There are ways to generate profits in the crypto industry that don’t involve actively trading assets, and these wealth-building opportunities have gained traction during the last few years. Crypto staking and yield farming are two more popular forms of earning additional crypto by simply locking your assets for a while.

This article discusses the differences between crypto staking and yield farming, how the two differ, and what method may suit your needs.

What is Crypto Staking?

Crypto staking is where a user provides a “stake” of coins or tokens to verify transactions, hoping to receive some of that token for their contribution. Proof of Stake (PoS) blockchains require that users who want to participate in verification put up a quantity of tokens to do so. While blockchains have different minimums, most operate on the process where those who stake more have a higher chance of winning rights to verification.

Each of these PoS blockchains employs a set of rules for network participants that stake crypto and validate transactions. These rules are embedded in the PoS algorithm and vary from case to case – they involve deposit thresholds, potential rewards, penalties, locked time, and other conditions.

By depositing a network’s native cryptocurrency in a specific wallet for a predetermined duration, holders become eligible for rewards in the form of native tokens. While staking rights are incredibly competitive in the modern blockchain landscape, many have turned to shared staking “pools” where several users, or entire organizations, maintain wallets to participate in staking for potential gains.

What Are the Benefits of Crypto Staking?

As PoS blockchains become popular alternatives to more cost- and energy-intensive Proof of Work (PoW) systems, staking is emerging as a popular way for crypto holders to put their funds to work and seek yield.

Crypto staking has several benefits, such as:

- Security and stability – By becoming a block validator in a PoS network, you contribute to the network’s security while benefiting from it. The funds are kept safely in a special wallet.

- Predictable returns – Stakers can easily calculate their returns, as the staking reward is generally predictable.

- Lower risk compared to yield farming – Staking is generally more stable than yield farming, which we will discuss below.

What Are the Risks of Crypto Staking?

Nothing, especially money, comes for free. Accordingly, staking isn’t without risks, and those participating are taking that risk knowingly to participate in potential yield.

Some of these risks include:

- Lockup periods: Some Crypto holders should know that most PoS networks have lockup periods during which stakers cannot use their coins. These events are intended to prevent liquidity or cashflow issues in the blockchain and often require that users unstake any staked crypto before transferring or using it (if they can use it at all).

- Slashing: If a user or staking pool fails to follow through with the terms of service of the blockchain (particularly regarding their responsibilities as validators) then the blockchain may slash the number of tokens they have. This can occur if a validating wallet goes offline for a long time or the user participates in an activity like fraud or double-spending.

To address the inconveniences of the lockup period, specialized liquid staking platforms, such as Lido, offer derivative tokens to be used in decentralized finance (DeFi) apps while staking. Most of these platforms are built for the Ethereum ecosystem.

What is Yield Farming?

Another way to put your crypto to work is yield farming. This practice contributes liquidity to DeFi services, such as decentralized exchanges (DEXs) or lending platforms. Users deposit crypto into DApps or DEXs through a smart contract that automatically provides or releases tokens (either the native or related tokens). Crypto holders can lock their funds with one or multiple DeFi protocols to earn interest from fees and other incentive schemes.

Yield farming exploded in 2020 when Compound, a leading DeFi lending platform, offered lenders rewards paid in its governance token, COMP.

As a rule, yield farmers lock their cryptocurrencies in DeFi protocols’ smart contracts to contribute to their liquidity pools. Decentralized liquidity is essential for DeFi services because all the rules are enforced by smart contracts and algorithms alone.

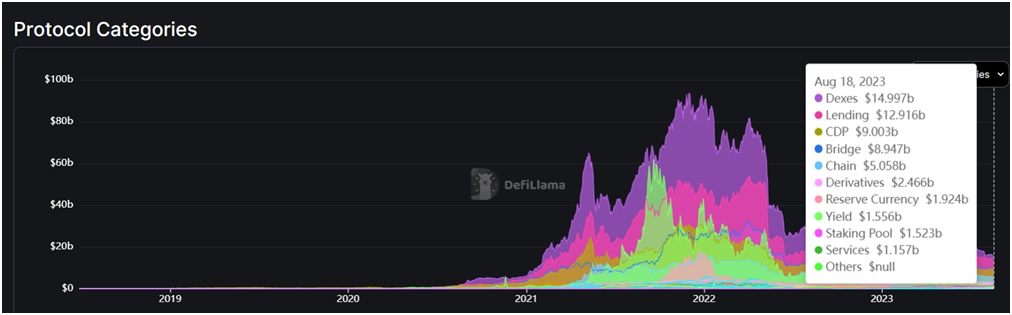

[embedded content]

Two primary forms dominate the yield farming practice:

- Liquidity mining – Here, users lock their cryptocurrencies into liquidity pools of DEXs like Uniswap. These platforms act as Automated Market Makers (AMM), which operate smart contract-based pools representing cryptocurrency pairs. This approach replaces the order books employed by centralized exchanges like Coinbase.These pools offer liquidity for traders who want to swap one token for another. In return for contributing liquidity, yield farmers earn rewards, generally in the protocol’s native token. Most liquidity pools involve paired tokens, often maintaining a 50/50 ratio, although multi-asset pools exist.

- Participation in DeFi apps – Besides DEXs, yield farming can also involve locking crypto assets in lending protocols and other apps. Lending protocols like Compound and Aave allow users to lend their tokens to earn interest. The returns can vary based on the volatility of the asset.

What Are the Benefits of Yield Farming?

Yield farming might seem like another staking approach, but this isn’t the case. Investing crypto into a DeFi app or platform can carry its own rewards. Despite being riskier than staking, yield farming has several advantages:

- Higher returns: Investors providing funds to DApps may receive much higher yields than in staking pools if they are more prepared to manage the tokens.

- Status: Yield farmers have a special status in DeFi as they contribute with liquidity, helping decentralized networks democratize finance and build censorship-resistant interactions.

- Participation: Yield farmers can have a voice and influence the progress of DeFi protocols when they get governance tokens as rewards.

What Are the Risks of Yield Farming?

Additionally, much like staking, yield farming has its downsides:

- Complexity: Yield farming requires a more hands-on approach from users, which can be incredibly intimidating and complex. Many beginners will need clarification on yield farming strategies.

- Impermanent loss: A persistent risk relates to impermanent loss, which occurs when the price of your tokens changes compared to when you lock them in the pool. For volatile tokens, this happens quite often.

Yield farmers should do their due diligence and deal with well-established protocols whose code is audited and reviewed professionally. Otherwise, the smart contracts may have loopholes, leaving them vulnerable to hacking attacks.

Crypto Staking vs. Yield Farming: Risks and Rewards

Both crypto staking and yield farming allow crypto holders to generate wealth, but, as you can already conclude, there are significant differences between the two:

Note that staking rewards are usually more predictable, with most PoS chains offering a fixed rate that is reset annually. Elsewhere, the APY one can generate in DeFi fluctuates by the minute, with the interest rate being influenced by factors like market conditions and protocol demand.

How to Choose Between Staking and Yield Farming

Holding cryptocurrency and waiting for its price to increase might be a reasonable long-term strategy, but why not seek additional returns, especially as you don’t give up ownership? The question is – which of these two wealth-building opportunities should you go with?

- You can start by defining your risk tolerance. As a rule, staking offers more stability with predictable rewards and fewer complexities. If you prefer a straightforward approach with minimal risks, staking might suit you.

- Another factor to consider is the type of tokens you hold. Some cryptocurrencies are more compatible with staking, while others are with yield farming. For example, PoW coins cannot be staked at all. Ethereum is a good example that may work well with both.

- Lastly, assess the time you can dedicate to managing your investments. Yield farming requires constant monitoring, while staking is simple.

The truth is that there is no better option, but one of them can align better with your risk tolerance, available assets, and time commitment.

Using liquid staking platforms like Lido, Ethereum holders can take the best out of both. These enable users to stake ETH and receive derivative tokens for yield farming opportunities, thus maximizing potential returns. This approach made Lido the largest DeFi protocol by total value locked (TVL), accounting for over 25% of the DeFi sector.

To make an informed decision, check the potential APYs regularly. Check out our Best Crypto Staking Rates (updated weekly) to monitor PoS rewards.

DeFiLlama is also a great tool for checking yield farming APY figures.

How Popular are Crypto Staking and Yield Farming?

Data from StakingReward shows that a good chunk of the circulating supply of all tokens on PoS chains are staked. For example, over 71% of all Solana tokens are staked, translating into $7.5 billion as of mid-September 2023. The Solana network, whose reward rate is about 7% per year, has paid over $500 million in staking rewards during the last 12 months to its more than 700,000 stakers.

Ethereum is another cryptocurrency preferred by stakers. About 20% of ETH is staked, which is more than $41 billion. With a reward rate of over 4%, Ethereum has paid about $1.7 billion in yearly rewards.

Of the $41 billion worth of staked ETH, more than $14 billion is staked with Lido alone.

Other PoS chains with high staking ratios are Cardano (62%), Polkadot (48%), Tron (48%), Avalanche (59%), and Polkadot (48%). Today, about $90 billion worth of PoS tokens are staked. Together, these chains have paid almost $5 billion in rewards during the last year, with an average reward rate of 5.9%.

Elsewhere, yield farming is half as big as the staking market, judging by the current TVL at $43 billion. DEXs and lending platforms attract the most users.

DEXs like Uniswap, SushiSwap, and PancakeSwap pay generous returns to liquidity providers. For example, the USDC-WETH pair on Uniswap has attracted over $200 million in tokens, offering an APY of over 10%.

Investor Takeaway

While staking rewards are more stable, yield farming can be more lucrative, though it demands constant monitoring. Both methods have pros and cons, so it’s up to you to determine your taste for risk, your time to babysit your accounts, and your desire for higher returns.

Before diving in, thorough research and due diligence are crucial. For those who need help determining where to begin, you can always stake a small amount to understand how it works, and grow from there.

Subscribe to Bitcoin Market Journal to discover more crypto and blockchain investment opportunities!

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.bitcoinmarketjournal.com/crypto-staking-vs-yield-farming/