Running a business is hard. Running a cash-intensive business like eCommerce is even harder. Many eCommerce businesses close shop not because they aren’t selling products but because they run out of cash and can’t order more inventory.

Small businesses have a limited budget, so every dollar you spend matters. By having a solid financial understanding of your business you can make sure you’re spending dollars where they’re most beneficial. That’s exactly what accounting will help you do.

Let’s explore the essentials of eCommerce accounting and how the right financial practices can grow your online business.

Table of Contents

What Is eCommerce Accounting?

eCommerce accounting is the critical practice of recording, organizing, and managing all of the financial data and transactions relevant to an eCommerce company.

When done properly, accounting tells you how healthy your eCommerce business is. It can show you:

- Sales and Revenue Tracking: Recording all incoming sales and revenue generated through online transactions.

- Inventory Management: Keeping track of the stock of products for sale, ensuring accurate valuation, and updating inventory levels in real-time as sales occur.

- Cost of Goods Sold (COGS): Calculating the direct costs associated with producing or purchasing the products that are sold. This includes costs like raw materials, production expenses, and shipping costs.

- Payment Processing Fees: Tracking fees charged by payment gateways and payment processors.

- Taxation: Complying with tax regulations and calculating the taxes applicable to eCommerce transactions, which can be complex due to different tax rules across regions and countries.

- Customer Returns and Refunds: Handling accounting entries for product returns, refunds, and chargebacks, ensuring that the financial records accurately reflect these activities.

- Financial Reporting: Preparing financial statements, such as income statements, balance sheets, and cash flow statements, to assess the financial health of the eCommerce business.

Accurate, timely, and comprehensive eCommerce accounting is crucial for making informed decisions. By understanding the true state of your business you can grow even with financial constraints.

How Does an eCommerce Owner Learn eCommerce Accounting?

If you want to become an accounting master, you’re going to need to start by becoming your own best bookkeeper. When you have clean, organized financial documentation you’ll be in a better position to understand, interpret, and apply the information.

Step 0: Generate Financial Documents

Before you can master eCommerce accounting you have to get in the practice of producing financial documents and start doing so each month.

The three primary financial documents for an eCommerce business are:

- Income statement – a snapshot of how much you’ve earned

- Balance sheet – the assets your business owns and the amount you owe to creditors

- Cash flow statement – the amount of cash entering and leaving a company

Step 1: Familiarize Yourself with Primary Financial Documents

The income statement, balance sheet, and cashflow statement provide a comprehensive picture of your business’s financial health.

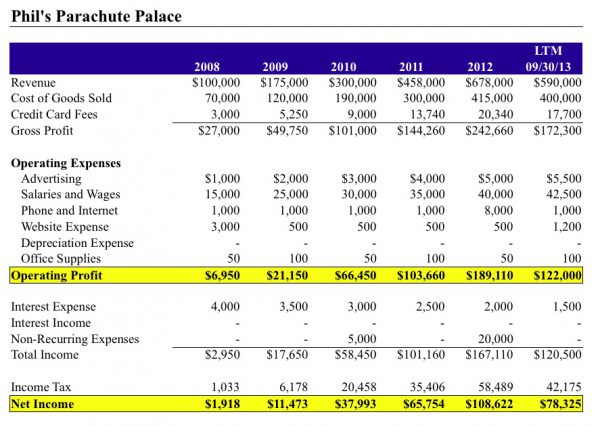

An income statement, also known as a profit-and-loss (P&L) statement, shows what your company earns, what it spends, and if it’s making a profit over a specific period of time. An income statement shows the following:

- Revenue

- Cost of goods sold/cost of sales

- Gross profit or contribution margin

- Operating expenses or selling, general and administrative expenses (SG&A)

- Operating income

- Non-operating items

- Earnings before taxes (EBT)

- Net income

The balance sheet shows the assets your business owns and the amount you owe to creditors at a specific point in time. A balance sheet shows the following:

- Current assets

- Fixed assets

- Current liabilities

- Long-term liabilities

- Shareholders’ equity

Lastly, the cash flow statement is crucial, especially for inventory-based businesses, as it tells you how much cash you’ve gained or lost for a certain period. A cash flow statement will track the following:

- Receipts from sales of goods and services

- Interest payments

- Income tax payments

- Payments made to suppliers of goods and services

- Salary and wage payments

- Rent payments

- Other expenses

These financial reports allow you to identify major warning signs and monitor the performance of your business.

For those eager to gain more knowledge about these documents, a recommended resource from the eCommerceFuel community is the book “Financial Intelligence for Entrepreneurs.” 📚

Step 2: Do Your Own Accounting

The second step involves doing your own accounting for a few months. It might be time-intensive and not necessarily the best value-add activity for most eCommerce entrepreneurs, but this process allows you to understand how these financial documents come together and how real aspects of your business show up on these financial documents.

Once you have a solid grasp of these documents, it’s time to hire a bookkeeper to generate these on a monthly basis. Having someone do this for you will enable you to focus more on marketing, operations, product development, and other critical aspects of your eCommerce business.

Do You Need an Accountant or a Bookkeeper?

You don’t need either an accountant or bookkeeper. However it is common to hire a bookkeeper, at least part time, as your business grows.

While an accountant and a bookkeeper both play significant roles in managing your eCommerce finances, their responsibilities differ.

What Does a Bookkeeper Do?

A bookkeeper gathers all your financial documents (like bank accounts and credit card statements), ensures their accuracy and completeness, then organizes them systematically in eCommerce accounting software like Xero or QuickBooks (more on software below).

Reviewing your statements, they generate financial documents such as:

- Income statements

- Balance sheets

- Cash flow statements

In essence, bookkeepers are financial organizers.

What Does an Accountant Do?

Rather than simply collecting financial information, accountants help you interpret it. They often assist with tax planning, cash flow management, and tax strategy.

A good accountant helps you structure your finances and spending to minimize your tax bill. They might guide you on making investments or taking advantage of tax programs or deductions that can reduce your tax liability.

In essence, accountants are financial consultants.

Start By Doing Your Own Bookkeeping

Many small business owners choose to handle their own bookkeeping, then hand it off to an accountant at tax time.

As your business grows and you have more and more financial transactions you’ll want someone to handle the bookkeeping for you. A part-time bookkeeper is very common in the eCommerceFuel community.

Planning for Growth with an Accountant

As your business continues to grow, you will want to bring on an accountant to help you make more important financial decisions such as which loans to take out and when.

One of the biggest challenges for growing eCommerce businesses is managing cash flow. A good accountant can help predict potential cash shortfalls and advise on financial options to sustain growth.

How An Accountant Could Help Your eCommerce Business

What is Cash-Based Accounting and How does it Differ From Accrual-Based Accounting?

Cash-basis accounting is the simplest type of accounting, and is where most eCommerce owners start. It merely tracks the cash that comes in and out of your business.

However, this simplicity comes with a downside: it’s the least accurate.

A more accurate picture of the financial health of a business can be obtained by using accrual-based accounting, which matches up the timing of sales with the related costs, taking into account inventory costs at the time of sale, rather than at the time of purchase.

💡 Tip: Accrual-based accounting is almost required if you’re going to sell your business. One of the members inside ECF shared this after selling her business (link for ECF members-only):

If your financials aren’t accurate, get ready for a world of hurt. This could affect your multiple, the cash you are expecting from a sale, your inventory numbers, the length of time it takes to close, etc… Making sure your books are accrual based and have accurate COGS especially are so important.

Can an Accountant Forecast Major Expenses? AKA Cash Flow Management

Forecasting major expenses is a crucial aspect of eCommerce accounting. Owners will often want to order large quantities of inventory for better bulk-pricing and efficient shipping costs. But it can be hard to know exactly how much you can afford to try to hit those bulk-pricing discounts.

Accountants can create financial projections to help you visualize the financial breakpoints, how much debt you’d take on, and how much you’d have to pay each month for these large inventory purchases.

[embedded content][embedded content]

Accountants can also help you set up separate business bank accounts for different types of purchases. It’s common to have a separate account to save up for large capital expenditures. This helps keep funds organized and makes it easier to spot necessary amounts.

Can An Accountant Estimate and Pay Taxes?

If you’re running a successful eCommerce store you should already pay quarterly tax estimates to the government. To do that accurately you need a rough idea of your sales tax rate, how fast your revenues and expenses are growing, and how much you’ll owe in taxes.

You can hire an accountant for this around tax time, or a part-time accountant on your team can keep your estimated payments updated as you go through the year.

Finding the Right eCommerce Accounting Support for Your Business

Locating the right accountant or bookkeeper can be a tough endeavor. Word-of-mouth referrals from peers in similar businesses can be a fantastic resource in this regard.

Furthermore, communities of like-minded members, such as eCommerceFuel or other eCommerce associations, can also provide recommendations based on personal experiences.

It’s crucial to remember that the best fit for your business can change over time as your business grows and evolves. If you find that your current accountant isn’t as proactive or knowledgeable as your growing business requires, don’t hesitate to seek out other options, even if it means spending a little more.

Specialized eCommerce Accounting: A Worthy Investment?

Given the numerous nuances in eCommerce, it’s beneficial to engage an accountant who specializes in this domain. Having an accountant with a firm grasp of accrual accounting can be a game-changer for inventory-based businesses like eCommerce merchants.

eCommerce Accounting Software

To be able to understand the essential financial documents you need accounting software to help you generate the right financial reports in the first place.

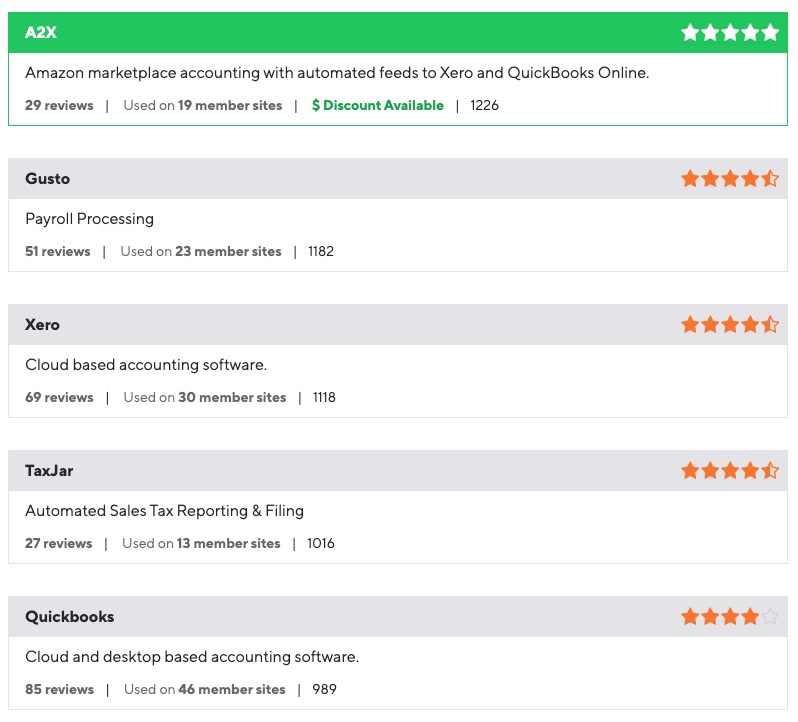

Selecting the best accounting software for your eCommerce business depends largely on your specific needs. Some popular options include A2X Accounting, QuickBooks, Xero, and others.

A2X Accounting serves as a bridge between your eCommerce platform (like Amazon or Shopify) and your accounting software, ensuring your data is clean and organized.

QuickBooks and Xero are comprehensive cloud-based accounting platforms, both offering robust features to manage your books effectively.

TaxJar is another useful tool for automating sales tax reporting and filing, while tools like Finale Inventory and Inventory Planner can significantly streamline your inventory management.

In the age of automation, platforms like these can prove to be vital components of your financial stack.

The eCommerceFuel community takes reviews seriously. We review software specifically with the lens of helping other eCommerce owners make the best decisions. Here’s a sneak peak of our review directory showing the top results for accounting software.

🙋♂️If you want to read the reviews and see the sites that use these services apply today to become a member of the eCommerceFuel community.

Final Thoughts: eCommerce Accounting

Strategic financial management is not a luxury but a necessity for every eCommerce business. You have to have someone on your team who can allocate money where it grows your business quickly without taking on too much debt.

As an owner that may be your job although an accountant can also help you with that. A bookkeeper will help you keep your financial documents organized and accurate.

With the right guidance, regular financial reviews, and suitable software tools, your business can not only sustain itself but thrive in the competitive eCommerce landscape.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.ecommercefuel.com/ecommerce-accounting-guide/?utm_source=rss&utm_medium=rss&utm_campaign=ecommerce-accounting-guide