For decades, private equity firms have relied on Microsoft Excel to analyze deals, model scenarios, value companies, and report portfolio performance. However, excel was never designed to manage the unique data, modeling, analysis, and collaboration demands of private equity. As firms scale towards billion dollar assets under management, Excel’s constraints become acutely apparent. Investors and deal teams need tailored software solutions that equip them to acquire the best assets, improve portfolio company operations, and drive efficiency firm-wide.

As competition intensifies and investors demand more transparency and technology-enabled value creation from their general partners, spreadsheet-based processes pose a severe liability. Integrated software built specifically for PE workflows is now a prerequisite to stay competitive.

The Pitfalls of Spreadsheets for Modern Private Equity

While useful for basic modeling, Excel has fundamental limitations that make it risky and inefficient for private equity:

- Manual Errors: Formula dependencies, deletions, and unintentional tweaks often create errors in sensitive valuation models, return calculations, and portfolio reporting. Such issues can have million dollar consequences if not caught.

- Fragmented Data: With no structured database, critical fund performance data, portfolio company financials, LP details end up siloed across myriad spreadsheets. This hinders holistic analysis and firm-wide visibility.

- Scalability Issues: Excel sheet connections suffer performance lags and complexity when modeling hundred-row cap tables, intricate fund structures, layered partnership waterfalls, and detailed operational models.

- Painful Collaboration: Emailing updated versions back and forth leads to confusion on latest inputs from specific counterparts. Lack of controls also allows inadvertent changes to cascade through models.

- Weak Analytics: Excel cannot handle large datasets, statistically robust analysis, predictive modeling, and other methods needed for differentiated insights. Lack of APIs also constrain data flows from external sources.

- Poor Security: Files on shared drives or floating through emails also pose confidential data leakage, IP loss, and manipulation risks without access controls.

- Lack of Transparency: Partners, investors, and deal teams lack real-time visibility into fund performance, capital flows, valuation changes beyond static PowerPoint reports.

In essence, spreadsheets are rigid, prone to errors, insecure, manual, and lack transparency – all deal breakers for today’s more sophisticated private equity ecosystem. Purpose built software is imperative.

How purpose-built software meaningfully impacts key PE stakeholders:

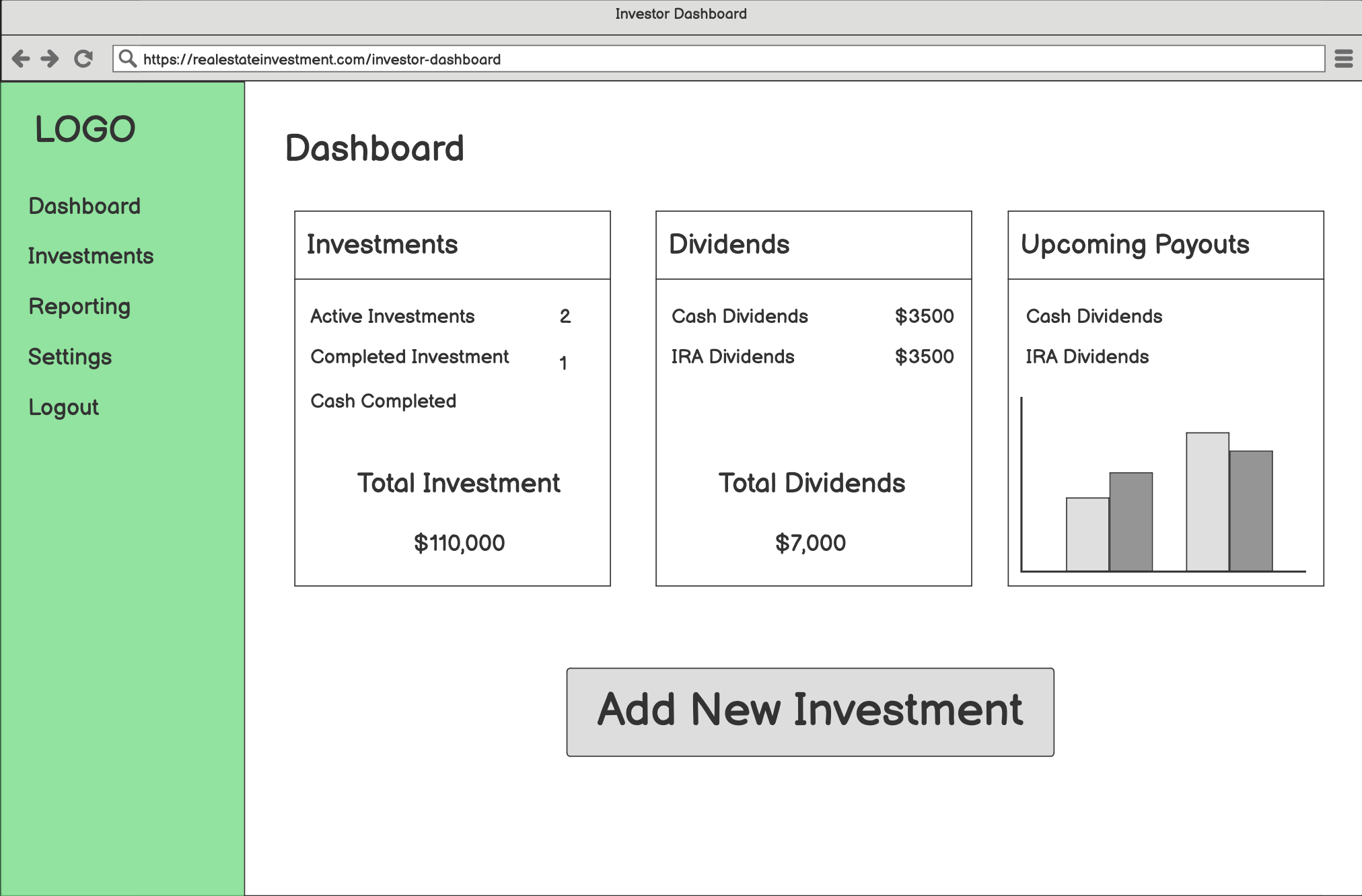

For Investors and Limited Partners

a) Access shareholder documents, capital accounts, statements through secure investor portal with permissions controls.

b) Leverage dynamic dashboards to track portfolio health across underlying funds.

c) Custom reporting views complement quarterly distribution reports. Easily manipulate data on the fly for ad-hoc analysis.

d) Monitor deal pipeline and track profile of prospective targets the GP is assessing.

e) Verify rigorous security, compliance and auditing safeguards around sensitive investment data.

f) Institutional grade performance metric calculation rigor around IRR, TVPI, RVPI.

For Deal Partners and Investment Teams

a) Search tools to quickly identify attractive targets across sectors, stages, geographies based on specified criteria.

b) Assess targets against benchmarks on relevant operational and financial KPIs.

c) Model tax, legal, commercial implications of various instruments like equity, convertible debt under future business scenarios

d) Secure collaborative workspace for deal teams to jointly stress test assumptions on returns, growth vectors, risks.

e) Structuring editors accelerate drafting key legal documents like LPAs, term sheets, shareholder agreements etc

f) Payment tracking ensures wires, equity vesting, principal legal fee processing goes smoothly.

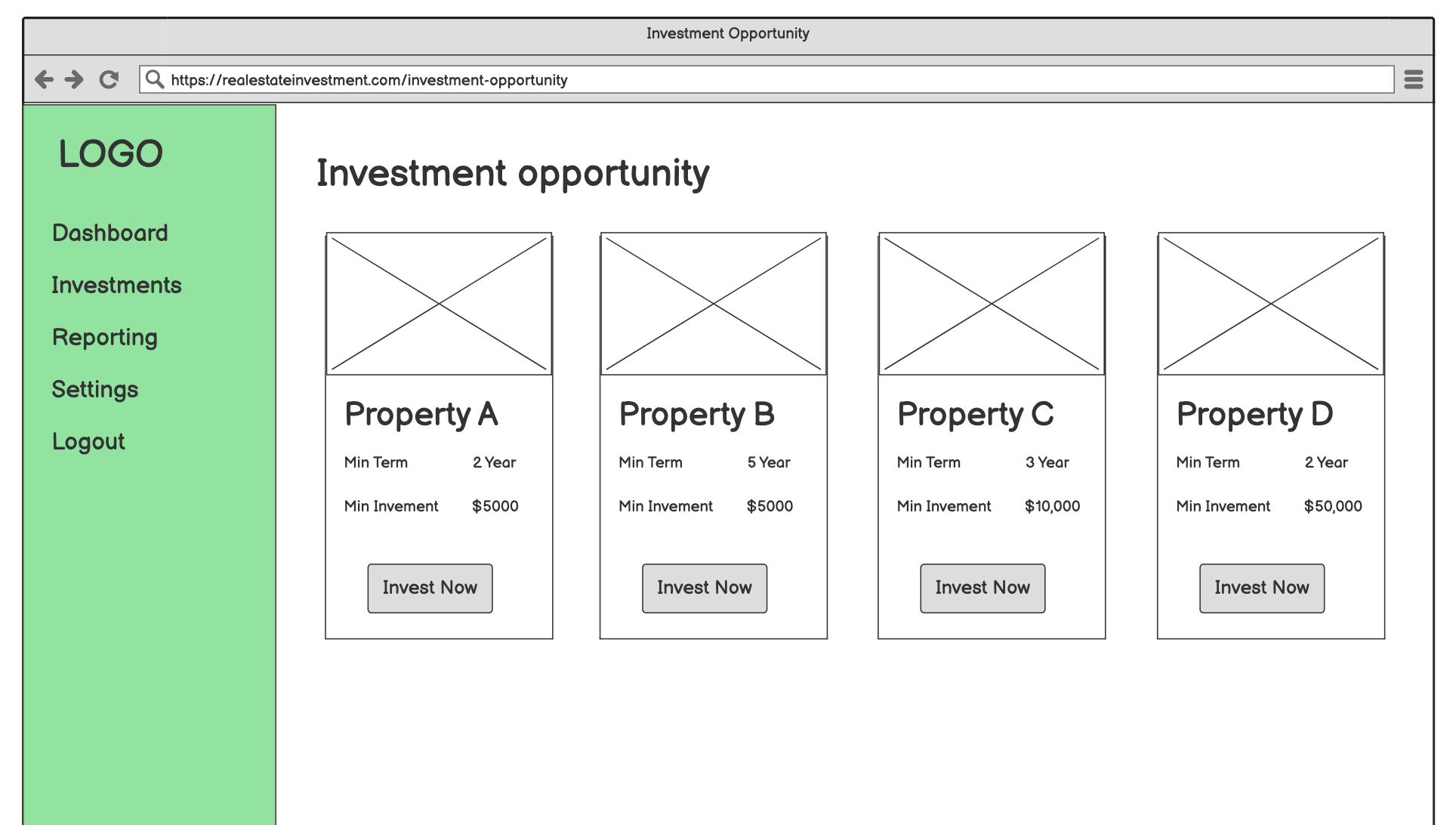

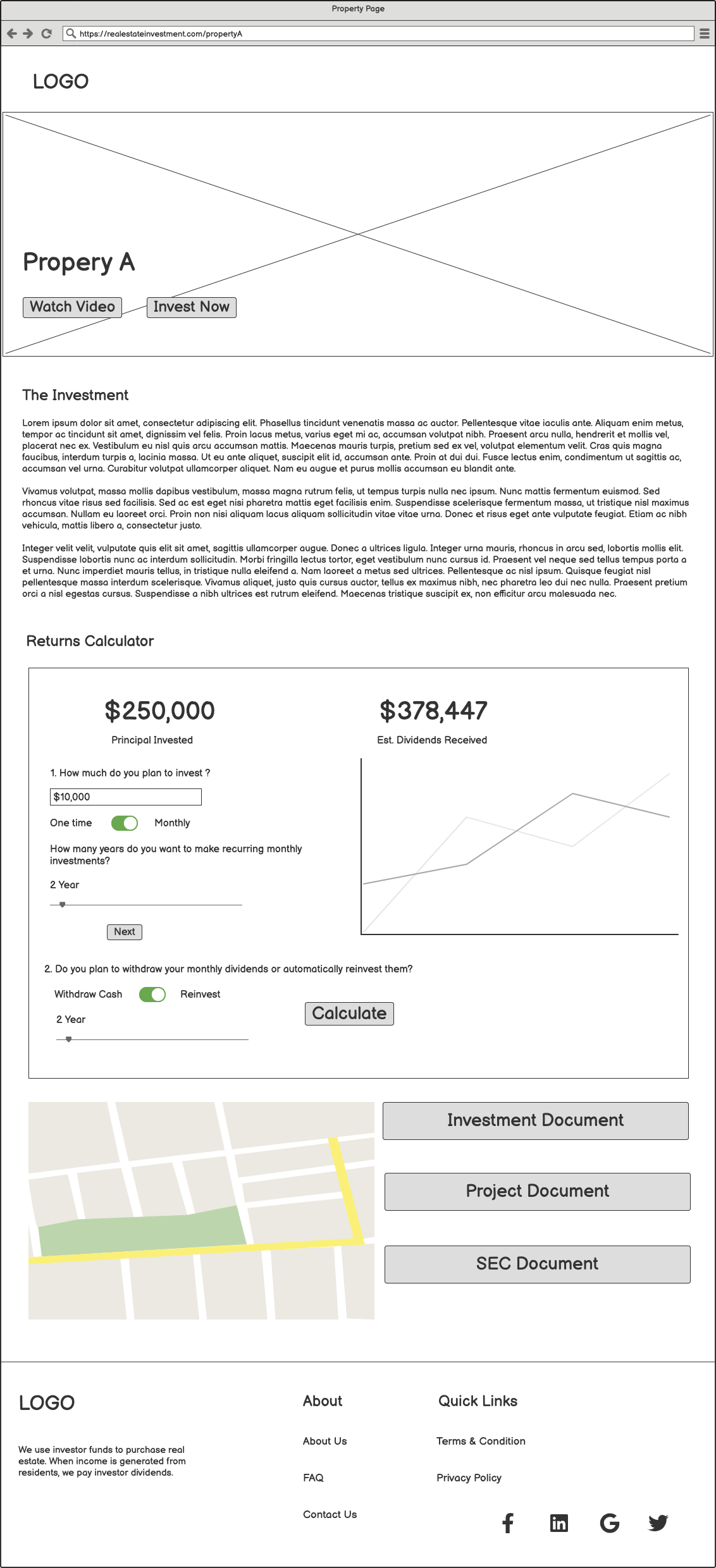

Next : Property detail page

NEXT : Investment / Payment page

For Technology and Operations Executives

a) Consolidate data from portfolio companies, administrators, custodians via APIs on a single platform. No more email attachments!

b) Detailed views across funds, underlying partnership structures, portfolio companies.

c) Real time tracking for key operational metrics across portfolio by sector, geography, or completely custom views.

d) Waterfall distribution analysis for exit scenarios factoring preferences, carry, catch ups for accurate return modeling.

e) Plan liquidity needs with capital call modeling, unfunded commitment tracking, distribution scheduling tools.

f) Ensure accurate expense allocations, cash flow projections based on limited partnership agreements.

g) Institutional grade security, user access permissions, activity audit logs, backup protocols.

In summary, purpose-built software equips private equity firms to execute better deals, improve portfolio company operations, and drive efficiencies firm-wide. By adopting solutions tailored to meet the needs of PE pros across the lifecycle, top quartile funds gain a real competitive edge.

Now, let’s explore how software earns its keep across key workflows:

Targeting & Origination

a) Filters to quickly pinpoint prospects from databases of hundreds of thousands of private companies based on sector, size, growth metrics and other criteria.

b) Interactive dashboards to track deals by stage, creation date, and priority plus drive pipeline reviews and updates.

c) Risk scoring frameworks based on initial red flags assessment, odds of winning, resource requirements, deal team bandwidth.

d) Tools to research markets, assess demand drivers, competitive threats regarding top prospects.

e) LBO models that flex to factor complex instruments like ratchets, equity kickers, operating partner stakes etc under future business scenarios

Due Diligence

a) Provide secure virtual data rooms for sharing confidential documents during due diligence.

b) Financial spreading tools avoid tedious manual rekeying audited financials from statements into Excel.

c) Analysis tools overlay portfolio company data with market data for demand forecasting, customer analytics, risks

d) Repository to centrally store findings from third party advisors like accountants, consultants organised by diligence category.

e) Enable internal comments and task assignments to address issues uncovered over the course of deep 7-week due diligence.

Deal Execution

a) Scenario testing capabilities help model preferred stock, common stock returns given economics.

b) Editor to quick draft key legal agreements like Letter of Intent, Purchase Agreement, Employment Agreements etc.

c) Synced calendaring for critical dates across internal team members and external lawyers, accountants involved.

d) Payment tracking ensures wires go out on schedule to appropriate recipients like shareholders, advisors etc.

e) Cap table updates and vesting schedules automatically reflected for shareholders as deal reaches close.

Asset Management

a) Store key operating metrics, KPIs to monitor across portfolio companies along with initiative plans to drive improvement.

b) Flexible data model captures complex fund structures across partitions, secondary deals, and related co-underwritten special purpose vehicles.

c) Waterfall distribution analysis for hypothetical exit outcomes factoring in carrying interest, catch ups, preferential returns for accurate cash flow modeling.

d) Propose and measure progress on value add initiatives focused on revenue expansion, product improvement, cost optimization etc.

e) Plan liquidity requirements with capital flow analysis, distribution scheduling, unfunded commitment tracking tools.

Investor Reporting

a) Quarterly statements, capital accounts, cash flow projections tailored by LP sections, closing dates etc.

b) Custom views blend portfolio company operating metrics with private and public market benchmarks.

c) Allow LPs to access and analyze portfolio data relevant to their specific co-underwritten deals.

d) Ensure accuracy around performance metrics like DPI relying on institutional grade calculations rather than manual Excel.

e) Meet demanding transparency and auditing standards like ILPA guidelines for data integrity and controls.

In summary, Excel is no longer adequate as the primary toolkit for private equity firms. Spreadsheets have material drawbacks around accuracy, security, scalability, integration, and transparency. As competition accelerates across private markets, specialized software has become essential.

Integrated solutions designed specifically for leveraged investing equips deal partners, operations leaders, and investors with differentiated visibility, analytics, and automation. By adopting next-gen platforms, general partners can drive operational excellence, augment underwriting, exert portfolio influence, and provide superior investor transparency – unlocking a true competitive edge in markets.

With technology now integral to private equity, sophisticated private equity software has become prerequisite, not optional. Firms who embrace purpose-built tools tailored to support leveraged deal workflows at scale will lead the pack – while laggards wedded to spreadsheets face risks. The incentives for adopting specialized solutions could not be clearer as the industry matures.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.fundraisingscript.com/blog/why-excel-alone-wont-cut-it-the-need-for-specialized-private-equity-software/?utm_source=rss&utm_medium=rss&utm_campaign=why-excel-alone-wont-cut-it-the-need-for-specialized-private-equity-software