The market turned strong again after two-day losses for consolidation, and jumped to new highs on July 6, backed majorly by foreign institutional investors’ support. Buying interest was seen in auto, oil & gas, select banks, metal, and pharma stocks.

The BSE Sensex hit a new all-time high of 65,833 and ended with 340 points gains at 65,786, while the Nifty50 finally hit 19,500 mark intraday for the first time, rising 99 points to end at record closing high of 19,497, and formed bullish candlestick pattern on the daily charts.

“A long bull candle formation signals that the market is in a sharp up trended move and there is a lack of selling interest at the new highs. This could be considered as an uptrend continuation pattern,” Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

Nifty reached the initial upside trajectory of 19,500 levels, which is 1.236 percent Fibonacci projection of weekly latest bottom-top-bottom swings. Hence, a sustainable move above this hurdle could pull Nifty towards another resistance of this projection at 19,800 levels -1.382 percent projection in the coming weeks, he feels. The immediate support is at 19,400 levels.

The broader markets rallied for yet another session, backed by positive breadth. The Nifty Midcap 100 index climbed 1 percent and Smallcap 100 index gained 0.8 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data and not just the current month.

Key support, resistance levels on Nifty

The pivot point calculator suggests that the Nifty may get support at 19,408, followed by 19,375 and 19,322, whereas in the case of an upside, 19,514 can be a key resistance area for the index, followed by 19,547 and 19,600.

The Bank Nifty also closed in a positive terrain after consolidation and rangebound trade, rising 188 points to 45,340 and formed bullish candlestick pattern on the daily charts. The index sustained above 45,000 mark, hence the same can be considered as a support in near term.

“The Bank Nifty index has shown a resilient performance as the bulls managed to hold the support level of 45000, which is considered a crucial make-or-break level for the index,” Kunal Shah, senior technical & derivative analyst at LKP Securities said.

The bears have been active around the 45,500 level. However, if the index successfully surpasses this level on a closing basis, it is likely to witness further upward movement toward the 46,000 levels, he feels.

Given the overall bullish undertone, it is advisable to adopt a buy-on-dip approach as long as the mentioned support level of 45,000 is held, Kunal said.

The pivot point calculator indicated that the Bank Nifty is likely to take support at 45,123, followed by 45,035 and 44,892, whereas 45,410 can be the initial resistance zone for the index, followed by 45,498 and 45,642.

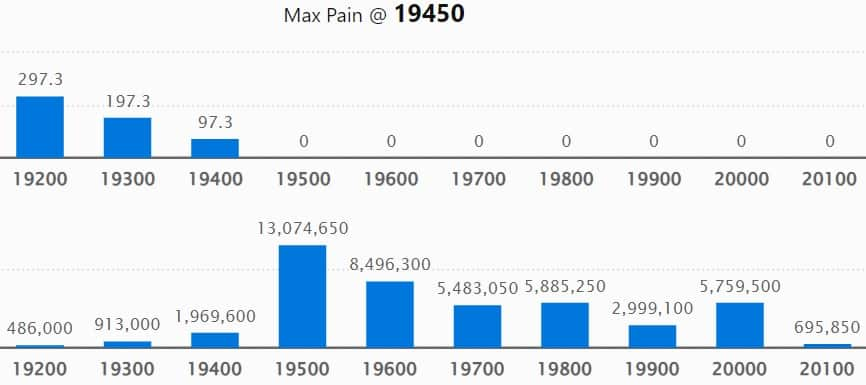

The maximum weekly Call open interest (OI) remained at 19,500 strike, with 1.3 crore contracts, which can act as a crucial resistance area for the Nifty50 in coming sessions.

This was followed by 84.96 lakh contracts at 19,600 strike, while 19,800 strike has 58.85 lakh contracts.

We have seen the meaningful Call writing at 20,300 strike, which added 13.49 lakh contracts, followed by 20,400 strike and 20,100 strike, which added 5.41 lakh and 2.54 lakh contracts, respectively.

Maximum Call unwinding was at 19,400 strike, which shed 94.59 lakh contracts, followed by 19,300 and 19,700 strikes, which shed 20.31 lakh and 10 lakh contracts, respectively.

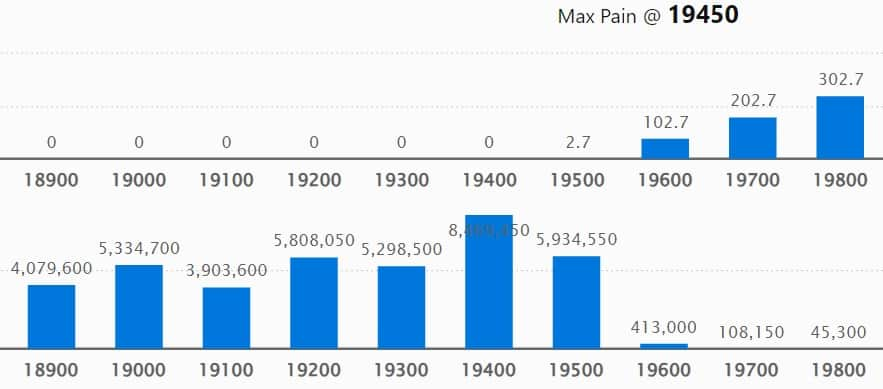

On the Put side, the maximum open interest was at 19,400 strike, with 84.69 lakh contracts, which can be a support level for the Nifty50 in the coming sessions.

This was followed by the 19,500 strike, comprising 59.34 lakh contracts, and the 19,200 strike, which has 58.08 lakh contracts.

Put writing was seen at 19,500 strike, which added 43.37 lakh contracts, followed by 18,400 strike and 19,600 strike, which added 6 lakh contracts and 1.33 lakh contracts, respectively.

We have seen Put unwinding at 19,300 strike, which shed 73.21 lakh contracts, followed by 19,000 and 19,200 strikes, which shed 54.85 lakh contracts and 33.5 lakh contracts, respectively.

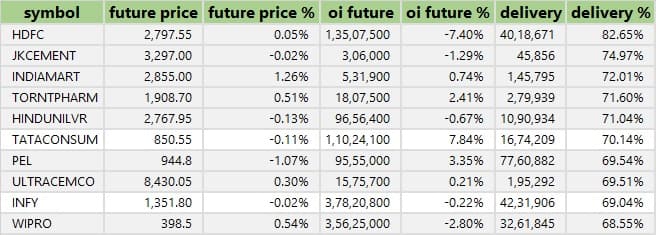

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. We have seen the highest delivery in HDFC, JK Cement, IndiaMART InterMESH, Torrent Pharma, and Hindustan Unilever among others.

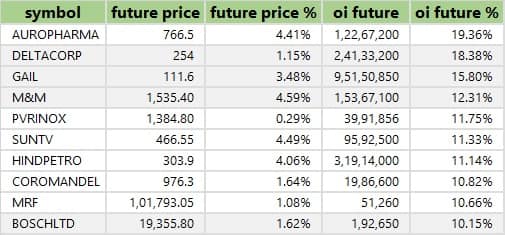

We have seen a long build-up in 80 stocks including Aurobindo Pharma, Delta Corp, GAIL India, Mahindra and Mahindra, and PVRInox, based on the open interest (OI) percentage. An increase in open interest and price indicates a build-up of long positions.

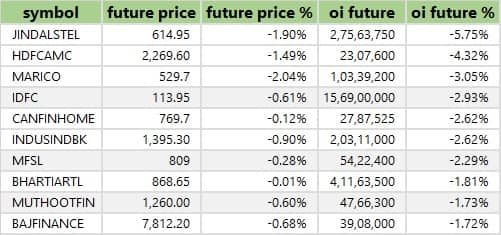

Based on the OI percentage, 25 stocks including Jindal Steel & Power, HDFC AMC, Marico, IDFC, and Can Fin Homes saw a long unwinding. A decline in OI and price generally indicates a long unwinding.

26 stocks see a short build-up

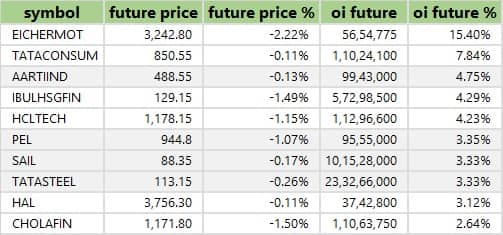

We have seen a short build-up in 26 stocks including Eicher Motors, Tata Consumer Products, Aarti Industries, Indiabulls Housing Finance, and HCL Technologies, based on the OI percentage. An increase in OI along with a price decrease indicates a build-up of short positions.

Based on the OI percentage, 58 stocks were on the short-covering list. These included Intellect Design Arena, HDFC, Hero MotoCorp, Coal India, and Bandhan Bank. A decrease in OI along with a price increase is an indication of short-covering.

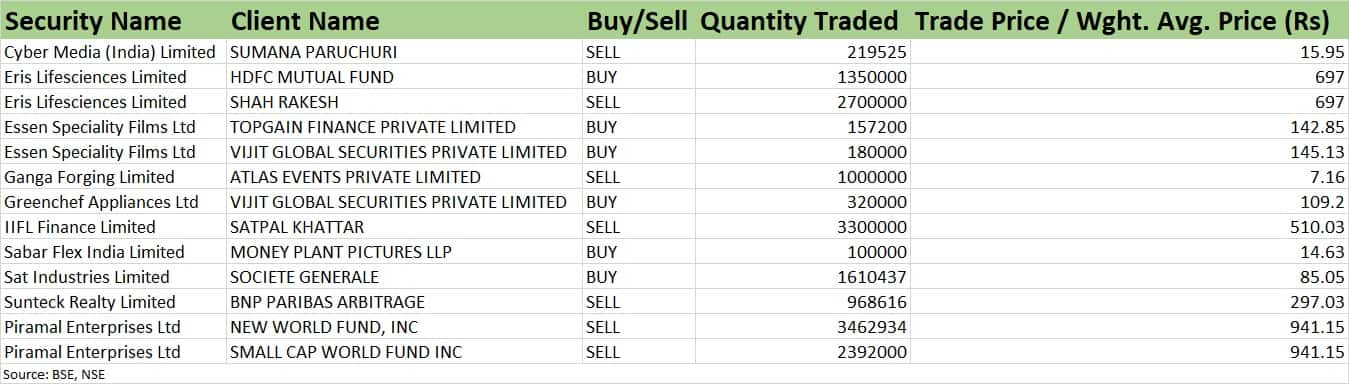

Piramal Enterprises: Foreign portfolio investors New World Fund Inc and Small Cap World Fund Inc exited the company by selling entire 34.62 lakh equity shares and 23.92 lakh shares, respectively, at an average price of Rs 941.15 per share. The stake sale amounted to Rs 551.03 crore.

Eris Lifesciences: HDFC Mutual Fund bought 13.5 lakh equity shares or 0.99 percent stake in the pharma company via open market transactions at an average price of Rs 697 per share, which amounted to Rs 94.09 crore. However, Shah Rakesh sold 27 lakh shares at same price, amounting to Rs 188.19 crore.

Sat Industries: Europe-based financial services group Societe Generale bought 16.1 lakh shares or 1.42 percent stake in the company at an average price of Rs 85.05 per share.

(For more bulk deals, click here)

Investors Meetings on July 7

Krsnaa Diagnostics: Officials of the company will meet I Wealth Management LLP.

Balkrishna Industries: Company’s officials will interact with investors and analysts.

Stocks in the news

Ideaforge Technology: The drone manufacturing company will make debut on the bourses on July 7. The issue price has been fixed at Rs 672 per share.

Sobha: The south-based real estate developer recorded a 27.9 percent year-on-year growth in total sales at Rs 1,465 crore for quarter ended June FY24, which is the highest ever quarterly sales value, while sales volume increased by 2.6 percent YoY to 1.39 million square feet. Price realisation for the quarter surged 24.6 percent to Rs 10,506 per square feet compared to same period last year.

Titan Company: The jewellery-to-watch maker registered a 20 percent year-on-year growth in revenue for June FY24 quarter, with all key consumer businesses exhibiting double-digit growth in the quarter. A total of 68 stores were added (including CaratLane) during the quarter taking Titan’s retail presence to 2,778 stores.

Dabur India: The FMCG major’s consolidated business including recently acquired Badshah Masala, is expected to register growth exceeding 10 percent for the quarter YoY. The international business is expected to report a strong performance with double-digit growth in constant currency as softening of inflation in international markets is having a positive impact on the business. India business is expected to post growth in high single digit.

JK Cement: Subsidiary JK Maxx Paints has acquired 20 percent stake, as a second tranche, in Acro Paints for Rs 60.24 crore. Consequently, JK Maxx Paints has acquired total 80 percent stake in Acro Paints, the paint & construction chemicals manufacturer, with immediate effect.

Capacite Infraprojects: The construction engineering company has raised Rs 96.3 crore as its board members approved an allotment of 56.65 lakh equity shares at an issue price of Rs 170 per share on preferential basis to 17 non-promoters including Param Value Investments, Vikas Vijaykumar Khemani, Capri Global Holding, and Value Prolific Consulting.

Indian Hotels: India’s largest hospitality company has expanded its portfolio to 270 hotels, with signing agreements for 11 hotels and opening 5 new hotels across destinations. With the current portfolio of 270 hotels, the company remains well poised to achieve its vision of over 325 hotels by 2025.

Fund Flow

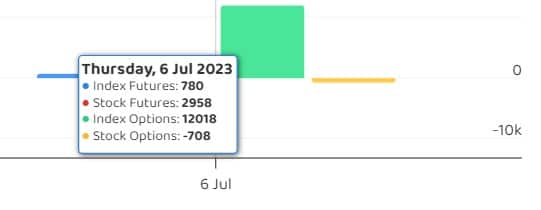

Foreign institutional investors (FII) bought shares worth Rs 2,641.05 crore, whereas domestic institutional investors (DII) sold shares worth Rs 2,351.66 crore on July 6, provisional data from the National Stock Exchange shows.

Stock under F&O ban on NSE

The National Stock Exchange has added BHEL and Delta Corp to its F&O ban list for July 7. Securities thus banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.moneycontrol.com/news/market-edge/trade-setup-for-friday-top-15-things-to-know-beforeopening-bell_17104751.html