Accounts payable software are increasingly being used by businesses worldwide. Automated accounts payable software can efficiently manage large volumes of financial transactions between a company and its suppliers.

There are a variety of AP software available today, with varying levels of functionalities and features. AP automation software that are available off the shelf today are either standalone products or a part of full stack accounting ERPs.

Given the number of accounts payable software available in the market, it may be difficult for companies to choose one. A company’s choice of AP automation software depends upon its features and the specific needs of the company.

In this article, we look at the most popular accounts payable software and their features.

What is accounts payable software?

Accounts Payable (AP), commonly referred to by accountants as “payables,” are the company’s pending short-term debt and liabilities owed to vendors, suppliers, or creditors.

Originally considered a transactional back-office function, the AP process is now considered a hub for critical financial data processing.

The AP process begins with the receipt of the invoice, passes through various levels of categorization, coding, data matching, and approvals, and ends with the payment of the invoice.

According to Insider, manual accounts payable processes can take 30 to 90 days. This long timescale arises from interoperability between the steps and the time delays in to-and-fro transitions.

The use of accounts payable software results in a 73% faster processing time. According to Goldman Sachs, the use of accounts payable automation software also results in 33% reduction in processing costs.

Another compelling driver of AP automation is the elimination of errors. each person in the world, on average, is responsible for 139 faulty invoices every year, which can be avoided with the use of AP software.

Not surprisingly, companies are increasingly adopting software tools for their AP processes. Brainy Insights reports that the global accounts payable automation market will grow to $7.5 billion by 2030.

Most tools automate the AP process end-to-end, and the best ones are customizable to meet the company’s needs. Such customizations would depend upon factors such as:

- the number of vendors or suppliers

- the volume (and amount) of payments expected to be made over a short period of time

- the types of documentation required to validate each purchase/transaction

Comprehensive accounts payable software solutions automate business payment processes from start to finish in accordance with custom instructions. Appropriate automated GL coding is enabled using filters, and multi-way match processes are factored before approvals.

Many AP software, however comprehensive, require that the data be available in recognizable digital formats. This is crucial for subsequent automated coding, matching, and approval processes.

AI-enabled accounts payable software like Nanonets can extract accounts payable data from various sources and convert them into structured digital information that can be further processed or fed into ERPs or databases.

There is no standard structure or function to accounts payable software. Some common features of AP software include:

- customizable AP workflows

- invoice categorization and batch processing of invoices

- approval processes

- 2, 3, or 4 way matching

- seamless expense claims

- custom user permissions

- providing AP metrics such as AP days, average invoice processing time etc.

- searchable document storage

- data export into ERPs

Advanced automated accounts payable solutions may support additional functionalities such as:

- supplier onboarding,

- tax and audit compliance workflows,

- security checks,

- payment discounts optimization,

- digital document matching,

- multi-currency transaction support,

- payments reconciliation, and

- cash management.

Looking to automate your manual AP Processes? Book a 30-min live demo to see how Nanonets can help your team implement end-to-end AP automation.

The top 17 AP software

Find below, a list of the top 17 accounts payable software platforms that are available off-the-shelf today, and their specialized features.

Flow

Core competency: end-to-end automated AP management – import, approve and pay invoices in the same platform

Features:

- Easy-to-use dashboard for invoices, approvals and payments

- 1-click approvals on mobile, email and Slack

- ACH, wire and multi-currency payments available

- AI-enabled security features – duplication detection, fraud prevention, payment tracking

- Fully customizable approval policies

- Invoice storage in the cloud

- Integrations with Quickbooks, Xero, Sage, NetSuite and SAP

- Flat one-time pricing – no cost scaling with users

- Target Users: Small to medium businesses, accounting firms, multi-country businesses

Price Range: $

Bill.com

Core competency: create and pay bills, send invoices, and get paid

Features:

- Unified dashboard

- Mobile app

- Intelligent Virtual Assistant technology to detect duplicate invoices.

- Integration with other software available for higher priced versions

- Data Storage: On premises

- Target Users: Freelancers, self-employed professionals, small businesses, independent accountants

Price Range: $

Airbase

Core competency: Bill Payments, Corporate Cards, Expense Reimbursements

Features:

- Unified dashboard

- Approval Workflows

- Accounting Automation

- Real-time Reporting

- Multi-currency support for Xero.

- Multi-destination mileage reimbursements.

- Unique transaction identifier.

- Bill filters for virtual card payments.

- Receipt reminder period.

- Integration with multiple Accounting software

- Data storage: On premises

- Target users: Freelancers, self-employed professionals, small businesses, independent accountants

Price Range: $-$$

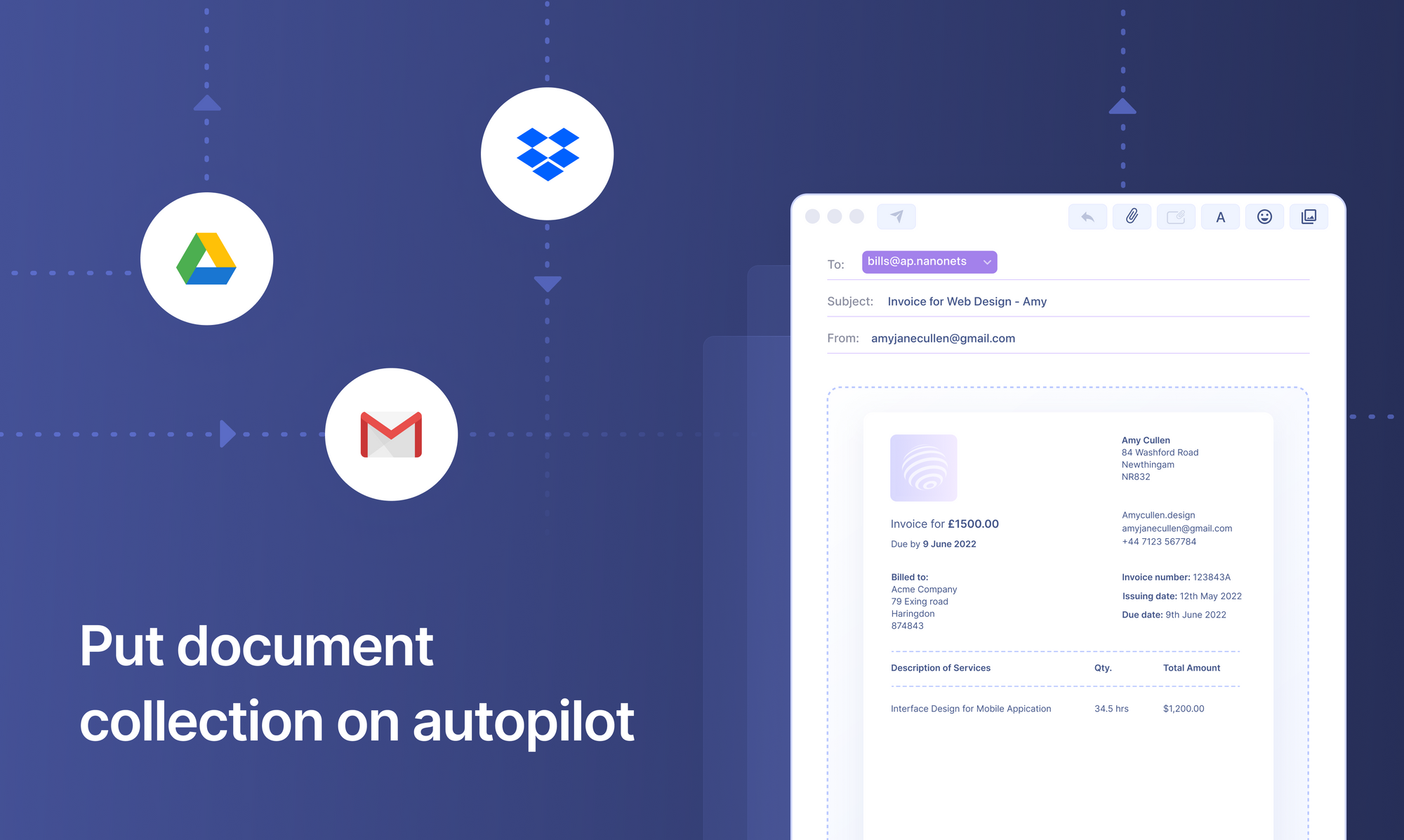

Nanonets AP Automation

Core competency: automate data capture, build workflows and streamline existing AP processes end-to-end

Features:

- Automated data entry

- Email bills fetched

- Extract line item data, match and reconcile invoices/receipts/POs

- Set up rules for validations & approvals

- Expense workflow

- Integrate seamlessly with ERPs (Salesforce, Quickbooks, Netsuite, Yardi, Entrata, Dynamics, etc.), cloud storage services (Drive, Dropbox, email, etc.), and databases (MySQL, PostGres, MSSQL, etc.)

- Zapier connector to automate end-to-end workflows

- Target users: Small to medium businesses, large enterprises with legacy ERPs, accounting firms, multi-national businesses

Price Range: $-$$

Set up touchless AP workflows and streamline the Accounts Payable process in seconds. Book a 30-min live demo now.

FreshBooks

Core competency: Automated accounting

Features:

- Unified dashboard

- Easy customization of Chart of Accounts

- Double-entry accounting

- Electronics document storage on cloud

- Accounting Metrics

- Accounting reports

- Data storage: Cloud

- Target users: Freelancers, self-employed professionals, small businesses, independent accountants

Price Range: $-$$

QuickBooks and QuickBooks Online

Core Competency: Business payments, manage and pay bills, and payroll functions

Features:

- Intuit Merchant Services for payment processing

- Remote access capabilities, remote payroll assistance and outsourcing

- Bank reconciliations

- Pre-authorization of funds

- Seamless integrations with third-party add-ons for accounts payable automation through the QuickBooks Apps Store.

- Data storage: On premises for QuickBooks, and in the cloud for QuickBooks Online

- Target user: Small and mid-market companies

Price range: $-$

Stampli

Core Competency: AP communication, documentation, and payments

Features:

- Real Time capture of invoice data with AI support

- Duplicate detection

- Built-in calculations

- Approval routing

- 2- and 3-way matching

- Data storage: Premises

- Target user: Small and midsized companies

Price range: $-$$

Tipalti

Core Competency: Accounts payable, procurement and global payments AI-driven automation software for businesses.

Features:

- Multi entry architecture

- Financial controls

- Payment API

- 2- and 3-way Matching

- Currency management

- Payment reconciliation

- Fraud detection

- Data storage:Cloud

- Target user: Small businesses to medium-sized companies

Price Range: $$

Microsoft Dynamics 365

Core Competency: Accounts payable solution with ERP

Features:

- Modular prebuilt applications

- Connectivity to Microsoft 365, Azure, LinkedIn, and other sources

- AI-enabled customer insights

- Bring together financial, behavioral, and demographic data

- Adaptive AI that continuously monitors evolving fraud patterns.

- Task automation with Robotic Process Automation (RPA)

- Data Storage: Cloud

- Target user: Small businesses to large corporations that use Microsoft products

Price Range: $-$$$

AvidXchange

Core competency: invoice automation, purchase order software and bill payment software

Features:

- integrates with over 220 different accounting programs

- 7-year storage

- OCR

- AI-enabled

- Reporting functions

- Invoice routing and approval

- Data Storage: Cloud

Price Range: $-$$$

Docuware

Core competency: invoice automation

Features:

- integrates with over 500 different accounting programs

- automated import and indexing routines for data capture

- Barcode recognition

- Data enrichment through metadata

- AI-enabled

- Reporting functions

- Data Storage: Cloud

Price Range: $-$$

Zoho

Core competency: Core accounting, stock tracking, bank reconciliation, automating workflows,

Features:

- End to end accounting

- GST compliance

- Integrated platform

- Mobile app

- Data Storage: Cloud

Price Range: $-$$$

Book this 30-min live demo to make this the last time that you’ll ever have to manually key in data from invoices or receipts into ERP software.

Epicor ECM AP Automation

Core competency: Capture of text from scanned or photographed invoices and automatically find matches in Kinetic (new name for Epicor ERP) or Prophet 21.

Features:

- Easy customization

- Intelligent data capture

- Advanced workflow with graphical interface

- Audit trail

- Email alerts

- Integration and functionality of key modules such as Epicor CPQ, Quick Ship, Epicor ECM, Advanced MES, and Epicor ECC.

- Data storage: On premises and cloud

- Target users: Large scale manufacturers, distributors, retailers, featuring supply chain and manufacturing

Price Range: $$-$$$

Lightyear

Core Competency: Cross-platform automated accounting and inventory sync capabilities.

Features

- Data Extraction

- Automated bookkeeping

- PO creation

- Automated 3-way match

- Multi Tiered approval

- Integration with accounting, ERP and Inventory software

- Export API/CSV

- Statement Reconciliation

- Data storage: Cloud

- Target users: Large and multiteam companies with multiple locations and/or products

Price Range: $$-$$$

Sage Intacct

Core Competency: AICPA-endorsed ERP accounting software system

Features:

- Designed for non-profit companies

- Easy customization

- Automated payables workflow

- Realtime tracking of payments, approvals and reports

- Integration with third party AP apps

- Data storage: Cloud

- Target User: NGOs, charities, schools, and faith-based organizations

Price Range: $$-$$$

NetSuite

Core Competence: A unified business management suite, encompassing ERP/Financials, CRM and ecommerce.

Features:

- Easy customization

- Real-time visibility to the invoice-to-pay process

- Accounting reports

- Accounting analytics

- Information sharing among different departments

- Seamless integration with other AP software

- Data storage: Cloud

- Target user: Pre-revenue startups to small and mid-sized companies

Price Range: $$$

Oracle EPM Cloud

Core Competency: Resource planning, budgeting, and forecasting.

Features:

- Easy customization

- Inclusive and transparent dashboard

- Complete EPM suite to align financials with business operations

- AI and ML driven advanced software

- Integration with EnterpriseOne software for consolidating financials or streamlining reporting.

- Data storage: Cloud

- Target user: Mid- to large-sized companies with intensive accounting needs

Price Range: $$$

Apart from the above, SAP is another high end ERP system that stores data in the cloud. It targets mid-sized and large companies and has a price range comparable to Oracle. Accounts payable software like Xero are similar to Quickbooks online, and are suited for small businesses. Beanworks is another cloud-based accounts payable automation application designed for businesses of all sizes and deals with real-time cash flow management, approval management, and bill management tools Basware automates the entire invoice process along with automated workflows and matching. Papersave AP automation, Melio and Fastpay are other popular AP automation tools that are used in the industry today.

Tired of manually entering data into ERPs or accounting software? Let us show you how you can automate your entire AP data workflow in seconds.

The automated accounts payable solution to be used in an enterprise must match its work style and requirements.

It must ideally include data capture, invoice processing, automated approvals, and payments.

The basic features that must be sought when looking for an AP automation software include:

Match with the AP workflow of the enterprise

An ideal AP tool must fit into the existing AP processes of an enterprise. It must optimise the existing setup without requiring drastic changes of existing workflows.

Accurate data capture

A company may invoice invoices in various formats – paper, pdf, xml , etc. Invoices and other financial documents may be received as mail, emails or through online forms. Manual data entry is expensive, prone to errors and time consuming, given these variabilities.

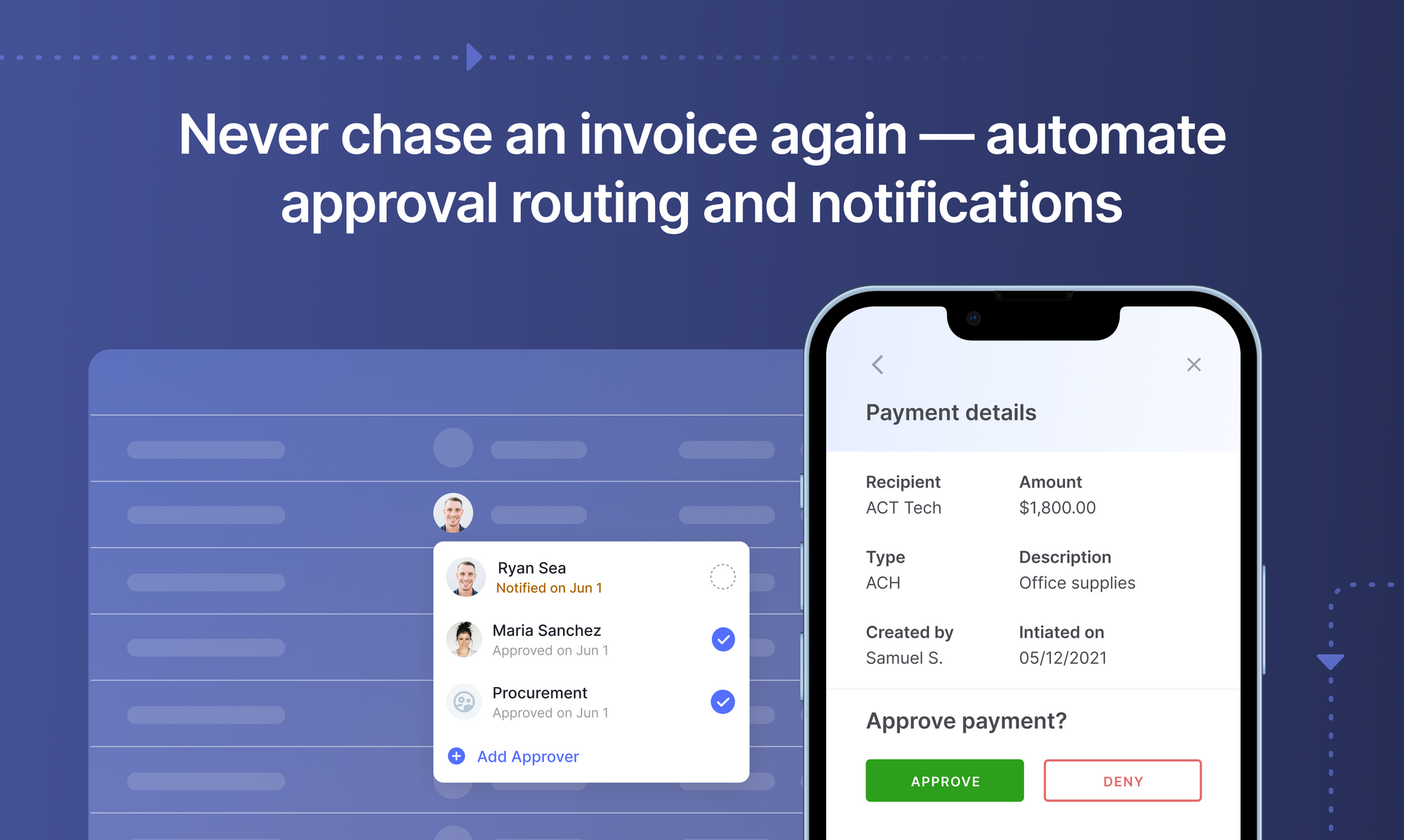

Easy invoice approvals

The people who approve invoices are often busy managers and executives. he automated invoice approval workflow must be easy, intuitive and convenient for such personnel. The approver must ideally be able to see and approve an invoice with a single click.

Real-time monitoring/tracking of AP invoices

Workflow tools must also allow any stakeholder to easily track the invoice. This will avoid delays, miscommunication and mismanagement in the accounts payable process.

Integration with existing accounting system

The company may use other business platforms and software to manage processes. AP tools must be able to integrate with them to prevent mismatch in data and operations.

Automation of payments

The final step in the AP process is payment. After all the approvals have been recorded, the software must be capable of initiating and processing payment towards suppliers.

Centralized information storage and management

Depending on the company’s needs, all AP data can be stored on a centralized server or cloud. The type of storage will have to be decided by the company in advance.

Integration with tax management

All accounting is ultimately related to taxation. It is preferable to have software that takes into account the taxation practices of the company.

Some other enterprise-specific factors that must be considered are:

- Hardware requirements – Does the company have the appropriate technology infrastructure to run the software efficiently?

- Need for auxiliary hardware such as signature pads, scanners, etc.

- Cost of the software and its maintenance.

- Availability and cost of technical support.

- Data storage and backup options.

- Need for the training of personnel to use the system.

- Level of integration with existing software products used by the company

Nanonets for your AP automation needs

The conversion of data into a unified digital platform is the fundamental task of the AP automation process. Nanonets is an AI-enabled OCR software that is ideally suited for the automated extraction of financial data from a variety of sources, to be used in an automated AP process.

With a range of tools including automated workflows, document verification, 3-way matching, and OCR API along with service choices like personalized training, annotators, 24×7 support along with a free trial, Nanonets is a perfect choice as an accounting automation software for small businesses in 2022.

Nanonets can also help in automating the Accounts Payable process by:

- Importing and consolidating data from multiple sources – email, scanned documents, digital files/images, cloud storage, ERP, API etc.

- Capturing and extracting data intelligently from invoices, receipts, bills, and other financial documents.

- Categorizing and coding transactions based on business rules.

- Setting up automated approval workflows to get internal approvals and manage exceptions.

- Reconciling all transactions.

- Integrating seamlessly with ERPs or accounting software such as Quickbooks, Sage, Xero, Netsuite and more.

Takeaway

The use of Accounts Payable software comes with compelling benefits such as time and cost savings, streamlined accounts payable process, and ultimately better bottom lines.

Automated accounts payable solutions will enable human employees to concentrate on higher-value tasks such as business development that contribute to enterprise value.

The choice of an invoice to payment automation tool depends on the level of automation that the business requires, and the ability of the software to blend with the company’s practices and policies.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://nanonets.com/blog/best-accounts-payable-software/