Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Cabotage acts are sabotage for maritime decarbonization. Well, that rhymes, but what does it mean? What is cabotage and why are Europe and the USA more impacted than Asia? It’s a tangled tale and we have to go back over a hundred years to unravel the story and its implications.

Let’s start in the future, however. When shipping is decarbonized, at least in my admittedly heterodox scenario, all inland and most short sea shipping will be running on batteries. Long haul coastal shipping and transoceanic shipping will be running on biodiesel with hybrid battery systems for near shore and port operation. Much of these batteries will be containerized, hoisted off ships to be charged on shore with new batteries dropped into waiting holds. Some will be built-in, especially for bulk carriers, with electron bunkering barges and shore connected charging buoys providing electrons while ships are moored.

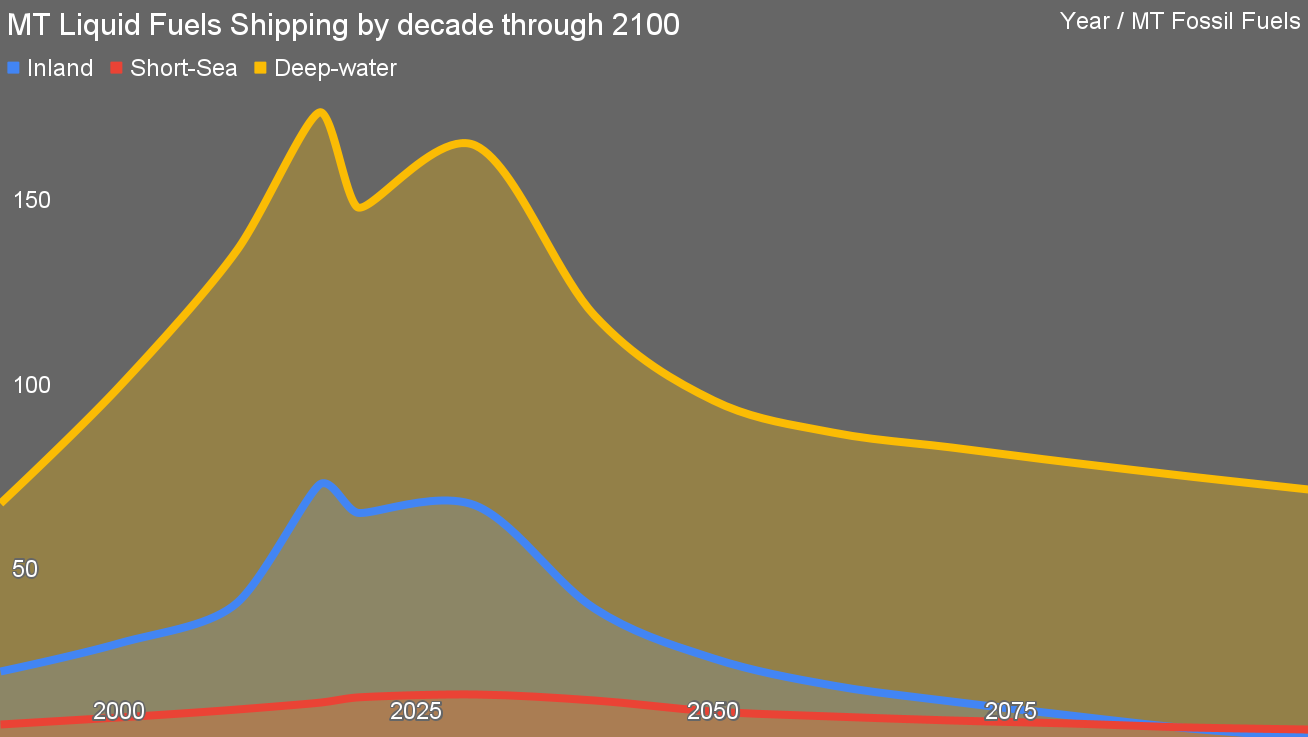

This chart from my scenario captures the end state. I assembled statistics on inland, short sea, and deep water shipping from 1990 to 2021, including the COVID-19 dip. My scenario respects that 40% of bulk shipping is of coal, oil, and gas and assumes that we will be reducing significantly shipping of those substances, in alignment with the International Energy Agency’s projection of declining demand, but contrary to the beliefs of the fossil fuel industry. Further, the 15% of bulks that are raw iron ore are going to diminish as economics move iron and steel manufacturing closer to mines, powered by renewably generated energy, and with reduction from green hydrogen or electrolysis.

It respects the flattening of population growth with an assumed peak between 2050 and 2070, aligned with a couple of major demographic organizations, but not the UN’s, which while it’s brought peak back to the 2080s and reduced peak population in its 2022 forecast, is still pessimistic compared to very strong alternatives.

It respects that China’s growth boom is flattening and that other developing nations such as India, Indonesia, and Brazil do not have the conditions for success for the rate of economic growth that China saw from 1990 through the present. This is not, however, a China-is-doomed narrative, but simply a reflection that the economic conditions of the world are changing and that China’s growth is in a different phase.

In this scenario, peak demand for burnable fuels is roughly 70 million tons in 2100. This contrasts with common projections of 350 million tons in 2050, which leads to systemic attempts to make green hydrogen unfathomably cheap in contradiction of the basics of the technology, electricity supply, and economics. My scenarios preserve green hydrogen for ammonia fertilizers, steel, and other industrial chemical feedstock use cases, outside of rounding error scenarios where there is waste hydrogen from processes such as chloralkali electrolysis that have no other value but to be burned for nearby process heat.

But that’s a lot of battery-powered ships to go with the ones burning biodiesel. And that’s a lot of hybrid-electric drivetrains in longer haul ships.

Who is going to build them? Where are the batteries going to come from?

The United States & The Jones Act

Let’s now cast our minds back to 1920. World War I had just ended. As with World War II, where Japan’s deep strategic mistake of attacking Pearl Harbor led to the US entering the war as a decisive force, the US had remained neutral through the first three years of World War I, supplying goods, materials, and ammunitions to both sides equally in the early part of the war.

Britain’s naval blockade of goods to the Central Powers of the German Empire, Austria-Hungary, the Ottoman Empire, and Bulgaria saw US merchant ships attempting to deliver materials turned back. As a result, war supplies to the Allies became the dominant economic opportunity and so US merchant marines pivoted to supplying them much more.

The German Empire made one significant strategic mistake and one debatable one. The significant mistake was attempting to create a military alliance with Mexico against the US, a significant overreach of capability. The debatable mistake was having their U-boats attack and sink American merchant marine vessels to cut off supply chains to the Allies.

The combination, plus undoubtedly a multitude of other factors, led to the US entering the war on the side of the Allies and playing an important and decisive role in the Allied victory. That, of course, led to the terrible mistakes in dealing with the losing countries that arguably led fairly directly to World War II, but that’s a somewhat different story.

The thread we want to pull on is the merchant marines and their decisive role as a logistics arm of the US navy. At least from the US perspective, without the merchant marines, the war would have been much harder to execute. After the war, discussions around it led to the creation of the Jones Act, formally the Merchant Marine Act of 1920.

The Jones Act is a controversial piece of legislation and unsurprisingly, I’m going to come down on a side about it. What is surprising is that apparently I agree with the Cato Institute, that far-right Libertarian think tank that’s equal only to the Heritage Foundation in working to make America’s political, economic, and industrial policies dystopian servants of oligarchic wealth.

Yes, we both think that the Jones Act should be at minimum heavily reformed and likely abolished. I’m not going to bother to parse the Cato Institute’s arguments because the odds of them having sufficient overlap with my perspective of reality means that I’ll likely be unable to appreciate the rich nuances that only devoted fans of Ayn Rand and the worst readings of Milton Friedman will see in it. Instead, I’ll make my arguments here.

The Jones Act is a cabotage act, that is, legislation which restricts various aspects of coastal shipping to domestic carriers. It’s the most restrictive cabotage act of any major economy. It requires that all cargo ships sailing between American inland or coastal ports must be made in American shipyards, be registered in the USA, be owned by American firms, and be crewed by Americans. This applies to bulk carriers, tankers, and container ships. It applies to ferries and cruise ships. It applies to tugboats, fishing vessels, research vessels, and offshore support vessels.

Yes, this is a deeply protectionist act in one of the world’s leading promoters of free trade.

Remember that the reason for the Jones Act was to maintain a strong merchant marine in the event of war, enabling logistical supply of both allies and of American military forces.

Let’s fast forward to today. As of 2022, there were only 93 oceangoing container ships, tankers, and roro vessels above 100 tons that complied fully with the Jones Act. Only a subset of those 93 ships are militarily useful. They are smaller coastal vessels which aren’t going to be crossing the Pacific or Atlantic except under duress. They aren’t Panamax tankers or 24,000 TEU container ships. They are small and often into their senior years as shipping vessels.

There are 299 active significant US naval warships in active service. The US maintains hundreds of military bases around the world, far out of reach of Jones Act registered ships. The world’s logistical supply chain has matured radically since 1920 and post-World War II. Ships are much bigger, ports are incredibly efficient loaders and off-loaders of goods, and globalization means that the US’ merchant marine ships are a rounding error.

Given that I have a perspective on commercial maritime shipping and pay attention to geopolitics, I see a lot of pearl-clutching and handkerchief-wringing among US maritime types about the challenges with getting war materiel to conflict zones. I also see most of the same people defending the Jones Act. The cognitive dissonance is powerful.

If the Jones Act had enabled the US to maintain a strong merchant marine, then it would have an argument for it. Clearly it didn’t succeed in that regard, although it’s not alone in causing US shipbuilding capacity and competence to wither outside of military vessels where budgets are abstract and often surreal. No, the post-World War II world order that the US was so instrumental in bringing to bear led to significant increases in global trade mechanisms and freer trade. It included the growth of not only the Asian tigers, including South Korea and Japan, but subsequently China itself.

The world’s shipbuilding industries moved to Asia. China is by far the world’s largest shipbuilder, with 44% of the world’s market in 2021. South Korea follows with 32%. Japan, which dominated for a while, is now in third spot at 18% and falling. The Philippines and Italy round out the top five, but Italy is under 1% of global shipbuilding.

The United States doesn’t make the top 15. Outside of occasional aircraft carriers, destroyers, and frigates, the United States doesn’t build ships any more.

That’s where decarbonization enters the picture. The Jones Act prohibits ferries, cruise ships, tugboats, roros, tankers, and container ships that sail between domestic US ports from being manufactured anywhere but the US. And the US doesn’t build ships. Where exactly are all of the new ships or rebuilt ships going to be built?

And, of course, there’s the question of batteries and electric drivetrains. As I was discussing recently, the US has military engineers who put electric drivetrains in nuclear submarines, but that’s about it. It’s not like electric drivetrains are horrifically difficult compared to combustion engine drivetrains, but there simply isn’t much domestic competence.

Meanwhile, in China they launched a pair of battery-electric 700-container, 10,000-ton ships for 1,000-kilometer routes on the Yangtze in 2023, part of its focus on decarbonizing all domestic maritime shipping in the next couple of decades. It’s trivial for China to source cheap batteries and build new ships around them and they are doing it.

To be clear, the transformation of maritime shipping to greater and greater electrification is going to start small and grow. Ferries and tugboats are obvious vessels for electrification. But there are a lot of them and very few organizations which can transform them in the US, never mind build new ones.

Decarbonizing inland and short sea shipping rapidly requires buying a lot of vessels from China. That’s not going to fly in the US, so it’s sailing against instead of with the tide.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Europe Is Better Off, But Not Much

Europe has its own cabotage acts, but they are nowhere near as pervasive as the Jones Act. By definition, the EU is a collection of nations with free trade, so there’s a strong argument against them. And neighboring countries have tended to have favorable cabotage allowances as well. It’s actively hard not to cross country borders in Europe, much more like crossing state boundaries in the United States. Frankly, it’s harder to cross provincial boundaries in most of Canada simply because the provinces are mostly so enormous. In Europe, some people wake up in one country, have lunch in another country and do some shopping in a third before returning home, all by car or public transit.

Italy, Germany, Finland, France, Norway, Turkey, and the Netherlands all maintain vestigial shipbuilding industries, but they add up to less than 2% of global shipbuilding and aren’t massive, scaled shipyards capable of churning out hundreds of new or retrofitted vessels. Their work forces are old and retiring.

And while battery gigafactories are emerging in Europe, China’s gigafactories are churning out TWh of batteries annually now.

As an indication of how this is playing out, Maersk is buying dual-fuel ships that can burn either methanol — or biomethanol, the best of the also-ran repowering alternatives from my perspective — or standard marine bunkering fuel, diesel’s uglier maritime cousin. Is it getting them from European shipyards? No, the first one was built in South Korea.

I’m in touch with multiple European maritime industry contacts, and last year was flown to Glasgow to debate maritime shipping decarbonization for a Stena Sphere shipping professionals audience. Europe’s ability to transform its fleets domestically is very low. Thankfully, its ability to buy from Asia is much less restricted, so as with the strong prevalence of Chinese-manufactured buses entering Europe, I expect a lot of Chinese-manufactured ships, along with South Korean ones, to be sailing in European coastal waters and rivers in the coming decades.

But when we consider the ships that will be delivering global trade, Europe and the United States won’t be building them any more than they do today unless they commit to massive reindustrialization of their economies. I just don’t see that happening.

What this means is that Asia has the conditions for success for electrification of shipping and will likely do it faster, Europe will lag but get there reasonably quickly with a lot of Asian-built and some domestically-built ships, and the United States, just as with rail, will be last and least to the actual decarbonization solution party.

A serious US response to decarbonizing shipping would involve eliminating the Jones Act and an industrial policy that actually built lots of new ships and battery gigafactories in the US. Only some battery factories are in plan and the current plummeting of battery prices globally is stopping many of those. I don’t see the United States getting its ducks in a row on this for at least a decade or two, if then.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica TV Video

[embedded content]

Advertisement

CleanTechnica uses affiliate links. See our policy here.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://cleantechnica.com/2024/03/27/europe-usa-sailing-against-tide-asia-sails-with-it-in-decarbonizing-shipping/