AI Innovation | March 1, 2024

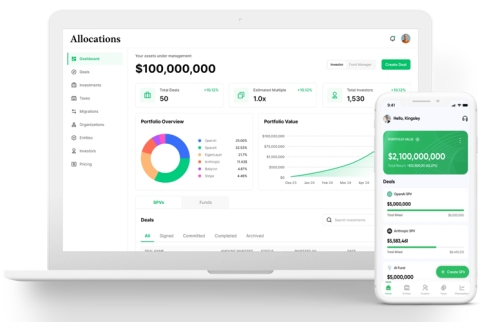

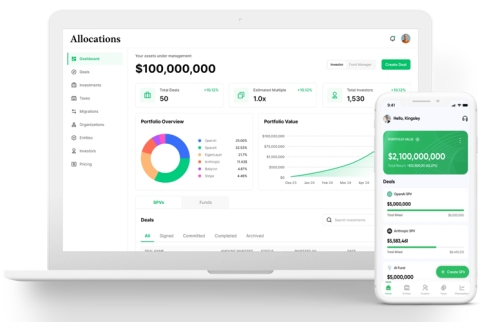

Image from Allocations website

Image from Allocations websiteStreamlining Investment Documents and Democratizing Deals with AI

Per VentureBeat’s briefing, Allocations, a pioneering fintech startup, has achieved a huge milestone by surpassing $2 billion in assets under administration, showcasing the burgeoning demand for alternative investments and the transformative power of artificial intelligence (AI) in the financial sector. Founded by Kingsley Advani, Allocations uses AI to streamline the process of private capital fundraising, making it faster, more efficient, and less costly. The platform’s AI capabilities enable the instant generation of customized legal documents necessary for fund launching, such as private placement memorandums and operating agreements, a task that traditionally consumed hours of legal work and significant financial resources.

- By employing machine learning models trained on over 100,000 investment documents, Allocations can generate legal paperwork in seconds, a stark contrast to the traditional, labor-intensive process. This efficiency allows each employee at Allocations to service up to 70 funds, dramatically outperforming the industry average.

See: Revolutionizing the Legal Function Through Legal Process Automation

- Allocations is not just about efficiency; it’s also about accessibility. The platform has facilitated investments in high-profile deals, including a $23 million investment in Leeds United and SPVs for SpaceX, OpenAI, and Anthropic. By automating the creation of legal entities and regulatory filings, Allocations lowers the barriers to entry for investing in alternative assets, enabling deals with minimum investments as low as $5,000.

- Allocations plans to launch a mobile app to cater to a generation that prefers managing finances via smartphones, aiming to power over $1 trillion in private market assets by 2030.

May Help

- By automating the generation of legal documents and facilitating the launch of funds with minimal effort, Allocations lowers the barrier to entry for smaller players. This democratization allows smaller asset managers and family offices to compete more effectively with larger institutions.

- The platform enables the creation of special purpose vehicles (SPVs) with lower minimum investments, making it feasible for angels and retail individuals to participate in deals that were previously out of reach due to high capital requirements. This opens up opportunities for a broader range of investors to engage in private equity, venture capital, and other alternative investments.

See: WealthTech in Asia-Pacific: A Trillion-Dollar Opportunity

- By facilitating easier access to capital through SPVs and other investment vehicles, Allocations can help startups and emerging companies find the funding they need more efficiently, potentially leading to a more vibrant and diverse innovation ecosystem.

Might Hurt

- The automation of tasks such as generating legal paperwork and performing compliance checks, which traditionally required significant manual effort and expertise, could reduce the demand for these services from traditional providers. This might lead to a shift in the market, where traditional roles such as fund administrators and law firms need to adapt to the new technology-driven landscape.

- While not directly hurt, large institutional investors might find the competitive landscape changing as smaller investors gain access to deals that were once exclusive to them. This could lead to increased competition for high-quality investment opportunities.

See: AI Metamorphosis in Venture Capital

- Individuals or entities that are slow to adopt new technologies or are skeptical of AI’s role in investment decision-making might find themselves at a disadvantage compared to those who embrace these innovations.

Conclusion

AI-driven efficiency and accessibility are breaking down traditional barriers. This evolution empowers a wider range of investors to participate in alternative assets and also fosters a more inclusive and dynamic financial ecosystem.

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, artificial intelligence, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada’s Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, artificial intelligence, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada’s Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

Related Posts

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://ncfacanada.org/wealthtech-startup-allocations-surpasses-2-billion-aua/