For the first time in human history, there is a hard asset whose future distribution and supply are known in absolute terms.

“A fixed money supply, or a supply altered only in accord with objective and calculable criteria, is a necessary condition to a meaningful just price of money.”

– Bernard W. Dempsey, S.J., Professor of Economics, St. Louis University

At its core, Bitcoin is software, and software is nothing more than a set of instructions written in code and math instructing computers to perform specific tasks.

Bitcoin = software = math + code

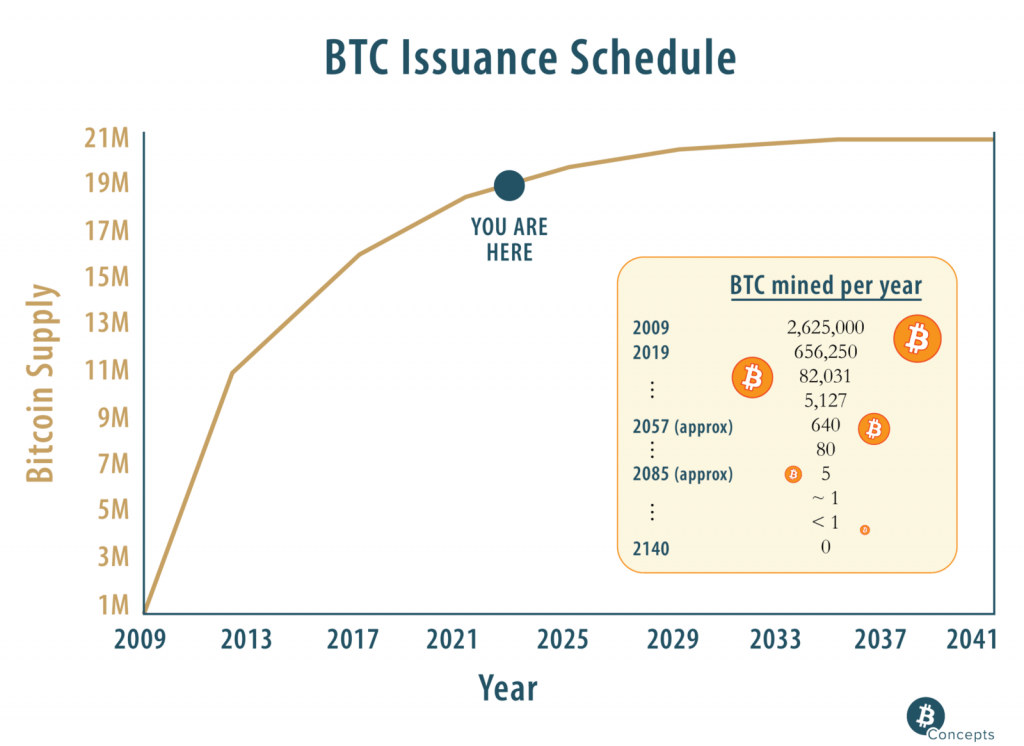

By implementing a difficulty adjustment algorithm in computer code, Satoshi made mathematics the ultimate restraint in issuing and distributing bitcoins into circulation. This algorithm is what enables us to know Bitcoin’s future supply and issuance rate with absolute mathematical certainty.

The algorithm adjusts the difficulty of mining bitcoin depending on how quickly bitcoins are mined (how quickly valid blocks are found). The dynamic adjustment of the network’s mining difficulty ensures the supply issuance of bitcoin cannot be altered, regardless of how many new miners join or exit from the network.

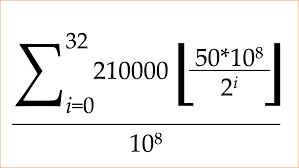

Bitcoin blocks are added to the blockchain roughly every ten minutes. At the beginning of the network, the block reward was programmed to be 50 bitcoins per block, but after every 210,000 blocks, the block reward drops by half. In other words, the rewards for mining bitcoin are programmed to be halved every four years, guaranteeing a decrease in the amount that can be mined in an algorithmically controlled fashion, regardless of how many miners there are, what the demand for bitcoin is, or what costs are associated with mining. As mining rewards exponentially decrease, so does the number of bitcoin mined each year and distributed into circulation.

Astonishingly, by 2025, 20 million bitcoins will already have been mined, leaving the remaining 1 million coins to be mined over 100 more years. Finally, by the year 2140, all twenty-one million bitcoins will have been mined, and there will be no more of them. Because of this, the supply issuance of bitcoin is completely inelastic, making bitcoin the first asset that has actual absolute scarcity, as Saifedean Ammous brilliantly explains:

“Beyond digital scarcity, Bitcoin is also the first example of absolute scarcity, the only liquid commodity (digital or physical) with a set fixed quantity that cannot conceivably be increased. Until the invention of Bitcoin, scarcity was always relative, never absolute. It is a common misconception to imagine that any physical good is finite, or absolutely scarce, because the limit on the quantity we can produce of any good is never its prevalence in the planet, but the effort and time dedicated to producing it…”

By implementing the difficulty adjustment algorithm, Satoshi created the first commodity in history whose supply was not affected by changes in demand. Typically, commodity producers will increase production if demand increases because it also increases their profitability. Conversely, producers can slow production and minimize financial losses if demand for a commodity decreases. Bitcoin, just like any other commodity, has a production cost. But, unlike any other commodity in history, its supply issuance is not affected by rises or falls in demand or price.

Monetary policy through software looks like this graphically:

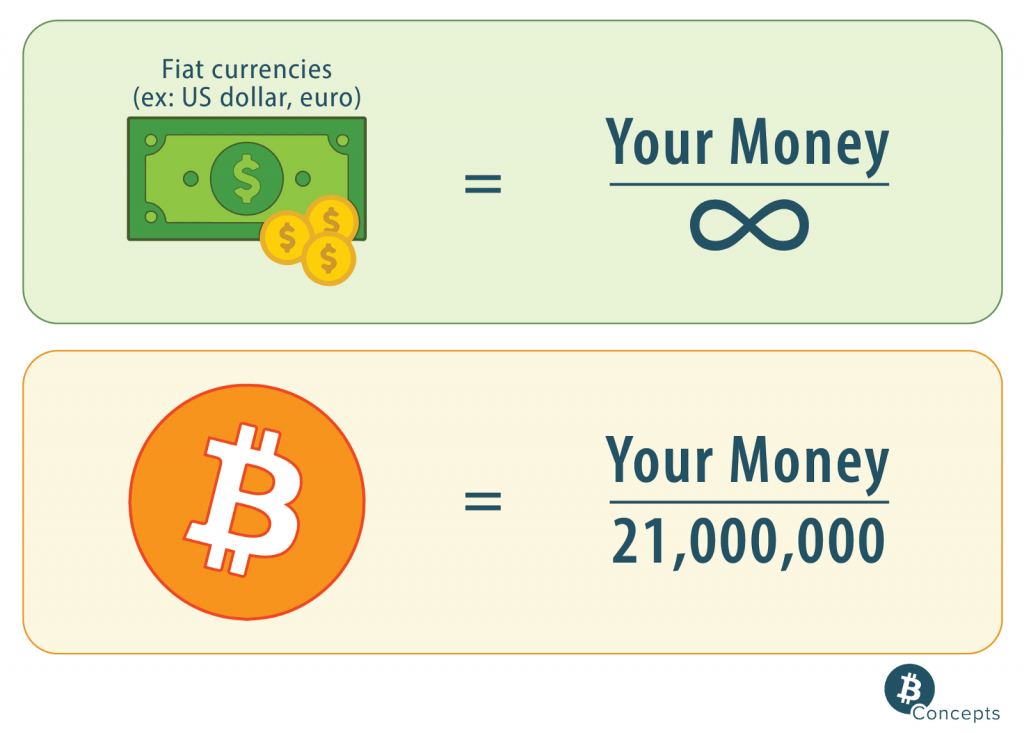

Now, why does this matter? Why is it important for bitcoin to have a fixed total supply and issuance schedule? A quick stroll through history allows us to examine the consequences of arbitrarily increasing a currency’s supply and not abiding by a fixed issuance schedule.

Historically, all governments that could have printed money at no cost have done so. Currencies, such as the German Mark or Zimbabwean dollar, are great examples of governments increasing monetary supply at no cost and causing complete currency debasement and destruction. Around 180 fiat currencies circulate worldwide, and most of these currencies experience significant recurring devaluations due to manipulated increases in supply and issuance.

Tragically, it is usually the most poverty-stricken nations whose currencies debase the most. The reason governments print money is, among many other reasons, primarily political. When governments increase the money supply, they also lower the cost of credit, making more money available to people at a lower price. Superficially, this sounds like a net positive, but in reality, it guarantees a cycle of economic booms and worsening busts.

An increased money supply heats the economy in the short term by increasing access to cheap credit (not to be confused with capital). Politicians use the money printing tool to get re-elected as they can point to the economic improvement in the short term to gain votes. The economy “doing better” is an illusion being created at the cost of debasing currency through debt expansion. Although people have “more” money, that money is worth much less. Every new fiat printed dilutes the worth of the existing money supply; it is that simple. This vicious cycle continues as our elected officials always chase extreme short-term economic growth over long-term sustainable growth. Intentionally done or not, that is what fiat monetary systems organically incentivizes by default.

Through what mechanism does a currency’s value dilute?

As the money supply increases, the currency’s value is diluted through inflation. In economics, inflation is an increase in the price level of goods and services. Each currency unit buys fewer goods and services when the general price level increases. In other words, inflation reduces the purchasing power of money. Inflation is theft because it robs those who earn in that currency of their purchasing power. It is the most cruel form of theft because it is systemically integrated and robs the most from poverty-stricken populations (Cantillon effect).

Inflation creates another vicious feedback loop concerning consumption. Immediate spending to consume in the present becomes the only rational choice because of the future diminishing purchasing power of fiat.

Satoshi knew that human greed and political ambitions would always overpower human restraint regarding printing money. Thus, Satoshi designed a monetary system based on computer code that factored in human greed and did not have to rely on human restraint to function properly.

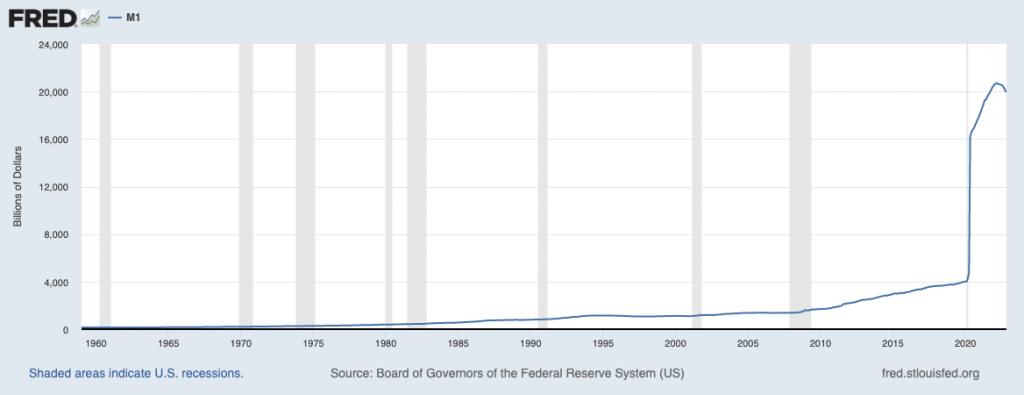

Monetary policy through humans instead of software looks like this graphically:

Even if one has not learned what this graph refers to, just by looking at it, anyone will know something went wrong and is not rooted in stability or predictability. Besides demonstrating how effective human restraint is as a stopping mechanism in money printing (spoiler: human restraint is not very effective), this graphic shows something even more enigmatic about our money supply: its issuance can be easily and rapidly manipulated at any point in time.

Contrast the issuance graph of bitcoin and the one for dollar supply, and it quickly becomes apparent which is prone to human manipulation and which is not.

So the questions must be asked: why let monetary policy be at the mercy of unpredictable human greed, incompetence, and corruption when there is a predictable mathematical and, thereby, utterly stable alternative?

What would be more valuable in the long run, a currency with infinity in its equation that can be issued at any velocity or one with 21 million with a fixed issuance rate?

Sources used:

Images: https://www.btc-concepts.com

FRED chart: Source

Gigi: 21 Lessons Book

River Financial: Bitcoin Price Determination

Saifedean Ammous: The Bitcoin Standard

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://bitcoinnews.com/bitcoins-fixed-issuance/