Key Takeaways:

- Exodus Movement is the US-based company behind the Exodus Wallet, a versatile and user-friendly cryptocurrency wallet with in-app swaps and staking options.

- They are one of the early pioneers of tokenizing stock: Exodus shares were launched in a mini-IPO on the Algorand platform in 2021.

- A planned 2024 launch on the NYSE would have made Exodus the first publicly listed American company with tokenized assets. However, an SEC review has delayed this indefinitely.

We believe tokenized stocks are the future of Wall Street.

It’s clear that investors already think of crypto tokens like stocks, and so do we (Read more about our investing approach here.) But it’s a different matter for a company to create a token legally equivalent to owning stock.

One of the pioneers of tokenized stock is the Exodus Movement, which issued a token (EXIT) as a legally constituted stock ($EXOD) and is battling with the SEC to get it listed on the NYSE.

This presents an exciting opportunity for both traditional and crypto investors, as we believe it’s a sign of things to come.

In this piece, we’ll trace the history of the Exodus Movement and examine its background and financial performance in depth. We’ll also assess the $EXOD’s risks, challenges, and investment potential as a legally tokenized stock.

Exodus Movement Overview

Exodus Movement was founded in 2015 by JP Richardson, a blockchain coding expert, and Daniel Castagnoli, an interface designer who had worked on projects for major brands like Apple and Disney.

Primarily a blockchain technology company, Exodus Movement’s main product is a cryptocurrency wallet designed to make cryptocurrencies more accessible to new users.

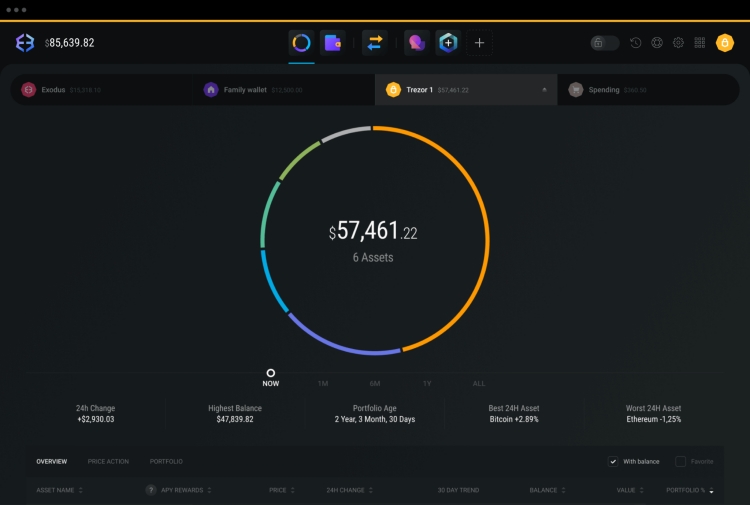

The Exodus wallet is a software platform for storing thousands of digital assets from over 50 major blockchain networks. It is available as browser plugins for PCs, mobile apps on iOS and Android, and desktop wallets for Windows, Mac, and Linux systems.

This self-custody wallet is a good choice for new users with its user-friendly interface, support for multiple networks, and in-app staking support. However, the convenience comes at the cost of some advanced features, making it less attractive to advanced users.

According to Coingecko, Exodus was the world’s ninth most popular crypto “hot” wallet, with just over one million total installations and users. The company earns income through fees on in-app token swaps and other transactions.

Exodus Tokenized Stock History

In 2021, Exodus Movement announced its intention to launch a tokenized version of its stock on a blockchain network before publicly listing it on any traditional exchange. The company wanted to give crypto enthusiasts and Exodus wallet users the first chance to become shareholders.

The digital tokens were named EXIT, and one token represented one share of the Exodus Movement Class A common stock. EXIT was launched in June 2021 on the Algorand blockchain. The company raised $75 million through the issuance of 2.73 million shares.

This entire process was facilitated by Securitize, a platform that helps businesses issue tokenized stock to raise capital from investors. Officially recognized by the SEC, Securitize focuses heavily on transparency and regulatory compliance.

After the initial success of the digital launch, EXIT shares began trading on the Securitize Markets platform in Q1 2022. Investors from 40+ countries, including all states of the USA, can publicly trade in EXIT tokens on the marketplace with a Securitize Markets account. At the same time tokenized shares began trading in OTC markets under the ticker $EXOD (as the $EXIT ticker was already taken). To be clear, their stock ticker is now $EXOD, but the EXIT tokens still exist and can be converted on a 1:1 basis to $EXOD.

After achieving an initial selling price of $27, EXIT suffered a -94% fall in value (YTD) in Q4 2022 as part of the industry-wide crash.

Tokenized Stocks: The Future of Wall Street

A tokenized stock is a digital representation of your ownership of traditional equity on the blockchain. Unlike most crypto tokens, these stocks are backed by real companies. Investors who own the token also own equivalent shares in the company’s stock.

Here is how the tokenization of stocks works:

- A company will partner with a blockchain firm specializing in share tokenization. Securitize and Tzero are examples of such entities.

- A percentage of the company’s shares is placed in a special purpose vehicle, corporate trust, or other legal entity.

- The entity will then issue tokenized securities with the assistance of its blockchain partners. Exodus launched the EXIT token on the Algorand blockchain.

- Usually, a single token will represent one share of the company’s stock. Fractional shares can also be issued.

- Investors can buy and trade these tokens on specific blockchain marketplaces. Securitize Markets is a good example.

- Ownership of the shares/tokens is recorded on the blockchain. Token holders are entitled to the same benefits as regular shareholders, such as dividends, voting rights, etc.

$EXOD Stock in the Over-the-Counter Markets

In 2023, Exodus Movement floated its Class A shares under the ticker $EXOD on the OTC Markets, one of the largest regulated over-the-counter securities markets in the United States. Initially, the shares traded on the OTCQB market before upgrading to the more tightly regulated OTCQX market in April 2024.

Even though these OTC markets are regulated, they still don’t hold nearly the trust of the primary markets, like the NYSE. Gaining an NYSE listing would not only gain trust for $EXOD, but it would also unlock much greater liquidity and potential interest from institutional investors.

Floated in June 2023 with a par value of 0.000001, the value of $EXOD peaked at $20 in May 2024 in anticipation of its planned upgrade to the New York Stock Exchange (NYSE) on May 9th. However, an SEC decision to review its registration statement has delayed the listing.

This was reflected in the value of $EXOD, which dropped to $12 by the middle of May 2024. However, by the end of May, the price had largely recovered to $17.58 a share, and investors remain confident that the SEC will approve the $EXOD listing on the NYSE.

Below is a quick overview of the other fundamentals:

- Market Cap: $312.39 million

- Outstanding Shares: 4,514,274

- Volatility: High (3.5 Beta, 5Y Monthly)

Exodus Movement Financial Performance

In Q1 2024, Exodus announced its fiscal results for 2023 with the following main takeaways:

- Total Revenues: $56.2 million

- Income from Operations: $8.4 million

- Net Loss: $12.8 million

- Adjusted EBITDA: $17.6 million

Total revenues increased 11% compared to 2022. Adjusted earnings of $17.6 million represent a positive turnaround of 1122% over the previous year. The number of active users (monthly) of the Exodus wallet also increased by 22%.

The company’s reported assets include $138.3 million, including $55 million in cash and cash equivalents (including USDC and treasury bills) and $80 million in cryptocurrencies (bitcoin and Ethereum). The cash ratio is 7.29, and the current liquidity ratio is 18.94.

As mentioned, Exodus Movement’s primary source of income is transaction fees on the app/wallet platform. A 4% increase in exchange provider processor volume and a 22% increase in active users contributed to revenues in 2023.

Preliminary reports from Q1 2024 also indicate a 118% increase in revenues compared to Q1 2023 and a 6,920% increase in income from operations for the same period. Net income was up $54.8 million compared to just $0.8 million in 2023.

Advantages of Stock Tokenization

Moving company shares to the blockchain has several advantages and benefits for companies and investors:

Accessibility: Traditional investing is often restricted to accredited investors. Moving stocks to the blockchain would make them more accessible to a broader pool of investors, albeit with some reasonable restrictions.

Liquidity: Fractional ownership could open up stock investment to untapped pools of investors, potentially increasing liquidity for companies seeking to raise capital.

24/7 Trading: Traditional exchanges have fixed market hours of operation. On the other hand, blockchain-based trading has no such time restrictions and can facilitate round-the-clock trading from anywhere in the world.

Transparency: Blockchain’s permanent nature makes it both highly transparent and secure. Record-keeping is not left in the control of any centralized entity.

Risks and Challenges

The primary challenge against the tokenization of stocks comes from regulators. In the United States, the SEC has been active in its pursuit of cryptocurrency exchanges and popular blockchain projects for alleged violations of securities regulations.

The lack of regulatory clarity surrounding the impact of securities laws on blockchain operations has cooled the broader adoption of the technology. We need regulatory clarity before we’ll see widespread adoption of tokenization by public companies.

The decision to delay the listing of $EXOD on the NYSE came at the last moment.

The U.S. government’s stance towards crypto assets has been marked by an overabundance of caution. Since 2023, the SEC and CFTC have imposed a broad crackdown on crypto businesses. On May 6, 2024, the Chair of CFTC, Rostin Behnam indicated that further regulatory action will be initiated against the cryptocurrency ecosystem over the next two years.

In this regulatory climate, the SEC’s move to delay listing a company with tokenized stock on the NYSE doesn’t feel out of the ordinary. Exodus has indicated that it will wait until the SEC delivers a definitive answer after a full review. It is difficult to predict $EXOD’s prospects; however, investors seem optimistic about the company’s future and eventual NYSE listing.

Investor Takeaway

Investors can already buy and sell $EXOD on the OTC markets. Like most other firms closely associated with the blockchain ecosystem, Exodus Movement’s stock price has been quite volatile. The increased regulatory pressure may further complicate matters.

On the other hand, the recent Exodus financials indicate that the blockchain business rebounded strongly after the market crash in 2022. The company could grow as more users join the ecosystem since its wallet is more oriented toward crypto newbies.

As it stands, $EXOD holds some promise. Unfortunately, its plan to become a publicly-listed company clouds the picture, as it requires a positive answer from the SEC. Given the highly volatile regulatory climate, a wait-and-watch approach may be better.

Subscribe to Bitcoin Market Journal for more great crypto investing ideas.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.bitcoinmarketjournal.com/exodus-movement/