Externality pricing is coming to New York City in a big, barrier-busting form known as congestion pricing. And judging from how it’s unfolding, it might just be bold enough to return U.S. carbon pricing to public consideration.

Another big milestone in the long journey was reached this week when New York’s Metropolitan Transportation Authority unveiled its prospective tolls to drive a car or truck into Manhattan’s central business district. Barring a last-minute reversal, the Western hemisphere’s first congestion pricing program, and the world’s biggest by far in terms of revenue, will begin in six months, in June 2024.

NY Gov. Kathy Hochul (top) and CTC director Charles Komanoff (below) speaking at Dec. 5 Union Square rally celebrating the march toward congestion pricing in NYC.

The plan took half-a-century to legislate and another four-and-a-half years to flesh out, culminating, for now, in its formal approval by the MTA board on Wednesday. Autos will pay $15 to drive into Manhattan south of 60th Street between 5am-9pm weekdays and 9am-9pm weekends and holidays. Night-time tolls will be 75 percent lower, at $3.75. Trucks will pay more than cars, and for-hire vehicle trips that touch any part of the 8-square-mile congestion zone will be surcharged $1.25 (for yellow cabs) and $2.50 (for “ride-hail” vehicles, largely Ubers). Peak-period car trips to the zone via tunnels under the Hudson and East Rivers, which already pay double-digit round-trip tolls, will get $5 off, but other exemptions or discounts will be few except for qualifying low-income residents of the zone and commuters to it. (Many details here, by the author; and here, by the MTA’s toll-setting panel.)

The 2019 state legislation authorizing the tolls requires that they generate $1 billion a year net of administrative costs — a revenue stream sufficient to bond $15 billion in transit investments. Eighty percent of that, $12 billion, is earmarked for subway improvements such as station elevators to increase accessibility and fully digital signals to boost train frequencies; the other $3 billion will be invested in expanding commuter rail service between the suburbs and Manhattan.

[Click here to watch/hear Gov. Hochul’s remarks depicted above. Click here for Komanoff’s.]

Revenue Most Visible

The billion-dollar a year take from New York congestion pricing puts it in the same league as the Northeast states’ Regional Greenhouse Gas Initiative, which currently reaps $1.2 billion a year from sales of carbon emission permits for burning fossil fuels to make electricity. Yet “RGGI” is largely invisible to the public. So too are California’s economy-wide carbon cap-and-trade program, which started in 2013, and British Columbia’s 2008 carbon tax as well as subsequent cap-and-trade schemes elsewhere in Canada, .

Those other mechanisms rest on what former CTC staffer James Handley habitually derided as “hide the price” subterfuges. Congestion pricing, in contrast, hides nothing. Motorists know full well what they’ll soon pay to drive into the nation’s most gridlocked (and transit-rich) district. True, the surcharges on for-vehicle trips can be tricky to track — they add to rather than replace incumbent FHV surcharges of $2.50 and $2.75 for “taxi zone” trips in yellows and ride-hails, respectively. But congestion pricing’s main event is the fees for private car trips.

And “main event” is putting it mildly. Though the $15 peak car toll is many times less than the socially optimal toll (per Paul Krugman, whose July encomium to congestion program relied indirectly on my traffic-cost modeling) or the congestion costs imposed by a single car trip, which is nearly the same thing, it’s still a gut-punch for diehard drivers. Not only that, imposing a hefty price on car travel to capture externality costs rather than merely to pay for infrastructure provision is, let us say, deliciously transgressive in the USA. Kind of like taxing carbon emissions.

The point being: successfully implementing congestion pricing in New York — not simply putting it in place but having it deliver tangible benefits like more-reliable travel, more-livable streets and re-invigorated public transportation — conceivably could burnish carbon pricing not just in New York but nationwide.

Enacting Carbon Taxes Remains Devilishly Difficult

As if getting New York congestion pricing within inches of the goal line hasn’t been hard enough, enacting a national, i.e., federal carbon tax worthy of the name — one that hits triple digits within a half-dozen years or less — will be devilishly more difficult. Consider these differences between New York congestion pricing and national carbon taxing:

-

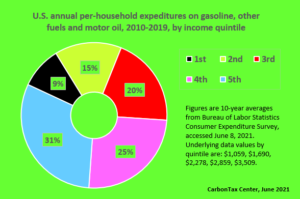

- The economic incidence of NY congestion pricing is far more income-progressive than national carbon pricing. A bulwark of CP advocacy here has been unstinting support from the Community Service Society — the city’s and nation’s oldest antipoverty NGO. It’s hard to picture comparable support for nationwide carbon pricing. Not even “dividending” carbon revenues, which CTC strongly supports, ensure guarantee that millions of U.S. households won’t pay more in higher fuel costs than they’ll get back in monthly carbon dividends. Inevitably and unfortunately, some will slip through the dividend’s safety net.

- NY congestion pricing comes with a natural route for managing the congestion revenues: investing them in long-term mass transit improvements. It was this facet, even more than the promise of lessened auto traffic, that brought the city’s rich tapestry of transit advocates into the fore of the congestion pricing campaign. Even motorists — some of them, anyway — grasp improved transit’s value to them as a means of dissuading others to invade “their” road space. National carbon pricing has no such obvious path for distributing or investing its revenues. Sure, spending carbon revenues on renewables and efficiency, particularly in historically disadvantaged communities, has a nice ring, but in practice there’s no clear carbon revenue spending path that won’t disaffect vast numbers of stakeholders. Now factor in the orders-of-magnitude difference in annual dollars — a billion or so in the case of NY congestion pricing vs. half-a-trillion for a comprehensive triple-digit U.S. carbon tax. Talk about a donnybrook gap!

- America’s geographic vastness and cultural separateness make it nearly impossible for citizens to consistently find common ground, as evidenced by our red-vs.-blue and urban-vs.-rural polarization. Even as New York City’s sense of conjoined fate has frayed somewhat, many residents still manage to cultivate a sense of connectedness to each other. Nationally, that ship has sailed. Woody Guthrie wrote “This Land Is Your Land” over 80 years ago. Fond hopes from the 1990s or early 2000s that combating climate change might re-invigorate Americans’ shared humanity seem almost as distant.

Antidotes

To these three difficulties we have three antidotes.

Over the prior decade, the wealthiest U.S. household quintile spent 3.3 times as much on gasoline as the poorest — evidence of the power of carbon dividends to more than offset the natural regressivity of higher energy prices.

The first is carbon dividends. Even if they can’t keep whole every single low-income U.S. household — there are, after all, 65 million below-median-income families, each with its own consumption profile — the vast majority of those households will reap more in dividends than they’ll pay with the carbon tax. Not just that, the dividend approach completely bypasses the political fights over where and how to invest the revenues.

The second is the exigency of the climate crisis itself. Unlike NYC traffic congestion or failing transit, which public policies like congestion pricing can vanquish going forwad, at least to some extent, climate collapse can’t be reversed. This ineluctable fact could, or should, motivate climate advocates to re-evaluate their largely ideological objections to robust carbon pricing (which we discuss in terms of climate justice campaigners and self-identified progressives). Given that people of color, whether in the U.S. or the Global South, are disproportionately vulnerable to climate chaos, should make carbon-pricing opponents reconsider their antipathy to the most efficacious policy for slashing emissions.

The third, as always is organizing. Carbon-taxing proponents need to keep up the pressure. We also need to expand our tent, as we wrote about last month in Gainsharing: Carbon Taxes Can Put Clean Energy Back in the Black. We’ll have more to say on that score soon.

<!–

–>

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.carbontax.org/blog/2023/12/08/congestion-pricing-coming-soon-to-new-york-city-could-bode-well-for-carbon-taxing/