Hey Folks,

Happy weekend! I wanted to take this opportunity for some longer reading and pass along a report from Katusa Research I’ve been following about the uranium industry. I hear that yawn ?! But as a trader (and an economist), it’s always important to know what’s going on with natural resources, the government and companies that have a stake in the game!

So put your feet up and your reading glasses on ?, and take a deep dive into the fascinating world of uranium!

September 29, 2023: A Run on the Uranium Bank Has Begun

By Marin Katusa of Katusa Research

In 2016, a member of the California State Lands Commission began advancing an effort to shutter the last remaining nuclear power plant in the state: Diablo Canyon.

Diablo is the single-largest source of electricity in California, providing nearly 10% of its power.

Four years later, the man who led the charge against Diablo Canyon was leading the state–Governor Gavin Newsom.

And the political environment surrounding nuclear had, at that time, completely and irrevocably shifted.

Facing pressure from scientists, celebrity activists, and multiple former U.S. energy secretaries–as well as devastating power blackouts…

The governor quickly changed his stance.

In fact, Governor Newsom has now become a vocal advocate for Diablo Canyon.

He has introduced legislation to keep it operating.

And he plans to get part of the $6 billion in federal funding available to ensure it does.

The cosmic shift in California is reverberating across the U.S.–and the entire world.

Which is why thirty countries are considering starting a new nuclear energy program.

Consequently, a nuclear renaissance is unfolding globally:

-

Canada is set to construct the world’s largest nuclear plant.

-

Sweden aims for 100% nuclear energy with 10 new reactors.

-

Japan is reviving its nuclear program post-Fukushima.

-

Other nations, including India, France, the UK, and Russia, have ambitious nuclear expansion plans.

India is planning 9 new reactors, France up to 14, the UK 24, and Russia 29.

The list goes on.

Today, more nuclear reactors are being built than any year since 1992.

All of that has increased demand for uranium, but it’s also accidentally created something much bigger.

A Source of Demand That NEVER EXISTED Before

It’s one that’s going to completely change how the uranium market works.

The prospect of unquenchable global thirst for uranium has invited speculators into the uranium market.

A handful of them are intent on taking every pound of available uranium off the market in order to force a long squeeze–and make a huge profit in the process.

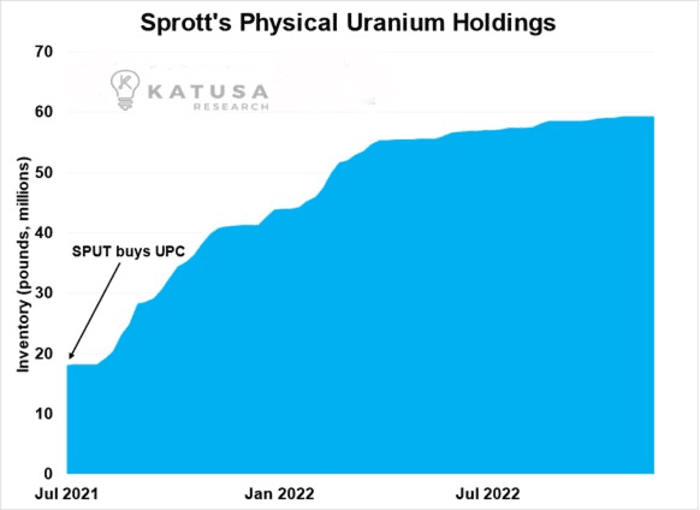

One of those speculators is Sprott, Inc., which in July 2021 bought a physical uranium holding company and rebranded it as “SPUT“: the Sprott Physical Uranium Trust.

SPUT immediately went on a buying spree, mopping up existing uranium inventory.

In fact, it bought more uranium than the original company had bought in 16 years… in just 4 months.

Total pounds of uranium the Sprott Uranium Trust holds to date is 61,845,847 pounds of uranium.

But here’s the real kicker, SPUT’s rules force it to buy uranium at spot prices every time its stock trades at a premium to net asset value (NAV).

Every time SPUT goes above NAV, the intent is that the trust buys more uranium at spot pricing.

-

That sucks up supply, which moves the price of uranium higher.

-

That brings in more investors, and SPUT buys more uranium.

But that intent changed on September 5th, 2023.

Something that has never happened, ever, in the spot uranium market has happened since September 5th, 2023.

On September 5th, 2023 Sprott Uranium Trust (SPUT) filed to raise $125 million.

SPUT is now sitting on just under USD$68 million cash and bought ZERO pounds of uranium since their announcement on September 5th, 2023 up until Thursday, September 21.

SPUT was only able to secure 100,000 pounds on Friday, September 22nd, and nothing since.

SPUT is sitting on enough cash to purchase almost 1 million pounds.

Prior to September 5th, 2023, SPUT has purchased 2,576,857 pounds of uranium.

With $68 million in cash, SPUT has purchased only 100,000 pounds of uranium, but the whole point of raising cash since September 5th was to buy more uranium.

The price of uranium during that time has literally moved from $61.25/lb the night before SPUT announced their funding to $72/lb as of close Thursday, Sept 28th.

The spot price of uranium has increased over 15% in less than 30 days without a single pound purchased by SPUT from the spot market.

America’s Secret Energy Grid

Hidden across 28 states is a secret energy grid that could soon penetrate every town and city in America – potentially unleashing $1 trillion in new wealth.

But wait there’s more…

There is a new fund that will raise $500 million dollars and has already closed their first tranche of $125 million from their cornerstone investor that intends on competing with SPUT to buy uranium in the spot market.

But for utilities, it’s not necessarily the price that’s important.

It’s the mere availability of uranium, especially if companies like SPUT keep taking it off the market.

Because SPUT’s current structure does not allow these pounds to be sold. In other words, once they’re bought, they’re permanently (in theory) erased from supply.

For countries with nuclear power, that’s a massive problem.

The Hair-Trigger Metal

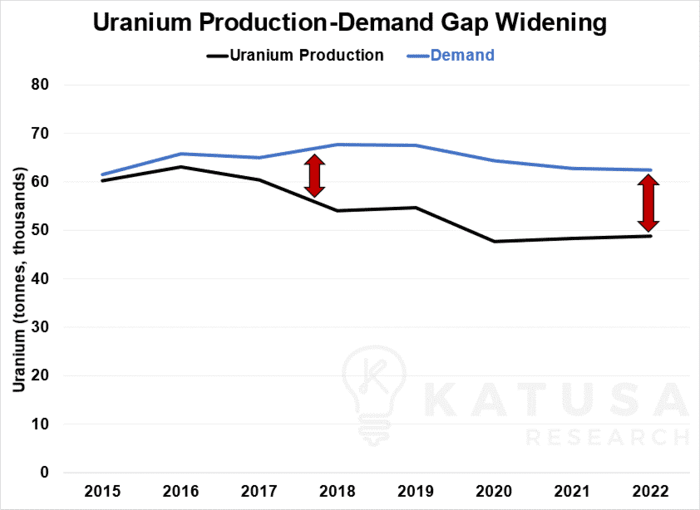

The gap between the amount of uranium miners produce and what reactors need continues to widen rapidly:

In 2022, coverage hit another record low. Only 74% of uranium demand was actually produced.

That’s 150% of yearly demand, and it’s growing larger faster every year.

And now SPUT (and other investors) will be taking uranium off the market, making it unavailable for use. For years, “secondary supply” has been used as a stopgap measure.

The secondary supply is miscellaneous uranium inventory held by utilities, fuel cycle companies, and governments.

But as the gap has widened, secondary supply has dropped precipitously. It’s down to 10,000 tonnes a year–enough to cover about 60% of the current gap.

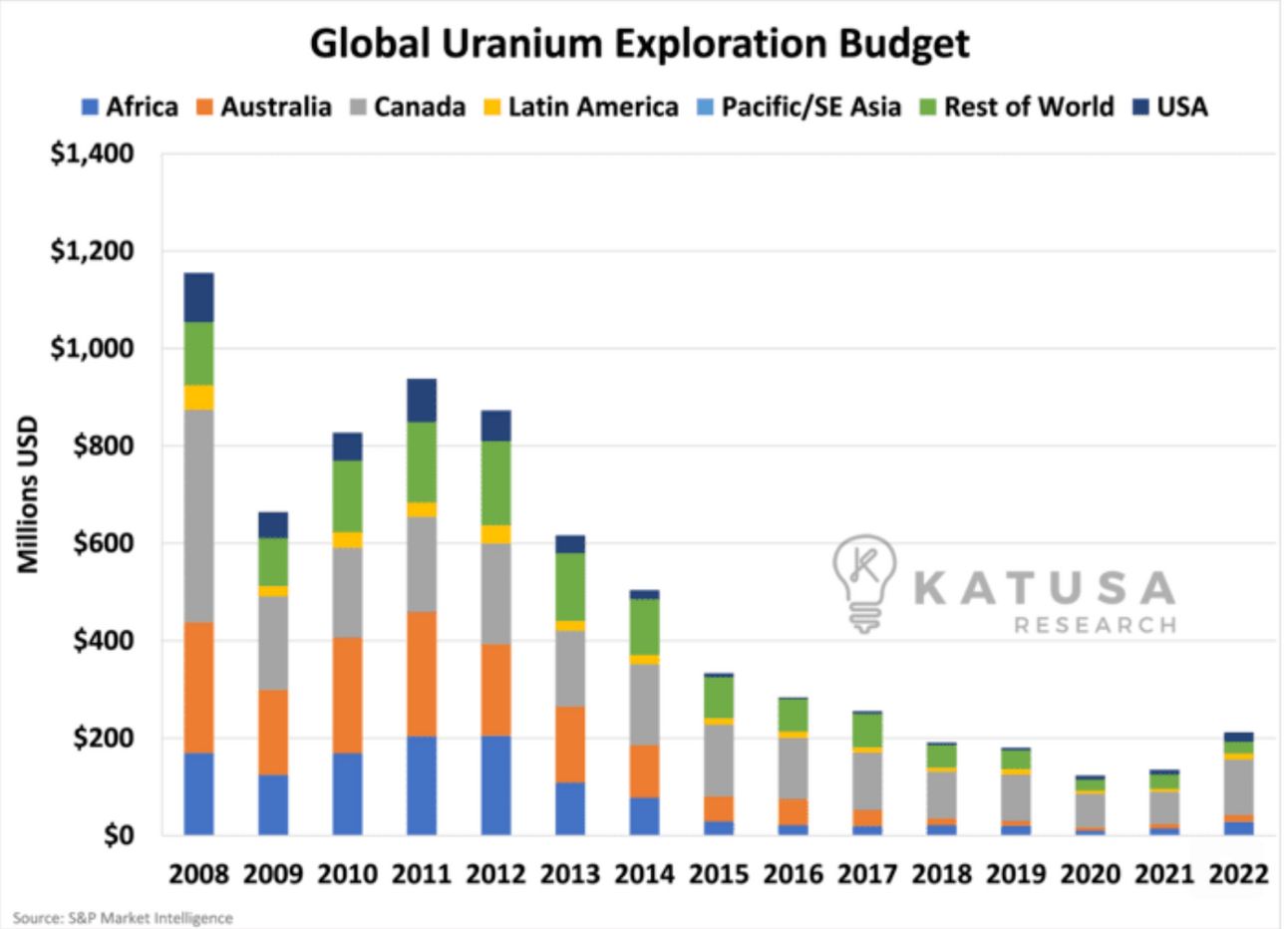

And miners have stopped investing in finding new uranium altogether. Exploration expenditures plummeted more than 80% from 2011-2021.

By 2030, low investment in new mines is projected to cut uranium supply in half.

Meanwhile, the World Nuclear Association is predicting nearly a 100% increase in uranium demand by 2040.

Even more shocking is the World Nuclear Association does not include a single pound in their projections from small modular reactors (SMRs) demand.

Why doesn’t the WNA include a single pound of demand from the future demand from SMRs in their demand projections?

Because not a single independent SMR developer is part of the WNA (paying member) so the brain trust at the WNA doesn’t recognize the SMR future demand. SMR demand is real and expect the independent SMR developers to do to the WNA nuclear developers what Tesla did to the traditional car manufacturers: kick their asses.

In short, while nuclear is taking off, the uranium market could set itself up for a severe, decades-long deficit.

A Run on the Uranium Bank HAS BEGUN

Now, with no new major mines coming online within the next 24 months…

Secondary supply drying up…

Hardcore production discipline by miners…

investors like SPUT grabbing new uranium off the market…

and SMRs going unnoticed in the nuclear sector by associations like the WNA…

Utilities are suddenly facing unprecedented uncertainty about future supply.

And if there’s one thing a nuclear plant operator doesn’t want to hear, it’s that there’s no uranium available. There are no substitutes for uranium.

Every nuclear plant owner, operator, and developer in the world is beginning to realize that they need to buy uranium before there’s none to buy.

“We’re in inning two–and no more than that… and now we have a bit of a crisis setting in.” – SVP of Cameco

That transforms this from a security-of-supply issue into a major energy security issue.

The last country to try to procure uranium might get caught without their largest source of power.

So the biggest nuclear powers in the world–France, the U.S., Russia, and China–are taking ruthless steps to ensure uranium access for their nuclear fleets.

Whoever can provide that access stands to become very, very wealthy.

In less than 72 hours you’re going to find out one of the best ways to play it.

Marin Katusa and the Special Situations Team

Katusa Research Disclosures

Copyright (C) 2023, Katusa Research, All rights reserved.

Details and Disclosures

Investing can have large potential rewards, but it can also have large potential risks. You must be aware of the risks and be willing to accept them in order to invest in financial instruments, including stocks, options, and futures. Katusa Research makes every best effort in adhering to publishing exemptions and securities laws.

By reading this, you agree to all of the following: You understand this to be an expression of opinions and NOT professional advice. You are solely responsible for the use of any content and hold Katusa Research, and all partners, members, and affiliates harmless in any event or claim.

If you purchase anything through a link in this email, you should assume that we have an affiliate relationship with the company providing the product or service that you purchase, and that we will be paid in some way. We recommend that you do your own independent research before purchasing anything.

Questions or concerns about our products? Email [email protected] (C) Copyright 2022, RagingBull

RAGINGBULL DISCLAIMERS To more fully understand any Ragingbull.com, LLC (“RagingBull”) subscription, website, application or other service (“Services”), please review our full disclaimer located at https://ragingbull.com/disclaimer

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. Any RagingBull Service offered is for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation, or be relied upon as personalized investment advice. RagingBull strongly recommends you consult a licensed or registered professional before making any investment decision.

RESULTS PRESENTED NOT TYPICAL OR VERIFIED. RagingBull Services may contain information regarding the historical trading performance of RagingBull owners or employees, and/or testimonials of non-employees depicting profitability that are believed to be true based on the representations of the persons voluntarily providing the testimonial. However, subscribers’ trading results have NOT been tracked or verified and past performance is not necessarily indicative of future results, and the results presented in this communication are NOT TYPICAL. Actual results will vary widely given a variety of factors such as experience, skill, risk mitigation practices, market dynamics and the amount of capital deployed. Investing in securities is speculative and carries a high degree of risk; you may lose some, all, or possibly more than your original investment.

RAGINGBULL IS NOT AN INVESTMENT ADVISOR OR REGISTERED BROKER. Neither RagingBull nor any of its owners or employees is registered as a securities broker-dealer, broker, investment advisor (IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization. Employees, owners, and other service providers of https:// ragingbull.com or RagingBull.com LLC are paid in whole or in part by commission based on their sales of Services to subscribers.

RagingBull.com, LLC shall be entitled to recover attorneys’ fees, costs and disbursements. In the event that any suit or action is instituted as a result of doing business with RagingBull.com, LLC and/or its affiliates or if any suit or action is necessary to enforce or interpret these Terms of Service, RagingBull.com, LLC shall be entitled to recover attorneys’ fees, costs and disbursements in addition to any other relief to which it may be entitled.

WE MAY HOLD SECURITIES DISCUSSED. RagingBull has not been paid directly or indirectly by the issuer of any security mentioned in the Services except possibly by advertisers in this email. However, Ragingbull.com, LLC, its owners, and its employees may purchase, sell, or hold long or short positions in securities of the companies mentioned in this communication.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://ragingbull.com/editorial/why-i-care-about-a-run-on-the-uranium-bank/