Elon Musk is leaving Twitter, at least as CEO, and only as someone “foolish enough” can be found to replace him at a company that is in seriously worse shape than what he found when he acquired for $44 billion at the end of October.

The serial entrepreneur is expected to refocus on the management of his earlier ventures, notably Tesla, which has suffered a seismic rupture in its stock price.

Off nearly two-thirds since Musk first announced his bid for the social media service last April, and more than 36% since the acquisition was completed, Tesla shares are now about where they were when it was added to the Fortune 500 in June 2017. It’s market capitalization this week fell below ExxonMobil’s. And after falling to a new 52-week low and then closing at $137.80 on Tuesday, even Musk’s decision to pull back from Twitter — and a broader stock market rebound — barely halted Tesla’s fall as of Wednesday morning.

With no clear direction as to Musk’s plans, complicated by broader macroeconomic issues, analysts and traders appear to be trying to make sense of what the latest developments will mean for Tesla’s future, both near and long term.

A fall from grace

“It’s very difficult to judge how much damage has been done to Tesla’s brand reputation,” said Sam Abuelsamid, principal auto analyst with Guidehouse Insights.

Like other observers, Abuelsamid believes Musk was as much the face of the EV pioneer as the products it sells. And by damaging his reputation, the question is how much will Tesla suffer as a result?

In the past, the damage might have been negligible since EV owners “had far fewer options.” But with the number of EVs tripling since 2021, and expected to double in the next 12 to 18 months, added Abuelsamid, “Now they can go somewhere else. And some existing Tesla customers are already looking elsewhere.”

The Twitter fiasco

Musk’s fling with the social media service seemed to go wrong right from the beginning, when Twitter management initially rejected the $44 billion offer — then later sued to force the deal through. All along, the South African-born billionaire kept amping up his use of the outlet and his tweets took on an increasingly extreme bent, often targeting Democratic leaders, members of the LGBTQ community, as well as the more Liberal voters who, studies show, make up a disproportionate share of Tesla buyers.

A self-described “free speech absolutist,” Musk quickly removed the suspensions of former President Donald Trump, as well as an assortment of controversial figures including Holocaust deniers and anti-vaxxers. But, seemingly at his whimsy, he suspended opponents, including some critics in the journalistic community. He reversed that move when that ignited a firestorm, including reproachment from a senior United Nations official.

Over the past weekend Musk announced a Twitter poll on whether he should resign as Twitter CEO. In the end, 57.5% of respondents said he needed to step down. But he hesitated initially. When one of his backers among Twitter users demanded that only those with the for-fee blue checks be allowed to vote. Musk responded “Good Point. Twitter will make that change.”

His MacBeth moment of uncertainty quickly passed, however.

Time to go — and not just at Twitter?

It may have been the fact that some significant Tesla shareholders were thinking twice about what Musk was doing. And they weren’t just worried about what was happening at Twitter.

“Elon abandoned Tesla and Tesla has no working CEO,” KoGuan Leo, Tesla’s third-largest shareholder with holdings worth $3.4 billion wrote late last week. “Tesla needs and deserves to have a working full-time CEO.”

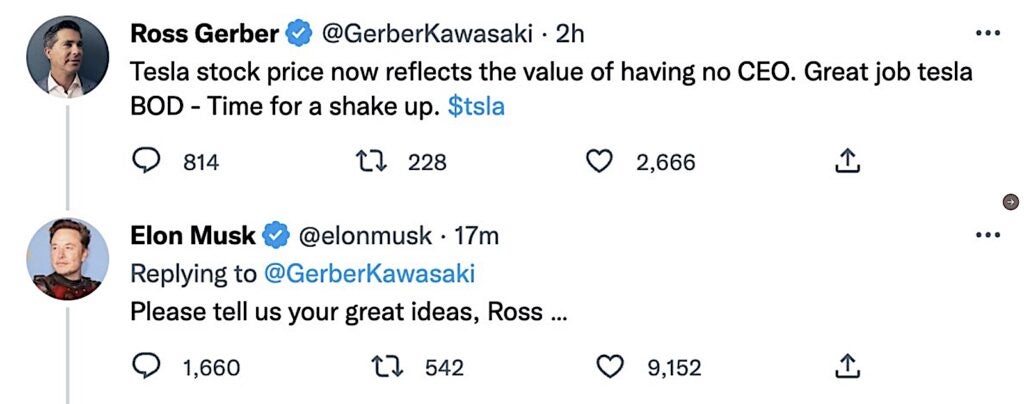

The drumbeat began to pick up momentum after the results of the Twitter poll were released. Ross Gerber, a longtime Tesla bull and founding partner of Gerber Kawasaki Wealth Management, was among those reaching their limits. In a tweet he wrote “Tesla stock price now reflects the value of having no CEO. Great job tesla BOD — Time for a shake up. $tsla.”

He has launched a move to rally other investors into pressuring the Tesla board to find a replacement for Musk. Whether that will go anywhere is uncertain.

Is Musk really out at Twitter?

At least for the moment, it’s unclear whether Leo, Gerber or others who’ve soured on Musk will be satisfied with the Twitter move. And the fact is, it’s far from clear what happens now.

In his Tuesday night tweet, Musk explained he will only step down as Twitter CEO “as soon as I find someone foolish enough to take the job!” But he added he would continue to “run the software and server teams,” which means he’s not severing his management involvement. And it’s yet to be seen if his eventual replacement will be someone capable of — and permitted to — take on a truly independent path.

Twitter has been sorely damaged during the past nine weeks. It has lost more than half of its staff, run into technical issues, seen a mass defection of users, and lost at least half of its traditional lead advertisers. With a $1 billion annual interest debt that’s a challenging list of problems for a successor to fix.

But how soon Musk could return more attention to Tesla is only one of the questions hanging in the air like a dense smog. And even if he does, analysts and investors have to wonder if his presence could now be as much hindrance as help, as it was previously at Tesla.

Ill winds blow

To say that Musk is the only thing Tesla has to worry about would be false from the very go. There are any number of macroeconomic issues, from the need to line up new raw material sources to the global economic slowdown.

“As bank savings account interest rates, which are guaranteed, start to approach stock market returns, which are not guaranteed, people will increasingly move their money out of stocks into cash, thus causing stocks to drop,” Musk tweeted this week. He has also spoken about the risks posed by rising interest rates, the U.S. Federal Reserve last week raising the prime by another half-percent.

But Musk has been a part of a number of other potential challenges Tesla is coping with.

“A series of questions”

There are signs investors were spooked, for example, when Musk decided to pick a fight last week with Senator Elizabeth Warren. A longtime consumer advocate, Warren wrote a letter to the Tesla Board of Directors questioning whether there were legal issues involving Musk “in the aftermath of his purchase of Twitter.”

Warren laid out “a series of questions about how the Tesla Board is dealing with conflicts of interest, misappropriation of corporate assets and other actions by Mr. Musk that appear not to be in the best interest of Tesla and its shareholders.”

The board has yet to respond, but Musk fired back Monday with a tweet declaring, “The United States has definitely been harmed by having her as a senator. lol”

Pick your fights carefully

The issue could play out in several ways, not only if Warren pushes for further action by the Senate but also in a Delaware courtroom where Tesla, Musk and the board are facing a suit by a disgruntled shareholder who has challenged the multi-billion-dollar pay package approved a few years back. The repeated payouts made Musk the world’s richest man – until the ongoing stock plunge ate into a chunk of his wealth.

And he’s not alone. Since April, around $750 in Tesla’s market capitalization has vanished, at least for now belying Musk’s November promise to shareholders that the company would soon be worth more than Apple and Saudi Aramco combined — over $4 trillion at the time.

In a pair of embarrassing setbacks, Tesla’s stock has dipped to the level it set more than five years ago when it became part of the influential group of Fortune 500 companies. And its opening price on Wednesday meant Tesla’s market cap of around $480 billion had been surpassed by ExxonMobil.

Court challenges

The lawsuit challenging Musk’s pay is just one of a growing assortment of legal actions facing the automaker. Tesla is being sued over alleged sexual harassment and racial discrimination, among other things. It is facing increasing scrutiny over its marketing claims – and the safety of – its Autopilot and Fuil Self-Driving technologies. One investigation in California could see it barred from selling vehicles in the state.

The autonomous driving technologies have been both a blessing and a potential curse for Tesla. It developed a legion of high-tech fans when Autopilot was first introduced, videos on YouTube and other social media sites showing owners driving hands-free, even falling asleep behind the wheel or climbing into the back seat. And then Tesla launched what it called its “Full Self-Driving” system which was supposed to take things a step further. Except it hasn’t.

A look at Tesla’s website reminds owners that they need to keep hands on the wheel with both systems. Yet Musk has continued buoying both features and recently the price of FSD rose to $15,000, roughly double what it cost when it was initially introduced a few years ago. A new software update is coming shortly. But, despite promises true hands-free functionality is going to be here by year-end, Tesla officials say there is no clear date when they’re confident it will be ready.

Meanwhile, federal data shows that, whether by falling asleep or simply not being able to respond quickly enough, the number of crashes involving Autopilot and FSD — a number of them fatal — continues to climb.

Promises, promises

“A lot of what he says he doesn’t mean,” analyst Abuelsamid said of the CEO of Tesla/Twitter/SpaceX and other companies. And other things he promises having no clear sense of if or when those promises will come true.

The outlandish Cybetruck was first unveiled in November 2019. Musk has repeatedly laid out launch dates, only to postpone them. Again, the date has been moved to late 2023. The second-generation Roadster is another uncertainty. That’s not to say he never delivers. The Model 3 arrived on time but faced “production hell,” in Musk’s words. The company’s new Gigafactories in China and Texas were on time and have been operating as, even better than, expected.

Perhaps the biggest promise Musk has made is outlining his plan to be producing 20 million EVs globally by 2030. Considering a forecast released yesterday by S&P Global Mobility foresees 2023 volume for all automakers reaching just 83 million, that’s an impressive number by anyone’s books — and nearly doubles the 11 million peaks seen in recent years by industry leaders Toyota and the Volkswagen Group.

Weakening EV sales and a tarnished image

But can Tesla pull it off? No question Tesla’s sales and earnings have been growing fast. The delivery and earnings numbers released for the July-September quarter were substantially up from prior quarters. But what dimmed investors’ reaction was the fact that the automaker still missed the consensus delivery forecast.

Now, add the worsening global economy and, in the U.S., fast-rising interest rates.

And there are dozens of new competitors as virtually every automaker worldwide adds EVs to their line-up. That’s reflected in Tesla losing market share, dipping from 79% to 73% of the U.S. EV market since the beginning of the year, according to industry data.

Widely respected analyst John Murphy, of Bank of America Research, released in June his annual “Car Wars” study forecasting Tesla’s share by 2025 will dip to 11% of the U.S. market, behind General Motors and Ford, each at 15%. That’s a sharp enough downturn that Tesla would barely maintain current American sales levels, even with EVs growing from the current 5% of U.S. vehicle sales to a forecast peak of 20% mid-decade.

China and foreign markets

The real growth opportunity for Tesla is expected to be abroad, starting with China, the world’s largest market for EVs. It has struggled to fend off domestic Chinese brands like BYD and Nio, as well as one of GM’s joint ventures. But Tesla production at its Shanghai plant has been substantial and would seem a good omen – except for its surprise decision to suspend production for the last week of the year, apparently to balance inventories and demand

In Europe, a new Berlin plant has helped the Texas-based carmaker gain share since it opened this past year. But Musk’s image appears to be taking at least a slight hit as EU regulators call out some of his actions at Twitter. It’s unclear whether that will translate into consumer preferences.

Tesla could get another boost this coming week if it announced plans for a new Mexican Gigafactory — though local newspaper Reforma cautioned the announcement could be put off until next month. The plant is expected to focus initially on parts production and cost $800 million to $1 billion. But sources quoted by Reforma, Reuters and others suggested the long-term goal is to add battery and vehicle production, as well.

A sense of direction

Tesla needs a clear sense of direction and leadership right now, according to the various analysts and investors TheDetroitBureau.com has spoken to. But there’s also growing concerns about whether Musk is still up for the job. “It may have nothing to do with his capabilities,” said one, explaining the embattled CEO risks becoming a distraction.

Social media sites have seen numerous posts from those now looking elsewhere for EVs. The head of the popular LGBTQ+ center in Palm Springs posted an Instagram video as he prepared to turn back his leased Tesla sedan 20 months early to trade in for competitor’s EV.

How low can Tesla go?

Among the many other questions is just how much further might Tesla stock drop? It may be too soon to tell since Musk’s Twitter departure notice comes as Wall Street is experiencing an especially good day. And it should be pointed out that while the automaker has a lot of room to keep falling, Tesla short-sellers shouldn’t necessarily be celebrating just yet.

They likely have painful memories of the cost of calling things wrong in the past. Tesla has ridden a stock market roller coaster since going public more than a decade ago. But it has routinely bounced back whenever a great fall seemed at hand and that could yet happen, several experts said on background when asked where they’d be placing their bets right now.

So, while there’s reason to believe Tesla’s current sell-off isn’t over yet, only those who can afford the risk should be betting against it for the long haul.

Will Musk ride out the storm?

There’s no question some of the biggest Tesla bulls and Musk fans are frustrated with the CEO right now. And he’s done a lot through Twitter to hammer his image as “the smartest guy in the room.” But betting against him is another risky move.

It would mark a rare show of independence for the Tesla board of directors to vote for his ouster. The BOD features members of Musk’s family, for one thing, and was essentially hand-picked by the executive. It showed its fealty by approving what became the most lavish executive compensation plan in the history of Planet Earth and has rarely — if ever — been known to block a significant Musk move. They certainly didn’t rein in his Twitter plans.

But with Senator Warren raising questions, the Musk pay move under court scrutiny — and with Tesla’s stock hammered, the CEO’s overall fall from grace leaves him looking exposed to a level he’s never experienced before. It’s anyone’s guess what might push things a step too far for Musk to survive.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.thedetroitbureau.com/2022/12/as-musk-leaves-twitter-hell-have-time-to-assess-the-damage-at-tesla/