Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Approximately 274,000 plugin vehicles were registered in November in Europe, down 2% year over year (YoY), the market’s first drop since July 2022. The overall market grew by 6% in what wasn’t a good month for plugins on the continent.

Last month’s plugin vehicle share of the overall European auto market was 26% (17% full electrics/BEVs). With that result, the 2023 plugin vehicle share remained at 23% (15% for BEVs alone).

Most of the plugin vehicle misfortunes should be attributed to PHEVs, which were down 15% YoY. BEVs were up, if only by 5%. Pure electrics accounted for 67% of all plugin sales in November, in line with the 2023 average of 67%.

The highlights of the month were the 1st place and 2nd place wins for Tesla, with the Model 3 ending fewer than 1,000 units behind the #1 Model Y. But let’s look closer at November’s plugin top 5.

#1 Tesla Model Y — For the 13th month in a row(!), Tesla’s crossover was the best selling EV in Europe, but this time, it had some competition for the top position, with its refreshed sibling Model 3 ending just 687 units behind. In November, the midsizer had 18,211 registrations. However, this year could be considered “Peak Model Y” in Europe. And that is starting to be visible in the YoY measures, as the crossover was down 7% year on year in November. I am confident the Model Y has already reached the market’s “natural limits.” After all, the Model Y, an expensive midsize model, is already Europe’s best selling model in the overall market…. Also limiting its growth is the refreshed Tesla Model 3, which was up 43% YoY, even if Europeans aren’t really into sedans these days. Regarding last month’s performance, the Model Y’s biggest European markets included France (3,218 units), Germany (2,840 units), and the Netherlands (1,324), followed by the Nordics — Denmark (1,701 units), Norway (1,496), and Sweden (1,236).

#2 Tesla Model 3 — The sedan is experiencing a 2nd youth in Europe, thanks to the recent refresh, and was delivered in large volumes in Europe, scoring 17,524 registrations in November, 43% growth YoY. The US sedan is expected to have a strong end of the year, with the Model 3 possibly breaking its sibling’s domination at the top of the ranking in December, when the Toyota-fied sedan is expected to have an above-average “high tide.” Looking at November’s performance, there is an interesting contrast to the Scandi touch of the Model Y deliveries, with the Model 3 scoring big in Southern European markets. With the exception of Germany (1,937 registrations), all of the other big markets had a definite sunny side: France (6,081 registrations), Italy (1,955 registrations), Spain (1,641), and … Portugal (1,209 units!!!) were the Model 3’s biggest markets. A personal note on the Model 3’s performance in Portugal — the first time I saw the number, I had to double check it. I just couldn’t believe so many Model 3s had been sold there. While I imagined that it would be a question of time until the Model Y reached this kind of volume, I would have never expected that in station wagon/crossover-friendly Portugal, the Model 3 would pull a four-digit performance before the Model Y … I guess this only shows the strength of the company car sales category in the overall market.

#3 Skoda Enyaq — The Czech crossover is a sure value in the EV arena, and has even managed to score another record month in November, with the good looking crossover ending the month with a podium presence thanks to 8,889 sales. Expect sales to continue strong in the coming months, especially now that production constraints have finally ended. Regarding the Enyaq’s November results, its biggest market was Germany (3,588 registrations), followed at a distance by France (600), the UK (505 registrations), and Switzerland (536 units).

#4 Audi Q4 e-tron — Audi’s compact crossover won another top 5 presence in November thanks to 7,118 registrations. With increased production availability, the Audi EV is now only dependent on demand to improve its performances. Regarding the November performance, its main market was the UK (2,150 registrations), followed by its domestic market of Germany (1,640 registrations) and then Belgium (958 registrations), a known stronghold for the four-rings brand, and Sweden (513).

#5 MG4 — The dragon slayer hatchback is fulfilling SAIC’s best expectations, with another top 5 presence thanks to 6,413 registrations. With almost unbeatable value for money, and the small detail of being at least 10,000 euros cheaper than its most direct competition (the VW ID.3 and Renault Megane EV), the Sino-British model is becoming the reference point in Europe’s compact hatchback class. This category used to be the sheer definition of what a European car was, with examples like the VW Golf, Skoda Octavia, and Opel Astra. Regarding the MG4’s November performance, this time its main market was not the UK (1,745 registrations), with higher volumes delivered in France (1,871 registrations), followed in 3rd by Germany (1,106 registrations) and the Netherlands (419).

Looking at the rest of the November table, we should highlight the record result of the #6 BMW i4, 6,055 registrations. Even if it is a placeholder model, until the all-new, EV-dedicated Neue Klasse models land in 2025, the liftback BMW is doing its best to stop the sales bleed in the midsize segment, and lately, things have been looking pretty good for it, with a couple of record performances in the last few months.

The BMW iX1 also hit a best ever result, 5,538 registrations — a prime example of BMW Group’s strong results in November. In addition, the veteran Mini Cooper EV posted a solid score, 3,700 registrations.

In November, the best selling plugin hybrid model was something of a surprise, with the Volvo XC60 PHEV scoring a record 4,474 registrations, which allowed the Swede to end in #12, followed by the Ford Kuga PHEV in #15 and the Mercedes GLC PHEV in #16. Expect the German SUV to be a strong contender for the category title next year.

Below the top 20, we should also highlight the Peugeot 308, which had a record 2,566 registrations. Although, intriguingly, only 214 units belonged to the BEV version…. Battery supply issues, or the electric 308 needs a price cut?

Finally, the Audi Q8 e-tron scored 2,974 units, a new best since the big SUV was refreshed and gained the “Q8” moniker.

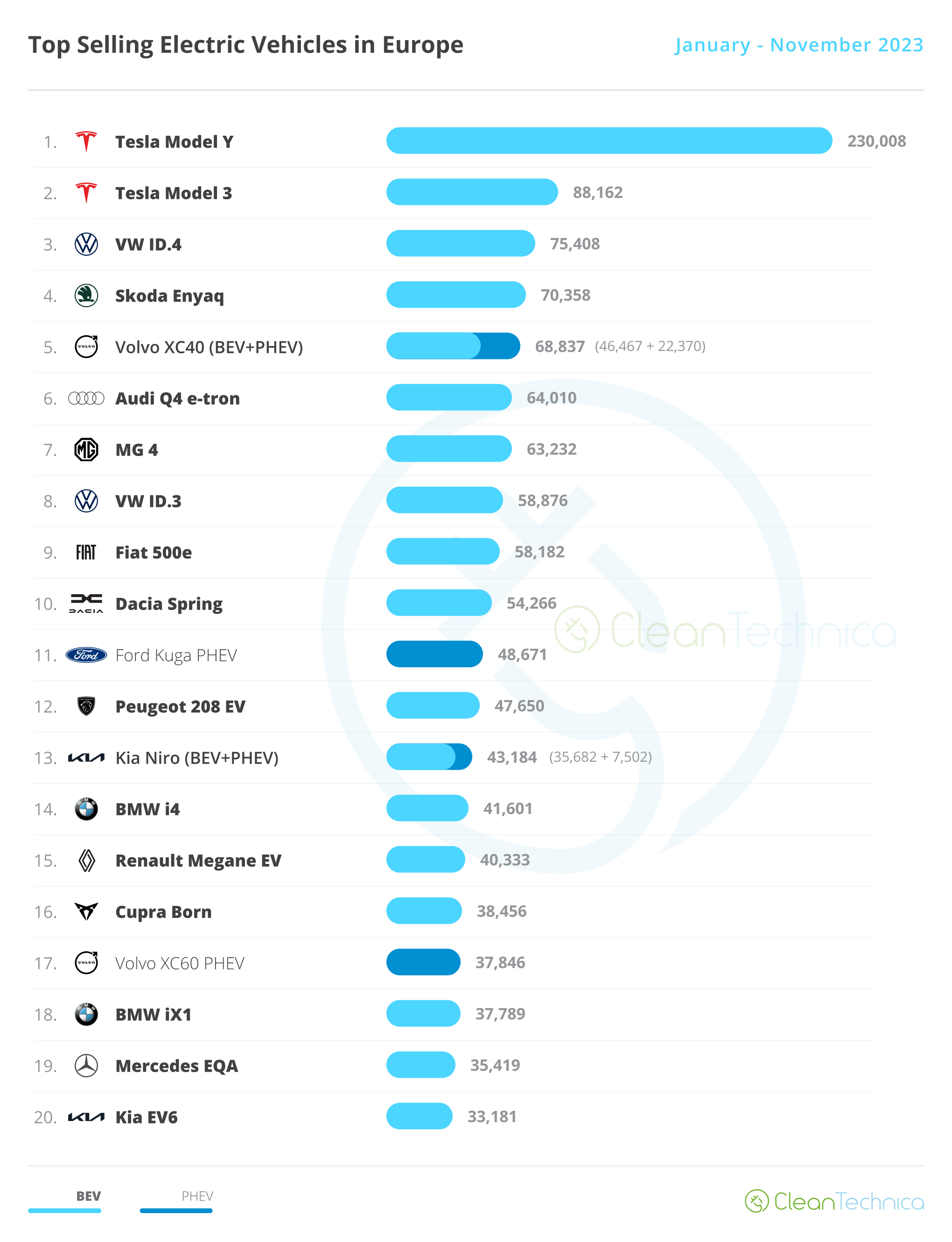

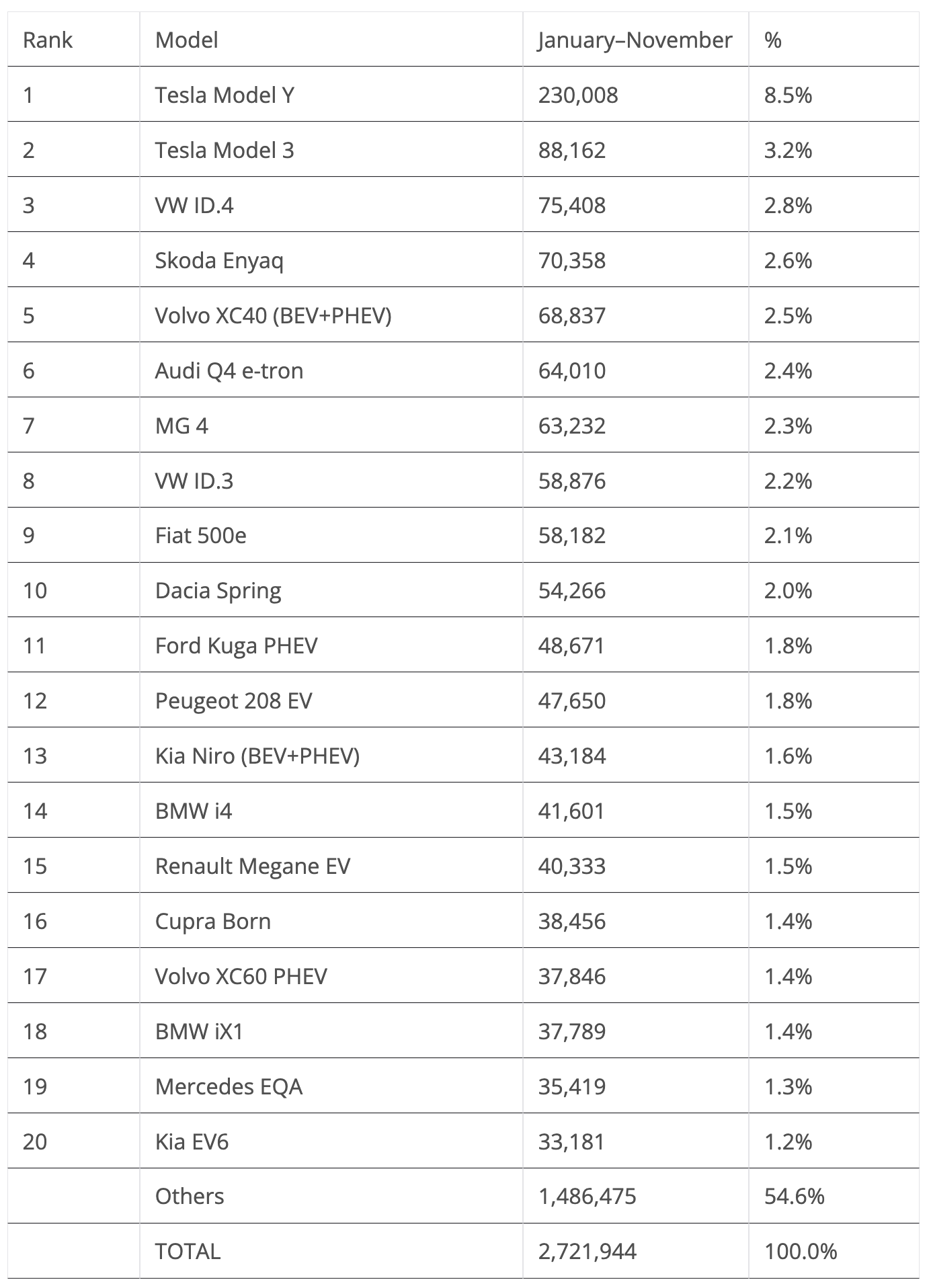

Looking at the 2023 ranking, with the Tesla Model Y having twice as many deliveries as the runner-up Tesla Model 3, and Tesla’s sedan now having an advantage of some 13,000 units over the #3 VW ID.4, the attention is focused on the last podium position. But even there, it seems unlikely that there is a last minute surprise. While the VW ID.4 is not in peak form, the 5,000-unit advantage it has over the new 4th placed Skoda Enyaq should be enough to keep it on the podium.

If the podium standings end as they currently are, then the 2023 podium will be exactly the same as the 2022 edition, and it will mark the 3rd consecutive win for a Tesla model in Europe, after the Model 3’s best seller title in 2021 and the Model Y’s win in 2022.

Looking below, Audi’s Q4 e-tron was again on the rise, climbing to the 6th position, but with the #5 Volvo XC40 some 4,000 units ahead, the German crossover should care more about keeping the #7 MG 4 behind it than trying to surpass the Swedish SUV…

The remaining position change came in the second half of the table, with the rising BMW i4 climbing again, this time to #14 at the cost of the Renault Megane EV. The German midsizer is looking to reach the #13 Kia Niro in the last stage of the race.

Finally, expect an intense battle for the last place in the table in December, as the current position holder, the Kia EV6, has a number of models looking to replace it. There’s the recently rejuvenated Hyundai Kona EV, just 194 units behind, then there’s the #22 Polestar 2 sitting only 274 units below the Kia EV, and even the #23 Mini Cooper EV (1,153 behind) could make a last minute surprise….

In the auto brand ranking, Tesla is leading with a comfortable 12% share of the plugin market, but it has seen its share drop in November by 0.1% share. We shouldn’t read too much into this, as Tesla will recover share in December and will celebrate its 3rd best seller title in Europe, its second in a row.

Volkswagen had a hot and cold kind of month. On one hand, it stopped the share slide by keeping the 8.2% it had in October, but on the other hand, it was powerless to keep a rising BMW (8.5%, up from 8.2%) from stealing its runner-up position.

This means that the 2023 podium is now replicating 2022’s final standing.

And it could be worse still for Volkswagen, because #4 Mercedes (7.8%, up from 7.7%) is also on the rise, and with only 0.4% share separating these two, we might even see the German brand being kicked off of the podium!

But while the Volkswagen brand is in a hot mess, its premium cousin, Audi, is on the way up. After a significant rise from 5.4% share to 5.6% in October, the Ingolstadt make was again on the way up, climbing to 5.8% share in November and keeping #6 Volvo (5.6%) at bay.

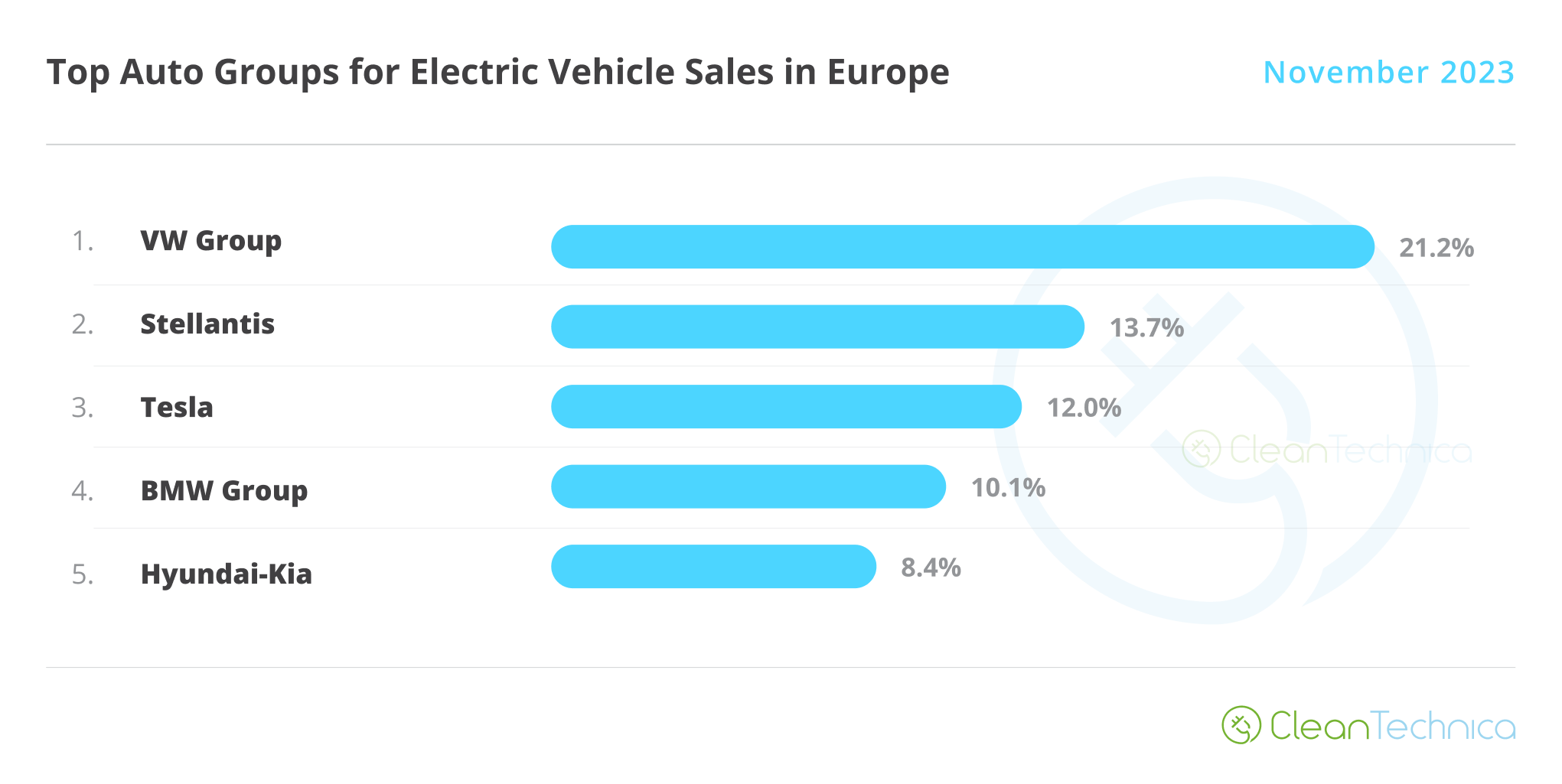

Arranging things by automotive group, the Volkswagen Group was up to 21.2%, from 20.6% in October. That is thanks to brilliant performances across the board: from Cupra to Skoda (Enyaq record score) and passing by Audi. This is added to a slight drop from runner-up Stellantis (13.7%, down from 13.9% in October), currently suffering from BEV battery supply starvation, thus allowing the German conglomerate to increase its lead even further.

#3 Tesla was down to 12%, while off the podium, #4 BMW Group was up to 10.1%. We have a close race for #5 — current holder Hyundai–Kia (8.4%) is now just a couple of hundred units ahead of #6 Mercedes-Benz Group (8.4%, up 0.1%).

Finally, an interesting note on the overall European market — the fastest growing brands in November were MG (+47% YoY), Cupra (+38%), and Skoda (36%), all brands with successful EV models. Coincidence?…

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Our Latest EVObsession Video

[embedded content]

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we’ve decided to completely nix paywalls here at CleanTechnica. But…

Thank you!

Advertisement

CleanTechnica uses affiliate links. See our policy here.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://cleantechnica.com/2024/01/04/1st-2nd-place-wins-for-tesla-in-europe/