What Is SUI?

Sui (pronounced “Swee”) is a decentralized Layer 1 proof of stake blockchain, meaning it serves as the foundational infrastructure for verifying and processing transactions, similar to Bitcoin and Ethereum. Layer 1 blockchains are the backbone that supports a specific token or a network of different tokens.

Sui was developed by Mysten Labs, a group of former Meta employees. It is designed to limit how long it takes to execute smart contracts and support scalability for decentralized applications (dApps). The network believes it has cracked the code on smart contract execution in terms of speed, high security, and low gas fees. This is possible because of the programming language it was designed with called “Move”. Move is a Rust-based programming language that prioritizes fast and secure transaction executions.

According to the whitepaper, the network is named after the element water in Japanese philosophy, a reference to its fluidity and flexibility that developers can use to shape the development of Web3. The network is focused on low latency and super scalability. This has seen it termed by supporters as “the Solana Killer.”

The Sui project was announced by Mysten Labs in September 2021, and in December 2021, Mysten Labs invested $36 million into the project. This was followed by a $300 million series B announcement led by a $140 million commitment by FTX in 2022, valuing the startup at $2 billion.

Reasons Why Sui Network Was Created

In the words of Sui Co-Founder and CEO, Evan Cheng, the current Web3 infrastructure is slow, expensive, and notoriously unreliable. Given this, Cheng said the network was created to change the Web3 game with some 5G level upgrades that would allow developers to create blockchain-powered applications with scalability that you can only associate with centralized technology hubs that dominated Web 2.0.

In other words, the Sui network was created to solve Web3 problems by simplifying and improving the creation of various applications and functions in the Web3 ecosystem, solving the most common problems in the Web3 industry: speed, security, and stability.

How Does The Blockchain Work?

Sui operates as a Layer 1 blockchain focused on optimizing fast blockchain transfers. It places a high level of importance on immediate transaction finalization, making Sui an ideal platform for on-chain applications such as decentralized finance (DeFi), gaming, and other real-time use cases.

Unlike the existing Layer 1 blockchains where transactions are added one after the other, which makes it slow as more transactions are being added to the blockchain, Sui does not make every transaction go through all the computers in the network. Instead, it picks the relevant part of the data it needs to check, which eliminates the problem of congestion on the blockchain and drastically reduces gas fees to carry out transactions.

The Sui network uses a permissionless set of validators to reduce latency and a protocol called the Delegate Proof of Stake system. It has epochs (each consisting of 24 hours), during which Sui holders select a set of validators with whom they store their staked tokens. The validators are then in charge of transaction selection and approval.

Who Are The Brains Behind The Sui Network?

Co-Founder and CEO Evan Cheng: Cheng previously worked at Apple for 10 years, and he was also the former Head of Research and Development at Novi and Technical Director of Meta.

The Chief Scientist George Danezis: Former researcher at Novi, Meta, and previously worked at Chainspace, Microsoft.

Adeniyi Abiodun, CPO: Former Head of Product Development at Novi, Meta. Previously worked at VMware, Oracle, PeerNova, HSBC, and JP Morgan.

Kostas Chalkias: Former leading cryptographer at Novi. He previously worked at R3, Erybo, Safemarket, and NewCrypt.

Sam Blackshear, CTO: Former Chief Engineer at Novi, specializing in the Move programming language.

Investors and Institutions Backing The Network

Sui was valued at $2 billion after FTX Ventures committed $140 million to the project. However, Sui also has other credible investors who also committed, like Binance Labs, the largest centralized crypto exchange by daily trading volume, and Coinbase Ventures, the largest crypto exchange in the United States.

Other investors included Franklin Templeton, a global leader in asset management with more than seven decades of experience, and Jump Crypto, an experienced team of builders, developers, and traders. Apollo, Lightspeed Venture, Circle Ventures, Partners, Sino Global, Dentsu Ventures, Greenoaks Capital, and O’Leary Ventures also invested in the blockchain.

Uses of Sui Coin

SUI coin plays a crucial role within the ecosystem and serves various functions:

- Governance: Sui coin holders can participate in governance decision-making, which includes parameter adjustments, protocol upgrades, and other key network changes. This means SUI holders have a say in the direction and development of the Sui Network.

- Transaction Fees: SUI coin is used to pay for transaction fees within the network. The coin acts as the medium of exchange to cover all associated fees, whether you are interacting with smart contracts, transferring assets, or participating in any Sui on-chain activity.

- Utility: The native coin will be used in various decentralized applications (dApps), gaming applications, and other projects built on the network. It will be used to purchase in-game accessories and NFTs.

- Staking: Staking SUI coin helps network security and consensus. SUI coin holders who stake their coins are being rewarded and given incentives for participation and engagement.

- Investment: Investors can buy and hold or trade SUI coins as an investment on centralized exchanges, just like Bitcoin, Ethereum, Solana, Cardano, BNB, and all other blockchains with good use cases.

Sui Network Plans To Improve The Web3 Ecosystem

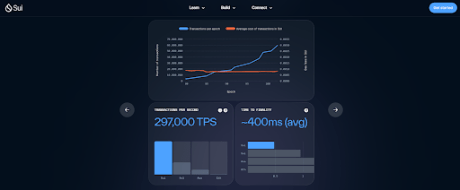

Transaction Speeds

Sui Network aims to solve the slow transaction problems on Web3. The network was built on a Rust-based programming language called Move, which prioritizes fast and secure transaction executions. Transactions on the Sui network are validated in epochs of 24 hours, each epoch can be validated independently rather than in blocks like it’s done on traditional blockchains.

The parallel execution of transactions increases Sui network transaction speed to 297,000 transactions per second and 400 milliseconds time of finality compared to Ethereum’s 20 transactions per second and 6 minutes time of finality or Solana’s 10,000 transactions per second and 2.5 seconds time of finality.

Focus On Web3 And Asset Ownership

The Sui network is focused on improving Web3 and Web3 experience by catering to the needs of millions of users, which includes speed and security. Sui allows users to create, upgrade, and deploy decentralized applications and non-fungible tokens (NFTs)

Scalability

Sui Network aims to make Web3 more scalable through parallel processing or execution. This means that the Sui network identifies independent transactions and processes them simultaneously. The implication is that transaction times are reduced, and it accommodates larger transactions loaded per time. It is made possible because of the Sui implementation of the Move programming language and the Narwhal-Bullshark-Tusk Consensus algorithm, which focuses on the details of a transaction rather than the entire chain of transactions.

The Tokenomics Of SUI coin

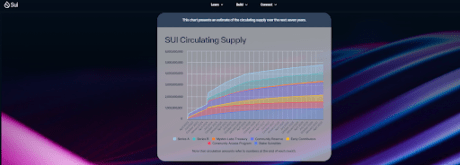

Sui’s native token is called SUI, which has several use cases. According to Coingecko, the max and total supply of SUI is capped at 10 billion coins with a current circulating supply of 1.2 billion, and it is ranked number 48 based on market cap value.

A share of the total supply of SUI was made liquid at the launch of its mainnet on May 3, 2023. Sui’s all-time high was on the day it was launched at $2.16. However, it is currently trading at $1.51, which is a 320% pump from its all-time low of $0.364 last year on October 19.

The tokenomics included 6% going to its Community Access Program and App Testers, 10% of the supply went to the Mysten Labs Treasury, 14% went to its Investors, and 20% went to Early Contributors. The vast majority of the supply, 50%, is kept in its Community Reserve. The purpose and distribution of the Community Reserve include a Delegation Program, Grant Programs, Research & Development, and Validator Subsidies, as shown in the illustration below:

Only about 5% of SUI coins were already in use when the Sui Mainnet launched, while the rest will be gradually released according to their planned schedule, as shown below:

Conclusion

Sui Network aims to improve Web3 by giving every Web3 user a much better Web3 experience without the struggles of slow transaction speeds. The network uses parallel execution for transactions to ensure lightning-fast speed, high security, and low gas fees.

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.newsbtc.com/sui/what-is-sui-sui-network/