs). A charge point operator (CPO) manages one or several networks of charging stations. The operator does not necessarily own the charging stations but is responsible for maintenance, service and administration of the charging stations in the network. For example, a housing cooperative can install charging stations and contract a CPO to be responsible for keeping the chargers functional and to distribute the charging cost between the users of the charging stations.

E-mobility service providers (eMSPs) mainly operate in the public charging segment and offer EV drivers access to the charging stations in their connected networks. This is accomplished by providing means of authentication at charging stations like customer accounts, RFID cards or tags, and charging apps. In most cases, CPOs also act as eMSPs but there are examples of companies acting only as a CPO or an eMSP.

The basics of EV charging

The rate at which an electric vehicle is charged is measured in kilowatts (kW), and the EV battery’s capacity to store energy is measured in kilowatt-hours (kWh). There are two main types of EV chargers – AC chargers and DC chargers – named according to the type of electric current they supply to the vehicle. In Europe, a charger able to charge more than one vehicle simultaneously is often said to have multiple charging points.

AC chargers are simpler and feed the EV with AC power from the grid without major transformations. An on-board charger in the vehicle then converts the AC power into DC power that can be stored in the battery. In this case, the on-board charger is usually the limiting factor when it comes to the rate at which the battery can be charged.

DC chargers are generally larger and more complex as they convert AC power from the grid into DC power directly, enabling the charging process to bypass the vehicle’s on-board charger and feed electricity directly to the battery. In this case, it is either the battery’s structure or the DC charger that limits the rate at which the battery can be charged.

Energy optimisation

Charging station management software is used to improve the efficiency and user experience of charging. In private settings, management software enables drivers to plan charging sessions, log power consumption and keep track of costs. The solutions also provide alerts to warn in case of malfunctions as well as functionality to share the charging stations and to assign cost to the right user.

Another important aspect of charging station management is energy management. Energy management solutions allow for monitoring and management of the charger’s electric consumption and adapt it to the limitations of the local grid connection. Load management features can distribute the charging load between charging points and the rest of the local grid to reduce the risk of overloading fuses and power outages.

Demand response solutions adjust the power consumption from the chargers to limit the strain of the power grid. For example, charging can be scheduled to occur on off-peak hours for the grid when prices are lower. Modern energy management tools can also consider the contributions from local power generation and energy storage solutions, like batteries or EVs capable of bi[1]directional charging. The case for smart charging and load balancing functions has become even stronger in view of the increasing energy costs.

Secure firmware updates ensure optimal performance

The demand for smart and convenient charging station features underscores the necessity for manufacturers to futureproof their products to ensure optimal performance. A critical component of futureproofing efforts is the implementation of secure firmware updates. Firmware updates can ensure that the chargers are compatible with new EV models, as well increase the reliability of or the chargers by minimising downtime. Similar to any connected device, charging stations are susceptible to cybersecurity risks. Manufacturers can address vulnerabilities in the charging station’s software through firmware updates and ensure that it remains secure against potential threats.

Cellular connectivity offers flexibility and independence

EV chargers commonly feature some type of connectivity, such as cellular, Wi-Fi or fixed connectivity. In a private setting, cellular connectivity offers distinct benefits to other options. If a CPO is responsible for the charging station, connecting it with cellular connectivity removes potential limitations and uncertainties related to using a third-party network. Wi-Fi coverage may be limited or easily disrupted at the installation site and wired connections may incur additional costs. Customers may also not prioritise improving Wi-Fi coverage as few other devices need a connection where EV chargers are installed. Cellular connectivity enables the chargers to be installed where they are most useful to the driver and not where connectivity is available. Additionally, it offers a more reliable and independent connection to the charger, which helps improve the service level.

EV charging will benefit from eSIM localisation

Cellular connectivity is an essential enabler for remote charging station management, which must be further optimised for coverage, performance and security to match the requirements for the deployment. Traditional roaming can meet the requirements for applications with low to medium data volumes but may lack support for connectivity across multiple networks in any given country. Local sourcing of SIMs from local mobile operators is always a possibility, but the model becomes increasingly complex when scaling to a growing number of countries.

eSIMs address the shortcomings of traditional cellular connectivity solutions by enabling over-the-air management of multiple operator profiles without having to replace the physical SIM itself. As the operator selection and personalisation is moved to the post[1]deployment stage, manufacturers can buy large batches of eSIMs and install them in their chargers without deciding which operators to use. With eSIM technology, the chargers can automatically scan networks and download the most suitable operator profile at the installation site when turned on. Thus, eSIM technology can both simplify manufacturing and installation processes, but also future proof the device against changes in network coverage.

Using a single cellular connectivity provider offers several benefits that streamline operations and reduce complexity. A unified platform for managing connectivity centralises control of devices and services, making it easier to monitor, manage and troubleshoot the network, and provides one point of integration. With one provider, it’s also easier to ensure that all devices adhere to the same security protocols and regulatory requirements, reducing the risk of breaches that can occur due to inconsistent security measures

Interoperability strengthens the EV charging value chain

The fragmentation of the EV charging market creates significant challenges relating to interoperability between the various products and solutions. An important means of mitigating the problems arising in the diversified EV charging market is the open charge point protocol (OCPP), which gives hardware from different vendors a common language for communication with charging station management software. This allows companies to specialise in their segment of the value chain, like charging hardware, software or services. The OCPP also opens up the market for players like CPOs and enables them to use hardware that suits their different installation sites and management software that suits their operation. In addition, a standard communications protocol reduces technological lock-in and reduces the risk of choosing new, untested suppliers.

The future of EV charging and home energy management systems

Future home energy management systems are likely to utilise the battery in electric vehicles as extra backup or even replacing home batteries. Vehicle-to-grid (V2G) or vehicle-to-home (V2H) are systems where the vehicle can send back power from the battery. This requires an EV charger that features bi-directional charging. It may also require an upgrade of the home’s electric system to enable disconnection from the grid. Bi-directional charging functionality is starting to be introduced in new chargers. A typical EV has a battery with a capacity of about 67 kWh. High-end EV models may have batteries with a capacity of well over 100 kWh. In comparison, battery storage systems for residential applications typically have a capacity of 5–15 kWh. Due to the size, an EV battery could power a home for several days in case of a blackout, whereas a typical home battery would last only for a day.

Comment on this article via X: @IoTNow_

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.iot-now.com/2024/03/28/143572-enhance-ev-charging-performance-with-cellular-connectivity/