- BlackRock intends to launch an Ethereum ETF, with Coinbase as the custodian of ether and an unnamed third party holding its cash.

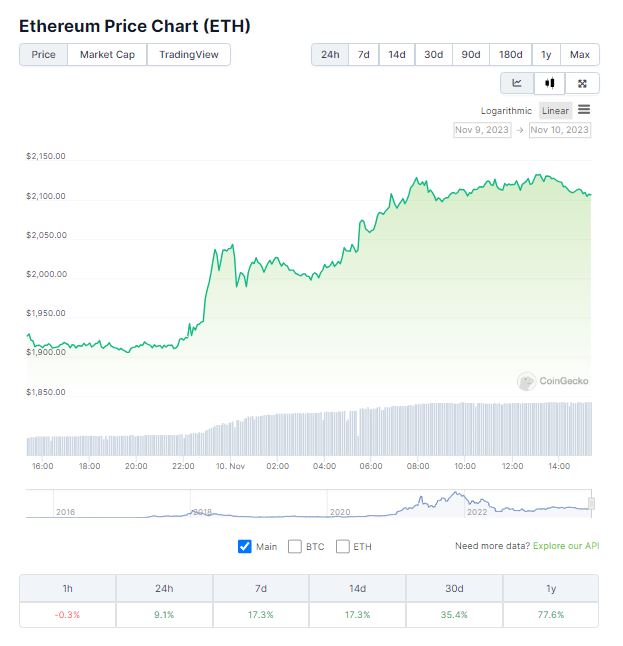

- Following the news of the Ether ETF, ETH surged by 10% to nearly $2,100, reaching a 7-month high.

- Several other companies, including VanEck, Ark Invest and 21Shares, Hashdex, Invesco and Galaxy Digital, and Grayscale, have filed for or launched Ethereum ETFs.

Through a recent filing on Nasdaq, it was revealed that BlackRock, an American multinational investment management corporation, is planning to create an exchange-traded fund (ETF) that will hold Ethereum’s ether. Following the news, ETH’s value significantly increased.

At the time this article is published, Ether’s price pushed above $2,000.

Read more cryptocurrency news:

BlackRock ETH ETF

As per the stock exchange’s Nasdaq filing, BlackRock is pursuing listing its product on the platform. Moreover, it also states that the U.S.-based cryptocurrency exchange Coinbase would act as the custodian of the ether held by the product, while an unnamed third party would hold its cash.

Following this, CoinDesk noted that BlackRock also has a market surveillance agreement with Coinbase which appears to be essential for obtaining approval for such ETFs from the U.S. Securities and Exchange Commission (US SEC).

Accordingly, it seems that the filing tried to address possible objections from the US SEC to the surveillance-sharing agreement by stating that BlackRock believes the prices of CME Group’s ether futures closely match spot ETH prices.

The filing asserted that either CME surveillance can detect spot-market fraud that affects both futures ETFs and spot exchange-traded products, or that surveillance cannot do so for either type of product.

“Having approved ETH futures ETFs in part based on such surveillance, the Commission has clearly determined that CME surveillance can detect spot-market fraud that would affect spot ETPs, and the Sponsor thus believes that it must also approve spot ETH ETPs on that basis,” the statement reads.

Previously, the corporate entity, iShares Ethereum Trust, BlackRock’s ETF Division, has recently been registered in the state of Delaware. However, it must be noted that offering ETFs still requires registration and approval from US regulators.

The U.S. SEC is currently reviewing 12 spot bitcoin (BTC) ETF applications, including the previous BTC ETF application from BlackRock. The SEC has until November 17 to approve all of these applications if it intends to do so this year. If the SEC cannot approve all of the applications by this deadline, the ETH ETF plan will have to wait until next year to be approved.

Ether Price Surge

Following the news about the Ether ETF, the price of the crypto surged 10% to nearly $2,100. This increase has led ETH to reach its 7-month High.

Currently, CoinGecko data shows that ETH is currently valued at $2,105.99 and was up by 9.1% for the last 24 hours.

Other ETH ETF Filings

According to Bloomberg Intelligence analyst James Seyffart, there are currently five other ETH ETF filings.

VanEck

The VanEck Ethereum Strategy ETF (EFUT), launched on October 2, 2023, is an exchange-traded fund that seeks capital appreciation by investing in ether futures contracts. The fund is actively managed and provides exposure to ether-linked investments through an accessible exchange-traded vehicle. The fund does not invest in ether or other digital assets directly.

ArkInvest and 21Shares

Ark Invest and 21Shares have partnered to launch a new suite of digital asset exchange-traded funds (ETFs). The suite comprises five ETF products that will be listed on the Chicago Board Options Exchange and are scheduled to begin trading the following week. The companies will use on-chain signals and their crypto-native expertise to provide long-term capital appreciation by investing in BTC and ETH futures contracts.

Hashdex

According to its website, the Hashdex Nasdaq Ethereum ETF (HETH.BH) is a fully physically backed ETF that seeks to track the investment results of the Nasdaq Ether Reference Price™ Index (NQETH™), a basket composed entirely of Ethereum. Moreover, it stated that the fund is listed on the Bermuda Stock Exchange and is only available to institutional investors.

Invesco and Galaxy

As per a report, Invesco and Galaxy Digital have filed for a spot Ethereum ETF with the US SEC on September 29, 2023. The Invesco Galaxy Ethereum ETF is noted to “reflect the performance of the spot price of ether” by storing units of the crypto with an unnamed custodian.

Grayscale

In addition to their BTC ETF, Grayscale also filed an application to convert Grayscale Ethereum Trust (ETHE) to a spot ETH ETF.

What are ETFs?

Exchange-traded funds (ETFs) are investment funds that are listed and traded on stock exchanges, just like individual stocks. ETFs are designed to track the performance of a specific market index, commodity, bond, or basket of assets.

In the web3 space, the current available crypto as an ETF is only Bitcoin following Grayscale’s successful appeal to the SEC to convert its Bitcoin Trust into an ETF.

This article is published on BitPinas: BlackRock’s Ethereum ETF Confirmed, Ether Surge in Price

Disclaimer:

- Before investing in any cryptocurrency, it is essential that you carry out your own due diligence and seek appropriate professional advice about your specific position before making any financial decisions.

- BitPinas provides content for informational purposes only and does not constitute investment advice. Your actions are solely your own responsibility. This website is not responsible for any losses you may incur, nor will it claim attribution for your gains.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://bitpinas.com/cryptocurrency/blackrock-ethereum-etf/