In case you haven’t read the news lately, 2014 is shaping up to be a controversial year; and we’re not referring to Justin Bieber’s antics either. Instead, a new contention is brewing in the annals of our newspaper’s business sections that is every mother’s worst nightmare: the legal recreational marijuana industry.

Yes, as of 2014, you or anyone older than 21 can purchase and consume marijuana in the State of Colorado; and guess what? Business is booming.

Demand is skyrocketing to such an extent that supply (currently consisting strictly of repurposed medical marijuana) is dwindling until the first crop grown for recreational use hits the market. As a result of the lowered supply, Colorado’s 37 dispensaries are jacking up the prices of legal weed and you, our readers, can’t stop forwarding articles about legal pot pricing.

With all of this reader interest and as devoted nerds of statistics and economics, we would be remiss if we missed the opportunity to explore the phenomenon of a newly opened and regulated market. As such, we collected some hard data to measure the price sensitivity of legal marijuana relative to the price sensitivity for illegal marijuana, while also comparing these figures to the average prices for each (we have real sources that don’t include talking to “that guy from college we knew”).

Yet, before you write this post off as some form of stoner smut, we assure you, there are quite a few implications here for your business. Let’s get to the corollaries between Colorado cannabis shops and your software business after digging through some fascinating data about how Ganja’s green goes well beyond the color of what Colorado is smoking.

Price Is King in the Mile High City

Prices for legal marijuana were expected to be high (no pun intended), because of a 15% excise tax and a 10% retail tax. However, what was unexpected was the latitude to which the legalized pot purveyors would increase their prices as a result of surging demand. NBC news highlighted that short supplies and long lines motivated one pot shop to push prices to $70 per eighth of an oz. – up from $25 the day before. Although these “cannabusinesses” face extremely tight regulations, there isn’t a required pricing structure all dispensaries must follow.

Translation: Despite being heavily taxed, distributors of legal weed are free to enjoy the benefits of a free market. Yay capitalism!

There are certainly a lot of variables in play here leading to high prices. As previously alluded to, supply is low, because dispensaries must use repurposed medical marijuana until the first crop of recreational pot is ready. Of course, novelty is also an issue here as pot is legal for the first time and out-of-state customers are flocking to Colorado to partake in an act of “green tourism”.

photo credit: thefixer via Compfight

Yet, what’s interesting and what ultimately lead to this study is the fact that the legality of weed typically doesn’t impact the recreational use by a considerable amount of individuals (just look at our arrest statistics). Logic begs the question then, is the legality of weed actually a direct driver of value, and therefore price, in the eyes of the consumer? This is exactly what we tested.

Our Study: Testing Price Sensitivity for Legal and Illegal Weed

To determine the price sensitivity and willingness to pay in the market, we utilized our price sensitivity tool and used our panel partners to distribute surveys to respondents in two groups –

Regular Pot Smokers: Adults (age 21 or over) who engage in smoking marijuana at least twice per month (includes individuals with a medical marijuana license).

Non-Pot Smokers: Adults (age 21 or over) who do not regularly engage in smoking marijuana (i.e., have not smoked marijuana in the last 90 days).

The large disparity between the black market price of marijuana and the new, legal price of pot sold at dispensaries (differing by as much as $200-$300 per ounce according to some reports) is definitely striking. As such, we wanted to compare the willingness-to-pay for both types of bud amongst both types of respondents. To control for interpretations of quality, the marijuana in question was described across the board as “high quality.”

Reefer Pricing Madness

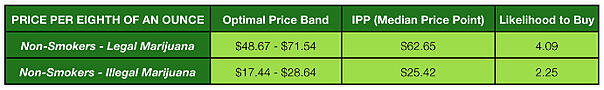

Guess what? The data backs up the long lines at dispensaries across Denver – the willingness-to-pay in the market for legal marijuana is dramatically more than illegal contraband of the very same quality. Non-smokers even appear to be two times more likely to purchase legal marijuana than illegal marijuana judging from their likelihood to buy values of 2.25 for illegal and 4.09 for legal.

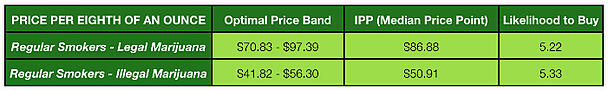

The full output is below (along with some extra information to help you navigate through the analysis), but overall, recreational pot smokers were willing to pay more for marijuana than non smokers. Although, both were willing to pay much more for legal marijuana than illegal marijuana (52.21% and 85.54% more, respectively).

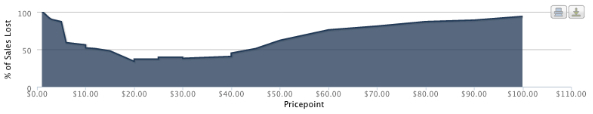

Non-Pot Smokers – Legal Marijuana (Price Sensitivity Per Eighth of an Ounce)

Non-Pot Smokers – Illegal Marijuana (Price Sensitivity Per Eighth of an Ounce)

Couple of notes:

The Optimal Price Band can best be thought of as the “sweet spot” in the market. Pricing a product within this range optimizes for both revenue and sales volume given the respondent data.

IPP is an acronym for Indifference Price Point. It’s the median point where half of all respondents believe the product is expensive and half believe it’s inexpensive. This “middle” number is excellent, because it allows you to make comparisons at a single data point.

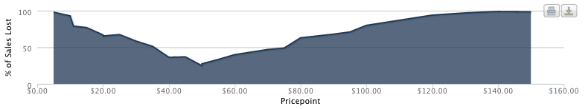

Regular Pot Smokers – Legal Marijuana (Price Sensitivity Per Eighth of an Ounce)

Regular Pot Smokers – Illegal Marijuana (Price Sensitivity Per Eighth of an Ounce)

How Does This Affect Me?

So what if stoners are willing to pay significantly more for legal marijuana? Well, the high price of pot (and the willingness to pay for it) demonstrates a few fundamental concepts about pricing strategy.

1. Early Adopters Can Be Some of Your Most Profitable Customers

While this is certainly the case for recreational legal weed, this also applies to other industries. Think about the organized chaos Apple creates with every iPhone release. Rabid Apple aficionados happily line up to pay full freight for the newest iteration of the popular device. The folks first in line to buy your product are the first to grasp the value of it and often hold power to influence other prospective buyers (e.g., their friends).

2. You Need to Be Mindful of What’s Valuable to the Customer

The dispensaries who sell newly legalized cannabis undoubtedly understand the connection between the high price they are commanding and the quality associated with that price. Sales staff at dispensaries take the time to educate buyers on things like THC potency, origin of the plant, and its effects, creating a value proposition-focused buying process and increasing the willingness to pay.

Similarly, identifying the unique aspects of your software product that resonate with your customers and truly set it apart from your competition is the first step to charging more for the value you deliver.

photo credit: prensa420 via Compfight

3. Pricing Should Be Dynamic, Not Static

All too often, companies approach pricing with a “set it and forget it” mindset. Pot shops in Colorado are astute to the fundamental idea many SaaS companies neglect – your prices should be dynamic – ebbing and flowing with market sentiment (i.e., the price sensitivity of your customers and prospective customers).

This doesn’t mean you change your price every day, but it does mean you need to focus on how your customers are moving and grooving with your offering(s). Plus, since supply of software isn’t limited, you have more discretion to differentiate your product on unique features and communicate those differences accordingly – raising or lowering prices in line with your production and marketing cycles.

4. Don’t Feel Guilty About Raising Prices

In the context of Colorado, raising your prices in the midst of a rush on your product can actually be the fairest way to deal with market pressures. Economics 101 tells us that as supply decreases, prices should increase accordingly. Grocery stores have been criticized for jacking up the prices of bottled water in the days leading up to a hurricane, but there’s a very real difference between turning customers into victims via price gouging during natural disasters, and raising prices to simply accommodate demand.

Think of it this way – if a legal marijuana dispensary continued selling an eighth of an ounce of pot for $25 (the previous day’s price for medical marijuana patients), then the business would lose a huge chunk of potential revenue. Nevermind the fact that the store would run out in hours and customers near the back of the line would lose the opportunity to purchase even a modest amount of pot.

Moral of the story – don’t feel guilty about raising your prices, especially if you have data to show that a large portion of customers will gladly pay a higher price for the value your product provides.

photo credit: eggrole via Compfight

Roses are Red, Violets are Blue, Ganja is Green and Money is Too.

Whether you’re selling software or legal marijuana, one constant holds true – you need to be cognizant of the actual value your customers ascribe to your product and their unique willingness to pay for it. Failing to assess either of these quantifiable variables on a regular basis not only leaves money on the table, but puts your profit potential in a similar position to the marijuana being sold in Colorado – it could quickly go up in smoke.

To learn more about the pricing process, take a look at our Pricing Strategy ebook or sign up for a free Price Optimization Assessment with an expert here on the team.

If you want to dive deeper into pricing page best practices, check out our latest eBook, The SaaS Pricing Page Blueprint, which offers in-depth data and analysis on building the perfect pricing page.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.priceintelligently.com/blog/bid/193879/from-grass-to-saas-what-pot-pricing-can-teach-you-about-your-pricing-strategy