(Last Updated On: May 24, 2023)

Learn about Injective, a blockchain built for finance and powering decentralized finance (DeFi) applications. Discover the unique features of INJ cryptocurrency, including the ability to participate in protocol upgrades and validation, staking for rewards, and burn auctions. Find out the benefits of taking out an INJ loan, including profit from volatility, making a huge purchase while continuing to hold your assets, tax optimization, and risk management. Follow these 4 easy steps to get a INJ loan and start benefiting today.

Injective is a blockchain built for finance. It is an open, interoperable layer-one blockchain powering next-generation DeFi applications, including decentralized spot and derivatives exchanges, prediction markets, lending protocols, and more.

Injective provides a next-generation, highly interoperable smart contract platform based on CosmWasm, with advanced interchain capabilities. Injective is custom built with the Cosmos SDK and utilizes Tendermint-based Proof-of-Stake consensus mechanism, providing instant transaction finality with the ability to sustain lightning-fast performance (25,000+ TPS).

The Injective ecosystem includes over 100 projects and over 150,000 community members globally.

Injective is backed by a group of prominent investors such as Binance, Pantera Capital, Jump Crypto and Mark Cuban.

What is INJ cryptocurrency?

Injective is governed by a global DAO through its native crypto asset: INJ.

INJ allows Web3 community members to participate in protocol upgrade proposals, validation of Injective’s blockchain network, staking for rewards, burn auctions and more on the PoS network.

The burn auctions on Injective are especially unique since 60% of all fees collected from dApps are auctioned off every week via a buy back and burn mechanism. This in turn allows the supply of INJ to dramatically decrease over time. The INJ burn auction is unique in that it helps accrue value for the entire Injective ecosystem. Currently, Injective has the highest token burn ratio in the industry.

What Makes INJ Unique?

- Injective is the only blockchain specialized for DeFi applications. It is the blockchain built for finance, and it is the first sector specific blockchain.

- Injective is the only interoperable blockchain that has a native decentralized order book infrastructure that can support all financial primitives (spot, perpetuals, options, expiry futures, etc.)

- Injective is built with the Cosmos SDK, but is uniquely compatible with multiple prominent layer ones, including Ethereum, Moonbeam, Solana, Polygon, Avalanche and more through the integration with Wormhole, making it highly interoperable.

- Injective has smart contracts enabled through CosmWasm, with a unique implementation that allows for smart contracts to be executed automatically at every block.

- Injective is complete MEV resistance due to its frequent batch auction model for transaction processing.

- Injective supports for Ethereum native tooling. For example, anyone can access Injective with MetaMask without having to switch networks, allowing users to avoid any switching cost.

- The block time of Injective is 1.1 seconds, making it one of the fastest blockchains in the world.

- Injective is over 1000x faster and cheaper than Ethereum.

What are the benefits of taking out a INJ loan?

With crypto loans, you can access funds without selling, increase liquidity, maximize capital utilization, and diversify your portfolio more effectively. In addition, crypto loans tend to have lower interest rates than traditional loans, so borrowers are able to get funds for much less. Finally, these loans provide additional peace of mind since crypto collateral is stored securely in a cold storage wallet.

Here are some cases where you can use INJ as a collateral and get profit:

- Profit from volatility – CoinRabbit loans remain fixed no matter the exchange rate of the collateral currency. An example will help to explain this concept. Suppose you received a loan with 90% Loan-to-value-ratio against 2,000,000,000 INJ when it was valued at $0.0000048 (approx. $9,600). You were then provided with 90% of your collateral; in this case $8,640. To receive your INJ collateral back, you must repay that exact amount – regardless if INJ rises to $0.0000080 or higher. Technically speaking, when repaying the loan at that point, you’d be getting back a total of $16,000 instead of the original $9,600! Crypto loans allow users to leverage their assets and potentially gain profit simultaneously – making them incredibly advantageous.

- Make a huge purchase and continue holding – The crypto loan allows you to enjoy the value of the invested fiat money while inflation permanently decreases it. Today the same amount values more than tomorrow. Therefore, when you take out a crypto loan against INJ, you keep all your INJ assets but gain extra funds to spend today, as we all know that tomorrow your wishes will be more expensive. 😉

- Tax optimization – Some countries require you to pay up to 40% on your crypto investment profits. There is no direct profit in a loan transaction. So you can take a loan and maximize your tax efficiency without worrying about taxes.

- Technique for managing risks – Rather than holding INJ tokens and risking the unpredictable fluctuations of the crypto markets, crypto investors now have the opportunity to utilize their investments as collateral for a INJ loan. They can access funds while their assets remain secure, allowing them to manage their risks. In this way, they can benefit from the lower interest rates of crypto loans while protecting themselves from potential losses from market volatility at the same time.

Is there a way to work with INJ volatility to avoid liquidation?

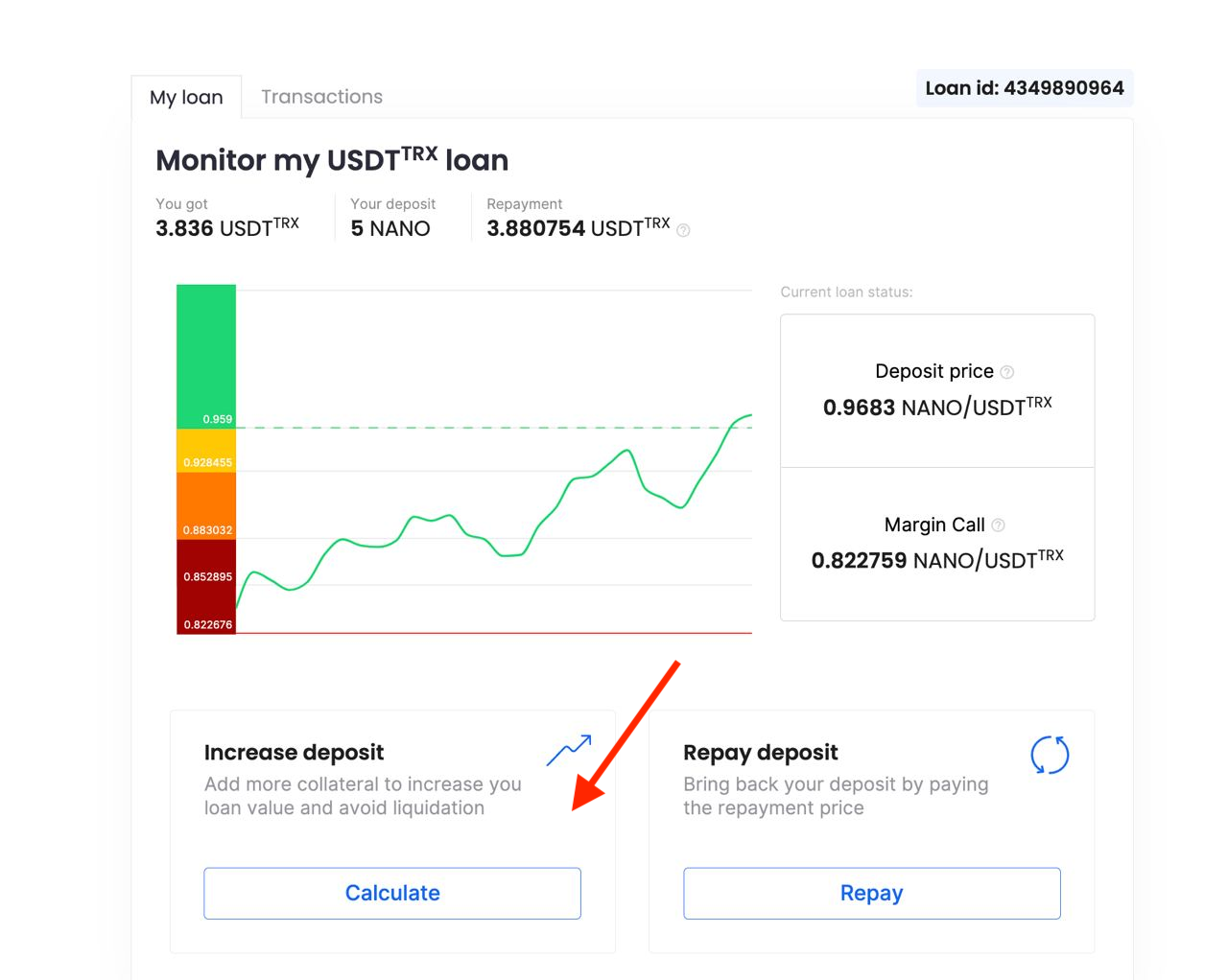

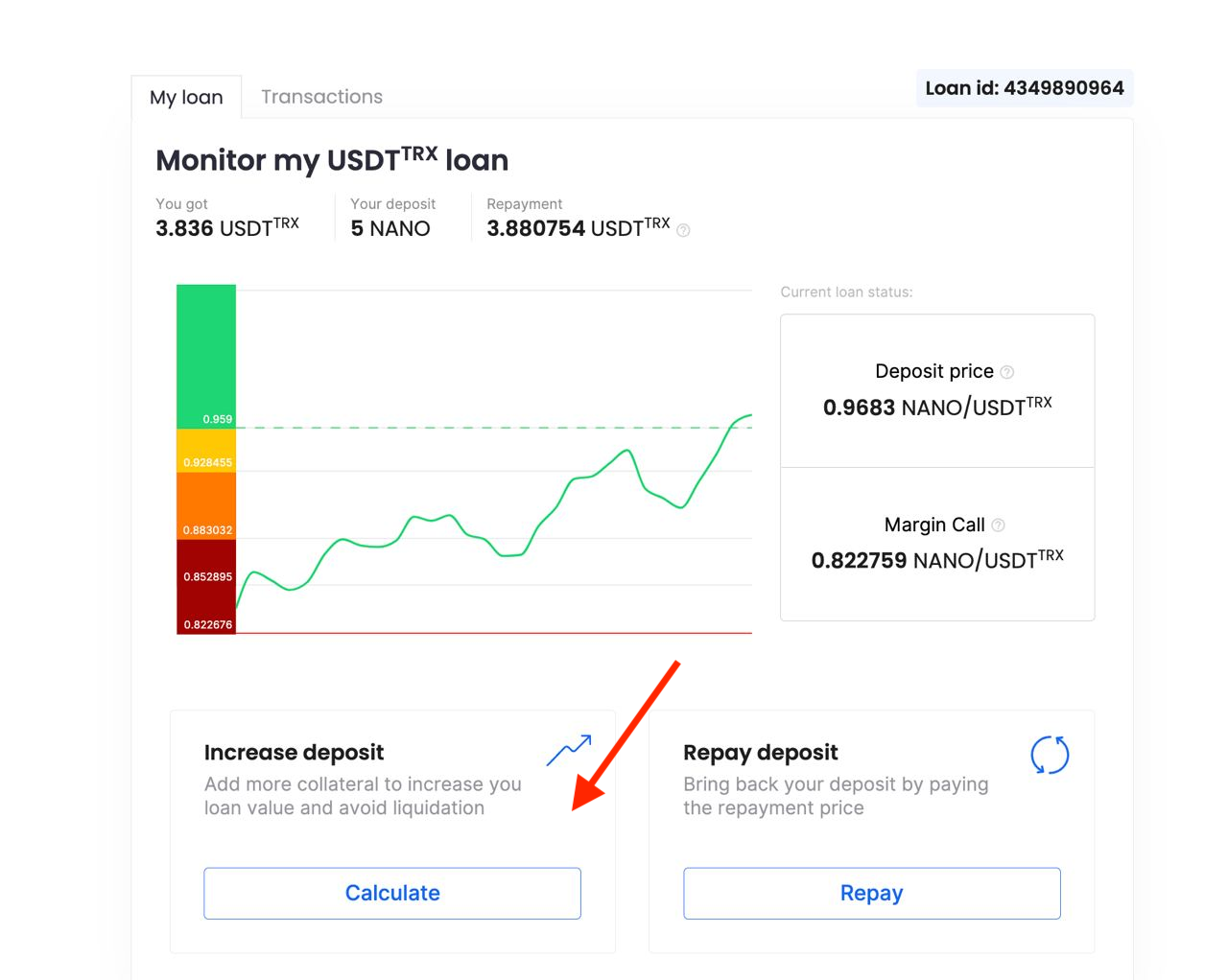

INJ crypto volatility can result in liquidation. When you use your INJ to take a loan, it is important to monitor the status of your loan. CoinRabbit offers an instant alert system, which uses SMS and e-mail to inform users when there is a potential liquidation.

You can always add more collateral to adjust the Liquidation price of your loan. Loan collateral at CoinRabbit isn’t frozen; therefore, liquidation prices are adjusted immediately by adding more collateral or repaying your loan.

Aside from that, you can decrease the LTV at any time while the loan is open by adding more collateral. For example, CoinRabbit’s minimum loan LTV is 50%. CoinRabbit allows you to increase collateral immediately after opening a loan, so the LTV will decrease at a rate that suits you.

How to get a INJ loan in 4 steps

The application process for a INJ crypto loan has been significantly simplified thanks to crypto loan platforms like CoinRabbit.

Conclusion

INJ crypto loans with CoinRabbit – is a great tool for crypto investors and holders: you can use a crypto loan to optimize your taxes, make a huge purchase, reinvest in new cryptocurrencies and many more while continuing holding your digital assets.

It’s important to remember that all operations with crypto are highly risky. When you get a loan with any crypto lending platform – don’t forget to check the status of your crypto loan periodically and add collateral if it’s needed to avoid liquidation of the loan.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Buy and Sell Shares in PRE-IPO Companies with PREIPO®. Access Here.

- Source: https://coinrabbit.io/blog/what-is-inj-and-how-to-use-it-to-gain-profit/