The formation of the Doji candlestick pattern on September 25 after consistent selling in the previous four sessions indicates the possibility of a bounce-back. Hence, the Nifty50 may march towards 19,800 in case of a bounce and sustainability of uptrend may take it towards the 20,000 mark, whereas the 19,600-19,500 is expected to remain a key support area, experts said.

The benchmark indices closed flat with a positive bias amid volatility. The BSE Sensex was up 14.5 points at 66,024, and the Nifty50 gained 0.2 points at 19,674.5, while the Nifty Midcap 100 and Smallcap 100 indices rose 0.66 percent and 0.04 percent, respectively.

“The present chart pattern on the Nifty50 indicates the formation of a Doji-type candle pattern at the swing lows. Normally, such Doji formations after a reasonable decline alert for a bounce back from the lows. A sustainable positive close in the subsequent session is likely to confirm an upside bounce for the market,” Nagaraj Shetti, technical research analyst at HDFC Securities said.

The Nifty is currently placed near the support of the 20-week EMA (exponential moving average) around 19,580. “The said moving average has offered strong support for the Nifty for the past 3-4 months. Hence, there is a possibility of an upside bounce in the near term,” Shetti said, adding that at the highs, the market could find strong resistance around 19,850 levels.

Immediate support to be watched is around 19,600-19,550 levels, he said.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks are the aggregates of three-month data and not just the current month.

Key support and resistance levels on Nifty

The pivot point calculator indicates that the Nifty may be taking support at 19,619, followed by 19,588 and 19,538. On the higher side, 19,721 can be an immediate resistance, followed by 19,752 and 19,803.

On September 25, the Bank Nifty also snapped its four-day weakness and jumped 154 points to 44,766, forming a bullish candlestick pattern with long upper and lower shadows, which resembles a High Wave sort of candlestick pattern (not exactly one) on the daily charts.

“The Bank Nifty index experienced a brief respite following a four-day sell-off, with buyers gaining traction from lower levels. However, the index continues to trade below its 20-day moving average (20DMA), which is currently positioned at 45,000. A close above this level would signal a potential resumption of the upward momentum,” Kunal Shah, senior technical & derivative analyst at LKP Securities said.

On the downside, he feels the lower-end support now rests within the 44,500 to 44,000 zone. A breach below this support range could result in additional selling pressure on the index, he said.

As per the pivot point calculator, the banking index is expected to take support at 44,497, followed by 44,370 and 44,165. On the upside, the initial resistance is at 44,906 then 45,032 and 45,237.

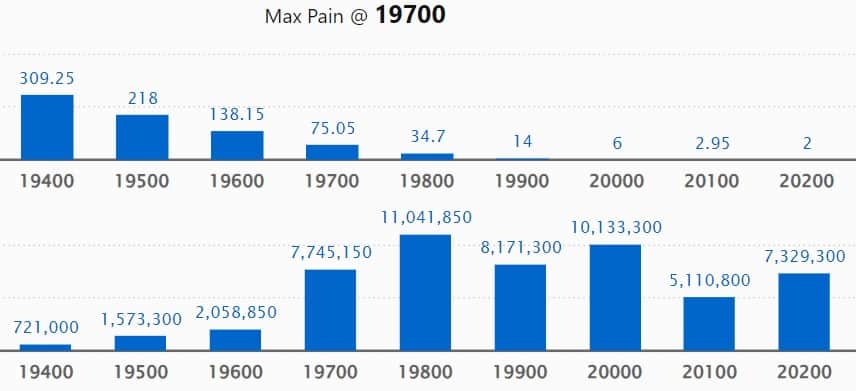

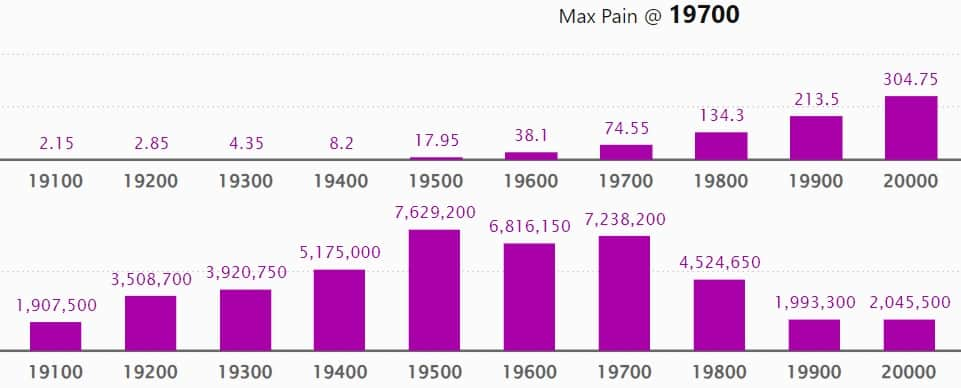

As per the options data, the maximum weekly Call open interest (OI) was seen at 19,800 strike with 1.1 crore contracts, which can act as a key resistance for the Nifty. It was followed by 20,000 strike which had 1.01 crore contracts, while 19,900 strike had 81.71 lakh contracts.

The meaningful Call writing was seen at 19,700 strike, which added 22.97 lakh contracts followed by 19,900 and 20,000 strikes, which added 9.94 lakh and 9.18 lakh contracts.

The maximum Call unwinding was at 20,500 strike, which shed 9.25 lakh contracts followed by 20,100 strike and 20,600 strike, which shed 5.23 lakh contracts, and 3.78 lakh contracts.

On the Put side, the maximum open interest remained at 19,000 strike, with 90.2 lakh contracts. This can be an important support for the Nifty in the coming sessions.

It was followed by 19,500 strike comprising 76.29 lakh contracts, and 19,700 strike with 72.38 lakh contracts.

The meaningful Put writing was at 19,400 strike, which added 18.01 lakh contracts, followed by 19,500 strike and 19,600 strike, which added 13.27 lakh and 10.93 lakh contracts.

Put unwinding was at 19,800 strike, which shed 9.66 lakh contracts followed by 18,500 strike and 20,000 strike, which shed 7.91 lakh and 5.34 lakh contracts.

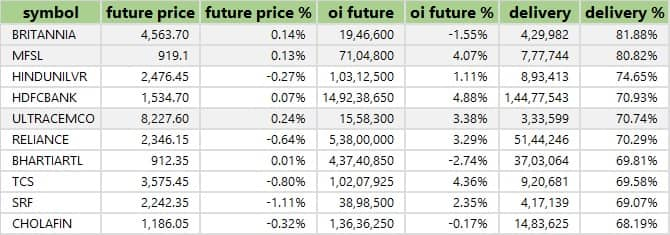

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Britannia Industries, Max Financial Services, Hindustan Unilever, HDFC Bank, and UltraTech Cement have seen the highest delivery among the F&O stocks.

The long build-up was seen in 64 stocks on Monday, including Dalmia Bharat, Punjab National Bank, Godrej Properties, Balrampur Chini Mills, and Persistent Systems. An increase in open interest (OI) and price indicates a build-up of long positions.

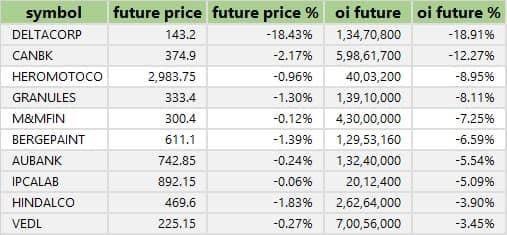

Based on the OI percentage, a total of 29 stocks including Delta Corp, Canara Bank, Hero MotoCorp, Granules India, and M&M Financial Services, saw long unwinding. A decline in OI and price indicates long unwinding.

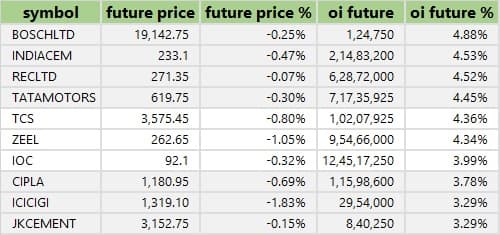

42 stocks see a short build-up

A short build-up was seen in 42 stocks, including Bosch, India Cements, REC, Tata Motors, and TCS. An increase in OI along with a fall in price points to a build-up of short positions.

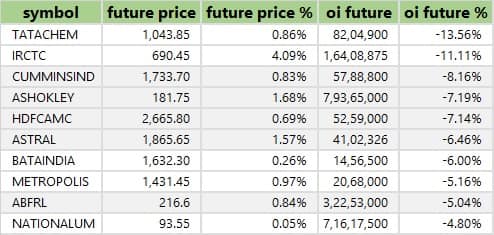

Based on the OI percentage, 51 stocks were on the short-covering list. These included Tata Chemicals, IRCTC, Cummins India, Ashok Leyland, and HDFC AMC. A decrease in OI along with a price increase is an indication of short-covering.

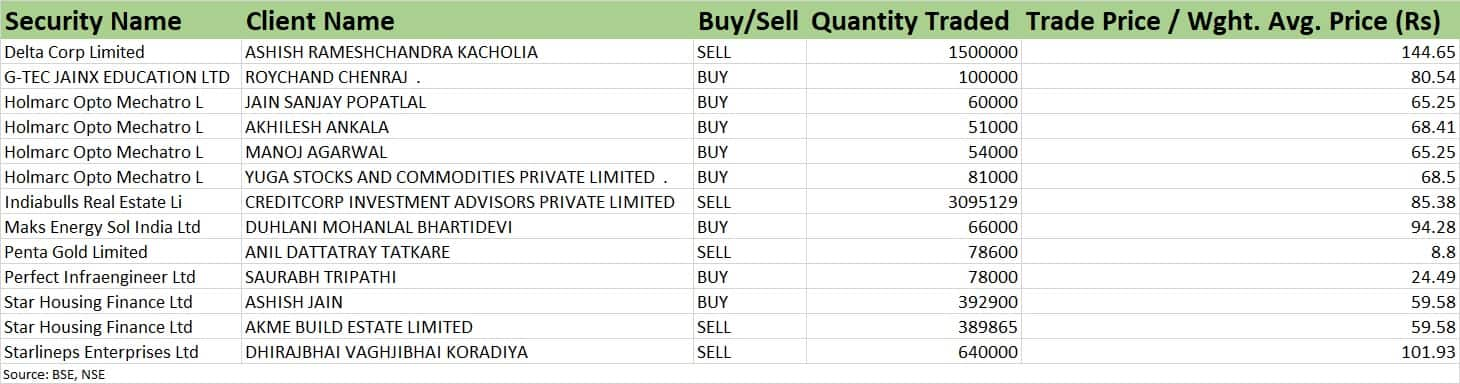

Delta Corp: Ace investor Ashish Rameshchandra Kacholia has sold 15 lakh shares, which is equivalent to 0.56 percent of the total paid-up equity, via open market transactions at an average price of Rs 144.65 per share.

(For more bulk deals, click here)

Investors meeting on September 26

Adani Green Energy: Officials of the company will interact with investors and analysts in an equity non-deal roadshow organised by Nomura in Singapore.

Som Distilleries and Breweries: The company’s officials will meet Clockvine Capital Advisors.

Metropolis Healthcare: Officials of the company will be meeting investors at Kotak Healthcare Forum 2023 in Mumbai.

Biocon: Senior officials of the company will attend Kotak Healthcare Forum 2023.

Five-Star Business Finance: The company’s senior officials will meet HDFC Mutual Fund.

Anupam Rasayan India: Senior officials of the company will meet Ocean Dial Asset Management.

Yatharth Hospital and Trauma Care Services: The company’s senior officials will meet SBI Life Insurance, Kotak Mahindra Life Insurance, and Bandhan Mutual Fund.

Eicher Motors: Senior officials of the company will meet Unifi Capital, and Franklin Templeton MF.

Stocks in the news

Welspun Corp: Subsidiary Sintex BAPL has entered into an MOU with the Telangana government to set up a manufacturing unit in the state with up to Rs 350 crore investment. The proposed project is under the state government’s incentive scheme and will be manufacturing water tanks and PVC pipes & fittings. The total investment will spread over the next three financial years.

RPP Infra Projects: The company has received a letter of acceptance for road and drain works-1 for CBR project of CPCL at Nagapattinam, Tamilnadu at a contract price of Rs 300.44 crore. Further, it received a contract worth Rs 90.18 crore for the provision of civil works and allied services for the engine test facility along with ancillary work for GRTE at Rajankute, Bengaluru. It also received a contract worth Rs 16.88 crore for the construction of a stormwater drain from Thoothukudi City Municipal Corporation, Tamil Nadu.

Tata Steel: Global credit rating agency Moody’s has upgraded the corporate family rating of Tata Steel from Ba1 to Baa3, and changed the outlook from Positive to Stable. The rating agency expects the company’s profitability to increase even as softer steel prices dent revenues, and the company to maintain conservative financial policies with a well-balanced capital allocation and financial metrics appropriate for its Baa3 rating.

Ujjivan Small Finance Bank: SMC Global Securities announced a strategic partnership with Ujjivan Small Finance Bank to offer online trading services to the bank’s customers. This association will offer services comprising savings, demat and trading accounts, to the bank’s customers. The collaboration will enable SMC Global to expand its client base by tapping into Ujjivan SFB’s extensive pan-India presence, serving over 76 lakh customers.

Wipro: The IT services company announced the sale of land measuring 14 acres and 2 cents, in Chennai, together with a 20-year-old building for Rs 266.38 crore. The company executed the sale deed on September 25 and Casagrand Bizpark was the buyer.

Fortis Healthcare: The company has received approval from the board of directors to enter into a Share Purchase Agreement for acquiring 99.9 percent stake in Artistery Properties. The enterprise value of the stake buy is Rs 32 crore. Artistery owns land and building situated adjacent to Fortis Hospital, Anandpur in Kolkata.

GR Infraprojects: The bids for 2 ropeway projects won by GR Infraprojects are annulled by National Highways Logistics Management. In February 2023, GR Infraprojects emerged as the L1 bidder for the development, operation and maintenance of a ropeways contract worth Rs 3,613 crore in Uttarakhand on Hybrid Annuity Mode.

Fund Flow (Rs Crore)

Foreign institutional investors (FII) sold shares worth Rs 2,333.03 crore, while domestic institutional investors (DII) bought Rs 1,579.28 crore worth of stocks on September 25, provisional data from the National Stock Exchange (NSE) showed.

Stocks under F&O ban on NSE

The NSE has added Balrampur Chini Mills to its F&O ban list for September 26, while retaining Canara Bank, Granules India, Hindustan Copper, and Indiabulls Housing Finance to the list. Delta Corp, and Manappuram Finance were removed from the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.moneycontrol.com/news/market-edge/trade-setup-for-tuesday-top-15-things-to-know-beforeopening-bell_17249741.html