CoinMarketCap, by far the world’s most-referenced price-tracking website for crypto assets, has just released its H1 2023 Report covering the market overview, key events, future themes, and much more. Here’s the Rundown!

Key highlights from CoinMarketcap’s H1 2023 Crypto Market Report:

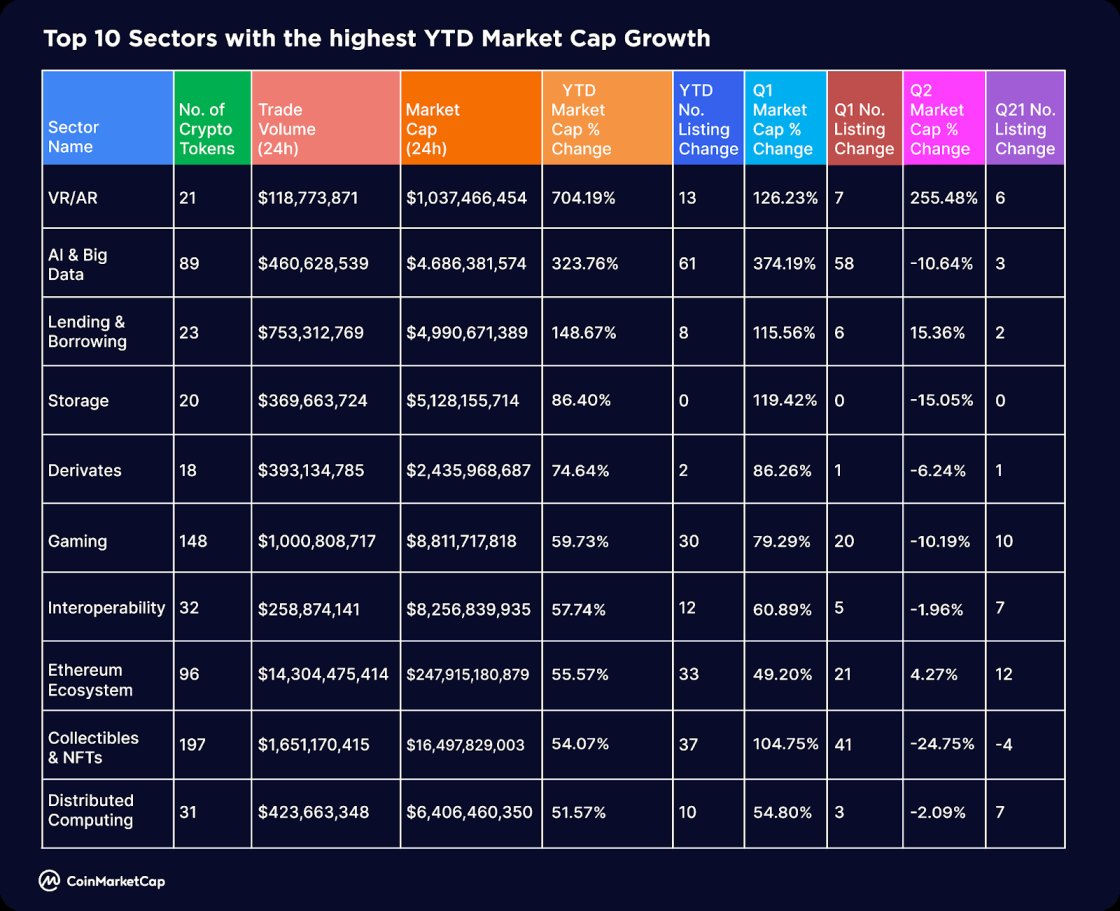

• Top 10 crypto sectors with the highest YTD market cap growth. AI & Big Data ranked 2nd

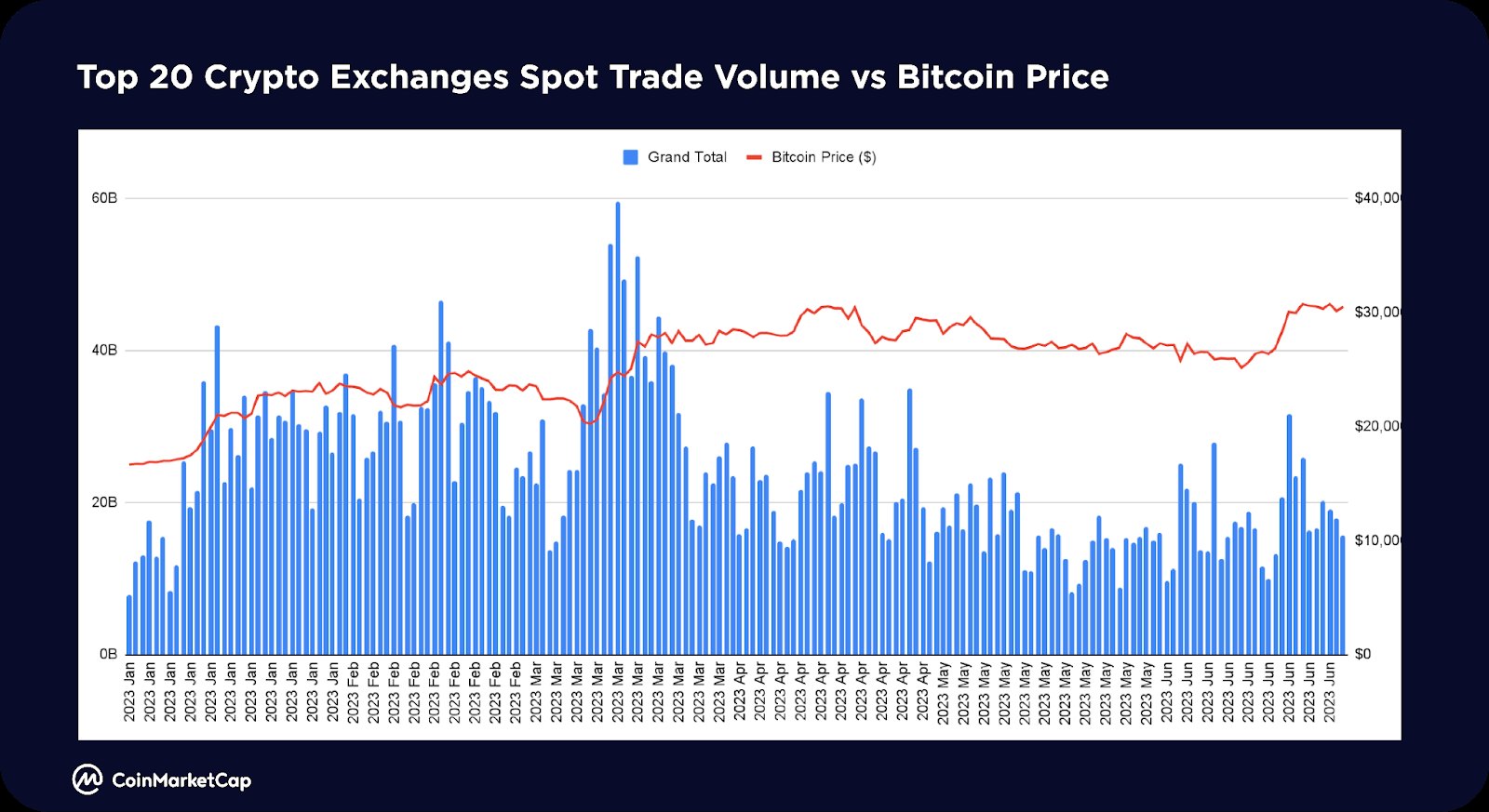

• Total Spot Trade Volume of the Top 20 Crypto Exchanges peaked in March and declined by 36% quarter-on-quarter

• Best performing coins of H1 2023. The top gainers are from the Arbitrum ecosystem

• The market sentiment has improved, but Q2 was a “lost quarter”

• Key themes for H2 2023

And much more.

A Lost Quarter

The global crypto market cap reached 1.17 trillion at the end of Q2, marking a 48% YTD increase. Interestingly, both Q1 and Q2 concluded with a similar total market cap, almost making Q2 seem like a lost quarter in the crypto world.

Q2 also lacked strong market narratives compared with Q1. In Q1 the market experienced more significant developments such as bitcoin price doubling, the rise of L2s like Arbitrium and ZK, and a more active NFT market partially driven by the product upgrades and Blur’s token issuance. Q2 failed to produce any similarly groundbreaking developments. Instead, Q2 witnessed different trends like the “meme-coin season” and the rise of BRC20 tokens, which, though noteworthy, did not match the level of excitement generated in the previous quarter.

The CryptoMarketCap (CMC) Crypto Fear and Greed Index began the year at approximately 30 (Fear) but concluded H1 around 52 (Neutral), indicating a notable improvement in market sentiment.

The Total Spot Trade Volume of the Top 20 Crypto Exchanges peaked in March and declined by around 36% quarter-on-quarter, reaching a near dormant state by the end of June at c.523 billion dollars per month.

Growing Sectors

Top 10 Sectors with the Highest YTD Market Cap Growth

Amidst a challenging market, certain sectors have shown remarkable growth in market cap year-to-date. VR/AR (704%) and AI & Big Data (323%) have been leading the narrative in the market, while bluechip DeFi projects and Infrastructure are making a strong comeback. Some of these sectors include Lending & Borrowing (149%), Derivatives (75%), Storage (86%), and Interoperability (58%).

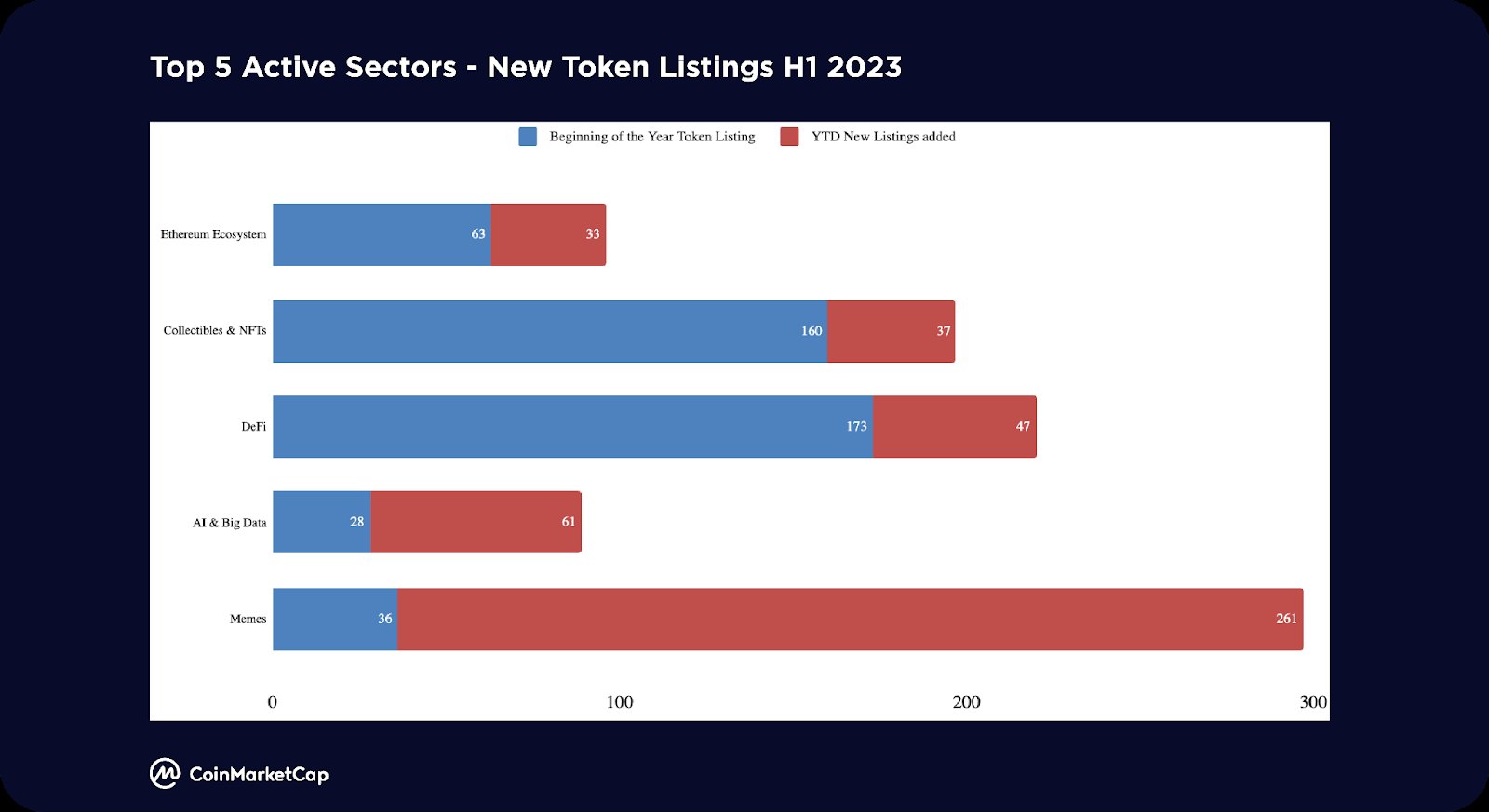

Notably, the Memes sector added over 260 new coins YTD, marking it the most active sector in terms of new listings. AI & Big Data is No.2 and added additional 61 coins, whereas DeFi is ranked No.3, with additional 47 new listings YTD.

Bitcoin Price and Key Events

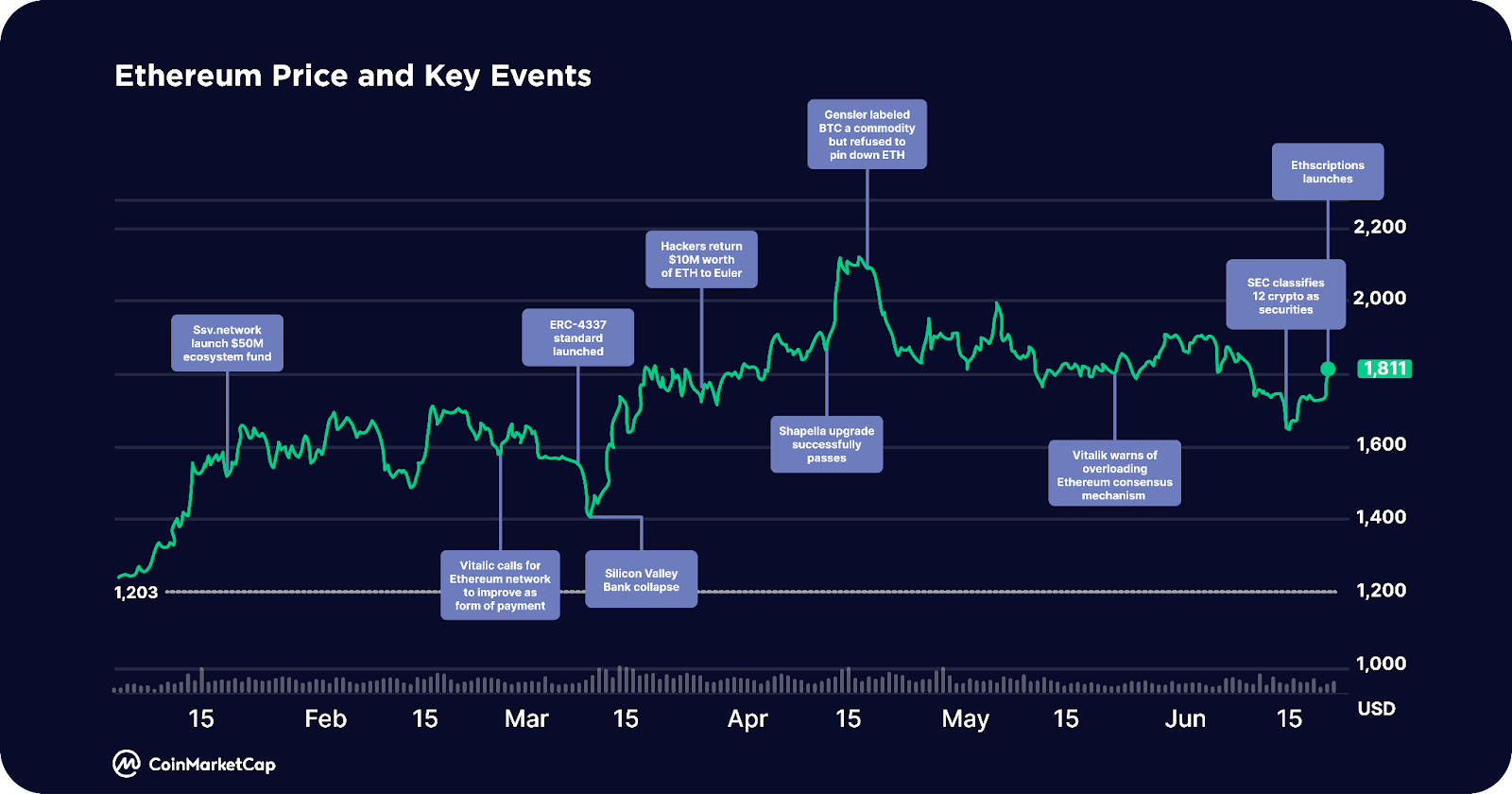

Ethereum Price and Key Events

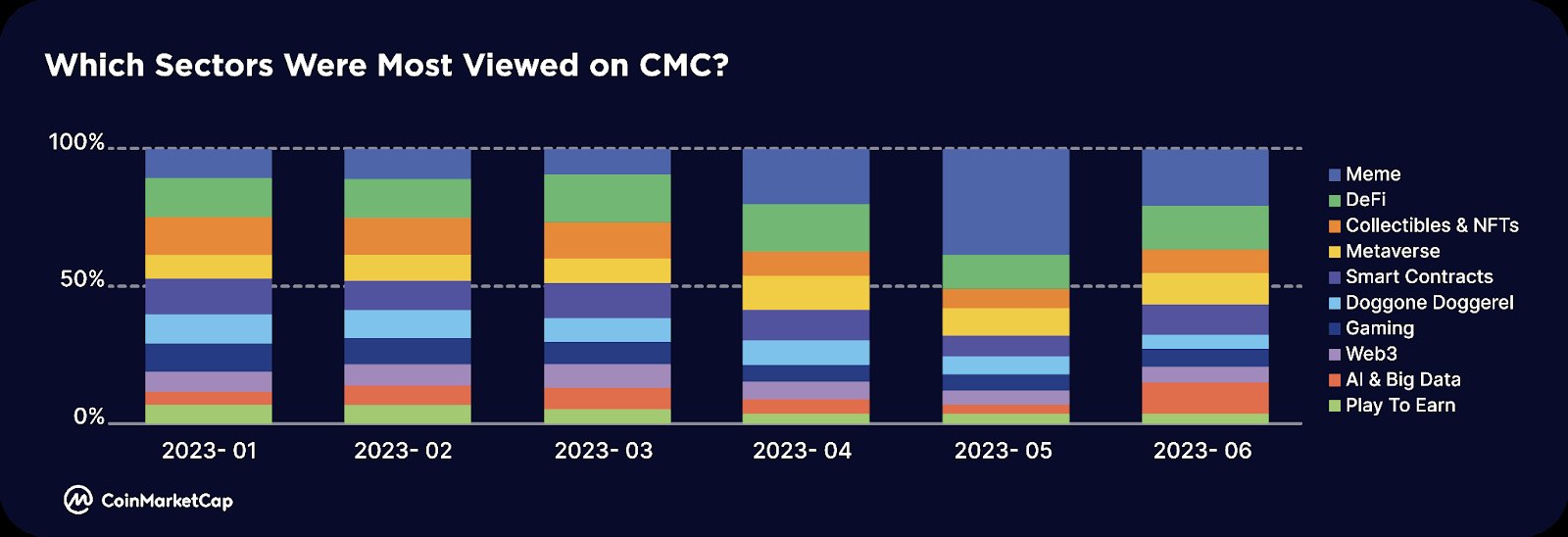

Most Popular Sectors and Coins

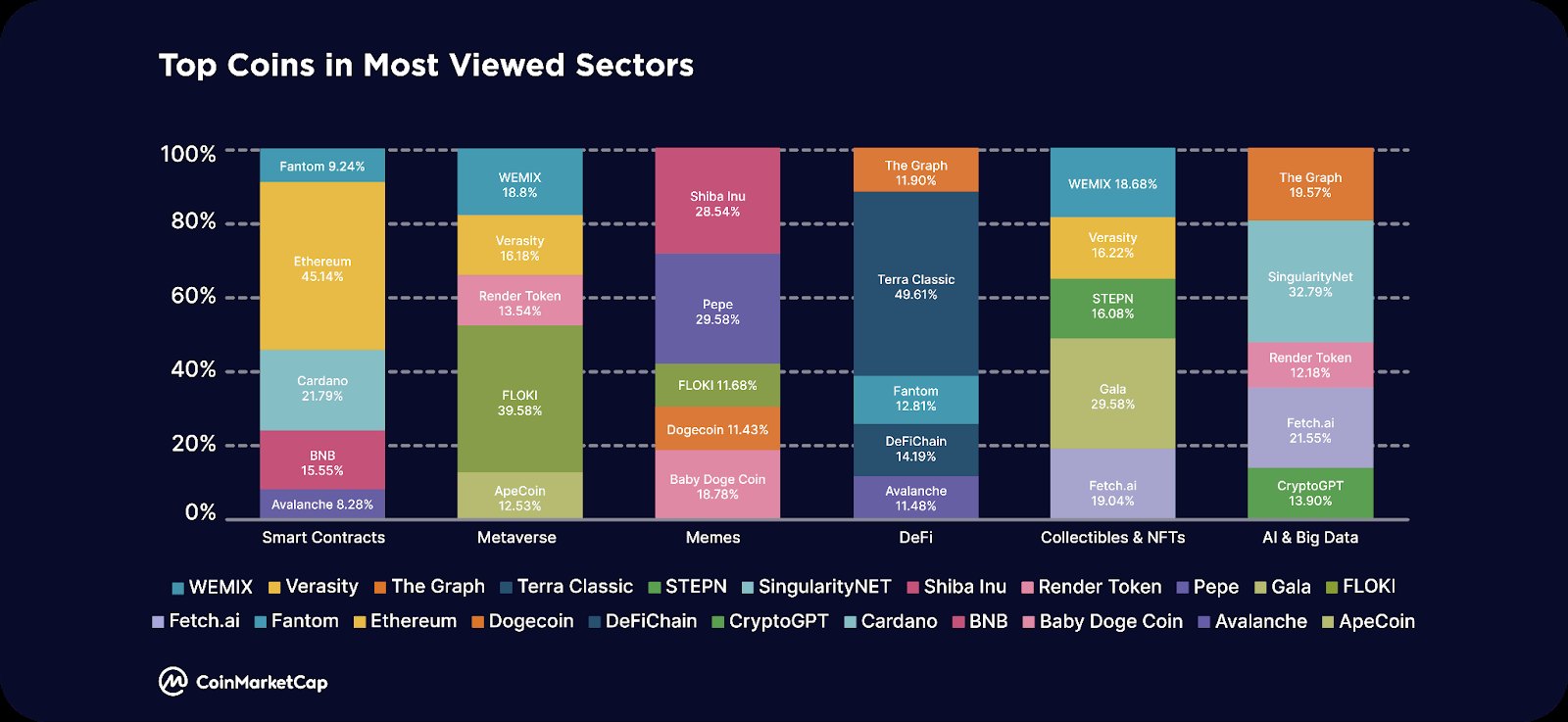

Memes sector generated the most interest, particularly for the last three months of H1 2023. This is largely led by PEPE, which saw an explosive rally of over 3700X from April to May. After retracing from its highs in May, PEPE has rallied almost 100% from its lows in mid-June. Memecoins from previous meme cycles, such as DOGE, SHIB and BabyDoge, remain in the most viewed of this sector

Smart Contracts interest remains mainly in Ethereum (ETH), after the network successfully underwent the Shapella upgrade on April 12, allowing staked ETH on the beacon chain to be withdrawn. Cardano (ADA) also received significant interest, likely due to technical developments like scaling solution Hydra and governance proposal CIP 1694

DeFi sector interest was mainly concentrated in Terra Classic (LUNC), likely due to events like Binance burning 2.65 billion of LUNC tokens, worth $236K, and the release of Alliance, a cross-chain yield trading protocol, by TFL

AI & Big Data saw a substantial return in interest in June, after the AI narrative in February and March. SingularityNET (AGIX) and Fetch.ai (FET) received the most views, after bouncing almost 40% from the lows in mid-June.

- PEPE joined the list of most added coins to the watchlist by CMC users, alongside other established meme coins Dogecoin and Shiba Inu.

- Besides the blue chips, other coins are mainly Ethereum Layer-2 scaling solutions, like Polygon, Arbitrum or competing Layer-1s, such as BNB and Solana

Most Engaged Communities

- The sector with most engagement (account likes, posts, comments) on CMC Community is memes, coinciding with the most viewed sector. The speculative memecoin season in April and May saw coins like PEPE, SNEK, LADYS experience explosive pumps.

Best Performing Coins in H1 2023

● Top gainers for H1 2023 include Arbitrum ecosystem tokens like Pendle (PENDLE), which went live on Binance Launchpool and expanded to BNB Chain, Radiant Capital (RDNT), which deployed on BNB Chain too and will be expanding to Ethereum, and Optimism ecosystem tokens like Velodrome Finance (VELO), which launched V2 on June 23

● Other top gainers include layer-one blockchains including Dione Protocol (DIONE), a “L1 blockchain in development enabling renewable energy,” which launched its Odyssey Testnet beta recently, Conflux (CFX), which rallied as part of the Hong Kong narrative as the “only regulatory compliant, public, and permissionless blockchain in China,” and Injective (INJ), a L1 blockchain built specifically for finance, which launched the first-ever Solana SVM rollup for the IBC ecosystem.

● Other top gainers include AI-related tokens like SingularityNET (AGIX) and Render (RNDR).

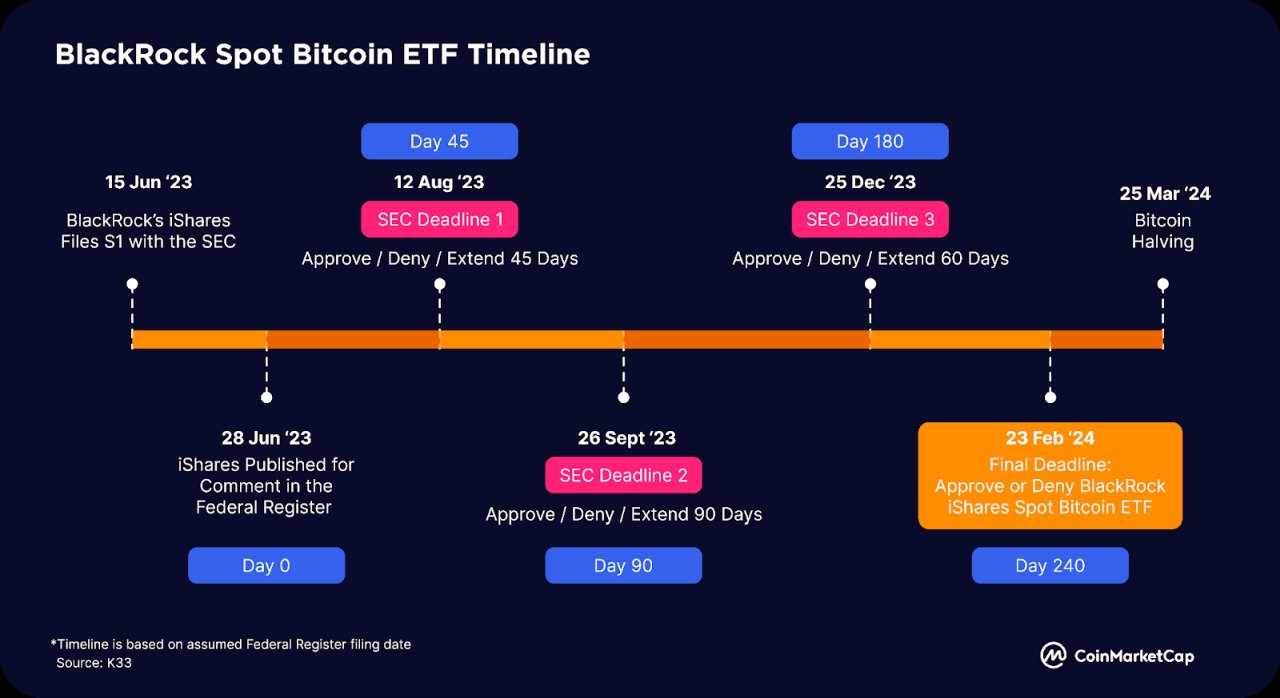

Bitcoin ETF

In June 2023, BlackRock, the world’s largest asset manager, filed for a Bitcoin spot ETF, creating heightened anticipation for the SEC’s approval of a Bitcoin spot ETF in the U.S. Other industry pioneers like Valkyrie, Fidelity, ARK Invest, and 21 Shares are also seeking approval for similar Bitcoin ETFs. If these ETFs get the green light, they could unlock substantial institutional investor demand by offering regulated products for asset allocation. Globally, the current crypto ETFs and ETPs already fetched c.$9.5 billion of assets. Once the U.S. market is unlocked with the new Bitcoin spot ETF approvals, a surge in demand for Bitcoin could push its price significantly beyond its All-Time High level.

Decentralized Public Infrastructure Networks

Another trending narrative is Decentralized Physical Infrastructure (DePIN), which provides solutions for access sharing of physical assets or services like warehousing and data networks. Builders and users are incentivized with tokens, and access is facilitated through staking, burning, or buying tokens/NFTs.

Though still in its early stages of expansion, the DePIN landscape already includes several notable players, including Helium (decentralized wireless infrastructure), IoTeX (Internet-of-Things hub), Arweave, and Filecoin (decentralized storage).

Real World Assets

Today, there is an ecosystem of projects focused on making RWAs tradeable on-chain. These largely consist of credit market protocols like Maple Finance and Goldfinch — which allow businesses to use DeFi to secure financing and loans.

Other platforms are instead now beginning to focus on the tokenization of RWAs, including real estate, collectibles, stock, intellectual property, and more — which can then be traded on-chain with less friction.

We expect that H2 2023 and beyond will see further stratification of the RWA space, with the first consumer-ready products likely to launch by year-end.

Liquid Staking Derivatives

Liquid Staking Derivatives (LSDs) saw a dramatic surge in activity in H1 2023 largely due to the Ethereum Shapella upgrade, with market leaders like Lido and Rocket Pool seeing their respective total value locked (TVL) swell by 138% and 220% respectively in H1 2023.

By the end of June, LSD platforms had secured more than a third of Ethereum’s TVS — with Lido capturing almost 75% of this at its peak.

H1 also saw the dramatic proliferation of the related LSDfi landscape, with platforms like Pendle, Lybra, and Flashstake seeing their TVLs well in this time. This propagation could continue through the remainder of 2023.

Restaking

Restaking emerged as a promising theme in H1 2023 after the introduction of EigenLayer — a middleware platform that allows staked ETH or liquid staked ETH tokens to be reused on the consensus layer.

This allows users to earn an additional yield on their assets by restaking it elsewhere while providing a new market for shared security — helping projects and services to bootstrap a new trust network and bolster their security.

In June 2023, EigenLayer’s Restaking Smart Contracts were deployed and reached their maximum limits within a day of mainnet launch — demonstrating considerable demand for restaking services.

The platform is soon set to increase its LST restaking capacity, which will shine a spotlight on the restaking space and potentially open the floodgates for a new wave of projects.

ZkSync

In 2023, zkSync emerged as a popular Ethereum-based layer-2 solution and strong competition for existing Ethereum optimistic rollups, including Optimism and Arbitrum.

As a zero-knowledge rollup (zkRollup) solution, zk-Sync uses zero knowledge technology to offload traffic from Ethereum to an efficient second layer. This helps to not only increase Ethereum’s throughput but also enables an array of new applications.

In March 2023, zkSync launches alpha mainnet — with zkSync Era becoming the first zkEVM to reach its mainnet stage of development. Since it launched, the total value locked (TVL) on the platform has grown considerably, reaching $686 million by the end of H1 2023, according to L2beat. It is just behind Arbitrum ($5.66B) and Optimism ($2.12B).

The platform boasts over 1.1 million unique wallets and has clocked in 1.38 million transactions and counting.

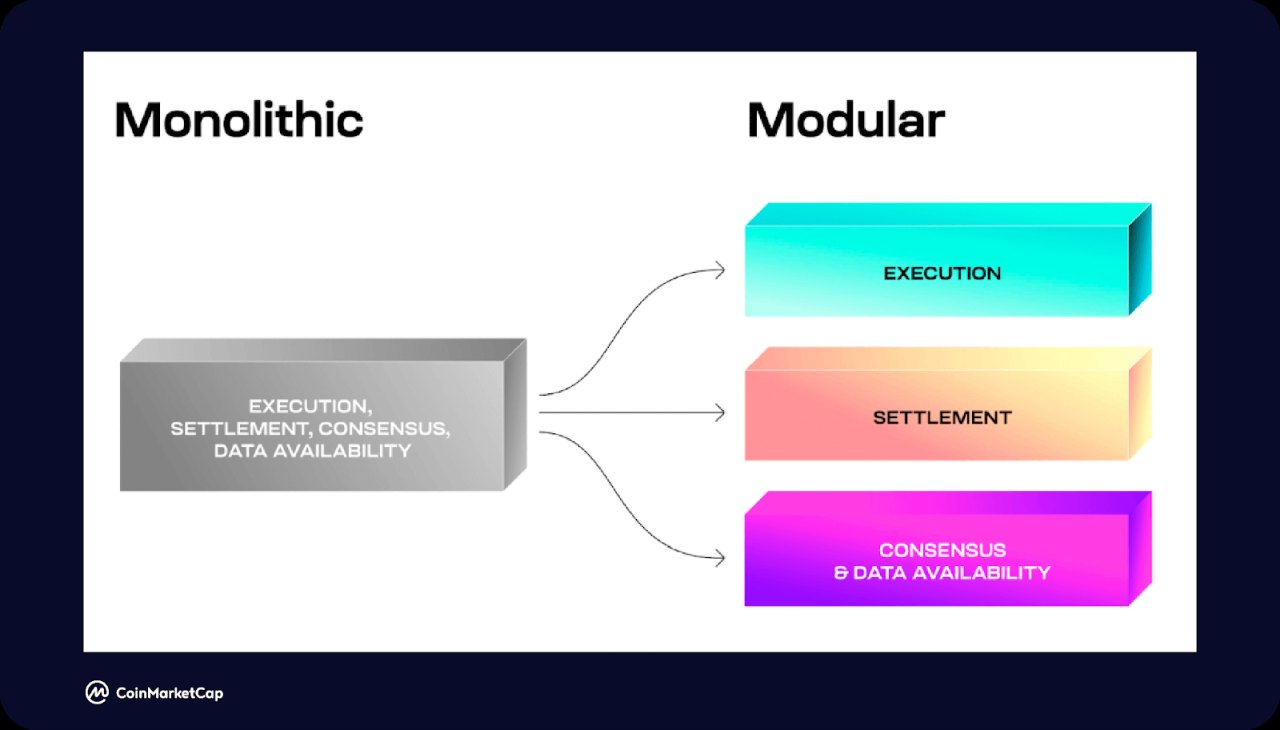

Modular Blockchains (Celestia)

Most layer-1 blockchains are currently monolithic chains — execution, data availability, security, and consensus are on a single chain. This leads to a slew of constraints surrounding efficiency, stemming from the blockchain trilemma of decentralization, security, and scalability.

Modular blockchains, like Celestia, aim to tackle this challenge by separating blockchains into three layers: execution, settlement, consensus, and data availability. It provides developers with modular data availability and consensus layers which can be leveraged by dApps and sidechains to bootstrap development.

Meanwhile, other platforms have emerged to provide modular execution environments and settlement layers — including Rollkit (settlement) and Fuel (execution).

Together, these platforms and more could help to improve existing monolithic blockchains — including Ethereum and Solana.

FTX Bankruptcy Developments

Following its collapse last year, FTX depositors were left in limbo for months as it was unclear how much of the almost $9 billion shortfall could be recouped in the liquidation process.

In January, it was revealed that more than $5 billion in liquid assets had been shored up from various sources, with this figure increasing to over $7.3 billion by April 2023 — providing some much-needed relief to FTX customers.

With the process now moving in the right direction, creditors were recently contacted by the restructuring firm handling the case and were given a “Customer Bar Date” of September 29, 2023.

Moreover, the FTX legal team is currently considering restarting the cryptocurrency exchange. Though it remains unclear whether this would entail using the debtor assets or soliciting new funds from elsewhere.

Despite the recent progress, debtors still cannot expect to receive their payout until at least H2 2024.

Chapter 5: Crypto Users Around the World

In H1 2023, regional differences in interest in various cryptocurrency niches and sectors were not significant.

Bitcoin (BTC) remains the most-viewed cryptocurrency across all regions in H1 2023, a similar trend from Q4 2022. This is also reflected in Bitcoin’s dominance (BTC.D) over altcoins, BTC.D increased from 40.09% at the start of the year to 50.39% at the end of H1 2023, a 25% increase. This could be attributed to events like BlackRock’s iShares spot Bitcoin ETF application and the upcoming Bitcoin halving around March 2024.

Shiba Inu (SHIB) remains a popular memecoin across all regions, alongside Baby DogeCoin (BabyDoge) in South America, Asia, and Africa. A new entrant in the most viewed coins per region, the explosive surge of PEPE has caught the attention of crypto traders and speculators across all regions except South America.

Meanwhile, Ethereum (ETH) remains a popular coin of interest in most regions except Asia and Africa, while Ethereum scaling solutions like Polygon (MATIC) and Arbitrum (ARB) gained attention in South America and Other regions respectively.

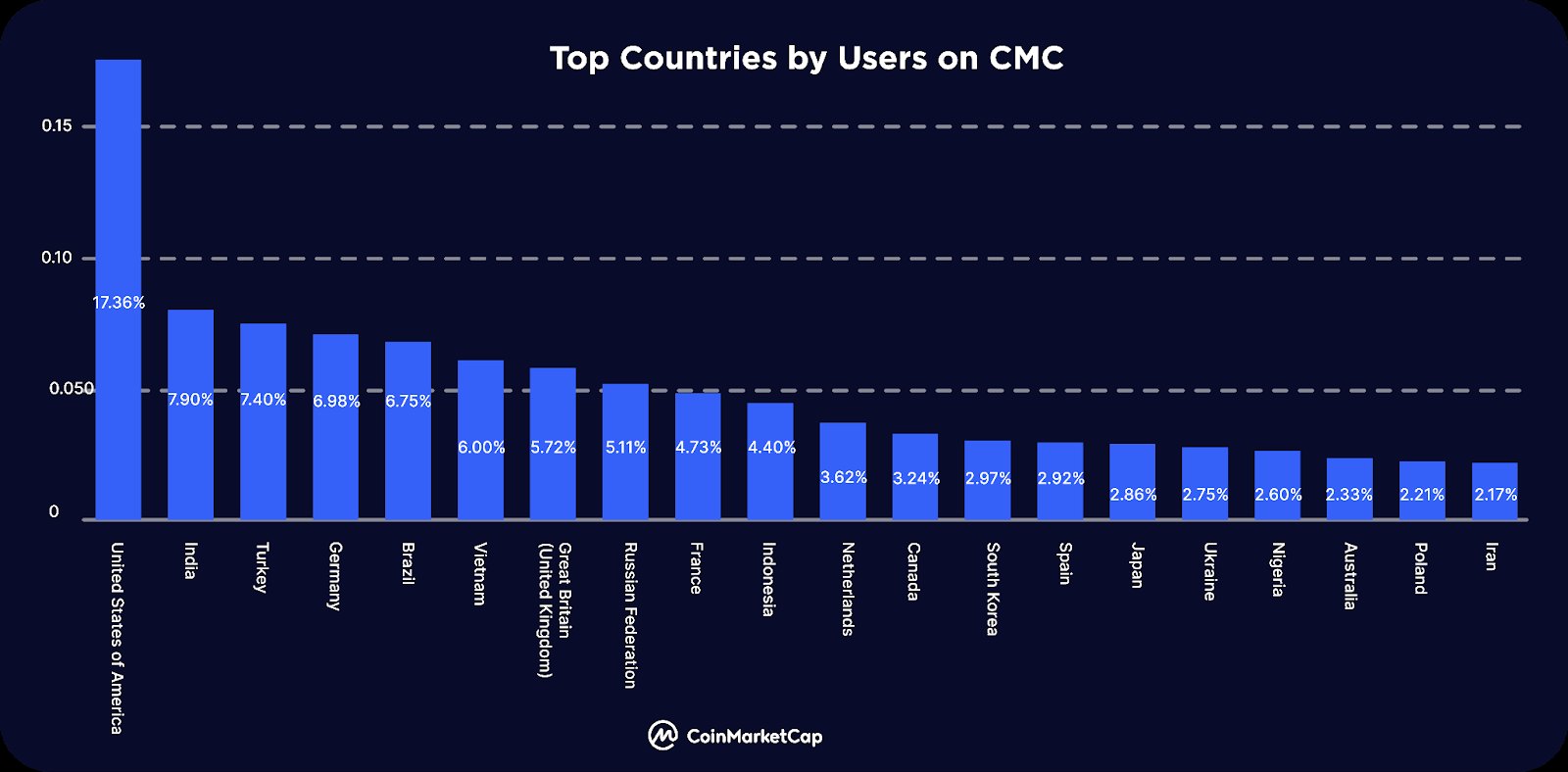

Top Countries by Users on CMC

The U.S. continues to dominate in terms of the distribution of cryptocurrency users worldwide. 17.4% of traffic in H1 2023 came from users in the United States, with 7.90%, 7.40%, 6.98%, 6.75%, and 6% of users in India, Turkey, Germany, Brazil, and Vietnam, respectively.

The vast majority of the remaining traffic is mainly among users in Europe and Asia.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://techstartups.com/2023/07/31/crypto-market-report-h1-2023-performance-insights-and-key-trends/