Be the first to know when new content like this is available!

Subscribe to our newsletter to get alerts about new posts, local news, and industry insights.

Thank you! Your submission has been received!

Oops! Something went wrong while submitting the form.

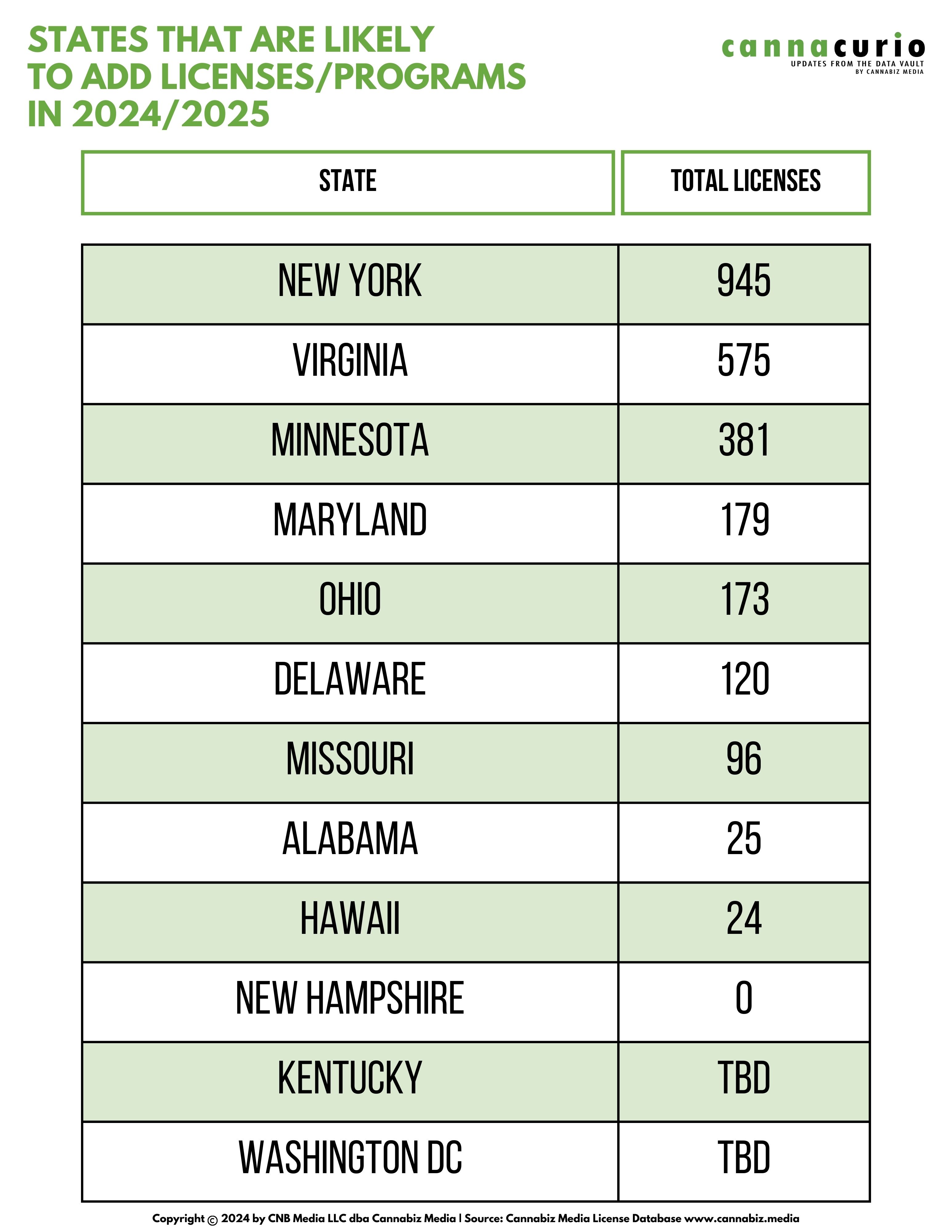

Since we founded Cannabiz Media, we have often looked back to report on the licenses that had been issued by state, activity and status. In this post we are taking a look forward at jurisdictions that will “likely” be issuing tranches of new licenses in the coming year. These future issuances are harder to predict and are subject to the whims and vagaries regulatory and legislative hurdles that can slow the process.

In looking back at 2023, the following table shows which states issues the most licenses. Oklahoma is excluded as they pretty much halted new licenses by March 2023.

But which states do we think are going increase or supersize their programs? Below our team has compiled a list based on sifting through regulations, state guidance and press reports. Some of these numbers are true guesstimates (New York) while others like Minnesota are based on the state’s published guidance.

Future licensure is hard to predict. The states above may be adding licenses by issuing new ones or expanding from medical to adult. New York is the state most likely to add a substantial number of licenses.

New York

There has been intense scrutiny of the New York program. Many press outlets cited the following estimates for new licenses:

- Retail Dispensary: 500 – 1000

- Microbusiness: 220

- Indoor Cultivation (Tier 1 – up to 5,000 sq.ft.): 20

- Indoor Cultivation (Tier 2 – between 5,000 and 12,500 sq.ft.): 20

- Processor (Type 1: Extracting, plus all activities of Types 2 and 3): 55

- Processor (Type 2: Infusing and blending, plus all activities of Type 3): 100

- Processor (Type 3: Packaging, labeling, and branding, including for the performance of white labeling agreements only): no allocation limit, OCM will review on a rolling basis

- Distributor: 30 (does not include processors who wish to also obtain a distributor license)

In reading through the programs annual report, there is incredible demand to get into this market judging by the number of applications received. NY’s Governor Kathy Hochul has called the rollout a disaster so the pressure is on for the Office of Cannabis Management to execute well in 2024. I expect a lot of licenses to be issued in the coming 10 months.

Virginia

The Old Dominion state has been in the news recently as the passage of some key provisions of their program were being tied to DC-based sports teams moving to Northern Virginia. This was coupled with the issue of whether Governor Glenn Younkin would sign off on the program. This program has not been slated to launch sales until 2025 and it looks like it will be a challenge to get over the finish line.

On March 1, Cannabis Business Times reported that the Virginia Cannabis Control Authority would be able to authorize 125 grows, 350 stores and 100 manufacturers for 575 total – that seems unlikely now. The state was supposed to start accepting applications on September 1, 2024.

Minnesota

Minnesota is wisely looking to other states to figure out how to size the program. At the beginning of the year, the state’s Office of Cannabis Management issued a report entitled An Examination of Cannabis Consumers and Cannabis Demand in Minnesota. The report estimated that the state would need 381 stores to meet demand. This program is scheduled to be live in 2025 and I think there is a good chance they hit this milestone.

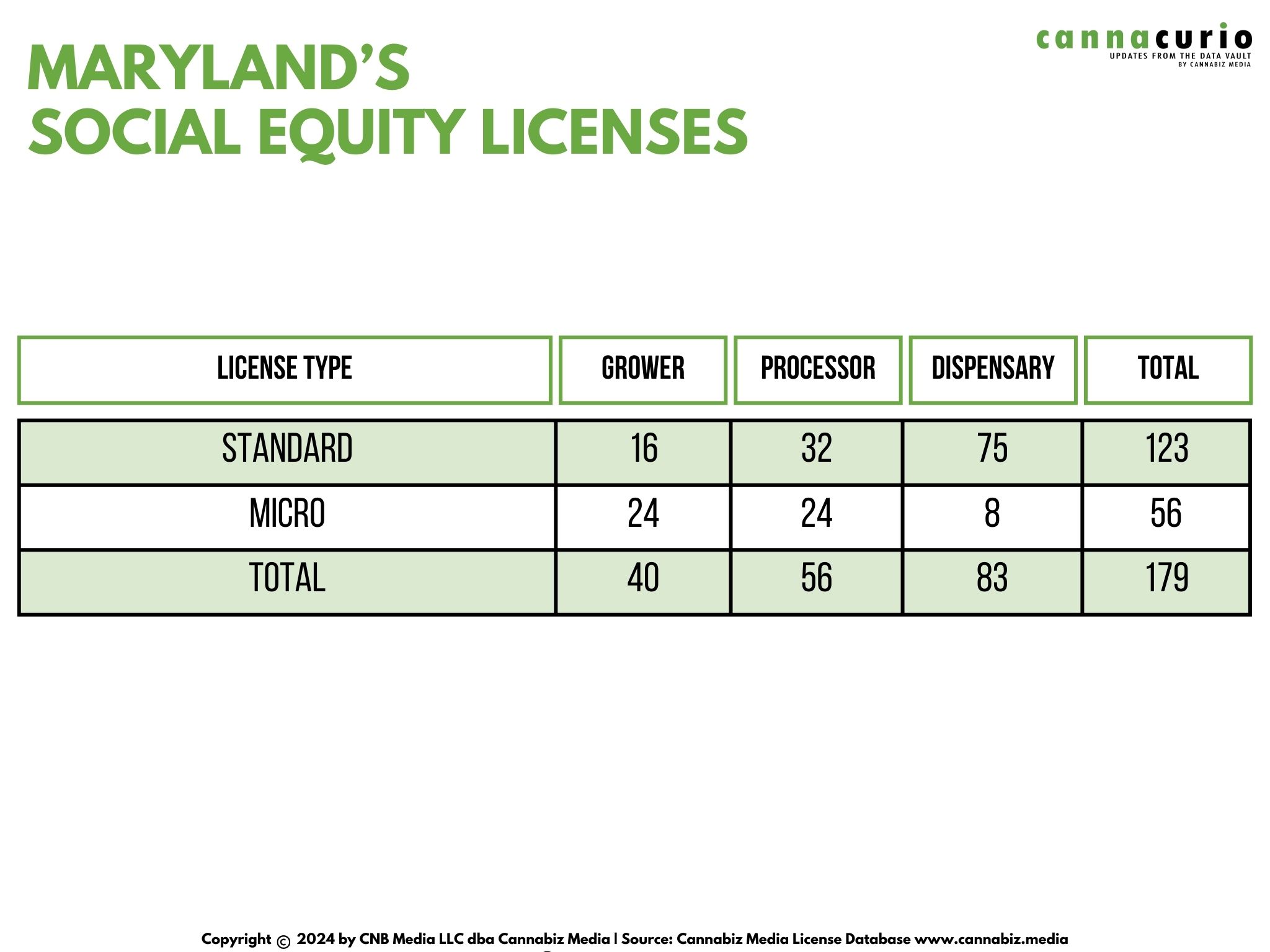

Maryland

The state is in the process of awarding 179 social equity licenses. They comprise the major activities in the value chain:

The lottery occurred on March 14th and winners are expected to be announced soon.

Ohio

Cannabis Business Times did an excellent job explaining the conversion process available to existing license holders.

- 23 Level I medical cultivators in Ohio who could apply for up to three adult-use dispensary licenses,

- 14 Level II cultivators who could apply for one adult-use dispensary license each, according to DCC. However, many of these cultivators are already vertically integrated with retail sites.

- A future licensing round for an additional 40 cultivators and 50 dispensaries is also possible.

These licenses could be issued as soon as September 7th with perhaps 173 though that number depends on how many license holders convert.

Delaware

This program is slated for mid-2025. Initial predictions expected retail and testing licenses to be issued in November 2024 but the new timeline expects licenses to be awarded in March 2025.

There are at total of 125 licenses to issue:

- 60 Cultivators

- 30 Manufacturers

- 30 Retailers

- 5 Testing Labs

Final rules are expected to be issued in July and licenses might be accepted as early as September 1st. Delaware has had a well-run program and I expect them to hit their deadlines.

Missouri

MO has historically done a great job of meeting their licensing deadlines. They are projected to issue 96 Microbusiness licenses as part of their equity program. The state cites:

- A microbusiness facility refers to either a microbusiness dispensary or a microbusiness wholesale facility, both of which conduct operations related to marijuana for medical and adult use.

- A microbusiness is different from a medical or comprehensive facility because it is designed to provide a path to facility ownership for individuals who might not otherwise easily access that opportunity, such as those with a net worth of less than $250,000 or veterans with a service-connected disability.

- Six microbusiness licenses are being issued in each of the eight congressional districts, as drawn and effective December 6, 2018. Of the six in each district, two are microbusiness dispensaries and four are microbusiness wholesale licenses.

In addition to the original set of licenses, the regulator will issue an additional 48 in 2024, and another 48 in 2025.

The states cited above are slated to launch programs or issue a spate of new license in 2024 and or 2025. There are other states that are also trying to achieve these goals but have run into hurdles:

- Alabama – 5 integrated facilities, 12 cultivation, 4 processor, 4 store licenses (3 stores each) are planned with no cap on transport or testing. Litigation has slowed this roll out but licenses are anticipated in 2024.

- Hawaii – The current scheme relies on an expansion of the current license holders. Each existing medical cannabis dispensary may convert their operation into licenses three medical cannabis dispensary licenses, and three retail cannabis store licenses, but not to exceed nine licenses in total. Hawaii’s senate and house are reconciling different versions of the plan.

- New Hampshire – The Granite State is entertaining a scheme to sell through state controlled stores. Some have pointed out that the state may become a plant touching business.

- Kentucky – the bill signed into law in March 2023 licenses the usual activities, and taking a page out of the Oklahoma playbook, has no license caps.

- Washington DC – D.C. cannot launch its own adult-use cannabis market due to its lack of statehood. The District is working to migrate 25 unlicensed retailers to transition to be medical dispensaries.

As we have seen for the last decade, each state embarks upon a choose-your-own adventure approach to licensing – and this will make for a very interesting 2024 and 2025.

Ed Keating is a co-founder of Cannabiz Media and oversees the company’s data research and government relations efforts. He has spent his career working with and advising information companies in the compliance space. Ed has managed product, marketing, and sales while overseeing complex multi-jurisdictional product lines in the securities, corporate, UCC, safety, environmental, and human resource markets.

At Cannabiz Media, Ed enjoys the challenge of working with regulators across the globe as he and his team gather corporate, financial, and license information to track the people, products, and businesses in the cannabis economy.

Ed graduated from Hamilton College and received his MBA from the Kellogg School at Northwestern University

Cannabiz Media customers can stay up-to-date on these and other new licenses through our newsletters, alerts, and reports modules. Subscribe to our newsletter to receive these weekly reports delivered to your inbox. Or you can schedule a demo for more information on how to access the Cannabis Market Intelligence Platform yourself to dive further into this data.

Cannacurio is a column from Cannabiz Media featuring insights from the most comprehensive cannabis market intelligence platform. Catch up on Cannacurio posts and podcasts for the latest updates and intel.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.cannabiz.media/blog/cannacurio-92-when-where-will-new-licenses-drop