Formula for Building Fintech Companies with Resilient Valuations

BCV | Sarahinkfuss and Tina Dimitrova | Feb 7, 2023

We share this analysis with the hope that our findings can inform and encourage the many talented founders and management teams building fintech companies. Do not let the volatility of the past three years obscure the greater arc of the fintech story: we are in the early innings of transforming our financial world, the market opportunity is massive, and our conviction in the value creation in this space has never been stronger

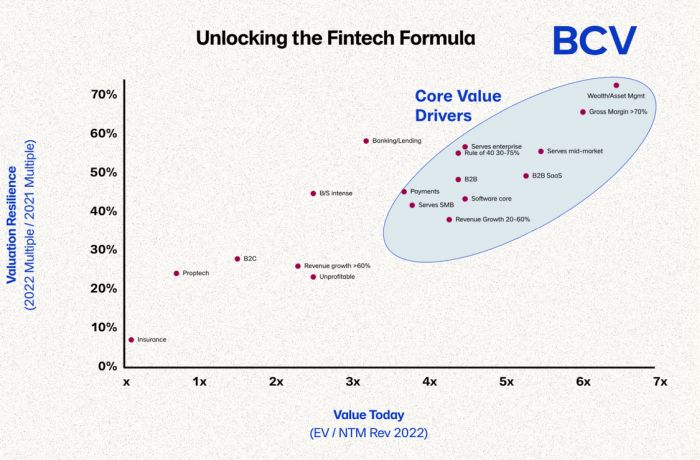

- The single attribute correlated with the highest valuation multiple is also the most persistent attribute:

- Companies in the wealth / asset management space.

- B2B SaaS and payments companies also have strong valuations combined with resilience.

- The median multiple for payments companies is lower than we expected but as you dig into the payments universe you see that it’s dragged down by the high proportion of nextgen fintechs that are payments companies and saw a greater drop in multiples in the past year.

- Banking/Lending, Proptech, and Insurance companies all have consistently below average multiple valuations.

- Differentiators: We see much of the separation in the relative performance of spaces come from the degree of recurrence of the business model, presence of a balance sheet, and differences in financial characteristics of the particular underlying companies (which may not necessarily persist with the companies of the next generation in these markets).

See: How Divestiture Can Create Corporate Value

- B2B companies consistently achieve higher valuation multiples than B2C companies.

- Further, B2B companies are more resilient: while B2C companies in 2022 were valued at 28% of their valuation multiple in 2021, B2B companies in 2022 retained 48% of their 2021 valuation, on average.

- there’s variation among B2B companies based on the end-market served: companies serving the mid-market have always outperformed enterprise and SMB, but SMB and enterprise switched in relative value over the past year. SMB was more highly valued in 2021, but then fell more in 2022, vs enterprise which is now more highly valued than SMB.

- We see that public markets do not know how to value hyper growth companies. Upon going public, Fintech company valuations are optimized when companies grow between 20% and 60%.

- The faster growing a company is, the more it can burn, but only up to a certain level. Combining the findings on the optimal revenue growth rate and Rule of 40 metric, there’s a clear tradeoff between revenue growth and EBITDA margin. How high, or low, can you go?

Continue to the full article –> here

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada’s Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada’s Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

Related Posts

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://ncfacanada.org/formula-for-building-fintech-companies-with-resilient-valuations/