By Dale Chang

If you look around, it’s clear that waves of layoffs have been hitting the tech industry at companies large and small. And the impact hasn’t been isolated to the companies themselves. Venture capital firms have also been cutting back and raising smaller funds in an attempt to refocus their strategies, and in some cases failing to raise.

This pullback follows the longer-than-a decade run-up in venture capital as startup valuations ballooned and venture funds grew (both in size and in total number), and firms ramped-up hiring to deploy and manage the capital.

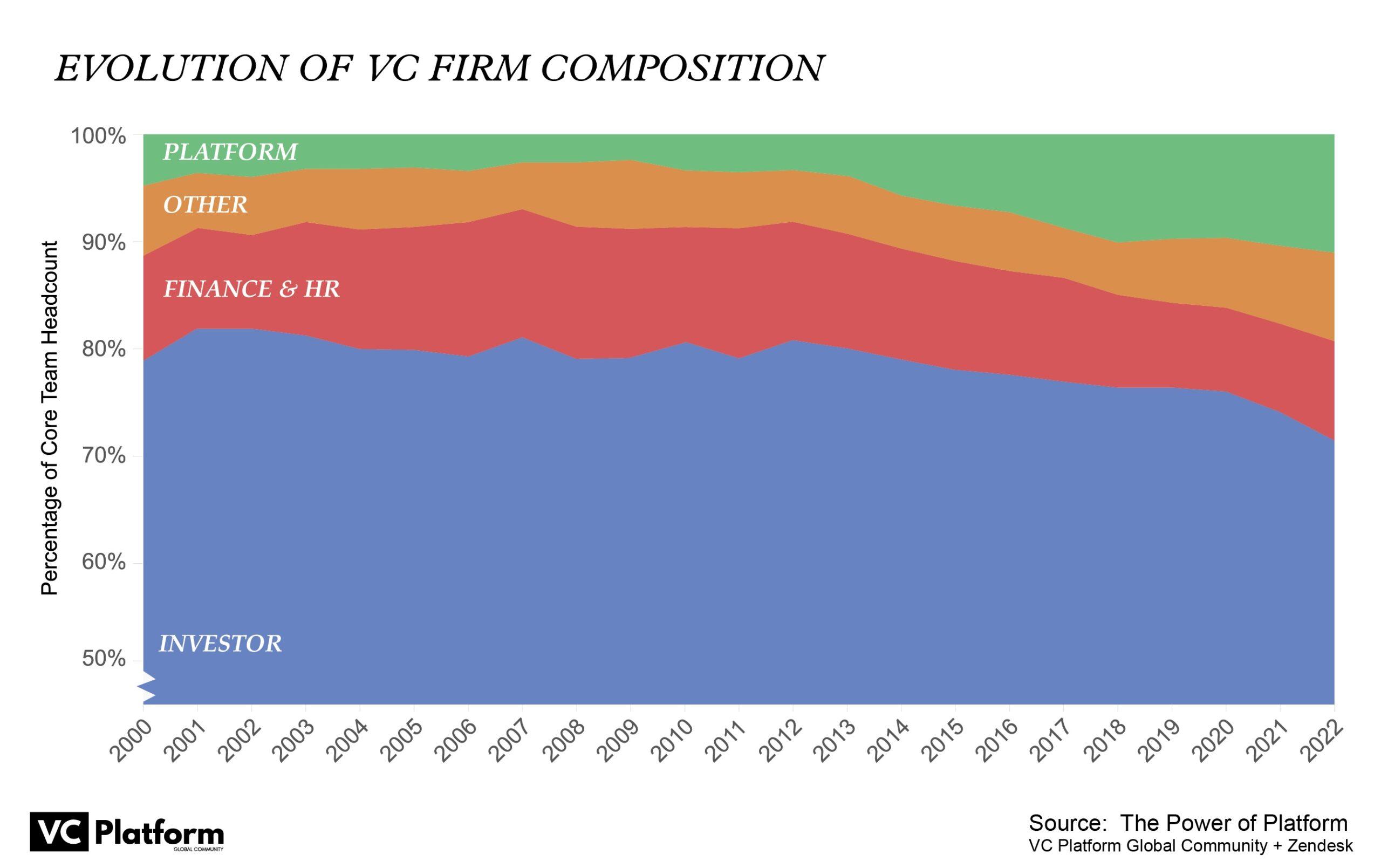

During this time of growth, the fastest-growing function within VCs was “platform,” defined as the collection of roles focused on specific non-investment functions, like community building, fund operations, marketing and business development.

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

Platform teams are designed to improve fund returns by getting access to better deals, winning those deals, and providing post-investment support to portfolio companies to increase their odds of success.

But the rapid cooling of what was a red hot venture market begs the question: Will venture firms follow the path of private equity firms — which have built well-established internal value creation capabilities that continue to be accretive despite market volatility — or will platform roles in venture firms not survive this downturn?

While the wheels may already be in motion for many of these funding allocations and downstream headcount decisions, a well-constructed platform team as part of a venture capital firm has a positive impact in both up and down markets.

Let’s start with some facts from the recently released study I co-led with Cory Bolotsky from the VC Platform Global Community, analyzing returns data from 850 venture capital firms over the past 20 years.

Platform roles appeared decades ago, but the concept didn’t gain significant traction until 2009 as the world was emerging from the Great Recession. At that time, Andreessen Horowitz sought to build out a new archetype of venture firm, one modeled after an agency blueprint with in-house specialists staffed to provide services to their portfolio of companies.

Since then, platform roles have become increasingly common in venture firms. In 2009, only 24% of venture firms had any platform headcount. Today, that number has more than doubled to 52% of firms with platform roles. In that same timeframe, employee composition of a firm shifted from less than 5% of total headcount represented by platform to more than 13%.

But what impact has firms doubling down on platform roles had on fund returns? Results of the study indicate a strong correlation between increased investment in platform teams and superior fund returns.

The correlation neither suggests that the relationship is causal nor does it imply that a fund must have a platform function to generate successful returns. But, it is interesting to note that funds that had significant platform teams outperformed those funds without platform teams by 1,100 basis points in Net IRR and 0.5x in TVPI over the most recent decade.

Investment in a platform function isn’t a checkbox. It should also be noted that not all platforms functions are created equally. The focus of the platform team must align with the investment strategy of the firm if it is to maximize value. The study took a look at where venture firms were placing their platform bets:

- The best performing small funds (less than $250 million in assets under management) that primarily focused on pre-investment related activities — marketing, community, investment operations — outperformed the pooled average by 450 bps in Net IRR and 0.5x in TVPI. Smaller funds that focused primarily on post-investment activities underperformed the pooled average.

- The best performing large funds ($500 million-plus in AUM) primarily focused on post-investment related activities — talent, business development/go-to-market, ESG — similar to their private equity counterparts. These funds outperformed the pooled average by 950 bps in Net IRR and 0.7x in TVPI. Larger funds that focused primarily on pre-investment activities tended to underperform the pooled average.

As my fellow platform leader, Dan Kozikowski of FirstMark, put it: “The question isn’t whether Platform works. It’s whether your Platform is working toward the right things.”

While there are certainly differences between this period of venture pullback and the dot-com crash, history can provide valuable lessons as to how to think about structuring teams for success.

If we look at venture returns from 2000 to 2009, the study indicates that while fund returns were depressed and below the long-term average for venture capital, firms that had a significant investment in their platform functions tended to outperform funds without platform teams by 430 bps in Net IRR and 0.1x in Net TVPI.

While this might not seem like much, the relative overperformance of these funds points to the fact that something they are doing — even in down cycles — is creating incremental value in their portfolio of companies.

There’s a chance that we’ll see continued cuts in the venture industry in the coming years and no doubt some of those impacted will be in platform roles. Firms that aren’t committed to a platform strategy will likely be the first to cut people in those roles when things get tough.

However, firms with thoughtfully designed platform functions will likely use this opportunity to further differentiate as they — and their investors — realize it can create real value for portfolio companies and investors in both up and down markets.

Dale Chang, also known as “Scale Dale,” is a VC Platform Global Community board member and operating partner at Scale Venture Partners, which invests in the next generation of enterprise software companies.

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

SoftBank’s Vision Fund unit — known for its investment in startups including Uber, WeWork and DoorDash — posted its first gain in six quarters as the…

Daybreak Health, a San Francisco-based provider of online mental health counseling for teens, has announced its Series B.

All funding stages — seed, early and late — in July 2023 were down close to a third compared to a year ago.

The summer can be slow for funding to startups — but not necessarily to unique ones. A handful of the deals that caught our eye in July includes a…

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://news.crunchbase.com/venture/vc-platform-teams-value-down-markets-chang-scale/