This article was originally published by Emile Phaneuf on Dassetx.com

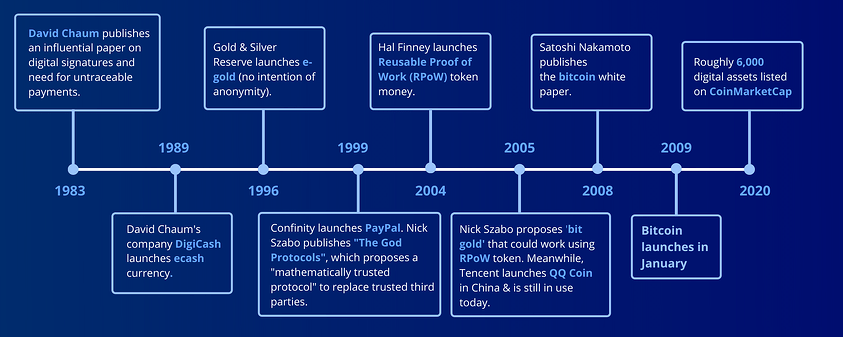

Satoshi Nakamoto remains an obscure character. Although little is known of his influences and motivations for creating bitcoin, this article explores his technological influences (see this for its philosophical and economic influences). What follows is a historical timeline of the various privately issued digital currencies before bitcoin’s 2008 white paper and its official launch in 2009 — all of which are likely to have influenced Nakamoto in some way (some definitely did).

Note that this article ignores the possibility that two of Nakamoto’s influences (Nick Szabo and Hal Finney) have both independently been suspected as being the individual(s) behind the Satoshi Nakamoto pseudonym. This article does not attempt to repeat the exhaustive hunt to find Nakamoto’s true identity.

Let us begin chronologically…

Ecash:

In 1983, cryptographer David Chaum published a research paper detailing how a digital cash system could work using blind signatures for untraceable payments. Chaum described these blind signatures as a “fundamentally new kind of cryptography” and proposed to make payments untraceable by preventing third parties from seeing transaction times or amounts, which he was concerned could “reveal a great deal about the individual’s whereabouts, associations and lifestyle.”

Chaum’s idea ultimately reached the light of day in 1989 in the form of an electronic currency offered by a company called DigiCash. DigiCash’s cryptocurrency “ecash” worked with software that ran on a user’s own computer, yet still worked with traditional banks “under the hood”. Through ecash, Chaum sought to achieve the untraceability that he had dreamed up in the early 1980s. But DigiCash eventually failed in 1998 and was sold. Chaum credited the failure of the company to having launched prematurely before the widespread development of electronic commerce.

In bitcoin’s white paper, Nakamoto noted that digital signatures (which David Chaum had previously proposed) “provide part of the solution” but proposed a way to handle payments peer-to-peer instead of trusting a third party. Yet the digital signatures that Nakamoto proposed to use were not the same as Chaum’s “blind signatures,” which could have been used to hide transaction times or amounts. In fact, Nakamoto’s bitcoin would be only pseudoanonymous. Transaction times and amounts would be visible to anyone knowing the wallet address, via a blockchain explorer such as blockchain.com.

E-gold:

In 1996, a company named Gold & Silver Reserve (G&SR) was founded that allowed users to create an account with a currency called “e-gold” backed with gold under the custodial supervision of G&SR. Although backed by a tangible asset (one thing that e-gold may have had going for it over bitcoin, if we ignore counterparty risk), e-gold’s model relied on a trusted third party (G&SR) — something that bitcoin does not do. Further, the e-gold model never attempted to achieve the untraceability that Chaum had previously sought after with ecash as G&SR’s own blog claimed that “Every transaction has a permanent record that includes not only typical identifying data, but transactional data that is traceable in its own right. Each account and all their transactions — the entire web of connections — is permanently traceable so ultimate identification is absolute. E-gold is not at all anonymous — never was and never will be.” In the end, G&SR faced trouble with the U.S. government, which accused e-gold of being used for illegal activities by its users. The judge went for a lenient sentence, arguing that any illegal activity was unintentional. As of the time of this writing, the company and its owners appear to continue their legal battles.

PayPal:

In 1999, PayPal arrived on the scene, launched by Confinity. PayPal initially began with the idea of transferring fiat money electronically using Palm Pilot with infrared technology. But the idea of being able to send money to an email address was the thing that eventually caught on and would ensure PayPal’s success. Interestingly, in the early days of bitcoin, IP addresses running full nodes were associated with wallet addresses, meaning that users could send bitcoin to IP addresses. (Or, more accurately, the user’s software would communicate with the software of the receiving party’s IP address, which would reveal a wallet address to which the bitcoin would be sent.) Although it is a bit speculative, there is a possibility that this early bitcoin feature could have been inspired by PayPal.

Although PayPal operates behind the scenes working with the traditional banking system (and indeed essentially became a bank when it merged with Elon Musk’s X.com online bank), to a certain extent, there appears to be a common vision between PayPal’s co-founder Peter Thiel and Satoshi Nakamoto. Thiel continues to make statements expressing admiration for bitcoin.

Nick Szabo’s “God Protocols” and “bit gold”:

In 1999, Nick Szabo published an article called “The God Protocols” in which he described problems with using traditional trusted third parties to settle and record transaction details. Instead, he pitched an alternative which he called “Mathematically Trustworthy Protocol,” — essentially a way to establish trust even between untrusting parties. Although the God Protocols concept was not a currency, it was a way of thinking that could be applied to designing currencies. Szabo’s article also mentioned running “a spreadsheet across the Internet,” which, for those familiar with Bitcoin’s distributed ledger, is all too familiar.

In February 2009 (one month after Bitcoin’s launch), Nakamoto introduced bitcoin in a web forum. Instead of using Szabo’s terminology “Mathematically Trustworthy Protocol,” Nakamoto used “cryptographic proof.” Instead of using Szabo’s “spreadsheet [that runs] across the Internet,” Nakamoto referred to bitcoin as “completely decentralized, with no central server or trusted parties.”

In 2005, Szabo published a blog post in which he described an ideal cryptocurrency, called “bit gold,” which worked with a proof-of-work (PoW) protocol. Szabo’s bit gold has been called a “direct precursor to the Bitcoin architecture” and (according to Szabo himself) was a variant of the computer scientist Hal Finney’s reusable proof-of-work (RPoW) token money.

Reusable Proof of Work (RPoW):

In 2004, cryptographer Hal Finney extended an invitation to subscribers of an email list to try his reusable proof-of-work (RPoW) token money. Proof-of-work (which bitcoin also uses) is a protocol used to deter certain types of undesirable behavior (such as denial of service attacks or spam) by requiring that a requesting computer demonstrate that “work” has been completed — using computing power. This is essentially what is done when bitcoin miners “mine” bitcoin. As Nakamoto himself explained in Bitcoin’s white paper in 2008: “The network timestamps transactions by hashing them into an ongoing chain of hash-based proof-of-work, forming a record that cannot be changed without redoing the proof-of-work.”

Note that Hal Finney was the first-ever recipient of a bitcoin transaction – 10 bitcoin from Nakamoto himself.

Liberty Reserve Dollars and Euros:

In 2006, yet another centralized digital currency model was founded — this time in Costa Rica. The service allowed users to buy Liberty Reserve Dollars or Liberty Reserve Euros with USD or EUR. The service had allowed users to register using only their names, emails, and date of birth. Liberty Reserve made money by charging a small transactions fee. The company remained in business until 2013 when it became the target of U.S. prosecutors, which used the Patriot Act to accuse the company, its owner, and key employees of money laundering.

QQ Coin:

In 2005, Tencent (the developer of WeChat in China) launched QQ Coin to allow users to purchase access to games and other online services. QQ Coins could be purchased at a rate pegged to the Chinese yuan currency. However, QQ Coin quickly became used to transfer value between individuals. This caught the attention of the People’s Bank of China, which claimed that the currency could be “used for money laundering or harbor other risks.” As of this writing, the digital currency remains in use.

Obviously, QQ Coin’s model is a centralized one — very different than the decentralized model of bitcoin. It is also unknown whether QQ Coin influenced Nakamoto in any way, but it is worth including here as it served as a proof-of-concept for a working, privately issued digital currency ahead of Bitcoin’s launch in January 2009.

Summary:

From the historical account detailed above, we know that Nakamoto was influenced in some way, even if indirectly, by David Chaum (digital signatures, emphasis on privacy), but bitcoin would be a peer-to-peer coin rather having to trust a third party or traditional banks in the way that Chaum’s ecash system had. E-gold may not have been a particularly large influence; in fact, e-gold was backed by real gold and also used a trusted third party; bitcoin’s value was not derived by “backing” of tangible assets. PayPal’s idea of sending money to an email address may have in some way inspired bitcoin’s (now defunct) feature of sending money to an IP address (which was sometimes connected to a wallet address). Nick Szabo’s “God Protocols” may have inspired Nakamoto’s idea for a distributed ledger. And finally, Szabo’s “bit gold” and Hal Finney’s Reusable Proof of Work (RPoW) are likely to have both influenced the way in which Nakamoto built bitcoin’s proof-of-work functionality. Liberty Reserve and QQ Coin — if they influenced Nakamoto in some way — are likely to have reminded him that a privately issued, centralized currency can be shut down on a whim if the authorities decide they don’t like it (although QQ Coin has so far survived as Tencent has seemingly “played ball” with the authorities).

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://bitcoinnews.com/tech-origins-of-satoshi/