Hundreds of millions of people take vitamins to supplement their health, yet few have a clue about what each capsule, tablet or gummy contains and where the ingredients originated.

For example, the Supplement Facts label on a multivitamin bottle typically describes how much one serving of each ingredient, such as Vitamin D, delivers toward the federally recommended daily value. But where did the Vitamin D come from? If it was extracted from fish liver oil, where were those cod swimming and how were they caught and processed?

The U.S. Food and Drug Administration does not require such details to be labeled, so they are almost always left unsaid.

Startup Ritual has seized those unanswered questions as a business opportunity. The 6-year-old, direct-to-consumer vitamin company is not only seeking to inject transparency and traceability into what it sees an outdated industry but also to mobilize its peers toward action on climate.

“Our founder (and CEO, Katerina Schneider) saw that there was an opportunity to have more transparency and traceability both in the science and sourcing behind ingredients in the prenatal multivitamin supplemental health category,” Lindsay Dahl, Ritual’s chief impact officer, said of the vision behind the brand, launched when Schneider was becoming a mother and couldn’t find great vitamins. The core customer for Ritual is skeptical of the industry, Dahl added. “So we don’t want people just to believe us, we want to show them.”

A Ritual bottle of women’s multivitamins.

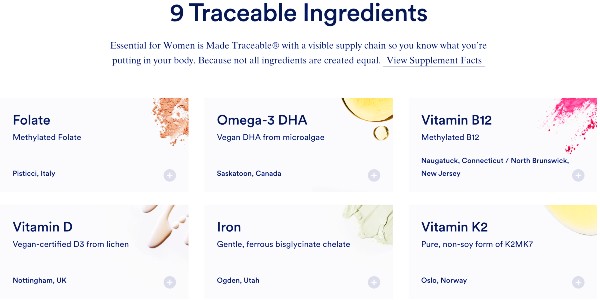

Toward that goal, in October Ritual issued a “Certificate of Traceability” snapshot displaying how each nutrient inside its products was sourced. It delivers, for example, vegan Vitamin D3 via lichen from GHT Companies in Nottingham, U.K., Boron from Futureceuticals in Momence, Illinois, and methylated folate from Gnosis in Pisticci, Italy. The company ruled out the presence of gluten, peanuts, fish, soy, milk and five other allergens. Third-party testing also verified the absence of microbes including yeast, mold, salmonella, escherichia coli and staphylococcus aureus. Arsenic, cadmium, lead and mercury? Also missing. As for the bottle? It’s 100 percent post-consumer recycled plastic with 100 percent post-industrial recycled caps.

Ritual now knows the”final place of manufacturing” and supplier name for 100 percent of its ingredients, which was the goal of its “Made Traceable” campaign, realized around the September debut of its products in Whole Foods stores.

The startup strives to work closely with its varied suppliers. “The basis of this work is good old-fashioned relationship and trust building, which comes through our diligent vetting of the science and sustainability behind their ingredients and operations,” Dahl said. “We spend years scouring the world to find leading ingredient suppliers that meet our incredibly high standards for quality, manufacturing and environmental impact. We have personal relationships with them, we know their history of honesty, integrity and fulfillment and visit many in-person throughout the year to ensure they are being manufactured in accordance with the FDA’s Good Manufacturing Practices (GMPs).”

The company’s supply chains vary in complexity by ingredient; some are developed in labs while others are grown on regenerative farms, such as peas for Ritual’s protein powder, she said. Ultimately the company would like to trace the origin of every ingredient, Dahl added. “Currently we have a level of transparency unheard of in our industry; we publicly share the final place of manufacturing and supplier name for our active and other ingredients, but we know that’s not where our work ends.”

Can this ambition for supply chain traceability catch on?

Despite projecting a mystique of wellbeing and fitness, dietary supplements companies are mostly opaque about what they’re selling. One clue is the lack of extensive sustainability policies by privately owned supplement makers such as Pharmvite or by the publicly traded mall vitamin retailers Vitamin Shoppe and GNC. Vitamin leaders Garden of Life, a B Corporation; Nordic Naturals and even Costco are among those surfacing corporate social responsibility efforts. Several giants in nutrition, such as bioscience leader Royal DSM, are investing visibly to improve the sustainability of vitamin C and algae-based Omega-3 fatty acids.

Ritual’s snapshot of traceable ingredients in a women’s multivitamin. (Source: Ritual)

One of the few third-party standards for vitamin makers comes from United States Pharmacopeia (USP), whose verification only applies to about 1 percent of vitamins and supplements overall, including Ritual’s “Essential for Women 18+.” Its verification label launched in 2001, but USP has been around since its founding in 1820 in Washington, D.C., and has worked since then with the government on consumer protections and regulatory compliance. The 1938 Food, Drug and Cosmetic Act required pharmaceuticals to meet USP quality standards. USP inspects production facilities and tests products to ensure accurate ingredient labeling and the safety, purity and absorption of supplements in the body. However, the FDA regulates vitamins like foods, not drugs, and their producers are not required to prove safety or efficacy.

The USP label appears on 21 vitamins sold under Costco’s private Kirkland Signature label, one of the largest vitamin brands in the U.S., which also offers a multivitamin with USDA-certified organic ingredients featuring whole foods, free of synthetic or genetically modified ingredients. USP Verification is on at least 85 vitamins sold under the Nature Made label, owned by Pharmvite, which advertises bringing “the gift of health to life.”

Founder Schneider has described Ritual as a data company engaging a science-based approach that includes third-party validation on some of its products, including USP and Non-GMO Project Verified. Ritual’s manufacturers are also NSF-certified, and the company intends to add other third-party certifications next year, Dahl said. That includes the Clean Label Project, which addresses consumer concerns about “heavy metals, pesticide residues, and plasticizers, other chemicals of concern, and truth in labeling.”

Booming industry

Ritual’s bid for traceability comes as the dietary supplements industry is booming, despite a relative slowdown in sales after the peak of the COVID-19 pandemic saw more people popping pills to boost their immune systems.

How popular are vitamins? The numbers vary. The Council on Responsible Nutrition (CRN), which lobbies for the supplements industry, determined from a survey of 3,133 adults in 2022 that three-quarters of Americans were taking supplements in 2022. Fifty-two percent of Americans had taken a vitamin in the past month, according to a National Health and Nutrition Examination Survey by the Centers for Disease Control and Prevention (CDC), between 2011 and 2014.

Grand View Research depicted the supplement industry at an all-time high in 2021, reaching $152 billion in global market size. It found that vitamins make up 30 percent of sales of dietary supplements, and it projected that proteins and amino acids, followed by botanicals, will dominate growth in the space through 2030. The industry’s market size has expanded by 1.6 percent each year since 2017, according to IBIS World, which forecast sales to decline by 0.5 percent in 2022, despite a continued climb in online sales.

The main reasons Americans take vitamins are to maintain or improve their health, according to CRN. It found that while probiotics, Omega-3s and sports nutrition products are on the rise, multivitamins remain the go-to choice in the space.

With its website swathed in yellow and white, Ritual projects a bright, tidy image cultivated to appeal to conscientious consumers, especially women. Dahl attributes the relatively small size of its product lineup — multivitamins for women, pregnant people, men and children as well as plant-based protein powders and a “synbiotic” for gut health — to the level of detail involved in creating each one.

Among other subscription services offering peppy web interfaces and personalized nutrition quizzes is HUM Nutrition, launched in London in 2012 and now also based in Los Angeles. Its supplements are compliant with Non-GMO Certified, the Clean Label Project and Good Manufacturing Processes (GMP) labels. HUM advertises vitamins free of 12 “tricky” ingredients such as artificial colors, preservatives and flavors; high-fructose corn syrup, talc and titanium dioxide. By the end of 2022, HUM aims for all of its bottles to be made from plastic collected from coasts via the Indonesia-based “Prevented Ocean Plastic” program.

Dahl described the visible effects of an accelerating climate crisis, such as wildfires throughout the West Coast, as a motivating factor for edgy, sustainability-focused vitamin startups to proliferate in recent years.

The Amway example

However, the roots of traceability and aspirations to care for nature in the wellness industry predate the hopeful innovators of this digital era. Before the internet, direct sales companies provided a pipeline to products that were “disruptive” for their day and couldn’t be found elsewhere. Before social media there was social marketing, the current lingo for the multi-level marketing (MLM) business model perfected by Amway, short for American Way, based near Grand Rapids, Michigan. A 1979 U.S. Federal Trade Commission ruling that Amway is not an illegal pyramid scheme opened the field for other MLM companies to flourish.

Amway’s Nutrilite is the best-selling vitamin and supplement brand in the world, according to market research company Euromonitor. Nutrilite made up 53 percent of the company’s 2021 sales, which totaled $8.9 billion, up by 4 percent from the previous year. It has 15,000 employees and millions of independent distributors in more than 100 countries.

Nutrilite was originally developed by a man credited with developing MLM in the 1930s, Carl Rehnborg. The legend is that he shunned chemical pesticides on his small farm in California’s San Fernando Valley after witnessing deforestation and malnutrition in travels through China. In 1949, Rich DeVos and Jay Van Andel became top distributors of Nutrilite. They founded Amway in 1959, first selling household products and then snapping up Nutrilite in 1972. The DeVos and Van Andel families continue to own Amway’s parent company, Alticor.

Amway’s Nutrilite traceability campaign, which includes a “3D” virtual tour of product origins, won four MarCom awards in 2019. (Source: Amway)

A major selling point for Nutrilite is that it grows its own plants on some 6,400 acres of certified organic farms in Mexico, Brazil and the U.S. to supply its supplements. Its 700-acre Trout Lake Farm in Washington state, for instance, grows herbs including echinacea, dandelion and black cohosh. The company lauds its “hero ingredient” acelora cherry, rich in Vitamin C, grown on an Amway farm in Brazil. Nutrilite ingredients come from hundreds of suppliers around the world, such as seaweed for immunity products from Iceland and beta carotene from salt flats in Australia, according to Amway.

“We’re fortunate that it’s always been part of our DNA since our inception, that we’ve always been focused on sustainable farming, earth-friendly products,” said Will Templeton, global director of Amway’s brand, sustainability and CSR. “And we are just on a journey to be a little bit more deliberate and purposeful, and how we integrate those practices more consistently throughout our operations.”

Lindsay Pott, Amway’s manager of marketing strategy and transparency, described the company’s traceability and sustainability efforts as “brother and sister.”

Many of the scores of Nutrilite vitamins and supplements, from multivitamins to “muscle health,” have third-party certifications including Non-GMO Verified, USDA Organic, Friend of the Sea, kosher and halal. Fifty-four of them are certified by the National Sanitation Foundation (NSF) based in Ann Arbor, Michigan, meaning they are routinely tested and facilities are audited for safety and truth in labeling.

Amway performs its own onsite audits for vendors to abide by its standards through its NutriCert certification and Supplier Quality Development (SQD) Program, Pott said, arguing that most traceability standards are too narrow. The Nutricert standard for Nutrilite is verified through the third party EcoCert.

“Most industry standards only require that you understand the nearest supplier you bought from and the consumer you sold to,” Pott said. “But that raw material broker you may have bought from may or may not have visibility all the way back to that original source. So that’s where we’ve created our own traceability standards that do — especially for our botanicals — require that visibility back to the origin.”

Amway’s Nutrilite Traceability program launched about 4 years ago. In 2020, an Amway poll of 2,000 Americans found that two-thirds were likely to pay one-third more money for products with “responsibly made and transparently sourced products.” Eighty percent said companies lack adequate transparency, and that understanding product ingredients increased their likelihood to make a purchase.

An Amway bottle of women’s multivitamins.

Amway views its areas of credibility and expertise as including sustainable farming practices, evolving to regenerative practices that focus on biodiversity, soil health and conservation; integrating sustainable design for packaging and ingredients; and setting operational targets and goals to reduce emissions and water waste.

Collective action: Climate and policy

Contrary to its sentiments and efforts to advance earth-friendly farming and sourcing practices for Nutrilite, Amway does not appear to be pursuing a strategy to reduce its greenhouse gas (GHG) emissions. That’s unsurprising, given that in 2022 alone, parent Alticor donated more than $1 million to 10 Republican political candidates and organizations that continue to deny the scientific consensus on climate change.

Ritual, by contrast, is a far smaller and newer entity that does not make political contributions. Its fledgling lobbying efforts have backed policies to tighten FDA oversight on safety and marketing claims for dietary supplements, including meeting with members of the Senate HELP (Health, Education, Labor and Pensions) committee ahead of the June passage of the Food and Drug Administration Safety and Landmark Advancements Act of 2022. Ritual, which offers 20 weeks of parental leave, also voiced its support to Congress for Paid Family and Medical Leave , partnering with the Paid Leave for All nonprofit.

Ritual has been hustling to advance sustainability targets, Dahl said, setting it apart from other vitamin producers. In September it issued goals for all packaging to be recycled, refillable or recyclable by 2025 and to reach science-based net zero GHG emissions by 2030. The company is in the process of understanding its CO2 footprint.

“Our category is built on protecting and taking care of people’s health and yet the biggest health issue of our time is climate change,” Dahl said. “Ritual feels like there’s a huge opportunity for industry to step up, in a way that a lot of other industries have, to talk more about climate change in a credible and science-based way.”

Dahl hopes Ritual can stand out from both longtime and nouveau brands not only by offering a traceability value-add but also by helping to inspire and provoke the greater supplements industry toward sustainability and social action.

In May 2022, Ritual was certified as a B Corporation, a designation that by a rough count applies to only 20 companies that sell vitamins. The business pursued that certification partly as a stepping stone to build collective industry action, given the B Corp offers infrastructure around advocacy issues including sustainability and workers’ rights, said Dahl, who describes her career history as coalition building.

For seven years at Beautycounter, she directed advocacy and worked on a unique effort to change the complex supply chain for mica. Dahl shifted earlier to business from activism, including campaigning successfully toward banning bisphenol-A (BPA) in baby bottles, and helping to launch the Mind the Store campaign at the nonprofit Safer Chemicals, Healthy Families, which advocated for big box stores to reduce toxic chemicals.

“Ritual really sees ourselves at the cutting edge of the industry, given when the business launched and what we’ve been talking about, and we hope these goals continue to help kind of raise the bar, whether it’s a new or older player in the market,” Dahl said.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.greenbiz.com/article/whats-pill-two-vitamin-makers-diverge-traceability