The 2024 US presidential election could end up a second

Biden-Trump contest, with former President Donald Trump the front

runner for the Republican party nomination after securing a win in

the Iowa caucus this week and President Joe Biden currently the

front runner for the Democratic party nomination.

Regardless of which party wins, the 2024 US presidential

election may affect the automotive industry profoundly. A shift in

the White House or Congressional majority could impact

environmental policy and the regulatory environment, and lead to

changes in the federal tax and incentive support for the EV

transition. That could have massive downstream repercussions on the

entire automotive supply chain, by triggering changes in capital

allocation and timing for planned and future automaker and supplier

investments.

Two key pieces of Democratic-led legislation passed under

President Joe Biden have significant impact on the development of a

US EV market, the Inflation Reduction Act (IRA) and the Bipartisan

Infrastructure Law (BIL). If the 2024 US presidential election

results in a Republican-led White House and/or Congress, the new

administration may look to curb these laws and change or eliminate

federal funding. A reversal or reduction of federal subsidies could

cause OEMs, suppliers, and battery companies to rethink their

product and investment strategy, particularly as it relates to

North American sourcing.

The election also has the potential to impact greenhouse gas

emissions and fuel economy regulations. Under the previous Trump

administration, less aggressive regulatory policy was enacted, and

the mechanism that allows California to set its own emissions

regulations was ended. Under President Biden, more aggressive

targets were finalized covering regulations through the 2026 model

year, and California’s waiver was reinstated. <span/>Proposed EPA and NHTSA rules for the 2027

to 2032 model years are expected to be finalized before the

election.

If the election results in a shift to a Republican

administration, regulations could be pulled back and that

California’s waiver again revoked. NHTSA is required by US law to

set standards at least 18 months before a model year; with a new

president taking office in January 2025, a regulatory change would

have to be passed nearly immediately to impact the 2027 model year.

However, the process for change simply does not happen that fast.

Given the time that it takes for regulation to work through the

system, the earliest model year to be affected by a new change may

be the 2028 model year.

Investment implications

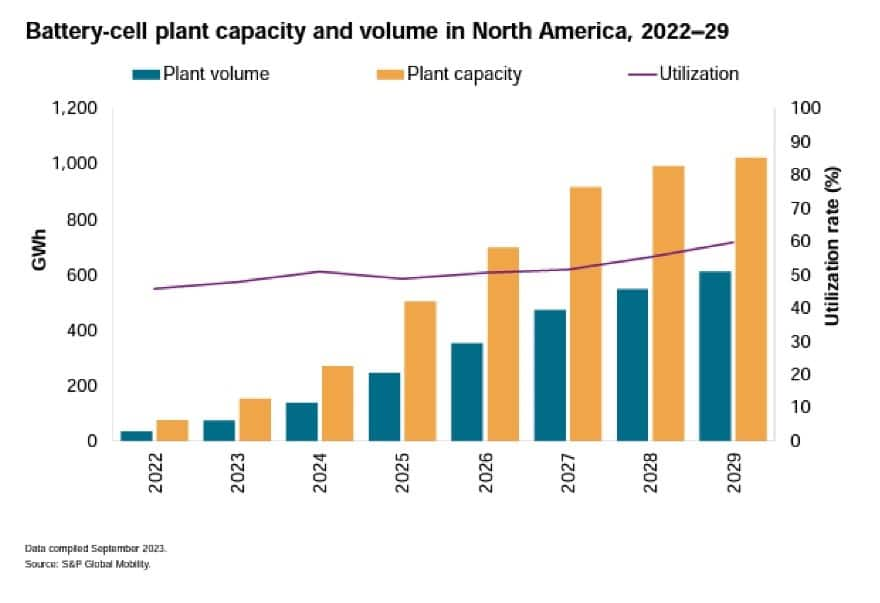

S&P Global Mobility estimates that, in the year following

the enactment of the IRA in August 2022, an investment exceeding

$100 billion was announced for US battery and electric vehicle

manufacturing initiatives. Of particular concern are projects which

have already started construction. S&P Global Mobility

estimates that in 2022, the US will have seven operational battery

plants, with an annual capacity of 75-gigawatt hours (GWh); after

the IRA, we see as many as 24 battery plants currently planned or

under construction, which could increase capacity to 732 GWh. We

also expect that this investment could exceed medium-term

demand.

Regardless of party affiliation, congressional representatives

will need to continue to support funding for projects bringing

investments and jobs to their states and districts. While on the

national stage, Republicans may object to any subsidy that conjures

imagery of the Green New Deal, but lawmakers in states already

benefitting will need to protect those projects. This situation

could create more tension than already exists between federal and

state authority on a number of issues.

How will industry respond?

A reversal or reduction of subsidies could have substantial

impact on for OEMs, suppliers and battery companies in terms of

product and investment strategy. Without national incentives for

local investment,

less expensive supply sources for key materials outside of the

region may become more attractive. The credits often offset the

higher costs of local sourcing; without them, an already

unprofitable situation can become more of a challenge.

However, S&P Global Mobility also sees potential for

currently known investment plans to create more battery capacity

than demand projections expect would be needed. We are also seeing

some automakers and suppliers delay planned EV and battery

manufacturing capacity plans for 2024. However, that is more

related to changing expectations for demand rather than increased

risk for the IRA subsidies to change. With planned investment

likely to be higher than demand, both sides of the party aisle have

pointed arguments for and against maintaining the credits.

The baseline S&P Global Mobility forecasts assume that

current emissions and fuel economy regulation proposals are

finalized and the IRA law remains in place and unchallenged.

However, if the situation does change, we see potential for

automaker reactions in several general categories:

- Automakers focused solely on EVs already;

- Those who are poised to stay flexible;

- Those who will hold a course toward electrification (or EVs)

but may adjust timing and sourcing; and, - Those who have been marching to their own timing already.

Any change to emissions regulations also has the potential to

change the picture; lowering compliance requirements can enable

automakers and the market to move more slowly to ZEVs but puts

medium-term investment plans into question. In the longer term,

continued progress to a ZEV future is supported by global policies

and regulations.

Electric anyway, stay the course

The automakers who are already fully electric will, of course,

continue that path. This will include Tesla, Rivian, Fisker, and

Lucid.

Tesla’s North American production footprint is expected to grow

beginning in 2025 or 2026 when its Mexico plant is finally

constructed and online. Tesla has slowed development of its Mexico

plant because of concerns CEO Elon Musk has over the economy and

interest rates, rather than potential changes in the political

landscape. Rivian is committed to a Georgia plant under

construction. Lucid’s production capacity expansion plans for the

US are likely to be more affected by real demand for the new

Gravity SUV. If consumer acceptance trails company expectations,

expansion could slow regardless of tax incentives. Meanwhile,

Fisker aims for contract manufacturing and is therefore in less

control over its supply chain.

2025 Lucid Gravity / Stephanie Brinley for S&P Global

Mobility

Stay flexible to market demand and regulatory

forces

Stellantis and BMW have focused on developing platforms that can

accept ICE, EV or PHEV solutions, and potentially fuel-cell EV

solutions. Mercedes-Benz is in this camp as well, with public

statements that it will increasingly move to BEV, but maintain ICE

vehicle production so long as consumers demand it.

Though BMW is poised to launch its Neue Klasse BEV platform in

2025, to date it has been offering EV counterparts to most of its

product lineup – including expectations it will launch the X2 and

iX2 in March 2024 as well as the latest Mini Cooper seeing ICE and

EV versions.

2023 RAM BEV Concept / Stephanie Brinley for S&P Global

Mobility

Stellantis has not yet jumped into the electrification market in

the US significantly, aside from PHEV versions of Chrysler Pacifica

and several Jeep products. However, in Europe, it is much more

aggressive with its BEV efforts. Stellantis’ electrification

profile in North America is expected to change in late 2024 and

2025. In early January, the company confirmed it plans to introduce

seven EVs for North America in 2024, including Jeep Recon and

Wrangler S, Ram 1500 REV, Dodge Charger Daytona, and Fiat 500e.

Stellantis is also expected to expand the use of its range-extender

solution, which comes first in early 2025 in the Ramcharger; in

that vehicle, a V6 engine generates power for an electric battery

but has no connection to the drive wheels. Although Alfa Romeo is

expected to blend PHEV and EV offerings, the Maserati brand is

poised to go all-electric first.

For North America, the automakers in this camp may extend

internal combustion engine programs or

place higher emphasis on hybrid and PHEV solutions through the

rest of this decade. Expectations are for EV programs to continue

to be developed, however. By 2030 or so, the EV programs should be

in full swing, as the investments do need to be realized.

Without the IRA subsidies, however, there is risk that these

companies make different sourcing decisions. According to some late

2023 reports, Mercedes-Benz may change sourcing for the EQS SUV

from the US to Germany, Though the EQS is too expensive to qualify

for US consumer tax credits, it is unclear if the company had been

eligible for the manufacturing credits under the IRA.

Toyota is almost a case unto itself, but fits in the “flexible”

category – albeit for more philosophical reasons — driving its

forward product plan than US regulatory conditions or incentives.

Though Toyota waited until 2022 to get aggressive with a BEV

future, the company maintains that reaching carbon neutrality is

the goal, rather than electrification for its own sake. Toyota

steadfastly maintains that the number of batteries it has deployed

into hybrid and PHEV products has had a greater impact on reducing

overall fleet emissions than if those same batteries were deployed

in a much smaller number of EVs. The result is that Toyota has a

propulsion system formula that could enable the company to lean in

whichever direction is required from the blend of customer and

regulatory forces, including the availability of subsidies in any

given region.

Stick to the strategy, with some timing

changes

2025 Chevrolet Silverado EV / Stephanie Brinley for S&P

Global Mobility

While a change in IRA or emissions and fuel economy requirements

could cause this group of OEMs to change timing for their

transition from ICE to BEV, we expect they will largely stick to

their plans to move to all EV or ZEV by the about the middle or end

of the next decade. Automakers in this category include GM,

Volkswagen, and Hyundai Motor Group (including Hyundai, Kia and

Genesis brands in the US).

Automakers potentially best positioned to modulate production

and vehicle offerings throughout a murky situation include Hyundai

Motor Group, and to a lesser extent, Ford Motor Company.

Hyundai Motor Group has dedicated BEV platforms and plans to

grow those offerings, but most of the existing Hyundai and Kia

products currently offer ICE, hybrid and PHEV solutions, with some

also offering BEV on the same platform. If there is a loosening of

regulations, Hyundai Motor Group has hybrids and PHEV solutions

available. Presumably, they could extend and make moderate

improvements to keep the products fresh if regulations and

consumer demand make that the more profitable path to the end

of the decade.

Ford also has more hybrid and PHEV solutions available to extend

vehicle programs if they need to. Ford’s plans to offer fewer

models on its EV platforms and focus on higher volume for a more

limited range of products could be a benefit here as well, as

delaying planned capacity means delaying fewer vehicle

programs.

GM is expected to be revising its EV product plan and

eliminating some products, ideally shifting that capacity to other

vehicles and holding down build complexity. A challenge for GM in

this case may be that it has more brands to feed than Ford.

US policy agnostic

Nissan, Honda and Mazda have all indicated plans for increasing

electrification and BEVs, though in the early part of this decade,

none was moving quickly to address the need for the US market.

2025 Honda Prologue / Stephanie Brinley for S&P Global

Mobility

Nissan executives speaking at the Japan Mobility Show in October

2023 said their plan to develop US electrified offerings will land

at just the right time. Nissan has confirmed US EV production for

2025 and is also working to develop the e-Power range extender

solution for US consumer demands.

Mazda was expected to lean on partner Toyota for EVs, though

recent CEO remarks suggest the automaker is looking to keep this

development in-house and has set an aggressive target for the

2026-27 timeframe. Mazda’s North American BEV production investment

is not final, but as a mainstream brand, its vehicles may be more

sensitive to pricing; and being ineligible for the consumer tax

credit could pose a higher risk.

Honda took an expedient course to get BEVs for both Honda and

Acura brands in the US in 2024 by leveraging its work with GM. But

its plan to build an affordable EV platform with General Motors was

canceled in 2023. Honda’s BEV development for the US will now be

internal. As the product plans have changed, Honda is also

increasing its reliance on hybrid offerings in the US, aiming to

see half of its Accord, Civic, and CR-V sales be hybrid models.

What to watch

A Republican in the White House – combined with Congressional

control – has the potential to create challenges to the regulatory

structure as well as both the BIL and IRA.

All of these policies are predicated on the Biden Administration

having set a soft target of seeing 50% of US light vehicle sales

being zero emissions in 2030. This target is also part of Biden

having the US re-join the Paris Climate Accord and targeting

broader, aggressive carbon neutrality targets.

But even if a Republican candidate wins the Presidency, changes

to the EV-friendly laws may be impossible without Republican

control of both the House and the Senate; the IRA and BIL are

simply too large to change from the present course.

In addition, several of the states in which large battery

manufacturing investments are being made and where construction is

already underway are swing states that are vitally important to the

result of the Presidential race, with Georgia, Michigan and the

Carolinas leading the way. However, there has also been pushback

from residents in both Georgia and Michigan to these manufacturing

investments, showing that the divide over the path to a ZEV future

is playing out on the local as well as national level.

If the Republican party pushes a target of modifying the laws

providing for federal funding of green-manufacturing development

under the guise of fiscal discipline, investment commitments could

be scaled back or delayed. The potential for ensuing lost

manufacturing investment could see the Democratic party positioning

itself as the party supporting business and workers regarding the

country’s automotive industry.

In addition, regardless of campaign promises and rhetoric,

changing the law will require Congressional input and votes. With a

potentially split or opposition Congress, the elected president

could have a more difficult time delivering on the changes promised

on the campaign trail. For industry, these factors create

uncertainty, which is the most disruptive of elements. With

billions of dollars and the future of these companies at stake, the

industry has time and again said that certainty related to

regulations and policy is what they need most in executing a

forward path.

Implications for EV share

Against the backdrop of the next US election, S&P Global

Mobility presents potential top-line scenarios to our baseline EV

adoption forecast for the US.

Today’s baseline forecast includes possibility for US EV market

share to be closer to 45% in 2030 and assumes that OEMs succeed in

lobbying efforts to move away from EPA emissions aspirations and

lean heavier on the latest NHTSA proposal, which may enable use of

more alternative powertrains.

However, in the context of this discussion, if there are drastic

changes to the IRA or BIL and incentives for manufacturers and

consumers are reduced, we could expect to see the potential for EV

share to be closer to 37% in 2030.

Should the EPA and NHTSA proposals of 2023 be finalized and

unchanged, the law of the land would push electrification north of

50% in 2030.

The result is a hugely complex political and business

environment, with numerous interwoven and discrete variables.

TO DISCUSS POTENTIAL ELECTION OUTCOMES WITH OUR ADVISORY

TEAM

FOR MORE ON AUTOMOTIVE PLANNING AND FORECASTING

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: http://www.spglobal.com/mobility/en/research-analysis/2024-us-presidential-election-and-the-auto-industry.html