The majority of traders are in and out of this business prior to even understanding how to properly build a strategy. More importantly, they fail to understand what makes a trading strategy profitable.

It’s common for new traders to trade strategies with loose definitions or missing some of the main components that every trading strategy MUST HAVE.

Loose definitions lead to strategies that aren’t repeatable and red trading accounts.

In this post we will walk through the main components of a trading strategy and you will learn how to build and outline your strategies into a Playbook. This is the same process I teach my current students, and have used personally for two decades.

To get started, let’s look at what a trading strategy is and break down the four main components.

What is a trading strategy?

A Trading Strategy is a well defined edge that signals when there is a higher probability of one thing happening over another. Trading strategies can be broken down into four components: Context, Triggers (Patterns), Trade Management, & Risk Management.

Your trading strategy needs to be defined in a clear and precise manner or the strategy will not be repeatable. If a strategy is not repeatable… it’s not a strategy.

Let’s dig into the four different components that make up a trading strategy.

1. Context

Context: the circumstances that form the setting for an event, statement, or idea (in our case a trade idea), and in terms of which it can be fully understood and assessed.

A lot of traders consider a simple pattern, what I typically refer to as a trigger, along with some basic trade and risk management a complete trading strategy. An example of this would be simply taking every Bull Flag Pattern you see.

Thousands of patterns like these in the financial markets every single day. However, only when the proper context is applied to patterns, do they become profitable.

You can think of Context as the CEO of your trading strategy. It looks out above the trees and says, “we’re going that way”.

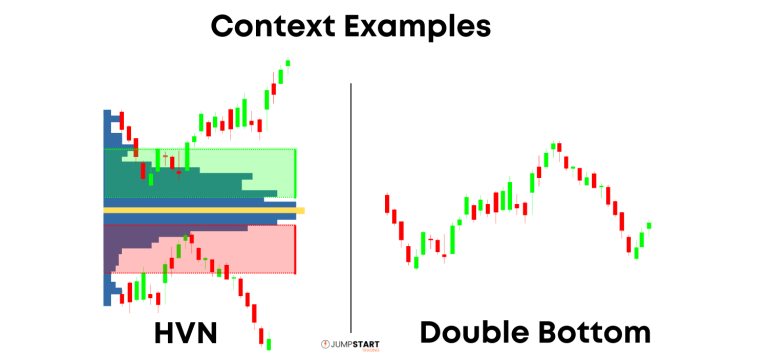

Above are two generic examples of context you may be familiar with already. On the left is a High Volume Node acting as support or resistance depending on location and the right a Double Bottom.

Learning to develop the proper context around your trades is critical if you want to become a profitable trader.

2. Triggers (Patterns)

Next, you need to define the triggers you will use to enter your positions. We apply context to triggers to analyze and find setups that meet the risk:reward parameters we have defined in our Playbook.

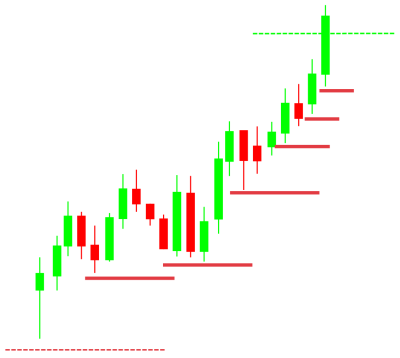

A basic example of a trigger is pin bar as seen below.

If we were building a very generic trading strategy, at this point our strategy would be to play pin bars (trigger) at retraces back to high volume nodes (context) or pin bars that form at a double bottom (context).

3. Trade Management

When new traders enter a position they tend to act like a deer in headlights. They freeze up and all logic gets thrown out the window.

It’s imperative you define in great detail a repeatable process to manage your trades. Make sure your trade management definitions reflect the goals of your trading strategy.

For example, if the goal of your strategy is to produce 3R trades or better, you’re going to employ a less aggressive strategy than someone who looking for a 1.5R minimum.

Far too often I see traders using way too much discretion when managing their positions, which leads to inconsistency.

4. Risk Management

The final piece of any trading strategy is risk management. Improper risk management is one of the primary reasons traders fail.

They start live trading with way too much leverage and blow up their account prior to ever truly understanding what they’re doing.

Your risk management plan doesn’t have to be complicated, but you must have one, and you must follow it.

It can vary depending on your trading style but for intra-day I recommend the following:

-1% max risk per trade

-3% max per day

-6% max per week

-15% max per month

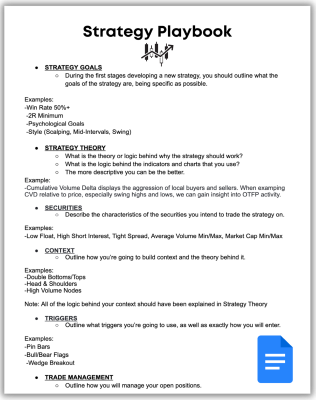

Whenever I’m developing a new trading strategy, I lay it out step by step in my strategy playbook. The rest of this post is going to teach you how to build a playbook step by step.

Developing Your Trading Playbook

Your playbook defines every component of your trading strategy step by step as well as the logic behind every component.

Your playbook will act as a living document that will help you improve your execution skills and progress as a trader.

A lot of the times OFP Members will ask me to review a particular trade setup. If I don’t have their playbook in front of me, it’s pretty much impossible to provide any advice.

You playbook outlines your context, triggers, trade management, risk management, goals, and strategy theory. You need precise definition of every step in order to build a repeatable process.

The following is the list of categories I recommend our students to have in their playbooks.

1. Strategy Goals

During the first stages developing a new strategy, you should outline what the goals of the strategy are, being specific as possible.

Examples:

-Win Rate 50%+

-2R Minimum

-Psychological Goals

-Style (Scalping, Mid-Intervals, Swing)

2. Strategy Theory

Next, you need to outline the theory behind why the strategy should work. Furthermore, you will explain the logic behind every indicator and tool you use in your trade analysis.

This will be where you spend the most time and the largest section of your playbook.

It’s very important that you understand the logic behind everything that you’re doing. If you can’t explain the logic behind an indicator or some other component of your strategy, you shouldn’t be using it.

Example:

Cumulative Volume Delta displays the aggression of local buyers and sellers. When examining CVD relative to price, especially at swing highs and lows, we can gain insight into Other Time Frame Participant activity.

3. Securities

Every security has it’s own characteristics in terms of volatility, how it tends to trade through key levels, spread, liquidity, and so on. Here’s where you will outline the characteristics of the securities you plan to trade the strategy on.

Examples:

-Low Float

-High Short Interest

-Tight Spread

-Average Volume Min & Max

-Market Cap Min & Max

4. Context

Next you’re going to outline the context you will use to find trade opportunities. Typically I just list the examples here as I like to explain the logic on everything in the Strategy Theory section.

Examples:

-Double Bottoms/Tops

-Head & Shoulders

-High Volume Nodes

5. Triggers

As mentioned earlier, we use triggers to evaluate the potential R of a setup in our pre-trade analysis and to enter the trade.

List out all of the triggers your strategy will deploy.

Examples:

-Pin Bars

-Bull/Bear Flags

-Wedge Breakout

6. Trade Management

Having a clearly defined Trade Management plan is essential to help improve your execution. Here you will clearly define how you will manage your positions step-by-step. DETAILS! DETAILS! DETAILS!

Examples:

-Trail Swing till 50% of Target 1 hit

-Exit on a extreme tick reading

-Stay in position as long as Delta is tracking

7. Sizing

When defining your sizing you should explain the different tiers you will use based on the setup, volatility, time of day, etc.

If you scale into positions or trade around a core, here’s where you would define how you do it.

Examples:

-Midday reduce risk by 50%

-Trading Around a Core Position: Exit 50% of core at Target 1. Add to position at tick extremes.

8. Tracking

In order to progress as a trader you have to track everything. Here’s where I define the acronyms I will use to track the Context, Trigger, Trade Management, and Risk Management techniques that were used on a given trade.

Examples:

P = Pin Bar (Trigger)

DB = Double Bottom (Context)

DT = Double Top (Context)

TC = Trail Candles (Trade Management)

1/2 = Half standard tier size

9. Questions

As you spend more time learning and trading a strategy, you’re going to find times where you’re unsure what you should do.

First and foremost, do what is most logical which is usually to pass on the trade or exit your position.

Take a screenshot and track in your playbook. After the session or maybe the week is over, do some testing to determine the action you will take next time.

Example:

-I took a short in a retrace off lows of day and got run over. There was a tick extreme at lows of day. Wonder if this isn’t a sign of capitulation?

10. Ideas

This is a great place to map out future things you want to test.

Examples:

-I feel I’m missing out on a large portion of moves. May want to look at last couple weeks of trade and see how I would have performed with a runner trailing just swings.

-Getting stopped out a lot using a fixed stop, may want to try trailing the most recent swing.

That covers all of the categories that I personally use in my playbook. Now it’s time for you to get to work. Want a template to get you started?

Free Playbook Template

I created a template with the categories and examples covered in this post to get you started. If you would like the template some other cool trading tools become a JT Insider. It’s free.

Final Thoughts

You should now have a clear understanding of what a trading strategy is and how to build a playbook to clearly define your strategies.

There’s no formal outline for a playbook, so get creative and include anything that you believe will help improve your definitions and ultimately your execution.

Ultimately your Playbooks are part of your overall Trade Plan. If you haven’t created your Trade Plan yet, here’s a guide and template for you.

If you have anything I didn’t mention that you like to include in your playbook or have a question, drop a comment below!

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.jumpstarttrading.com/trading-strategy/