This article was originally published on SubStack.com

Table of Contents

Introduction

In the kaleidoscope of financial innovation, few things spark as much anticipation and debate as the Bitcoin Exchange-Traded Fund (ETF). Like the first streaks of dawn heralding a new day, the newly approved Bitcoin Spot ETF stands on the horizon, promising to reshape the landscape of digital asset investments.

But as the financial world buzzes with predictions and punditry, I cut through the noise to bring you a clear, concise, and compelling look at what this ETF really means. Is it the golden key to mainstream acceptance for Bitcoin, or just another speculative bubble waiting to burst? Buckle up as we embark on a journey to demystify the Bitcoin ETF, dissecting its potential to revolutionize the way we view, value, and invest in the digital gold.

Breaking Ground in the Bitcoin World

As dawn breaks over the digital horizon, a new era is being ushered in with the possibility of the first Bitcoin ETF. A concept that has been long in gestation, the Bitcoin ETF is not just another financial instrument; it represents a bridge between the often opaque and wild digital assets markets and the regulated, mainstream world of investment. The journey of the Bitcoin ETF has been anything but smooth, marked by anticipation, numerous rejections, and the relentless pursuit of validation.

The very first Bitcoin ETF filing was made back in 2013 by the Winklevoss twins, known for their early involvement in Facebook and later as cryptocurrency pioneers. Since then, the U.S. Securities and Exchange Commission (SEC) has received numerous applications for Bitcoin ETFs, but approval has been elusive. As of now, over a dozen proposals have faced rejection, each time sending ripples of disappointment through the Bitcoin community.

The repeated rejections have primarily hinged on concerns about market manipulation, liquidity, and the need to protect investors in a market that is notorious for its volatility and speculative nature. However, each rejection has also been accompanied by a deeper understanding and maturing of the Bitcoin market and the mechanisms that underpin it.

The anticipation of a Bitcoin ETF has significant implications for the entire digital asset world. For Bitcoin, approval would likely mean increased legitimacy and potentially a massive influx of institutional money, which could drive up demand and price (theoretically). It represents a shift from niche, tech-savvy circles into the mainstream investment portfolios, making Bitcoin accessible to a broader audience through traditional investment channels like retirement accounts and stock exchanges.

For the broader digital asset market, the approval of a Bitcoin ETF would signal a maturing of the industry and might pave the way for other digital assets to receive similar treatment. It could lead to more innovation, improved regulatory frameworks, and greater stability in a notoriously turbulent market.

Decoding the Bitcoin Spot ETF: Beyond the Hype

With all the buzz surrounding the Bitcoin ETF, it’s easy to get lost in the financial jargon. Let’s take a step back and demystify what ETFs are, especially in the whirlwind world of Bitcoin.

An ETF, or Exchange-Traded Fund, is essentially a basket of goods that you can buy or sell through a brokerage firm on a stock exchange (think the appetizer platter at your favorite diner). Just like individual stocks, ETFs are traded throughout the day at varying prices. There are ETF’s for commodities like gold (GLD), silver (SIVR), or uranium (URA), but also ETF’s that are focused on a sector of stocks such as tech (ARKK), energy (VDE), or even Bitcoin mining (WGMI).

A Bitcoin ETF, then, is a type of ETF that tracks the price of Bitcoin. It allows investors to invest in Bitcoin without the challenges of buying, storing, and securing the digital asset themselves. Instead of grappling with exchanges, digital wallets, and the often daunting task of safeguarding cryptographic keys, investors can simply buy and sell the ETF through traditional investment platforms.

The allure of a Bitcoin ETF lies in its ability to merge the world of digital asset investments with the familiarity and regulatory safeguards of traditional finance. For seasoned traders and cautious newcomers alike, it provides a regulated and more accessible pathway to investing in Bitcoin. It’s a game-changer because it broadens Bitcoin’s appeal to a larger pool of investors, including those who might be wary of direct Bitcoin investments due to concerns about security or simply the technological learning curve.

However, a Bitcoin ETF doesn’t come without its own set of considerations. Unlike direct investment in Bitcoin, where investors own the actual digital asset (not your keys, not your coins), an ETF investor owns shares in a fund that represents Bitcoin.

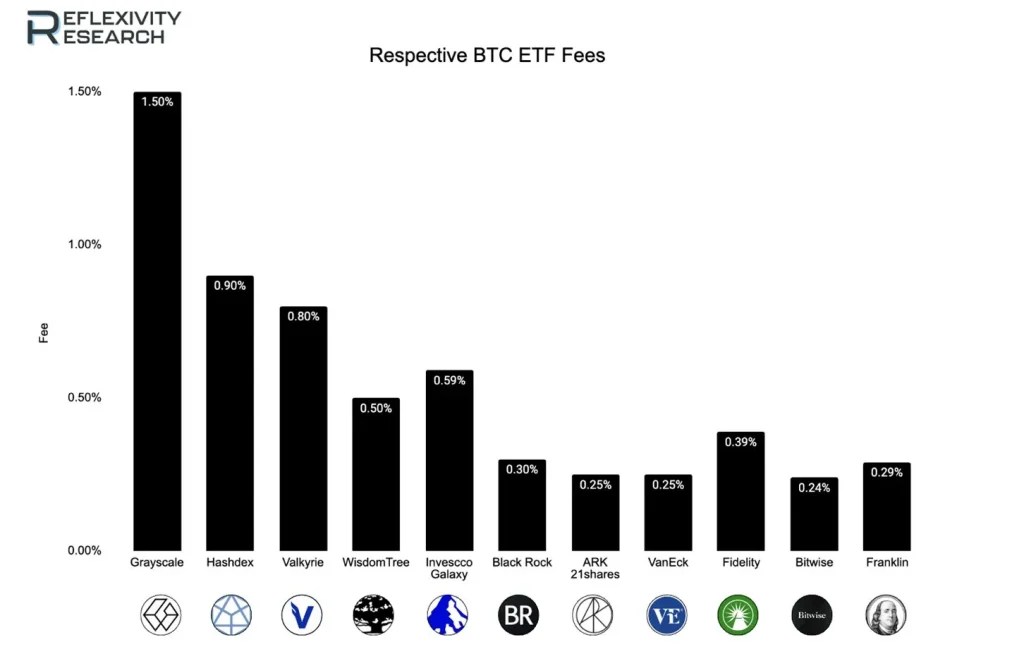

This means they are subject to the ETF’s management structure, fees (GLD charges an annual expense ratio of around 0.40%, covering operational costs, a fee structure expected to be similar in a Bitcoin ETF for managing and securing the digital asset), and the potential divergence in tracking the actual price of Bitcoin known as tracking error.

Below is an image from Reflexivity Research breaking down the proposed fees for each Bitcoin ETF. Moreover, while a Bitcoin ETF might mitigate some risks associated with direct digital asset ownership, it doesn’t eliminate the inherent volatility of Bitcoin itself.

The real game-changer, however, comes in the potential unlocking of vast retirement and institutional funds.

With total assets in different retirement accounts amounting to $35.7 trillion, the Bitcoin ETF opens a massive avenue for investments into Bitcoin. This move not only signals a broader acceptance of Bitcoin as a legitimate asset class but could also lead to significant capital inflows into the market, potentially increasing liquidity and stabilizing the notoriously volatile Bitcoin prices.

The enthusiasm and anticipation surrounding the ETF indicate a collective investor sentiment that sees it as a harbinger of increased institutional participation and a maturing digital asset market.

Understanding the mechanics and implications of a Bitcoin ETF is crucial as it moves from a speculative possibility to a real investment option. It’s not just about riding the wave of Bitcoin’s popularity; it’s about making an informed decision that aligns with your investment goals, risk tolerance, and understanding of both the potential and the pitfalls of this emerging asset class.

Weighing the Scales: Benefits and Risks

Pros: Broadening Horizons with BTC Exposure

The allure of Bitcoin ETFs lies in their promise to bring Bitcoin exposure to the masses, particularly through retirement accounts like Roth IRAs and 401(k)s.

In Roth IRAs, for instance, investments grow tax-free, meaning you don’t pay capital gains tax on the profit from your Bitcoin ETF investment when you withdraw it in retirement. Similarly, 401(k)s offer deferred taxation, providing tax advantages up front and allowing investments to grow tax-deferred until withdrawal. This is a game-changer for those seeking exposure to Bitcoin’s potential upside without the tax bite, but for me personally I will only purchase a Bitcoin ETF in my Roth IRA (not financial advice).

Cons: The Trade-Offs of Indirect Ownership

However, with every silver lining comes a cloud. One significant drawback of a Bitcoin ETF is that you’re not owning Bitcoin directly.

Instead, you’re investing in a fund that represents Bitcoin, which means you’re subject to the risks of third-party custodianship. This arrangement can leave investors vulnerable to counterparty risks, where the entity holding the Bitcoin (the custodian) might face issues like bankruptcy, as seen in the Celsius debacle. While an ETF like BlackRock’s might have more robust financial safeguards compared to platforms like Celsius, the fundamental risk of entrusting your assets to a third party remains.

Moreover, if you’re not investing through a tax-advantaged account, the Bitcoin ETF might lose its luster. Without the tax benefits, you’re essentially paying a premium for convenience, potentially missing out on the full benefits of owning Bitcoin directly, including holding your own private keys and having complete control over your assets.

Ripple Effects: The ETF’s Market Impact

Take gold, for example. Before the gold ETF (GLD) was launched in 2004, gold was a physical commodity that required storage and security. The ETF democratized access to gold, allowing more investors to easily add the precious metal to their portfolios. Following the launch of GLD, gold embarked on a remarkable bull run, climbing significantly in price over the following years. This period coincided with a broader commodities boom, suggesting that ETFs can indeed play a role in amplifying market trends.

Comparing Commodities to Digital Assets

However, it’s important to remember that while history can provide clues, it’s not a crystal ball. The backdrop of the commodities market during gold’s ETF launch was characterized by rising demand and geopolitical tensions, contributing to the bull market. The Bitcoin market, while similarly volatile and influenced by macroeconomic factors, operates under a different set of dynamics (yet the same rising demand and exact same geopolitical tensions are present in 2024).

The broader digital asset market is notoriously correlated with Bitcoin’s fortunes, often mirroring its rises and falls (Bitcoin accounts for over 50% of the entire digital asset market cap depending on price: this is often called Bitcoin dominance). A Bitcoin ETF could potentially exacerbate this trend, as increased liquidity and accessibility lead to more capital flowing into Bitcoin and, by extension, the rest of the digital asset market.

However, skeptics worry that it could also lead to increased volatility, especially if the ETF becomes a vehicle for speculative trading or if the market misinterprets the custodial risks associated with holding Bitcoin in fund form. The key difference between the digital asset market and the commodities market is the degree of maturity and regulation, with Bitcoin still in its nascent stages and subject to rapid changes in technology and regulatory oversight.

Navigating the New Terrain: Tips for Potential Investors

For those intrigued by the Bitcoin ETF and considering adding it to their portfolio, navigating this new terrain requires a mix of enthusiasm and caution. Here are some insights to guide potential investors:

- Know the Custodian: One of the critical aspects of any ETF, especially a Bitcoin ETF, is understanding who is holding the underlying assets. The custodian’s credibility and security measures are paramount. Coinbase is the most-popular choice for custodian among Bitcoin ETF applicants, including BlackRock, Franklin Templeton and Grayscale Investments, according to a tally by Bloomberg Intelligence. Investigate their track record, security protocols, and any insurance measures they have in place to protect assets.

- Beware of Paper Bitcoin: An ETF might give you exposure to the price movements of Bitcoin, but it’s not the same as owning the actual digital asset. You’re essentially owning a share in a fund that holds Bitcoin, not the Bitcoin itself. This distinction is vital, especially for those seeking the full benefits and responsibilities of true ownership, such as being able to take your bitcoin anywhere in the world with you.

- Real Bitcoin and Self-Custody: If possible, consider buying and holding real Bitcoin, where you control the private keys. This approach isn’t feasible or practical for everyone, especially those looking to invest through tax-advantaged accounts like IRAs or 401(k)s, but it’s the purest way to invest in Bitcoin. It provides autonomy, reduces reliance on third-party custodians, and fully embraces the decentralized ethos of Bitcoin.

- Retirement Accounts and Bitcoin Exposure: For many investors, especially those with substantial funds in retirement accounts, a Bitcoin ETF offers a first real opportunity for Bitcoin exposure. It provides a way to invest in Bitcoin within a familiar, regulated, and often tax-advantaged framework. Understand the tax implications and benefits of investing through different types of accounts and weigh them against the purity and control of direct Bitcoin ownership.

As with any investment, doing your due diligence and understanding your own financial goals and risk tolerance is crucial. The Bitcoin ETF, while a significant milestone, is just one of many ways to gain exposure to Bitcoin and should be considered as part of a broader investment strategy. Whether you’re a seasoned Bitcoin investor or new to the space, navigating this terrain with informed caution and a clear understanding of your investment thesis will stand you in good stead.

The Bitcoin ETF Verdict: Revolution or Caution?

As we wrap up our deep dive into the world of the Bitcoin ETF, it’s evident that this financial innovation stands at the crossroads of revolution and caution. It heralds a potential paradigm shift in the way mainstream and institutional investors can access Bitcoin, promising broader acceptance and possibly more stability for the leading digital asset. Yet, it’s essential to approach this new investment avenue with a balanced perspective, acknowledging both the bright prospects it offers and the inherent risks it carries.

For long-term Bitcoin enthusiasts and so-called “Bitcoin maxis,” the ETF represents a significant stride toward global mass adoption. It simplifies Bitcoin investment to the extent that even those traditionally less tech-savvy or risk-averse, such as your parents or grandparents, can now consider adding bitcoin to their retirement accounts with ease. The idea that someone can gain exposure to Bitcoin as simply as they might open a checking account is a revolutionary thought and marks a significant moment in Bitcoin’s history.

However, while the ETF opens doors, it also brings with it the need for investor education and caution. Understanding the difference between owning actual Bitcoin and holding a share in a Bitcoin ETF is crucial. Investors must navigate this new terrain wisely, considering factors like the ETF’s custodial risks, the implications of indirect ownership, and the broader market impact.

As the narrative of the Bitcoin ETF unfolds, one thing is clear: the financial markets will never be the same. Whether you view the ETF as a beacon of progress or a product to approach with skepticism, its introduction is undeniably a milestone in Bitcoin’s journey.

As with any significant financial innovation, the key lies in staying informed, understanding your investment goals, and carefully weighing the potential rewards against the risks. So, whether you’re ready to embrace the Bitcoin ETF or prefer to stick to traditional methods of investing in Bitcoin, the choice is yours. The future of finance is evolving, and Bitcoin continues to play a pivotal role in shaping it.

Nothing here should be considered financial advice. You must do your own due diligence.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://bitcoinnews.com/bitcoin-spot-etf-game-changer-hype-bubble/?utm_source=rss&utm_medium=rss&utm_campaign=bitcoin-spot-etf-game-changer-hype-bubble