US CPI m/m

- MON: Swiss CPI

(Dec), EZ Retail Sales (Nov), Sentix (Jan), Japanese Tokyo CPI (Dec), Chinese

Trade Balance (Dec) - TUE: EIA STEO; German

Industrial Output (Nov), US NFIB (Dec). - WED: CNN

Republican Debate; Norwegian CPI (Dec), Chinese CPI/PPI (Dec), Chinese M2

(Dec). - THU: US CPI

(Dec), IJC (w/e 5th Jan), Japanese Current Account (Nov). - FRI: UK GDP

(Nov), US PPI Final Demand (Dec), Canadian Housing Starts (Dec). - SAT: Taiwan

Presidential/Parliamentary Elections.

NOTE: Previews are listed in day order

Swiss CPI (Mon):

November’s release was markedly cooler than

expected at 1.4% Y/Y (exp. 1.7%), even given the influence of the Rental Rate

increase from mid-2023. However, the SNB’s December forecasts (provided after

the November data) look for inflation to tick up to an average of 1.8% across

Q1-2024. Though, crucially, inflation is seen within the 0-2% target band for

the entirety of 2024. December’s data will be assessed to see if the November

M/M decrease at -0.2% continues, a decline that was driven by reduced fuel, hotel

and holiday pricing with the bulk of this stemming from imported products.

While the Rental Rate remains the headline point for those watching Swiss CPI,

the nation’s statistics office only updates on this quarterly and is next

scheduled for February’s CPI, due around two-weeks before the March SNB policy

announcement.

China Trade (Mon):

There are currently no expectations for the

December Trade Balance (prev. 35.39bln in USD terms) and the Imports/Exports

breakdown (prev. -0.6% and +0.5% respectively). The data will be eyed for a

diagnosis of foreign and domestic demand. In terms of the prior month’s

metrics, exports in November saw a surprise increase (in USD terms) of 0.5% Y/Y

(exp. -1.1%), which ended a six-month streak of consecutive declines. The

unexpected strength in exports was attributed to China’s increasing share in

the global export market, despite overall falling global trade volumes. Key

factors include a shift towards EVs, although some desks suggest Chinese

exporters face challenges such as lower profit margins and limited scope for

further price reductions, potentially impacting export performance in 2024.

Imports last month remained weak and continued to raise concerns surrounding

Chinese domestic demand.

Norwegian CPI (Wed):

December’s print is expected to continue the

incremental downward trend in the Norges Bank’s main measure of CPI-ATE

inflation, which printed at 5.8% Y/Y in November, a figure which matches the

January 2023 reading but was markedly below the 2023 peak of 7.0% from June.

December’s policy announcement from the Norges Bank saw a somewhat unexpected

hike to a likely 4.50% peak, though high inflation and NOK downside were cited

as potential drivers for further tightening. For reference, the Bank’s Q4-2023

CPI-ATE view is 5.83%, roughly in-line with November’s figure. In terms of

December, SEB forecasts a Y/Y print of 5.6% writing that the expected modest

upward surprise has not occurred in the series.

China Inflation (Wed):

The prior month’s release saw inflation print

below expectations across the board, with CPI Y/Y at -0.5% (exp -0.1%), M/M at

-0.5% (exp -0.1%), and PPI Y/Y at -3.0% (exp -2.8%). The decline in consumer

price inflation was driven by a further decrease in food prices, from -4% to

-4.2% Y/Y, and a 0.5% M/M decrease, after accounting for seasonality. Energy

prices also fell by 2.7%M/M, contributing to the deflation. Core inflation,

excluding food and fuel, remained steady at 0.6% in November. Analysts cited by

SCMP expect Chinese inflation to remain low in the near term, but do not

anticipate a deflationary spiral, and suggest core inflation is likely to

increase in the first half of 2024 due to a rise in policy support, potentially

boosting domestic demand and services inflation. SCMP also posits that food and

energy price deflation is expected to lessen due to changing base effects, with

CPI inflation forecast to average 1% in 2024, up from 0.3% so far this year.

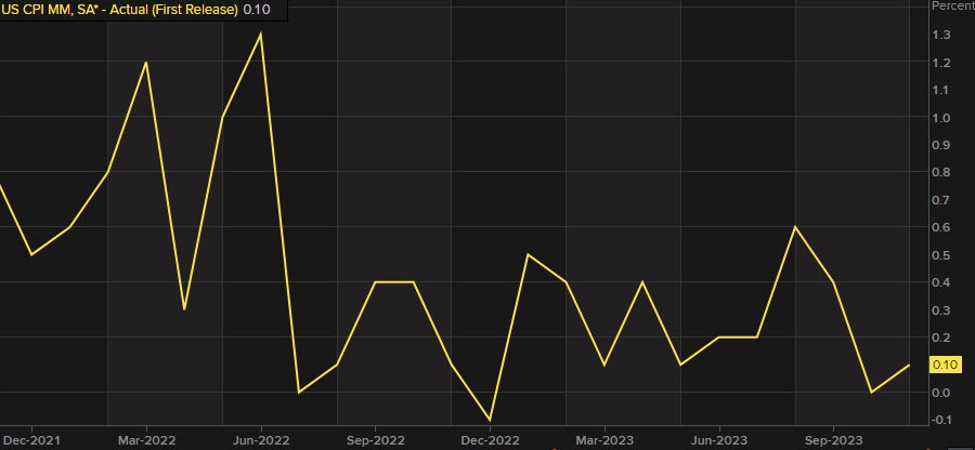

US CPI (Thu):

US headline CPI is expected to rise +0.2% M/M in

December (prev. +0.1%), while the core rate is seen rising +0.3% M/M, matching

the rate seen in November. Traders will be looking to see if there is any

resurgence in price pressures that could knock the market’s dovish view of the

Fed’s rate trajectory (currently, the market has priced six 25bps rate cuts in

2024, but the FOMC’s December projections sees only three). November’s report

saw headline inflation continuing to fall, though analysts at JPM noted that

core inflation remains sticky at a level higher than what the Federal Reserve

wants, as elevated wages in the services sector continue to add an element of

stickiness; after that November data, JPM said that it appeared less likely

that the Fed will implement a rate cut in the upcoming March 2024 meeting. This

week’s edition of The Economist notes that the recent fall in inflation might

be a “false signal”; it notes that while goods prices have declined,

services prices continue to edge up, with many rising more quickly than the

pre-pandemic trend, while even house prices saw a rebounded in 2023 (as

mortgage rates now fall back, it leaves risks that house prices could pick-up

further), while an easing in financial conditions as the Fed cuts rates would also

feed into renewed price pressures. “If inflation rebounds the Fed would

have little choice but to keep interest rates elevated, perhaps reviving the

fears of a recession that have all but vanished,” The Economist said.

US Corporate Earnings (Fri):

According to FactSet, Q4 earnings growth for the

S&P 500 is estimated to be +2.4%, which would mark the second straight

quarter of Y/Y growth for the index. It also notes that these estimates have

been falling as we approach Q4 reporting: in September, analysts expected the

S&P 500 earnings growth rate to be +8.1% Y/Y. Ahead of earnings season,

FactSet’s data shows 72 S&P 500 companies issued negative EPS guidance, 39

issued positive EPS guidance. Looking ahead, a longer-term poll from Reuters

finds that analysts expect US corporate earnings to improve at a stronger rate

this year as inflation and interest rates fall, though concerns surrounding

slower economic growth cloud the outlook. The Reuters poll says that analysts

expect S&P 500 earnings to rise +11.1% this year after +3.1% in 2023. But

analysts want to see solid earnings growth to support lofty equity valuations,

which are currently around 19.8x forward 12-month earnings estimates for the

S&P 500, significantly above the long-term average of around 15.6x.

“The market trading where it is at current levels demands earnings to show

strong growth next year,” Wells Fargo said. Accordingly, analysts will be eyeing the Q4 earnings report for signs on how higher rates are impacting the

economy and corporate earnings. It will also be interesting to see how

analysts’ views evolve after Q4 earnings, as some predict Q1 earnings will

weaken at a quick pace.

UK GDP (Fri):

Expectations are for GDP to rise +0.1% M/M in

November (vs. the 0.3% contraction seen in October, despite consensus expecting

an unchanged outcome, the release reported falls in every sector, with services

sector the main contributor for the declines. This, combined with the negative

Q3 GDP print has stoked some concerns over a potential H2 2023 recession. For

the November release, analysts at Investec note that their forecast of +0.2%

would be “too small to prevent a technical recession,” albeit, such a recession

would be “as mild as they come.” In terms of the drivers for a rebound in

production, the desk cites strong retail sales volume growth, lack of NHS

strike action and cooler weather prompting an increase in heating needs. That

said, upside could be capped via the pressure on households and firms from

higher interest rates. Beyond the upcoming release, Investec expects lacklustre

activity to continue into Q1 before recovering later as inflation declines.

From a monetary policy perspective, the upcoming release will likely have

little sway on market pricing for the BoE, with the MPC more concerned about

services inflation and wage growth. However, a particularly soft release could

see markets bring forward current expectations of the first BoE rate cut from

June to May. As a reference point, markets currently price around 120bps of

cuts by year-end.

For more like this, check out Newsquawk.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexlive.com/news/week-ahead-cpi-releases-from-the-us-and-china-are-the-highlights-20240107/