Ethereum. The world’s decentralized supercomputer. The collective orchestra of transistors distributed in every corner of the globe working to power a logic machine upon which we can, theoretically, run the processes of our world’s systems.

Except, there’s a problem. The Ethereum supercomputer isn’t quite so super. The blockchain trilemma which has plagued the adoption of these new distributed ledgers is no more keenly felt than when dealing with the ancient and monolithic consensus and application mechanisms that Ethereum possesses.

In short, it’s too slow. Way too slow. And way, way too expensive. At times of high network congestion, singular transactions can be hamstrung by fees of hundreds of dollars. The idea of processing or storing any large data model, any high-throughput transaction strategy, or infrastructure for gaming or metaverse applications is simply absurd. The network can’t cope. As immutable, transparent and trustless as Ethereum is – and the wonderful opportunities it offers – there’s still a long way to go.

Scaling the Heights

Of course, crypto developers know this. Feverish work has gone into producing scaling solutions for Ethereum that help make the chain suitable for the variegated financial and sysadmin applications it is capable of. At this point, it seems L1 solutions implemented directly onto Ethereum itself are not going to work, and L2 solutions are seen as the best way to advance the chain and make ‘The Infinite Machine’ truly as infinite as it is supposed to be. Vitalik Buterin, God-Emperor of the Ethereum ecosystem, is convinced that L2s, especially rollups, will be necessary to make the chain viable for adoption and suitable for the applications people are desperate to build.

L2s, though, have a problem of fragmented liquidity – which we’ll return to later. For now, let’s have a brief overview of various scaling solutions, L1 and L2, and where they are succeeding – and where they are failing.

Sharding – an L1 solution

For the longest time, sharding was seen as Ethereum’s best method of scaling. An L1 solution, meaning that the scaling happens using the main Ethereum protocol itself. Rather than have all nodes process all transactions, sharding involves ‘breaking up’ Ethereum into multiple shards which can be parallel processed. Each shard has its own validators, meaning that individual nodes don’t have to process everything every time.

Sharding, though, is a technical headache. What’s more, it’s not future proof. Continually breaking up the blockchain also dilutes the central consensus in the first place, with any attempt to reestablish it then running straight into the problems it was initially trying to solve.

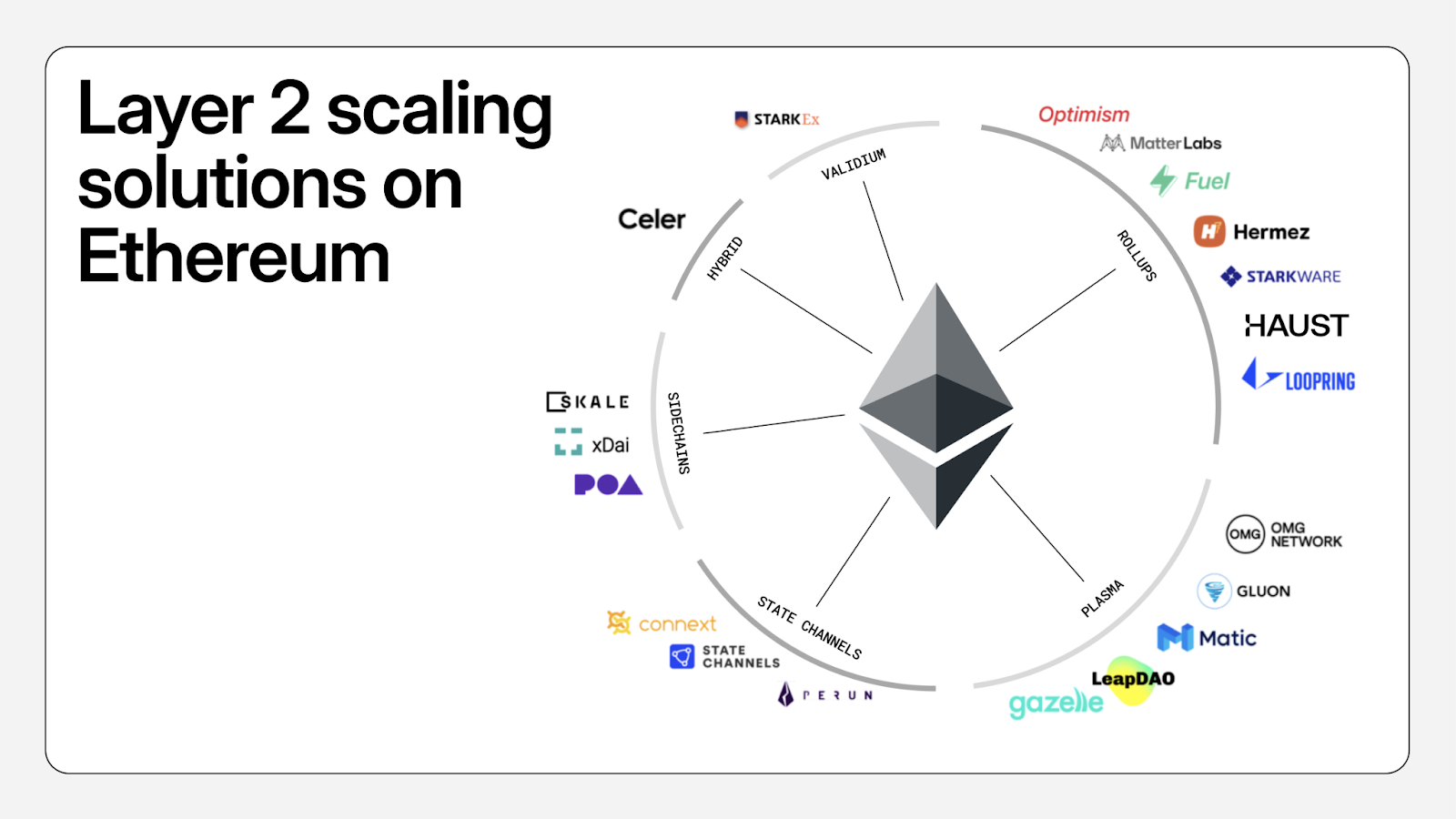

Common L2 Solutions

An L2 is a network built ‘on top of’ Ethereum that borrows Ethereum’s security to process its own transaction data. However, an L2 network has its own validators, and may operate a different – likely faster – consensus mechanism. L2s however have their data validated by Ethereum itself, ensuring consistency and applicability, and leveraging the Ethereum consensus that makes it so valuable in the first place. There are many types of solutions being used by L2.

Rollups

Networks using rollups operate in parallel with Ethereum but record transactions on the main network. Rollups come in two distinct flavors: optimistic and zk-rollups. Since the Ethereum DenCun update, recording data for verification on the L1 network is now economically feasible on a large scale, and rollups are seen as the most likely path for future Ethereum scaling.

Optimistic Rollups

Optimistic rollups are optimistic because they assume the best. They form batches of their transactions, record them in a compressed form (making it cheaper) and rather than checking the data before imprinting it, they simply accept it as given. Of course, this is a security hole, but optimistic rollups work by allowing a period where any given transaction can be contested, and those pointing out errors are rewarded for this work – ensuring the sanctity of the data. Of course, there is a risk as invalid transactions can be recorded as valid, but the market forces of having spotters check through the optimistic rollups ensures this is rare.

ZK-Rollups

The current belle of the cryptographic ball. Zero Knowledge (ZK) rollups are similar to optimistic rollups in that they also form batches of transactions to send to Ethereum, but also provide a cryptographic ‘proof’ that attests to the validity of the data submitted. Because the proof itself is enough, there is no contesting period, no secondary market requirement, and no possibility of error. ZK-proofs are mathematically complex and difficult though, so there is a long way to go.

Plasma

The idea behind Plasma is not all transactions require verification by all Ethereum nodes, just some. Plasma chains periodically record the results of its operations as cryptographic proof. Although the validity of transactions is not verified, once a commitment is recorded on Ethereum, a Plasma chain can’t retrospectively alter the transaction history.

State Channels

State channels are a way of using two transactions to “bookend” a set of private transactions made between two agents. A multisig smart contract is deployed on Ethereum, which demands sign off by participants. Users deposit the funds, interact off chain, and then each sign the smart contract to validate the transactions that have occurred, with the smart contract distributing the funds.

Validiums

Validiums are similar to ZK-rollups, but the data is stored off-chain. Immediately, that should set off alarm bells for any crypto enthusiast. Validiums can have their own architecture, can be less secure and, without the data on the L1 network as a sacrosanct base, a Validium operator can act malfeasant and restrict access to a user’s funds.

Sidechains

Similar to Validiums in that they are separate entities, sidechains are a completely separate and independent blockchain that connects to Ethereum via a two-way bridge. The security of the sidechain is entirely dependent on how it has been built, and that opens up attack vectors since the baseline Ethereum consensus isn’t used, and the two-way bridge can be a faultline through which funds can be compromised.

The Lost Liquidity of Layer 2s

As we can see, there is no shortage of L2 solutions. There has been a mass proliferation of blockchains positing themselves as the solution to Ethereum’s eternal scaling issues. L1 scaling is probably out of the question in any near-future protocol upgrade, and L2s are widely seen as the best way to help Ethereum make good on its potential. Security, technical, and operational issues aside, L2s have another major issue: liquidity fragmentation.

Since L2 scaling solutions require funds to be held on various blockchains, interoperability between them is not always possible. The time-lag, expense, hassle, and security headaches that occur when adopting a DeFi strategy using multiple L2s can be inimical to a profitable portfolio, as well as being far beyond the capabilities of most DeFi users.

Unified Liquidity is Accessible to Everyone

There are some developers who are taking on this challenge however. Blockchains like Haust Network, for example, are developing networked smart contracts that automatically interact with liquidity on multiple L1 and L2 chains and allocate it to profitable staking programs, before delivering it to users automatically. This kind of ‘fire and forget’ DeFi will be crucial if we are to see widespread adoption of decentralized financial primitives in the mainstream. Grandma can’t be loading up three L2 blockchains’ wallets everytime she wants to check on her savings.

Even experienced crypto users get lost, and the brutal fragmentation of liquidity due to these

L2 scaling solutions is a real issue when it comes to growth of the Ethereum network as a whole. Going forward, it’ll be essential for Haust Network – and other liquidity distribution protocols like it – to help merge this disparate technical landscape into a unified, simplified offering that delivers the yield that users crave without sacrificing the cryptographic security they demand. New finance needs new solutions, but when it comes to L2s – those solutions are only the beginning.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.crypto-news.net/tipping-the-scales-the-lost-liquidity-of-ethereums-l2-solutions/