– High NA EUV’s coming out party – “Dawn” of the Angstrom Era

– Well attended, positive vibes, not much new but good progress

– Concerns about Samsung slowing spend while Intel accelerates

– KLA reticle inspection quandary – Risky business in China

SPIE was a High-NA “coming out” party

We would view this years SPIE 2024 conference as the official launch of High-NA EUV technology, both figuratively as well as in reality.

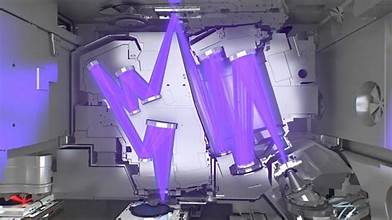

It was announced by Ann Kelleher of Intel that “first light” was achieved by an ASML High-NA tool in Veldhoven (soon to be followed by Intel’s first High-NA tool).

In her presentation we attended we saw a strange set of banana shaped light images on a wafer that were evidence of the first EUV light through a recently assembled tool.

Although its sounds simple, its a big step on the way

Ann also gave a great overview of where the industry and specifically Intel was at and reiterated the five nodes in four years mantra which seems to be underscored by solid progress. It was one of the better overviews talks we have seen.

Tribute to Gordon Moore

There was also an “all star” cast of industry titans who gave a very heartfelt tribute to the late Gordon Moore, father of the semiconductor industry’s heartbeat of “Moore’s Law”. Perhaps the most touching was from Craig Barrett, former CEO of Intel.

It was very appropriate timing as High-NA represents the gateway to the Angstrom era which is proof positive of the continued life and legacy of Moore’s Law and its continued progress

No “New” news

The conference was very well attended and bounced back even more than its pre covid highs. The number of “poster” presentations appeared to more than double. However, there were no major announcements that moved the industry as in some past SPIE conferences.

Many of the presentations were on one aspect of EUV or High-NA or another. DUV was left in the dust along with “I-Line” lithography and other ancient technologies. Photoresist, reticles, metrology and other accoutrements to EUV were the majority of the topics of presentations.

A tale of “two semis”

We heard from a number of people in the equipment industry and supply chain that Samsung has slowed, canceled or delayed many orders. It also seems to be not just the memory side of Samsung that is slowing but the logic/foundry side as well.

It seems fairly clear to us that memory still has a lot of excess fab capacity and that situation has not gotten much better or at least better enough to start capacity purchases.

What is more interesting is that the foundry/logic side is also weak. We could speculate about the continued foundry weakness and would bet that TSMC is likely taking share from Samsung during this weaker period.

We have mentioned this before as second tier foundries get overflow business when things are hot and TSMC can’t service everyone. But when things slow, customers come back to TSMC. We saw other evidence of this with GlobalFoundries projected decline which could be a foreshadowing of Samsung foundry weakness.

On the other side of the coin, Intel seems to be cranking on all cylinders, and going in the opposite direction from Samsung’s slowing spend.

Perhaps Intel being more positive while Samsung cools nets out to the flattish projections we heard from semiconductor equipment makers reporting their December quarter

Applied continues to call SCULPTA etch tool a patterning tool -NOT-

Applied had a repeat performance of its etch tool called SCULPTA which it continues to palm off as a patterning tool by talking about it at SPIE.

Last year, dumb analysts, trashed ASML’s stock by predicting the end of double patterning and the reduction of ASML sales due to SCULPTA which obviously didn’t happen so there was no stupid knee jerk reaction this year….just a ho hum.

A “RAPID” decline? Photons are better than electrons

We continue to express concern and warn about the long term direction of the “RAPID” division of KLA (reticle inspection) which was one of the two founding pillars of the company.

It sounds like the 8xx, E beam reticle inspection tool, which was most likely to be an interim placeholder while waiting for the delayed Actinic inspection 7xx is now dead at two key customers.

It also sounds like the optical market that the 6xx plays in has become more of a commodity horse race which has negatively impacted pricing.

On the bright side it sounds like the long anticipated 7xx Actinic tool may be close to experiencing its version of EUV “first light”….light at the end of a very long tunnel.

Also on the bright side for KLA, the rumored Zeiss Actinic inspection tool that we first reported on sounds like it could be a bit over hyped with too high expectations and may struggle much as their first “AIMS” review tool.

It may still be a race to see who gets the second Actinic tool on the market, KLAC or Zeiss, years after the Lasertec tool. Stay tuned.

Risky business in China

We have long warned about the risk and exposure of 45% of the industry’s semiconductor equipment business being in China. The risk is compounded by potential for prohibited behavior consequences.

Back in the fall it was reported that AMAT was under investigation for violating export regulations on China by cross shipping to China through Korea. We had noted at the time, and no one else seemed to pick up on, the additional risk to CHIPS act awards due to potentially prohibited behavior.

Yesterday, it was widely reported in the news that not only has Applied received more subpoenas regarding the original concerns but the investigation has broadened to now include the SEC.

As we had predicted, the company also just reported that it also received subpoenas related to “certain federal award applications”, which sounds like the feds may be wondering about Applied getting CHIPS act money if they are violating China restrictions ….this could be a “triple play”…..

Link to Reuters article on AMAT subpoenas

The Stocks

There was not a whole lot of impactful news at SPIE this week but the other China news clearly underscores the continued risks.

We also remain concerned that weakness from Samsung may slow any recovery which is hoped for in the second half of the year.

The stocks in general remain fully to well over valued in our view and continue to be swept up in the Nvidia/AI tsunami

We wonder if or when investors will start to separate out those stocks with more or less exposure especially if the recovery takes longer than the expected end of year timeframe.

The China risk continues as a cloud over the industry as evidenced by Applied.

While we still adore Nvidia, and personally own it, other semiconductor stocks may not deserve the same adoration simply through association of being in the same semiconductor industry.

We do still like both ASML, now the biggest equipment maker, and TSMC, by far the biggest and best foundry….but we get a bit more picky as we go down the list especially at nose bleed valuations

About Semiconductor Advisors LLC

Semiconductor Advisors is an RIA (a Registered Investment Advisor),

specializing in technology companies with particular emphasis on semiconductor and semiconductor equipment companies. We have been covering the space longer and been involved with more transactions than any other financial professional in the space. We provide research, consulting and advisory services on strategic and financial matters to both industry participants as well as investors. We offer expert, intelligent, balanced research and advice. Our opinions are very direct and honest and offer an unbiased view as compared to other sources.

Also Read:

AMAT – Flattish QTR Flattish Guide – Improving 2024 – Memory and Logic up, ICAPs Down

KLAC- OK Quarter & flat guide- Hopefully 2025 recovery- Big China % & Backlog

LRCX- In line Q4 & flat guide- No recovery yet- China still 40%- Lags Litho

ASML – Strong order start on long road to 2025 recovery – 24 flat vs 23 – EUV shines

Share this post via:

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://semiwiki.com/semiconductor-services/342674-spie-let-there-be-light-high-na-kickoff-samsung-slows-rapid-decline/