Cash flow underwriting has been “the next big thing” in lending for several years now. And while several lenders are using it as part of their underwriting, it has not become a mainstream tool. That could change with the announcement today from Plaid.

While Plaid first announced a cash flow underwriting initiative a year ago, today, they are taking it to the next level with the launch of Consumer Report,

Let’s step back for a minute. Plaid became a consumer reporting agency (CRA) last year, and the agency is called Plaid Check. This had profound implications for its cash flow underwriting goals. When you are a CRA you can provide not just data but, most importantly, insights from that data that lenders can use for underwriting. If you are not a CRA, you cannot provide such insights.

This is an important point because most lenders don’t want to deal with cash flow data itself, as it is notoriously complex and convoluted. The value is in providing insights into that data.

So, Plaid will now provide lenders with insights from up to 24 months of consumer-permissioned bank account data. It will also provide Income Insights, which verifies a consumer’s ability to pay. But what is perhaps most interesting in today’s announcement is Plaid’s expanded partnership with Prism Data, which will provide a unique cash flow risk score.

Prism Data was spun out of credit card fintech Petal last year and has been powering credit products since 2018. They have also developed the CashScore, a metric for creditworthiness not unlike a credit score, but based purely on cash flow data. Plaid will be using this score as part of Consumer Report.

How cash flow underwriting is being used today

Plaid has been running beta tests of Consumer Report with almost a dozen lenders across personal loans, BNPL and proptech, including big names like Oportun and H&R Block.

Jonathan Gurwitz, the Credit Lead at Plaid, discussed how lenders will use Consumer Report. The two primary use cases are for a second look for borrowers who have been initially declined for credit and for increasing acceptance rates by providing a better interest rate to those borrowers who have already been approved.

“That’s not a small population, a lender’s set of marginal declines,” said Gurwitz. “Even in certain situations, marginal approvals, where you feel like you don’t have a competitive rate to offer that customer, giving them the ability to link their account and improve their offer. That’s a pretty broad population overall, and I think there can be real impact here.”

When I tried to get Gurwitz to share what type of growth in the borrower pool lenders can expect, he was hesitant to give hard numbers.

“I hesitate here, because it’s so varied, but I think, overall, you know, an estimated 5 to 15% growth in originations without adding risk…there’s not too many initiatives you can do in like, you know, the pretty developed credit space where you can get that type of lift.”

Lenders are using Consumer Report in addition to pulling a traditional credit report to expand their customer base as well as providing better pricing for those customers that have been marginally approved.

This is a win-win-win. It is a win for the borrower, who has now been approved or received a better interest rate. It is a win for the lender, who now has a paying customer. And it is a win for Plaid, which generates revenue from the use of its data.

Lenders implement the Plaid user experience for connecting bank accounts, which most people are familiar with now. So, it is a light lift for the borrower with a significant reward.

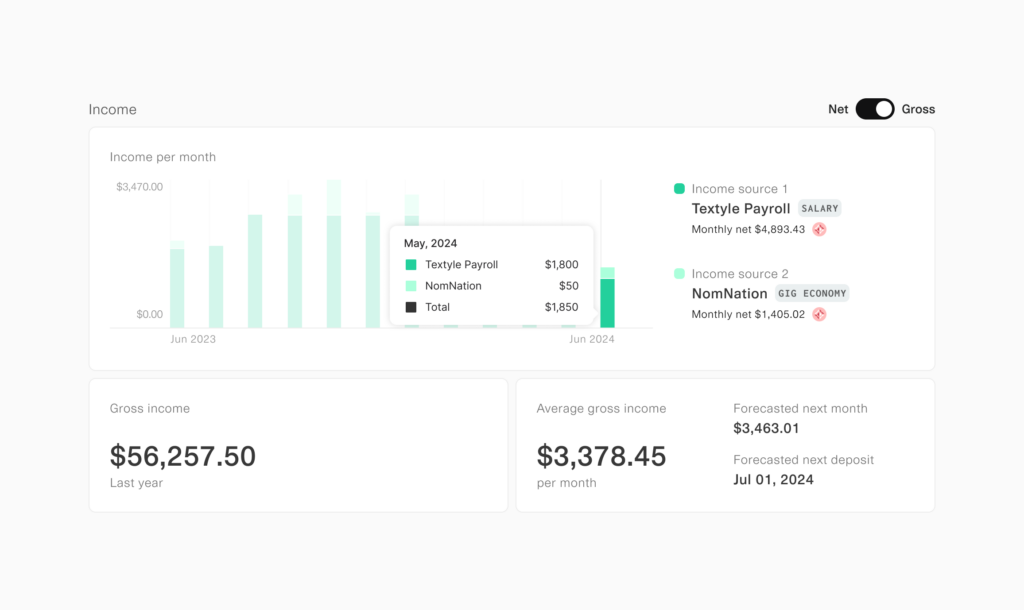

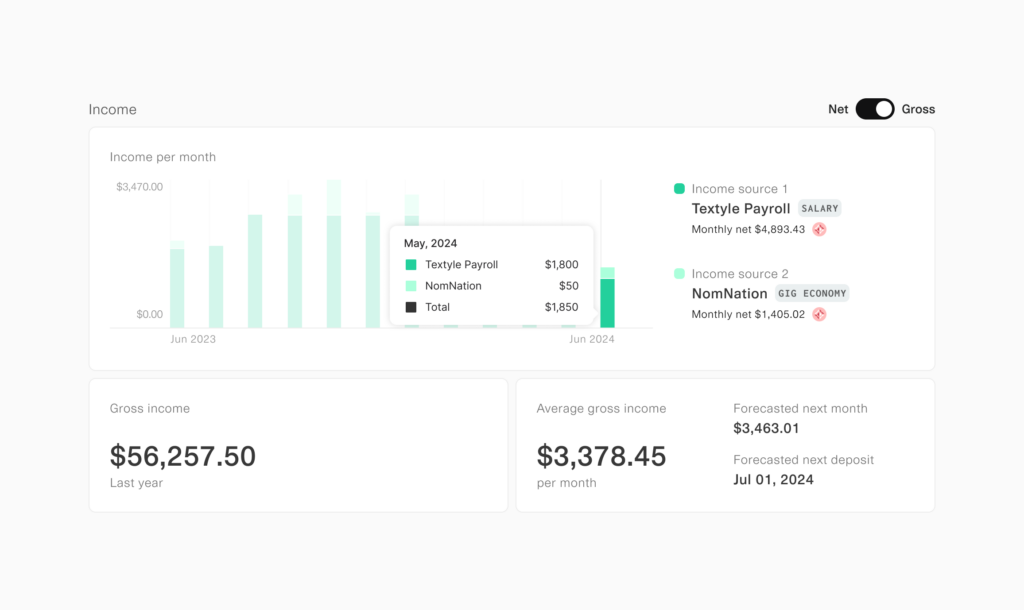

We don’t want to gloss over the Income Insights tool because that is a key part of the equation here and one that sets cash flow underwriting apart from traditional credit reports. Often, the credit side of a consumer’s bank account is complicated. Many people earn more than just W2 income these days. There is often money from gig work, side hustles and Venmo or PayPal payments flowing in and out.

“It is not trivial to go from the bank transaction data, to actually being able to develop a strong estimate around someone’s gross income,” said Gurwitz.

Plaid includes over a dozen categorized income streams to provide forecasted net and gross income as well as a projected next paycheck date. This makes debt-to-income calculations far more accurate.

Looking ahead

The machine learning models at the heart of Consumer Report will continue to improve and Plaid is also looking at building new cash flow attributes to help lenders better predict short- and long-term credit risk.

The Plaid network is unique in that it encompasses 500 million connected accounts. So, the company is currently examining account connection activity across the Plaid network as a predictor of risk. This is in its infancy, but there is a treasure trove of information there, obviously only used with the customer’s permission, which could further increase the effectiveness of Consumer Report.

There may come a day, in the not-too-distant future, when Plaid will look at all of a consumer’s linked accounts, including brokerage and money market accounts, and use all this real-time information to make an underwriting decision.

Regardless of where this is going, the advances Plaid is announcing today are going to have a dramatic impact on the future of lending in this country. It could well be the kickstart needed to bring cash flow underwriting into the mainstream.

.pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .box-header-title { font-size: 20px !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .box-header-title { font-weight: bold !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .box-header-title { color: #000000 !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-avatar img { border-style: none !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-avatar img { border-radius: 5% !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-name a { font-size: 24px !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-name a { font-weight: bold !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-name a { color: #000000 !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-description { font-style: none !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-description { text-align: left !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-meta a span { font-size: 20px !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-meta a span { font-weight: normal !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-meta { text-align: left !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-meta a { background-color: #6adc21 !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-meta a { color: #ffffff !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-meta a:hover { color: #ffffff !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-user_url-profile-data { color: #6adc21 !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-twitter-profile-data span, .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-twitter-profile-data i { font-size: 16px !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-twitter-profile-data { background-color: #6adc21 !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-twitter-profile-data { border-radius: 50% !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-twitter-profile-data { text-align: center !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-linkedin-profile-data span, .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-linkedin-profile-data i { font-size: 16px !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-linkedin-profile-data { background-color: #6adc21 !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .ppma-author-linkedin-profile-data { border-radius: 50% !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-author-boxes-recent-posts-title { border-bottom-style: dotted !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-multiple-authors-boxes-li { border-style: solid !important; } .pp-multiple-authors-boxes-wrapper.box-post-id-45383.pp-multiple-authors-layout-boxed.multiple-authors-target-shortcode.box-instance-id-1 .pp-multiple-authors-boxes-li { color: #3c434a !important; }

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.fintechnexus.com/plaid-launches-new-product-cash-flow-underwriting-mainstream/