When making investments, understanding valuations has become increasingly important for private market investors in recent years. In the face of bloated valuations being corrected with time, the intricacies of startup valuations and valuation methods paired with an understanding of valuation trends can help investors make informed investment decisions.

Calculating a valuation is the process of determining the economic value of a company, and in the context of startups, it can play a pivotal role when making investment decisions. A startup’s valuation may impact the potential growth on an investment and the risk associated with the investment.

Recent Inflated Valuations

The recent years witnessed a surge in startup valuations, partly fueled by the unprecedented influx of capital into the venture capital and private equity markets. The COVID-19 pandemic, while causing economic disruptions, also led to a surge in digital transformation and innovation, driving investor interest in technology and disruptive business models. As a result, many startups experienced inflated valuations, often driven by market hype and FOMO (fear of missing out)[1].

For example, Stripe’s valuation increased to $95B after a funding round in March 2021[2]. Two years later, Stripe cut its internal valuation nearly in half in March 2023, reporting $50B[3]. The COVID pandemic saw an increased amount of venture funding and increased valuations, and once the market corrected, venture funding declined and valuations fell[4]. These market corrections from the bloated rounds that startups experienced in 2021 has caused complications in the valuation methods for startups[5].

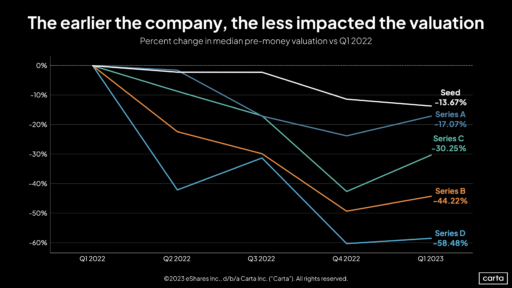

The chart below shows the valuation declines from Q1 2022 to Q1 2023 based on the funding stage of the company. Later stage companies were the most affected by valuations declines, while earlier stage companies still experienced decreases, however they were much less dramatic.

It’s important for investors to be cautious of inflated valuations and to conduct thorough due diligence to help ensure that the startup’s valuation aligns with its fundamentals, market potential, and competitive landscape. While a high valuation may seem appealing, it can also carry inflated expectations and increased risks.

Understanding Valuation Metrics

When evaluating a startup’s valuation, investors should consider using a range of valuation metrics to gain a comprehensive understanding of the company’s financial health and growth potential. Some of the generally accepted key valuation metrics include:

Revenue Multiple

This metric compares the company’s valuation to its annual revenue, providing insights into how the market values the company’s sales. A high revenue multiple may indicate strong growth potential but could also signal an inflated valuation.

EBITDA Multiple

The Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) multiple measures the company’s valuation relative to its EBITDA. It may offer perspective on the company’s operating profitability and cash flow generation.

Comparable Company Analysis (CCA)

CCA involves comparing the startup’s valuation to similar companies in the industry, taking into account factors such as growth rate, market share, and competitive positioning. This analysis can help investors gauge the relative valuation of the startup within its industry.

Discounted Cash Flow (DCF) Analysis

DCF analysis involves projecting the startup’s future cash flows and discounting them to their present value. This method could provide a fundamental valuation assessment based on the company’s expected future performance.

Navigating Inflated Valuations

In a market environment where valuations can be inflated, investors are advised to approach startup investments with a discerning eye. Conducting thorough due diligence, leveraging valuation metrics, and seeking expert guidance can help investors navigate the complexities of inflated valuations.

Additionally, engaging with experienced venture capital firms and angel investors can provide valuable insights into the startup’s valuation and growth prospects. Collaborating with seasoned professionals who have a keen understanding of startup valuations can help you research your opportunities.

The Role of Market Trends

Market trends and macroeconomic factors can significantly influence startup valuations. In the wake of the COVID-19 pandemic, certain sectors experienced accelerated growth, leading to heightened investor interest and subsequent valuation increases. Technology, healthcare, and e-commerce are among the sectors that witnessed notable valuation inflation as they responded to evolving consumer behaviors and market demands[6].

As we move toward the future, investors should remain attuned to market trends and industry dynamics, recognizing that the valuation landscape is dynamic and subject to shifts driven by changing market conditions.

Final Thoughts

Understanding valuations in the context of startup investments can be an intricate process that demands careful consideration of various factors. With the potential for inflated valuations post-2020/2021, investors may want to consider a diligent and informed approach to evaluating startups.

Ultimately, a well-informed understanding of valuations can help empower investors to make investment decisions and contribute to the growth of innovative and impactful startups.

Want to learn more about valuations and other impacts of COVID-19 on venture capital and private equity? Check out the following MicroVentures blogs to learn more:

Are you looking to invest in startups? Sign up for a MicroVentures account to start investing!

[1] https://ijebmr.com/uploads/pdf/archivepdf/2024/IJEBMR_1297.pdf

[2] https://techcrunch.com/2021/03/14/stripe-closes-600m-round-at-a-95b-valuation/

[3] https://www.reuters.com/technology/fintech-stripe-valued-50-bln-after-65-bln-fundraise-2023-03-15/

[4] https://pitchbook.com/news/articles/venture-fundraising-forecast-quant

[5] https://carta.com/blog/valuation-landscape-2023/

[6] https://www.morningstar.com/markets/these-sectors-performed-best-worst-pandemic

*****

The information presented here is for general informational purposes only and is not intended to be, nor should it be construed or used as, comprehensive offering documentation for any security, investment, tax or legal advice, a recommendation, or an offer to sell, or a solicitation of an offer to buy, an interest, directly or indirectly, in any company. Investing in both early-stage and later-stage companies carries a high degree of risk. A loss of an investor’s entire investment is possible, and no profit may be realized. Investors should be aware that these types of investments are illiquid and should anticipate holding until an exit occurs.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://microventures.com/whats-it-worth-navigating-inflated-startup-valuations?utm_source=rss&utm_medium=rss&utm_campaign=whats-it-worth-navigating-inflated-startup-valuations